Remember to have your property's tax id number or parcel number available when you call! Click on the binoculars to apply.

Iqxh63zhvrukmm

May 13th for lubbock county, may 26th for ector county.

Lubbock property tax office. If you have filed a protest with lubbock cad and would like for us to take it over for you, you can still contact us. To file online, locate your property by using the property search. Get property records from 2 assessor offices in lubbock county, tx.

The median property tax in lubbock county, texas is $1,801 per year for a home worth the median value of $103,100. Property tax loans capitalize your overdue property tax payments, and with direct tax loan, we’ll go above and beyond to make the process as simple. The average property value in lubbock is about $169,000.

The median property tax on a $103,100.00 house is $1,866.11 in texas. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. Click on your property and you will see hs exemption.

In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. Find 238 listings related to property tax office in lubbock on yp.com. Lubbock county appraisal district makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link.

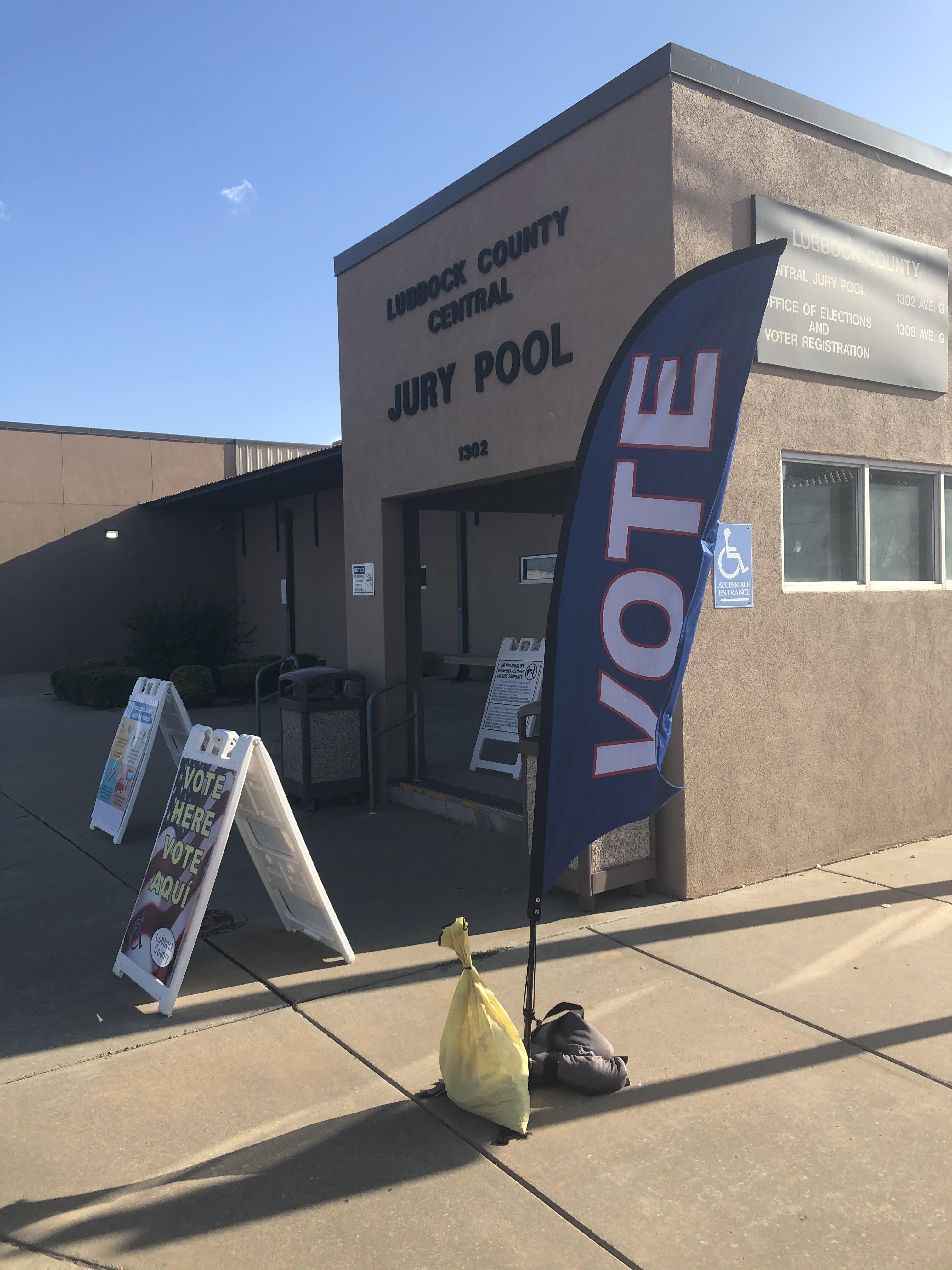

Lubbock county collects, on average, 1.75% of a property's assessed fair market value as property tax. To some people, lubbock property taxes may be too costly, but this tax rate doesn’t scratch the surface of the texas counties with the highest property taxes. Voters to decide whether lubbock county can raise property tax rate

