The clark county sales tax rate is %. Binghamton, ny sales tax rate:

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The current total local sales tax rate in lincoln county, nc is 7.000%.

Lincoln ne sales tax rate 2018. Nebraska collects a 5.5% state sales tax rate on the purchase of all vehicles. This table provides an analysis of federal adjusted gross income, net nebraska tax and liability per return for farmer and rancher returns. The combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on capital gains and the marginal effect of pease limitations (which results in a tax rate increase of 1.18 percent).

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Brooklyn, ny sales tax rate: 2,000 9 madonna rehabilitation hospital 1,500 10 duncan aviation 1,200

A reporters’ estimated cash rental rates (both averages and ranges) from the unl nebraska farm real estate market survey, 2017 and 2018. State of nebraska 8,795 2 lincoln public schools: Lexington, ne sales tax rate:

, notification to permitholders of changes in local sales and use tax rates effective april 1, 2022 updated 12/02/2021 effective nebraska sales and use tax | nebraska department of revenue Decrease in state sales tax rate on telecommunications services and prepaid calling cards effective july 1, 2018. Buffalo, ny sales tax rate:

3,454 6 city of lincoln 2,653 7 saint elizabeth regional medical center: An alternative sales tax rate of 4.5% applies in the tax region pennington, which appertains to zip code 57703. The nevada state sales tax rate is currently %.

Nevada has state sales tax of 4.6% , and allows local governments to collect a local option sales tax of up to 3.55%. A base tax set in nebraska motor vehicle statutes is assigned to the specific msrp range and motor vehicle tax is then assessed. Lincoln, ne sales tax rate:

There is no applicable county tax or special tax. Registration year base tax amount 1 2 3 4 5 6 7 8 9 10 & 11 12 & 13 14+ 95% (year 1) (see below) $0 to $3,999 $25.00 $25 $22.50 $20.00 $17.50 $15.00 $12.75 $10.50 $8.25 $6.00 $3.75 $1.75 $0.00 $23.75 C reported in dollars per pair.

Crete, ne sales tax rate: These tables are presented on yearly tabs. Coney island, ny sales tax rate:

Fremont, ne sales tax rate: Average sales tax (with local): Amherst, ny sales tax rate:

Sales tax rates quarter 4 (txt) sales tax rates quarter 3 (txt) sales tax rates quarter 2 (txt) sales tax rates quarter 1 (txt) You can find these fees further down on the page. While the exact property tax rate you will pay for your properties is set by the local tax assessor, you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate fair market value of your property into the calculator.

Additional state capital gains tax information for nebraska. Kearney, ne sales tax rate: There is no applicable county tax or special tax.

In addition to taxes, car purchases in nebraska may be subject to other fees like registration, title, and plate fees. B cash rents on center pivot land assumes landowners own total irrigation system. Albany, ny sales tax rate:

The current month table shows a summary by city of the sales and use tax, sales tax on motor vehicles, refunds to taxpayers, administration fee and settlement amount. There are a total of 39 local tax jurisdictions across the state, collecting an average local tax of 3.348%. Grand island, ne sales tax rate:

The nebraska state sales and use tax rate is 5.5% (.055). A bill (lr11ca) seeking a 2022 vote of the people on a constitutional amendment to replace the state's income, corporate, sales and property tax system with a new consumption tax. Mccook, ne sales tax rate:

Motor vehicle tax calculation table msrp table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/gvwr of 7 tons or less. Gering, ne sales tax rate: The rapid city, south dakota sales tax rate of 6.5% applies to the following three zip codes:

Has impacted many state nexus laws and sales tax collection requirements. Detailed nebraska state income tax rates and brackets are available on this page. There are approximately 64,151 people living in the rapid city area.

The 2018 united states supreme court decision in south dakota v. The nebraska state sales and use tax rate is 5.5% (.055). Hastings, ne sales tax rate:

Bensonhurst, ny sales tax rate: Local sales and use tax remitted to cities, and settlement amounts and dates. Brentwood, ny sales tax rate:

Cheektowaga, ny sales tax rate: Notification of change of sales tax rate for remote dealers and consumer use tax. The nebraska income tax has four tax brackets, with a maximum marginal income tax of 6.84% as of 2021.

The 7.25% sales tax rate in lincoln consists of 5.5% nebraska state sales tax and 1.75% lincoln tax. La vista, ne sales tax rate:

Nebraskas Sales Tax

Nebraskas Sales Tax

Corporate Tax In The United States – Wikiwand

2

Pdf Tax System Change And The Impact Of Tax Research

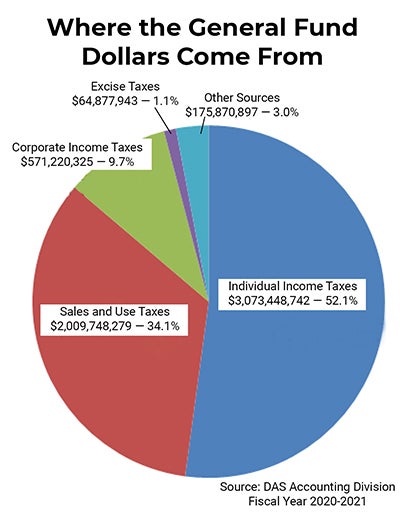

General Fund Receipts Nebraska Department Of Revenue

Nebraskas Sales Tax

Pdf Tax System Change And The Impact Of Tax Research

Corporate Tax In The United States – Wikiwand

Nebraskas Sales Tax

Corporate Tax In The United States – Wikiwand

Nebraskas Sales Tax

I Robot U Tax Considering The Tax Policy Implications Of Automation – Mcgill Law Journal

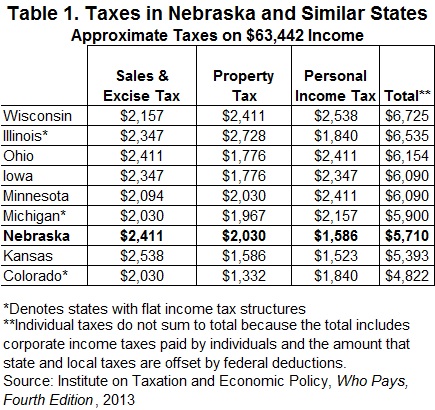

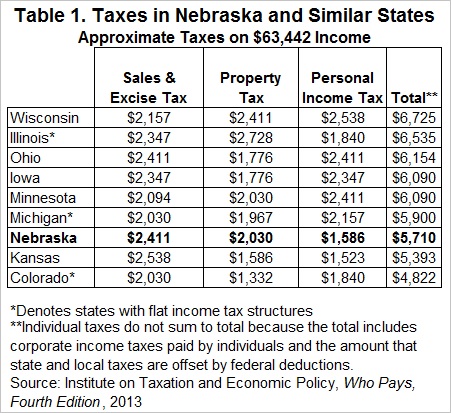

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Ny Property Taxes

Pin On Nma Driving In America

Nebraskas Sales Tax

Corporate Tax In The United States – Wikiwand

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute