All estimates are for tax year 2020 taxes paid in 2021. As your lake county real estate taxes are calculated basically by multiplying the evaluated value of your house by its areas set tax rate, you do not have any premises to appeal the tax rate just the real estate assessment value.

Lake-county Property Tax Records – Lake-county Property Taxes In

Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

Lake county real estate taxes ohio. At that time the lake county auditor’s office made the. As of december 3, lake county, oh shows 304 tax liens. The figures presented here are based on official records and are as accurate as we can make them, but other factors may exist that affect.

The collection begins on november 1st for the current tax year of january through december. Lake county ohio local county sites: See detailed property tax report for 8124 dartmoor rd, lake county, oh.

112,991 (2021) terms of use privacy policy copyright 2020 by lake county, ohio last updated: Houses (4 days ago) the following table shows real property taxes as computed in lake county: Ashtabula county cuyahoga county geauga county:

The median property tax in ohio is $1,836.00 per year for a home worth the median value of $134,600.00. Lobbyist joe in cleveland heights shares his thoughts about the cleveland heights astronomical property tax levy on the march 17th ballot. Your only opportunity of approach is to prove your home is less than the value the assessor thinks.

By contributing writer on january 26, 2020 • ( 20) (lfc comments: How does a tax lien sale work? The last full reappraisal in lake county was completed in 2012 (read lake county reports drop in residential, commercial property values for more details).

Find your appropriate taxing district on the chart above. Ohio is ranked number twenty two out of the fifty states, in order of. Ohio law requires a general reappraisal of all real property every six years with an update during the third year after the reappraisal.

Property information and tax bill data is currently frozen. The taxable value is 35 percent of true (market) value, except for certain land devoted exclu sively to agricultural use. Population 230,149 (2019) | parcels:

Lake county auditor 105 main st. These real estate taxes are collected on an annual basis by the lake county tax collector's office. Counties in ohio collect an average of 1.36% of a property's assesed fair market value as property tax per year.

Po box 490 suite c101 painesville, oh 44077 The median property tax (also known as real estate tax) in lake county is $2,433.00 per year, based on a median home value of $158,100.00 and a median effective property tax rate of 1.54% of property value. The 7.9 mill levy will cost a taxpayer $276.50 per year for every $100,000 of market valuation….

Cleveland heights tax levy…7.9 mills…oh, my. Lake county property records are real estate documents that contain information related to real property in lake county, ohio. Multiply the assessed valuation (35% of the market value) by the effective rate for your taxing district and divide by 1,000.

December 02, 2021 | powered by iasworld public access: (ohio revised code 5713.03, 5715.01) the real property tax base is the taxable (assessed) value of land and improvements. Interested in a tax lien in lake county, oh?

Tax bills reflect amounts due as of july 7, 2021. Contesting your lake county, ohio property value. The charge will appear on your credit card statement, the tax amount on one line and the convenience fee on a separate line.

All estimates are for tax year 2020 taxes paid in 2021. Taxes lake county ohio port & economic development authority. Home owners in lake county can expect their triennial property tax update in the fall of 2015 and their next reappraisal in the fall of 2018.

To access more auditor resources please use the lake county links below. It is the responsibility of each property owner to see that their taxes are paid, and that they do indeed receive a tax bill.

