Tax rate of 4% on taxable income between $25,001 and $100,000. Though sales taxes can be steep due to local parish and jurisdiction sales taxes, food and medications are exempt from sales taxes.

Historical Louisiana Tax Policy Information – Ballotpedia

Depending on local municipalities, the total tax rate can be as high as 11.45%.

Louisiana estate tax rate. The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection, law enforcement, education, recreation, and other functions of parish government. It is designed to give you property tax estimates for. With local taxes, the total sales.

Two particular scenarios come to mind that will likely affect the way certain louisiana property transactions are structured in the future. At just 0.53%, louisiana has the fifth lowest effective property tax rate of any u.s. The table below summarizes uppermost capital gains tax rates for louisiana and neighboring states in 2015.

Tax rate of 6% on taxable income over $100,000. Assessment is the basis upon which taxing authorities tax a property. The exact property tax levied depends on the county in louisiana the property is located in.

Tax on a $200,000 home: Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower The calculator will automatically apply local tax rates when known, or give you the ability to enter your own rate.

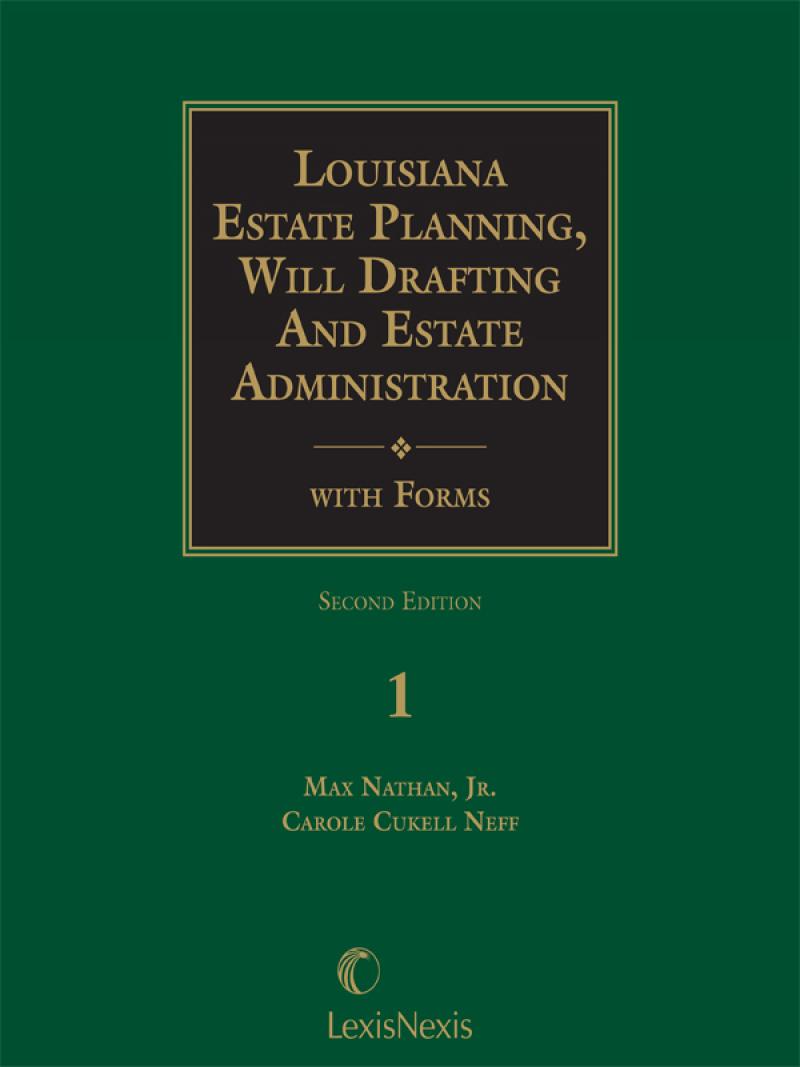

The combined uppermost federal and state tax rates totaled 27.9 percent, ranking 29th highest in the nation. The louisiana (la) state sales tax rate is currently 4.45%. Severance oil & gas return;

Use this louisiana property tax calculator to estimate your annual property tax payment. The median property tax (also known as real estate tax) in lafayette parish is $583.00 per year, based on a median home value of $151,600.00 and a median effective property tax rate of 0.38% of property value. The top estate tax rate is 16 percent (exemption.

With the top louisiana individual income tax rate at 6%, the ability to structure a sale to fit within this exemption may result in significant tax savings. The median annual property tax payment in louisiana is $919, though this can drop to around $200 in some counties. Tammany parish collects the highest property tax in louisiana, levying an average of $1,335.00 (0.66% of median home value) yearly in property taxes, while st.

However, because of the varying tax rates between taxing districts, the average tax bill fluctuates from parish to parish. The income tax in louisiana is progressive, and rates range from 2% to 6%. The top estate tax rate is 16 percent (exemption threshold:

31 rows the state sales tax rate in louisiana is 4.450%. In louisiana, the assessed value is determined as a percentage of fair market value and taking into consideration the classification of the property subject to taxation. On average, a homeowner pays $5.05 for every $1,000 in home value in property taxes with the average louisiana property tax bill adding up to $832.

