Try it now & grow your business! The lakewood, new mexico sales tax rate of 5.9583% applies in the zip code 88254.

Colorado Sales Tax Rates By City County 2021

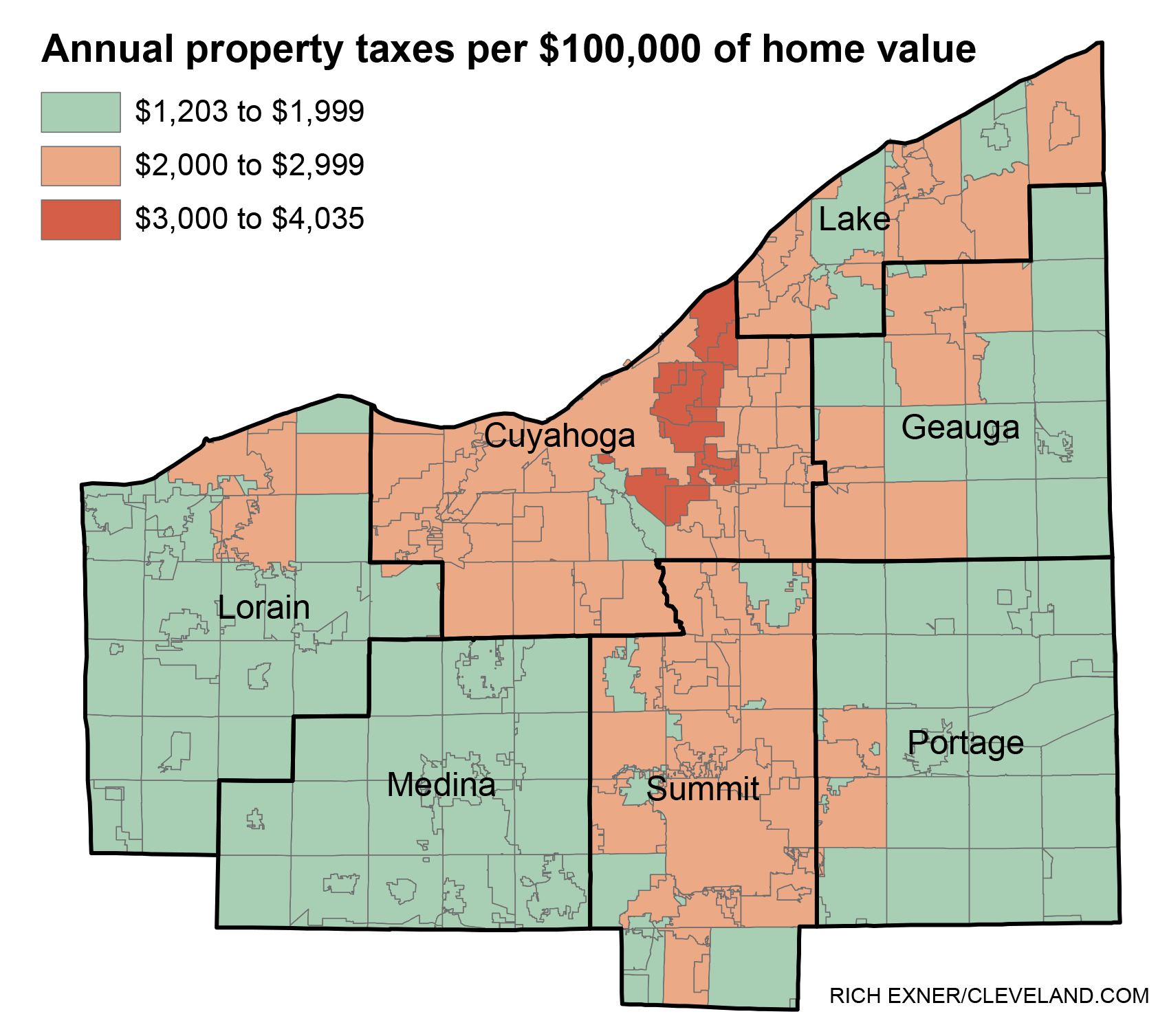

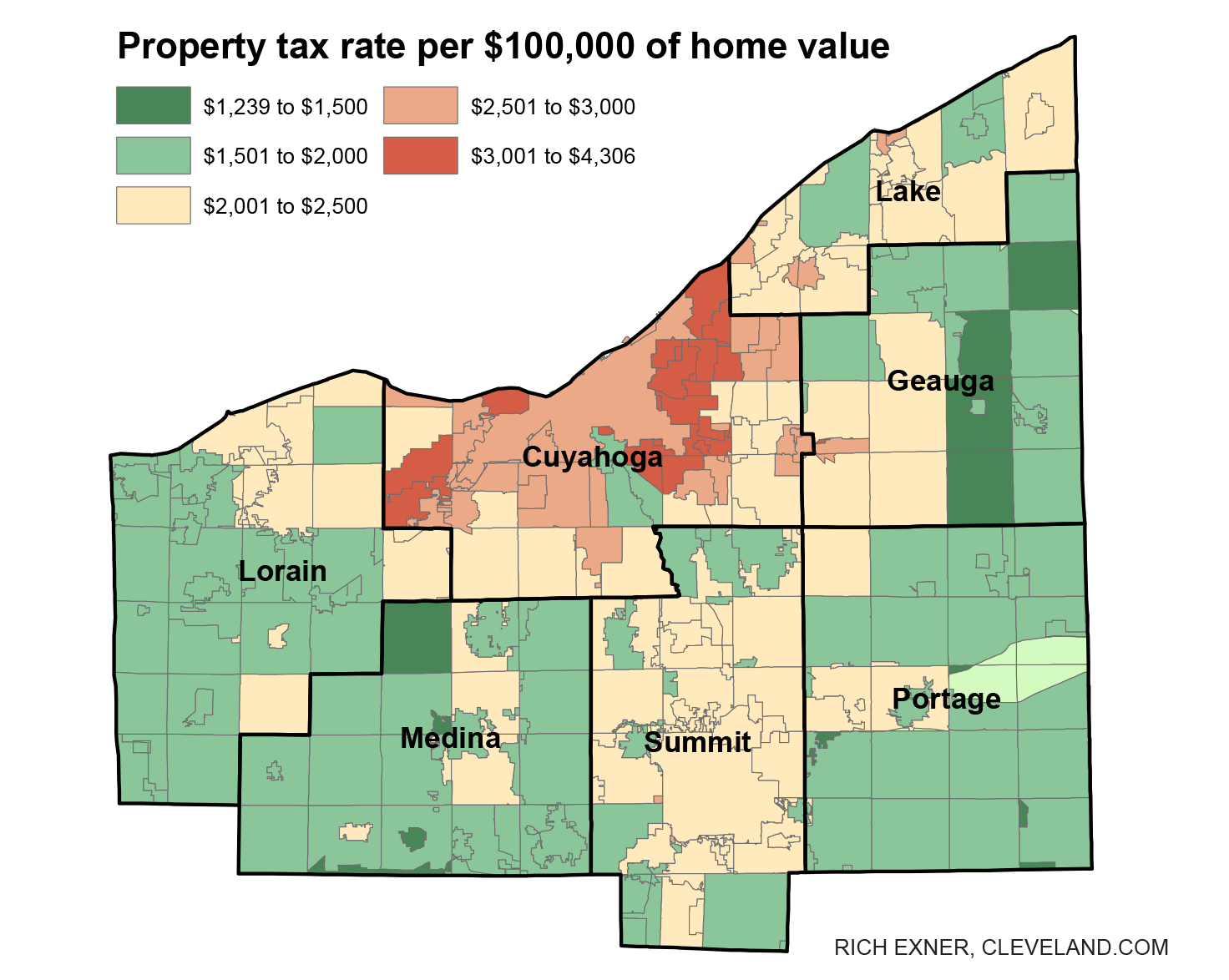

Property taxes are calculated based on the value of your property and the tax rate within your community.