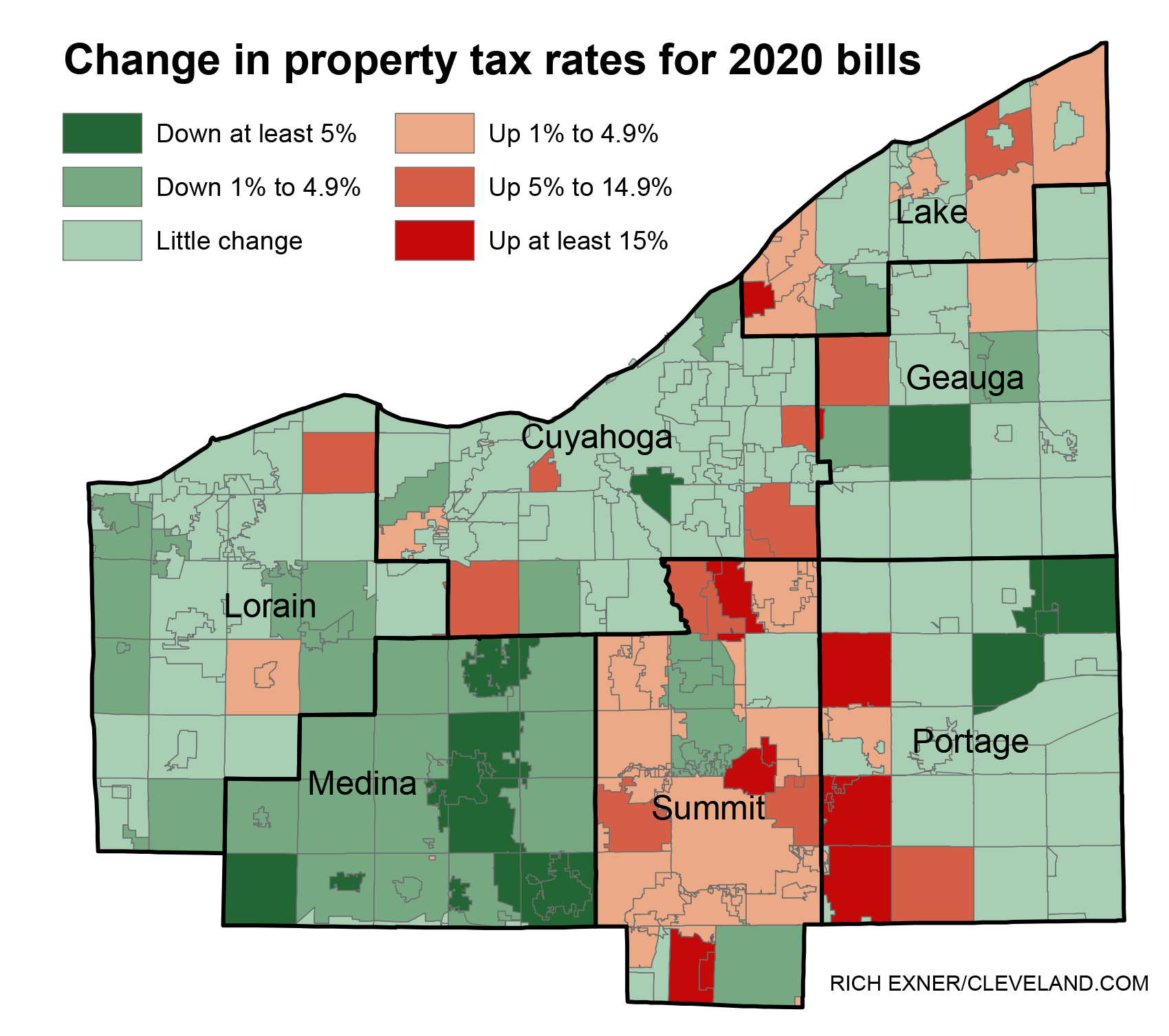

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Clevelandakron Area – Clevelandcom

Greater Clevelands Wide Spread In Property Tax Rates See Where Your Community Ranks – Clevelandcom

2

Ohio Property Tax Calculator – Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Sheriff Lake County Ohio

Real Estate Taxes Auditor

The Gibbs Firm – Property Tax Appeals Litigation

Greater Clevelands Wide Spread In Property Tax Rates See Where Your Community Ranks – Clevelandcom

Pay Taxes By Credit Card E-check Treasurer

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio – Clevelandcom

Auditors Office

Ohio Property Tax Hr Block

Map Of Geauga And Lake Counties Ohio Library Of Congress

Ohio Property Tax Calculator – Smartasset

Oregon Home With Views Of Lake Erie Online Auction At 2057 Lilias Drive Oregon Ohio 43616 – Biddi Residential Real Estate Real Estate Auction Vinyl Siding

Mentor-on-the-lake Real Estate – Mentor-on-the-lake Oh Homes For Sale Zillow

Clerk Of Courts Lake County Ohio

25 Hidden Gem Real Estate Markets