It’s also a community property estate, meaning it considers all the assets of a married couple jointly owned. Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The portion of the state death tax credit allowable to louisiana that exceeds the inheritance tax due is the state estate.

Louisiana state inheritance tax. Many states repealed their estate taxes as a result. If you’re looking for more guidance to navigate the complexities of louisiana inheritance laws, the smartadvisor tool can set you up with financial advisors in your area to help you plan your estate. Under the federal estate tax law, there is a credit for state death taxes that are paid, up to a certain amount.

The federal estate tax only affects.02% of estates. But that changed in 2001 when federal tax law amendments eliminated the credit. An inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs.

Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.twelve states and the district of columbia impose estate taxes and six impose inheritance taxes. Louisiana department of revenue taxpayer services division p.

In more simplistic terms, only 2 out of 1,000 estates will owe federal estate tax. Probate is called “succession” here, and the state code applies a legal concept called “usufruct” to property, so one beneficiary may have the right to live in or use the inheritance while another beneficiary holds a form of ownership. There is no louisiana estate tax.

They leave you their estate that's worth $1 million. For federal tax purposes, inheritance generally isn’t considered income. The portion of the state death tax credit allowable to louisiana that exceeds the inheritance tax due is the state estate transfer tax.

The good news is that, while some other states still tax inheritances, louisiana abolished its state inheritance tax in 2004. In order to understand louisiana inheritance law, you need to be familiar with the legal terms usufruct and usufructuary. Here's how estate and inheritance.

State rules usually include thresholds of value—inheritances that fall below these exemption amounts aren't subject to the tax. Louisiana has completely eliminated taxes on any inheritance, but for estates that are large enough to require a federal estate tax return, there is a louisiana estate transfer tax. You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000.

All inheritance are exempt in the state of louisiana. This right is called a usufruct and the person who inherits this right is called a usufructuary. But in some states, an inheritance can be taxable.

This variable assesses if a state levies an estate or inheritance tax. Thus, there is no requirement to file a return with the state and no state inheritance taxes are owed. Maryland is the only state to impose both now that new jersey has repealed its estate tax.

The louisiana inheritance tax is imposed on the heirs or legatees of a decedent for the privilege of receiving property from the deceased. Louisiana state inheritance tax the state of louisiana has repealed all state inheritance taxes. Louisiana does not have an inheritance tax.

If the total estate asset (property, cash, etc.) is over $5,430,000, it is subject to the federal estate tax (form 706). Generally, an inheritance is not considered earned income, so you will not have. Like the federal estate tax laws, louisiana’s inheritance tax laws have.

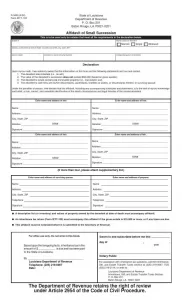

The state has laws relating to inheritances that aren’t shared by any other jurisdiction. Often in louisiana, one person will inherit the right to use property and receive the fruits (income) from property. Original return amended return partial return date of originalaaa / / real estate (louisiana property only) stocks and bonds mortgages, notes, and cash insurance other miscellaneous property

Inheritance tax is a state tax on assets inherited from someone who died. Sion, and sought a rule against the louisiana inheritance tax collector to determine and fix the amount of state inheritance The economic growth and tax relief reconciliation act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur after december 31, 2004.

At one point, all states had an estate tax. Louisiana inheritance and gift tax. Data were drawn from mcguire woods llp, “state death tax chart” and indicate the presence of an estate or inheritance tax as of january 1, 2021.

Iowa doesn't impose an inheritance tax on beneficiaries of estates. The federal estate tax exemption is. You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000.

For example, let's say a family member passes away in an area with a 5% estate tax and a 10% inheritance tax. For instance, kentucky’s inheritance tax applies to any property in the state, even if the inheritor lives out of state. Don’t confuse the inheritance tax with the federal estate tax, which is tacked on estates worth more than $11.7 milllion.

An inheritance tax is a state tax you have to pay on property or money you receive from someone who has passed away. Louisiana does not impose any state inheritance or estate taxes.

Louisiana Succession Taxes Scott Vicknair Law

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Attorney General Opinion Ww-911 – The Portal To Texas History

Louisiana Inheritance Tax Estate Tax And Gift Tax

2

Estate Planning In Louisiana A Laymans Guide To Understanding Wills Trusts Probate Power Of Attorney Medicaid Living Wills Taxes Paul A Rabalais 9780979398209 Amazoncom Books

Wheres My State Refund Track Your Refund In Every State

Louisiana Probate Law Practice Ex Parte Petitions For Possession – Pdf Free Download

