There is no applicable county tax or special tax. The december 2020 total local sales tax rate was also 7.500%.

Vehicle And Boat Registration Renewal Nebraska Dmv

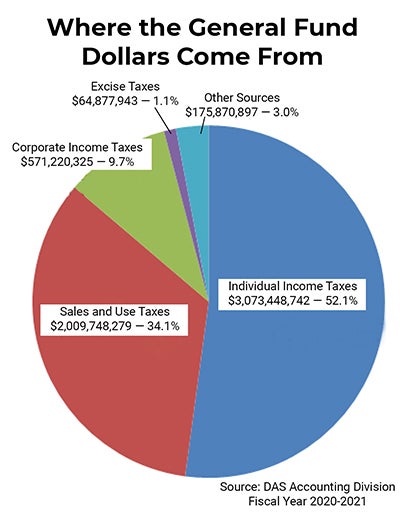

If property taxes, sales taxes and income taxes were equalized as sources of state and local revenue, property taxes would need to be reduced over $600 million.

Lincoln ne sales tax 2019. The current total local sales tax rate in york, ne is 7.500%. Ordinances 5445, 5449, and 5456. The current total local sales tax rate in lincoln, ne is 7.250%.

Property taxes account for 38% of total state and local tax collections in nebraska, the highest of any tax. For 2021, the overall blended rate of the three agencies is 5.3%, with lincoln’s portion is only 2.17% on your overall tax bill. The taxpayer has the opportunity to pay the taxes in full prior to the sale and a very high percentage is paid after advertising and before the sale.

The morning of the sale. Form 1310n, statement of person claiming refund due a deceased person. Local sales and use tax remitted to cities, and settlement amounts and dates.

Download our california sales tax database! The impact to property taxes is a combination of these three agencies, but lincoln only controls approximately 1/3 of your tax bill. The current month table shows a summary by city of the sales and use tax, sales tax on motor vehicles, refunds to taxpayers, administration fee and settlement amount.

Bidders must register in the collector’s office and complete an affidavit stating. Ordinances 20579, 20586, and 20718. In counties containing a city of the metropolitan class, 18% is allocated to the county and 22% to the city or village.

555 south 10th street suite 205 lincoln ne 68508. The filing deadline for this election was march 7, 2019. There are approximately 38,746 people living in the lincoln area.

0.5% lower than the maximum sales tax in ne the 7% sales tax rate in ashland consists of 5.5% nebraska state sales tax and 1.5% ashland tax. For other states, see our list of nationwide sales tax rate changes. Lancaster county board of commissioners langailearr§ounty.

The lincoln sales tax has been changed within the last year. Two months of 2019 nebraska sales taxes up $107 million over same months of 2018 two months of 2019 nebraska sales taxes up $107 million over same months of 2018 nrf credits legislation requiring online sellers to collect according to the nebraska department of revenue, the state received $107 million more in sales tax for november &. Form 2210n, 2019 individual underpayment of estimated tax.

The december 2020 total local sales tax rate was also 7.250%. Although candidates had the option to file with political parties, city elections were nonpartisan and political parties. Notification to permitholders of changes in local sales and use tax rates effective january 1, 2022.

Historical sales tax rates for lincoln. 18% is allocated to the city or village, except that: There is no applicable county tax or special tax.

The additional tax rate will begin in october, because of the timelines set by the state, and will bring the city sales tax to 1.75 percent for the next six years. There is no applicable county tax or special tax. The nebraska state sales and use tax rate is 5.5% (.055).

Lincoln, ne sales tax rate. Over the past year, there have been seventeen local sales tax rate changes in nebraska. Registration begins at 8:00 a.m.

The city of lincoln, nebraska, held general elections for mayor, city council districts 1, 2, 3, and 4, and one of five elected seats on the airport authority on may 7, 2019.a primary was scheduled for april 9, 2019. Registration will be held in the collector’s office room 103 at the lincoln county courthouse. Buyers must be present to bid.

Sales taxes are 29% of total tax collections, and income taxes are 26%. , ne sales tax rate. The nebraska state sales and use tax rate is 5.5% (.055).

It was raised 4% from 6% to 10% in november 2020. The lincoln, california sales tax rate of 7.25% applies in the zip code 95648. The 7.25% sales tax rate in lincoln consists of 5.5% nebraska state sales tax and 1.75% lincoln tax.

This table lists each changed tax jurisdiction, the amount of the change, and the towns and cities in which the modified tax rates apply. If the tax district is not in a city or village 40% is allocated to the county and; Shall the city council of lincoln, nebraska increase the local sales and use tax rate by an additional one quarter of one percent (1/4%) upon the same transactions within such municipality on which the state of nebraska is authorized to impose a tax for a

This does not include the two tif collections that were completed in 2019. 555 south 10th street, room 110. As of december 31, 2019, there were 76 active tif projects in the city of lincoln, 64 of which were collecting divided taxes.

Form nol, nebraska net operating loss worksheet tax year 2019. This page will be updated monthly as new sales tax rates are released.

Nebraskas Sales Tax

Voted Have You Thank You Realtors Association Of Lincoln For The Stickers Governmental Affairs Realtors Association

2

Nebraskas Sales Tax

Todays Ljs Is The Last Edition Printed In Lincoln Endofanera Signsofprogress Instagram Prints Mostly Sunny

Nebraskas Sales Tax

General Fund Receipts Nebraska Department Of Revenue

The 10 Most Affordable States In America States In America Map Best Places To Retire

Illinois Doubled Gas Tax Grows A Little More July 1

Nebraskas Sales Tax

2

2019 Nebraska Property Tax Issues Agricultural Economics

Pin On House Project – Outside

Document Management Proposal Template Request For Proposal Proposal Templates Business Proposal Template

Nebraska Sales Tax – Taxjar

Nebraskas Sales Tax

Pizza Ranch Guest Satisfaction Survey 2019 In 2021 Pizza Ranch Ranch Pizza Buffet

Nebraska State Tax Things To Know Credit Karma Tax

Pin On Travel