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. The lubbock central appraisal district reserves the right to make changes at any time without notice. The median property tax on a $103,100.00 house is $1,082.55 in the united states.

List of lubbock assessor offices Don’t get us wrong — lubbock county does have a higher rate than counties like borden (0.34%), ward (0.53%). Registration renewals (license plates and registration stickers).

See reviews, photos, directions, phone numbers and more for property tax office locations in lubbock, tx. Lubbock county has one of the highest median property taxes in the united states, and is ranked 567th of the 3143 counties in order of median property taxes. Current assessments and tax bills for individual properties can be see here.

The lubbock county tax assessor is the local official who is responsible for assessing the taxable value of all properties within lubbock county, and may establish the amount of tax due on that property based on the fair market value appraisal. When you’re faced with delinquent property taxes, tax office penalties, and possible foreclosure on your lubbock home, one of the most practical solutions you can look to is a property tax loan. 2109 avenue q , lubbock , tx 79411.

The lubbock county assessor's office, located in lubbock, texas, determines the value of all taxable property in lubbock county, tx. Lubbock county assessor's office services. When a county tax assessor does not collect property taxes, the county appraisal district may be responsible for collecting some or.

There are 2 assessor offices in lubbock, texas, serving a population of 247,323 people in an area of 123 square miles.there is 1 assessor office per 123,661 people, and 1 assessor office per 61 square miles. The lubbock central appraisal district makes no warranties or representations whatsoever regarding the quality, content, completeness, accuracy or adequacy of such information and data. Last day to contact us to file a protest on your property is:

Please contact your county tax office, or visit their web site, to find the office closest to you. The median property tax on a $103,100.00 house is $1,804.25 in lubbock county. In texas, lubbock is ranked 263rd of 2209 cities in assessor offices per capita, and 262nd of 2209 cities in assessor offices per square mile.

The lubbock county commissioners court back in august voted unanimously to increase the county's property tax rate from $.339978 to $.359990 per $100 valuation. Original records may differ from the information on these.

2916 78th St Lubbock Tx 79423 Realtorcom

6106 21st St Lubbock Tx 79407 Mls 202104634 Zillow

Lubbock County Tax Assessor-collector Offices Closed To The Public As Of March 23

5601 101st St Lubbock Tx 79424 – Realtorcom

What To Expect In 2021s Housing Market This Is How Much Home Prices Will Rise Housing Market House Prices Real Estate Marketing

Lcad Releases 2020 Property Tax Information Notices To Be Mailed April 14 Klbk Kamc Everythinglubbockcom

Lubbocks Abortion School Bond Election Draws 26000 Early Voters

8910 County Road 6875 Lubbock Tx 79407 Mls 202111518 Trulia

10301 Vernon Dr Lubbock Tx 79423 Realtorcom

10809 Miami Ave Lubbock Tx 79423 Zillow

All Lubbock County Tax Assessor-collector Offices Require An Appointment Prior To Arrival Klbk Kamc Everythinglubbockcom

1205 Private Road 1260 Lubbock Tx 79416 Realtorcom

Lubbock Co Tax Assessor Says Temporary Extensions Are Granted For Registration Fees Other Items Klbk Kamc Everythinglubbockcom

9708 Louisville Ave Lubbock Tx 79423 – Realtorcom

3106 County Road 7560 Lubbock Tx 79423 Realtorcom

5106 71st St Lubbock Tx 79424 Realtorcom

Voters Approve Property Tax Hike To Raise Lubbock County Sheriffs Office Salaries Klbk Kamc Everythinglubbockcom

Lubbock County Gives Notice Of Tax Increase Rate To Stay The Same While Assessed Values Go Up Klbk Kamc Everythinglubbockcom

11911 Frankford Ave Lubbock Tx 79424 Loopnetcom