Lakewood co sales tax rate 2020. Lakewood, wa sales tax rate. Simply press one rate and then press and maintain alt + select the other rate (s). The county sales tax rate is %.

Lakewood, co sales tax rate the current total local sales tax rate in lakewood, co is 7.500%. Try it now & grow your business! The minimum combined 2021 sales tax rate for lakewood, colorado is.

• the hamilton county (31) sales and use tax rate will increase from 7.00% to 7.80% effective october 1, 2020. Cuyahoga county $ 41.53 lakewood s.d. Businesses located in belmar or the marston park and belleview shores districts have different sales tax rates.

Visit the sales tax rate changes web page for information on the most recent sales tax rate changes. Background the colorado constitution gives local municipalities the ability to determine their tax base, establish rates, and perform their own tax collection. The december 2020 total local sales tax rate was 9.900%.

Lakewood municipal code (“lmc”) and regulations summary. $ 311.50 rates of taxation for tax year 2020 due in 2021 rates are expressed in dollars and cents on each one thousand dollars of tax value. Remember that zip code boundaries don't always match up with political boundaries (like lakewood or eddy county ), so you shouldn't always rely on something as imprecise as zip codes.

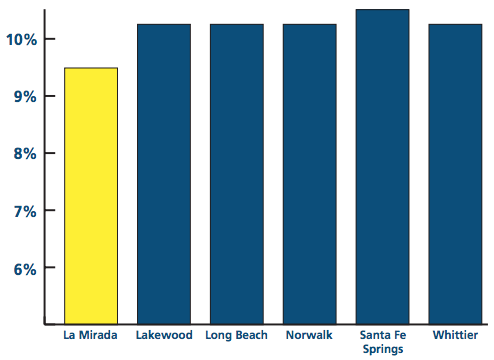

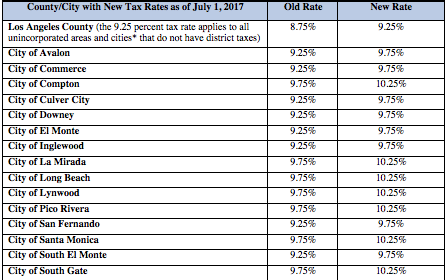

The 10.25% sales tax rate in lakewood consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% lakewood tax and 3.25% special tax. 2021 fee schedule as adopted by city council on nov. , wa sales tax rate.

Code local rate state rate combined sales tax (1) a aberdeen. You can print a 10.25% sales tax table here. The lakewood, colorado sales tax is 7.50%, consisting of 2.90% colorado state sales tax and 4.60% lakewood local sales taxes.the local sales tax consists of a 0.50% county sales tax, a 3.00% city sales tax and a 1.10% special district sales tax (used to fund transportation districts, local attractions, etc).

Create your own online store and start selling today. For businesses that operate in more than one jurisdiction, managing the (sales/use) taxation can be complex and burdensome. This downloadable spreadsheet combines the information in the dr 1002 sales and use tax rates document and information in the dr 0800 local jurisdiction codes for sales tax filing in one lookup tool.

7.65% [is this data incorrect?] the denver, colorado sales tax is 7.65% , consisting of 2.90% colorado state sales tax and 4.75% denver local sales taxes.the local sales tax consists of a 3.65% city sales tax and a 1.10% special district sales tax (used to. The lakewood sales tax rate is %. The colorado sales tax rate is currently %.

Use our local tax rate lookup tool to search for rates at a specific address or area in washington. Location tax rates and filing codes. Sales tax rate changes sales tax rates generally change every six months on january 1st and july 1st.

The remainder of the taxes should be remitted to the state of colorado. State of colorado 2.9% jefferson county 0.5% rtd (1.0%) + cultural (0.1%) 1.1% city of lakewood* 1.0% total combined rate. Sign up for our notification service to get future sales & use tax rate change information.

The county sales tax rate is %. The colorado sales tax rate is currently %. Please visit our website at.

State of colorado 2.9% jefferson county 0.5% rtd (1.0%) + cultural (0.1%) 1.1% city of lakewood* 3.0% total combined rate 7.5% in belmar, the combined sales tax rate is 5.5%: There will be two (2) sales and use tax rate changes effective october 1, 2020. Lakewood combined sales tax rate.