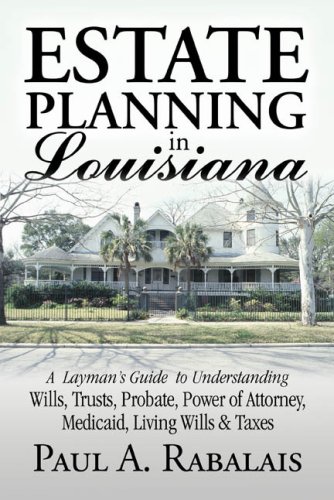

Louisiana Successions A Brief Explanation

Historical Louisiana Tax Policy Information – Ballotpedia

Pa Remainder Inheritance Tax – Mobil Motor Terbaru Berita Review Panduan Membali Gambar Dan Lebih

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Laws Governing Estate Inheritance For Children In Louisiana Legalzoomcom

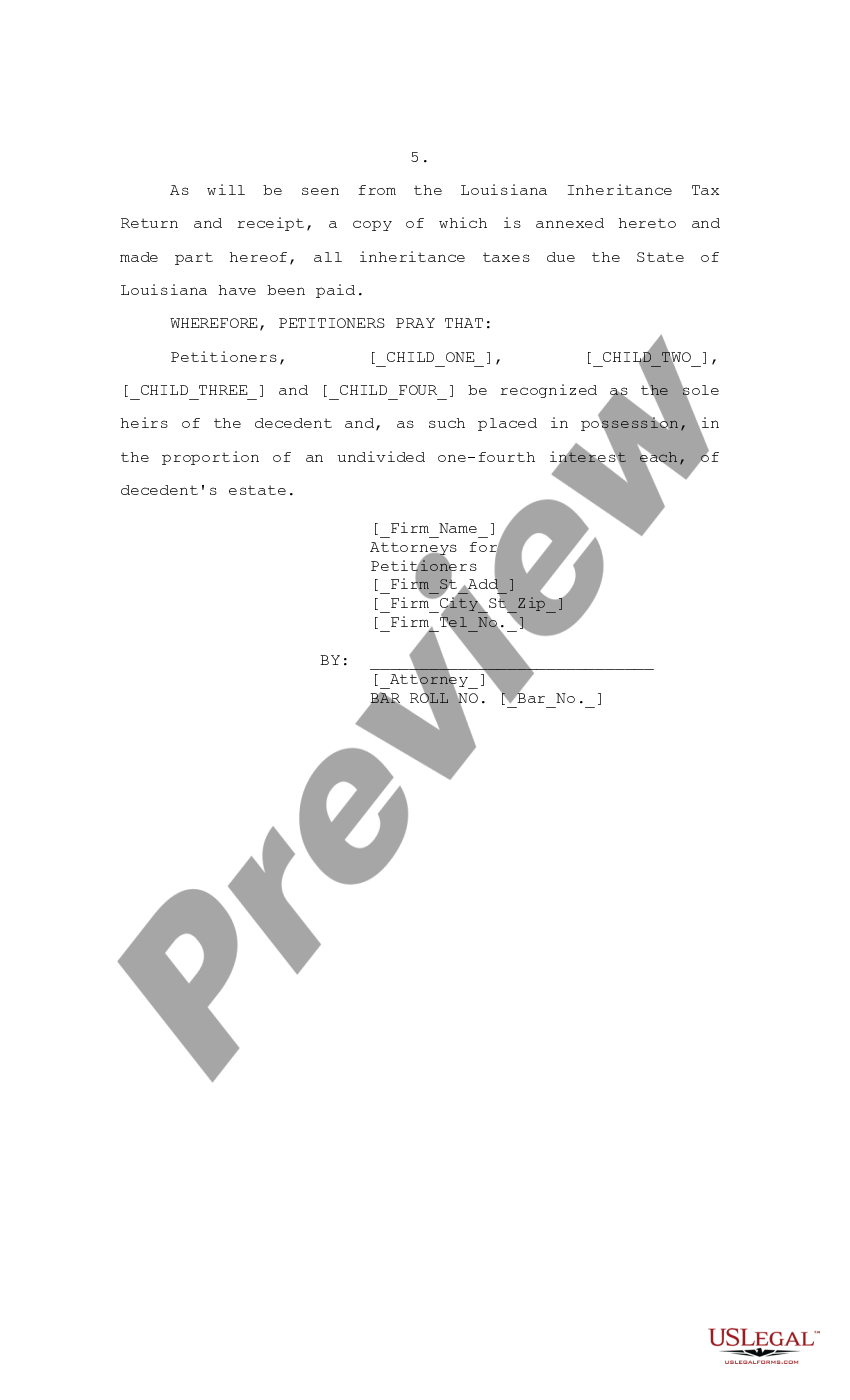

Louisiana Petition For Possession And Affidavit Of Valuation And Detailed Descriptive List – Petition For Possession Louisiana Us Legal Forms

Louisiana Retirement Tax Friendliness – Smartasset

Louisiana Estate Tax Planning Vicknair Law Firm

Louisiana Inheritance Tax Estate Tax And Gift Tax

Free Louisiana Small Estate Affidavit Form Pdf Formspal