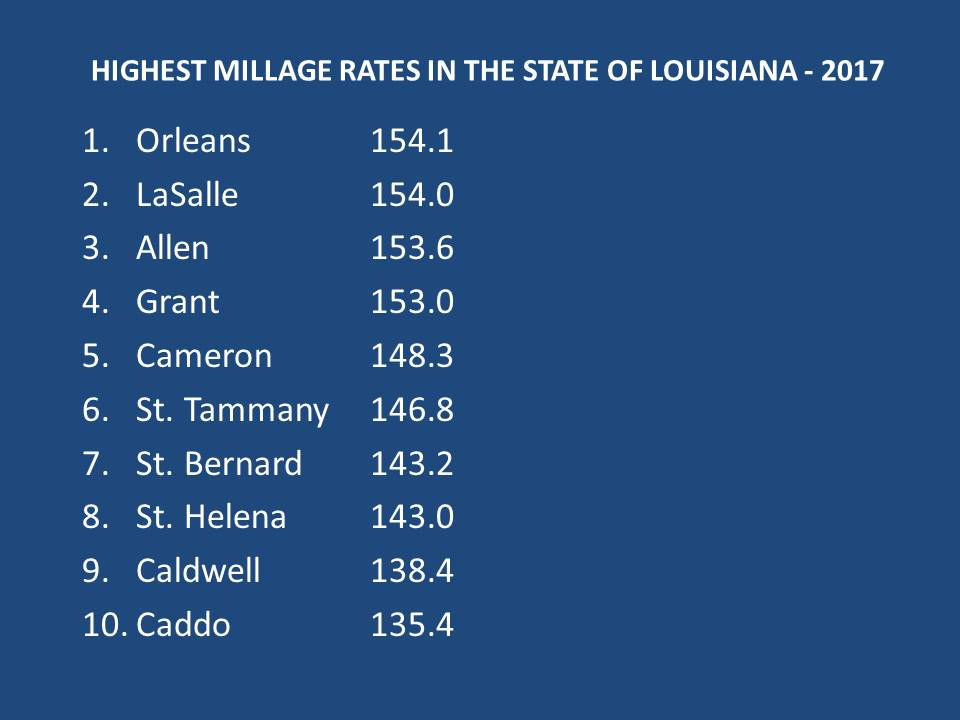

Louisiana state allows a deduction up to $75,000 for most homeowners. Louisiana tax commission the louisiana tax commission is a state agency vested with broad authority as to the administration and enforcement of the state property tax and assessment laws. See below the top 10 parishes by millage rate, fitzmorris’ graphic and millage rates in the remaining metro new orleans parishes.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to louisiana to the total federal gross estate. Tax on a $200,000 home: In louisiana, the uppermost capital gains tax rate was 6 percent.

The jefferson parish assessor's office determines the taxable assessment of property. No estate tax or inheritance tax. Louisiana has the third lowest property tax rates in the nation.

The louisiana constitution requires residential properties and land to be assessed at 10% of their fair market value, by which the tax millage rate is applied. Use this new orleans property tax calculator to estimate your annual property tax payment. Nationwide, the median property tax.

This ratio is applied to the state death tax credit allowable under internal revenue code section 2011. Landry parish has the lowest property tax in the state, collecting an average tax of $202.00 (0.25% of median home value) per year. The commission is composed of five members appointed by the governor from the state public service commission districts.

The top inheritance tax rate is 10 percent (no exemption threshold) massachusetts: The top estate tax rate is 12 percent (exemption threshold: Louisiana stadium & exposition district hotel occupancy tax;

The tax is calculated by multiplying the taxable assessment by the tax rate. For the single, married filing jointly, married filing separately, and head of household filing statuses, the la tax rates and the number of tax brackets remain the same. If it is a commercial or industrial building, then the assessed rate is 15% of their fair market value instead of 10%.

The average effective rate is just 0.51%. Lafayette parish collects fairly low property taxes, and is among the lower 25% of all counties in the united states ranked by property tax collections. What to bring when visiting ldr;

2021 louisiana tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

Louisiana Property Tax Calculator – Smartasset

Louisiana Estate Planning Will Drafting And Estate Administration With Forms Lexisnexis Store

How High Are Capital Gains Taxes In Your State Tax Foundation

Louisiana Property Tax Calculator – Smartasset

Louisiana Sales Tax Rate Remains Highest In The Us Legislature Theadvocatecom

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Retirement Tax Friendliness – Smartasset

States With Highest And Lowest Sales Tax Rates

10 Louisiana Parishes With The Highest Property Tax Rates – 3 Are In Metro New Orleans Archive Nolacom

Quin Hillyer Louisiana Should Tax The Rich Current System Is Bass-ackwards Opinion Theadvocatecom

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Sales And Use Tax Rate Changes Cut The Additional Temporary Penny And Raise The Rate On Business Utilities – Effective July 1 2018 Louisiana Law Blog

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana La Property Tax Hr Block

Ranking State And Local Sales Taxes Tax Foundation

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Sales Tax – Small Business Guide Truic

Are There Any States With No Property Tax In 2021 Free Investor Guide