The county sales tax rate is %. Any company may use this online payment system to pay any of the following occupation taxes:

History Of Lincoln Nebraska – Wikipedia

Hastings, ne sales tax rate:

Lincoln ne restaurant sales tax. City of omaha waiving restaurant tax penalties. The bill of sale must include the sellers name, the purchaser’s name, a description of the vehicle including make, model, year and vin, the purchase amount, the date of sale and signature of the seller. Restaurants in the city of omaha have received some good news.

Accounting, administration, budget, city clerk, city treasurer and purchasing. The rate is two percent (2%) of all gross receipts for each calendar month derived from the drinking places and restaurant. Lincoln, ne sales tax rate:

Become familiar with the sales tax provisions affecting bars, taverns, and restaurants. 68501, 68502, 68503, 68504, 68505, 68506, 68507, 68508, 68510, 68512, 68516, 68520, 68521, 68522, 68524, 68526, 68528, 68529, 68542, 68583 and 68588. The nebraska sales tax rate is currently %.

The finance department is composed of five divisions: On september 3, mayor jean stothert announced that the city’s finance department has been directed to forgive late fees on restaurant tax payments due from march through the end of 2020. Lexington, ne sales tax rate:

Mccook, ne sales tax rate: This is the total of state, county and city sales tax rates. Depending on local municipalities, the total tax rate can be as high as 7.5%, but food and prescription drugs are exempt.

Payments will be processed on the first working day after the 25th of the month. The nebraska state sales and use tax rate is 5.5% (.055). The december 2020 total local sales tax rate was also 7.250%.

Nebraska city, ne sales tax rate: The restaurant tax is imposed upon each and every person operating a drinking place or restaurant business or providing the services within the city for any period of time during a calendar month. Nebraska provides no tax breaks for social security benefits and military pensions while real estate is assessed at 100% market value.

The nebraska (ne) state sales tax rate is currently 5.5%. An occupation tax deferment for lincoln restaurants and bars may prove a key piece in a collective effort to keep those businesses afloat during the. Prepared food is food intended for, and which is generally ready for, immediate consumption, either on or off the premises of the.

The city of lincoln finance department is proud to provide services to city and county residents and internal departments that is consistent, reliable and timely information. The current total local sales tax rate in lincoln, ne is 7.250%. Funds will be removed from your account the next working day.

Best dining in lincoln, nebraska: Estimated sales in nebraska’s restaurants in 2018 4,113 eating and drinking place locations in nebraska in 2018 96,900 restaurant and foodservice jobs in nebraska in 2019 = 9% of employment in the state and by 2029, that number is projected to grow by 7.5% = 7,300 additional jobs, for a total of 104,200 nebraska restaurant industry at a glance Kearney, ne sales tax rate:

Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: Grand island, ne sales tax rate: More information for consumers, retailers and others who hold sales and use tax permits is available at lincoln.ne.gov (keyword:

This page describes the taxability of food and meals in nebraska, including catering and grocery food. Gering, ne sales tax rate: Lincoln's new occupational tax begins jan.

What is the restaurant occupation tax rate? * includes the 0.50% transit county sales and use tax. The minimum combined 2021 sales tax rate for bellevue, nebraska is.

Revenue will be generated from the increase starting october 1, and once in place, will bump up lincoln's sales tax rate from the current 7. There will be a 4 percent occupational tax on hotel rooms, rental cars and a 2 percent tax on meals and drinks in restaurants and bars. The bellevue sales tax rate is %.

La vista, ne sales tax rate: Lincoln, ne sales tax rate. Join chef brian or chef dan in one of our two kitchens at the sysco lincoln culinary center in lincoln.

While nebraska's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. The lincoln, nebraska sales tax rate of 7.25% applies to the following 21 zip codes: See 19,281 tripadvisor traveler reviews of 725 lincoln restaurants and search by cuisine, price, location, and more.

Occtax@lincoln.ne.gov online occupation tax payments The current state sales and use tax rate is 5.5 percent, so the total sales and use tax rate will increase from 7 percent to 7.25 percent.

End Of An Era Grisantis Contents To Be Auctioned Local Business News Journalstarcom

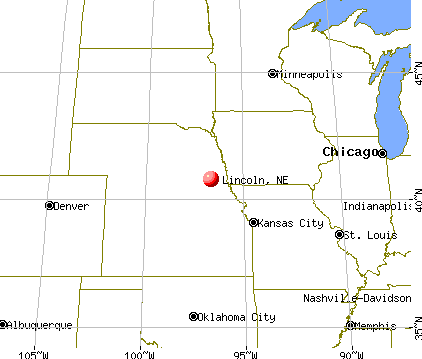

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lincoln Nebraska Hotel Courtyard Lincoln Downtownhaymarket

Meetings And Events At Embassy Suites By Hilton Lincoln Lincoln Ne Us

Red Roof Inn Suites Lincoln – Lincoln Ne 3939 North 26th 68521

An Awesome Tax Sale Property Being Sold In Huron-kinloss Ontario Bruce County – Looks Like The Kind Of Retreat I Could Get Use T Sale House Property Ontario

Pandemic Will End Nebraska Clubs 66-year Run In Lincoln Dining Journalstarcom

Lincoln Nebraska – Wikiwand

Lincoln Scheels Scheelscom

Calculating The Costs And Benefits Of The Arena Project Pinnacle Bank Arena Journalstarcom

Pandemic Will End Nebraska Clubs 66-year Run In Lincoln Dining Journalstarcom

Lincoln Nebraska – Wikiwand

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lincoln To See New Sales Tax Revenue Starting October 1

Hyatt Place Lincoln Downtown – Haymarket In Lincoln Ne Expedia

History Of Lincoln Nebraska – Wikipedia

Pin On Furniture

2

Lincoln Ne Lnk Great American Stations