This way, you could select multiple rates based on your needs. $ 171.50 olmsted falls s.d. For most of lakewood, the combined sales tax rate is 7.5%:

For those who file sales taxes. The local sales and use tax rate of 10.0%. Amount before taxes sales tax rate (s) 7.5% (combined) 2.9% (state) 0.5% (county) 3% (city) 1.1% (special) amount of taxes.

The colorado springs sales tax rate is %. • the tuscarawas county (79) sales and use tax rate will decrease from 7.25% to 6.75% effective october 1, 2020. The tax rate for most of lakewood is 7.5%.

Your 2020 property value was. This is the total of state, county and city sales tax rates. This is the total of state, county and city sales tax rates.

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and annexations. The city portion (3%) must be remitted directly to the city of lakewood. The minimum combined 2021 sales tax rate for colorado springs, colorado is.

The december 2020 total local sales tax rate was also 7.500%. The tax will be used for chemical dependency or mental health purposes. Create your own online store and start selling today.

The current total local sales tax rate in lakewood, wa is 10.000%.

Greater Clevelands Wide Spread In Property Tax Rates See Where Your Community Ranks – Clevelandcom

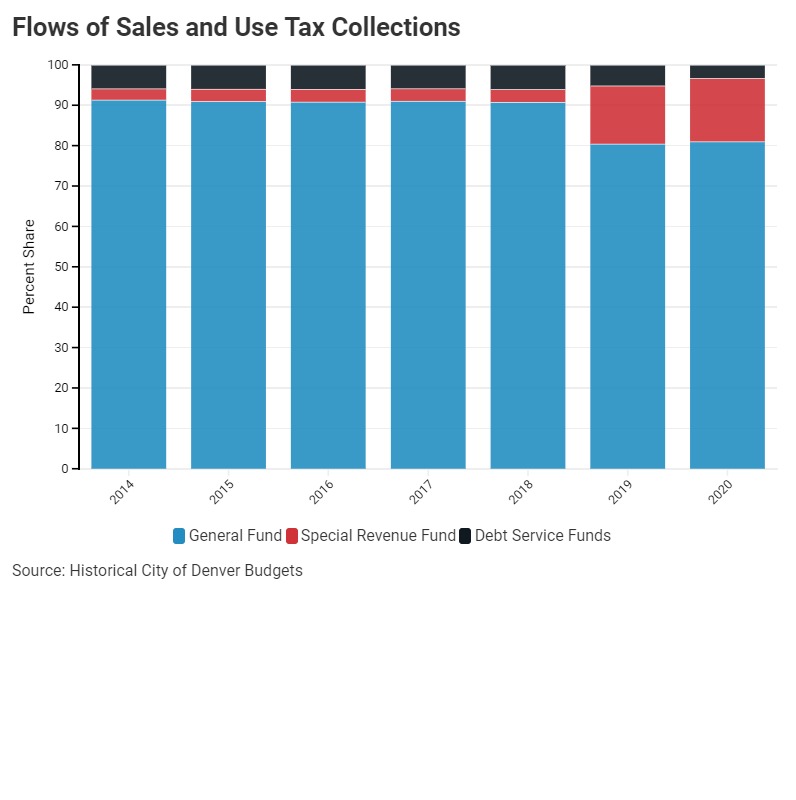

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

California Sales Tax Rates By City County 2021

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

States With Highest And Lowest Sales Tax Rates

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

How Colorado Taxes Work – Auto Dealers – Dealrtax

Haves And Have Nots County Property Taxes Provided 25 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed – The Center For Community Solutions

Taxes Fees In Lakewood – City Of Lakewood

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio – Clevelandcom

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Clevelandakron Area – Clevelandcom

Sales Use Tax – City Of Lakewood

Sales Tax Rate – Jeffcoedc

Los Angeles Countys Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizens Voice

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

States With Highest And Lowest Sales Tax Rates

2021 – 2022 Tax Information Euless Tx