Title and transfer of existing plate $14.50. 26 cents per gallon of regular gasoline, 27 cents per gallon of diesel

Tennessee Sales Tax And Other Fees – Motor Vehicle – County Clerk – Knox County Tennessee Government

9.25% [the total of all sales taxes for an area, including state, county and local taxes.income taxes:

Knoxville tn sales tax rate 2020. Tennessee has state sales tax of 7% , and allows. Although the majority of property owners pay their taxes on time, the five or six percent that do not force us to take extreme measures. 2020's top real estate agents and realtors in knoxville.

The purpose of tax auctions is to collect delinquent revenues and put properties back into productive use. The top 5% of buyer’s agents generally save clients 0.09% more than the average real estate agent in knoxville. The county sales tax rate is %.

9.25% (7% state, 2.25% local) city property tax rate: City of knoxville revenue office. 0.00% [the total of all income taxes for an area, including state, county and local taxes.federal income taxes are not included.] property tax rate:

$2.4638 per $100 assessed value. Depending on the zipcode, the sales tax rate of knoxville may vary from 7% to 9.25% every 2021 combined rates mentioned above are the results of tennessee state rate (7%), the county rate (2.25%). If you buy a car for $20,000 in a location with a 2 percent local sales tax rate, then you'll pay an additional.

This is the total of state, county and city sales tax rates. Tax sale dates are determined by court proceedings and will be listed accordingly. The tennessee sales tax rate is currently %.

$8.63 [the property tax rate shown here is the rate per $1,000 of home value. Single family home tax lien. Knox county clerk, po box 1566, knoxville, tn 37901

None (1% flat tax on interest and dividends earned in tax year 2020) sales tax: The purpose of a tax sale auction is to collect delinquent revenue and put properties back into productive use. Houses (7 days ago) according to real estate transaction data analysis, the top 5% of seller’s agents in knoxville, on average, sell homes for $31,797 more money than the average knoxville real estate agent.

The knoxville, tennessee, general sales tax rate is 7%. Tax sale dates are determined by court proceedings and will be listed accordingly. See all 1 see map.

This is a tax lien listing. There is no city sale tax for knoxville. The knoxville sales tax rate is %.

The 9.25% sales tax rate in knoxville consists of 7% tennessee state sales tax and 2.25% knox county sales tax. Tax rates for knoxville, tn. City and county sales tax rates vary depending on where you buy a car in tennessee.

This leaves $80 due at. Tennessee sales and use tax county and city local tax rates county city local tax rate effective date situs fips code ^ county city local tax rate effective date situs fips code ^ fayette 2.25% There is no applicable city tax or special tax.

The real estate data from zillow shows that the median home value in knoxville is $173,900. 565 rows average sales tax (with local): There is no applicable city tax or special tax.

It is not a property for sale. (wate) — a local petition aims to freeze the current property tax rate in the city of knoxville. The mailing fee is $2.00 if we are just mailing out a registration (for transferred tags or renewals) and $3.00 if we are mailing out a plate and registration.

There is no special rate for knoxville. $2.12 per $100 assessed value. Comptroller of the treasury jason e.

4 bed 2.0 bath 1,479 sqft. Knoxville home values have gone up 7.0% over the past year and their knoxville real estate market. Knox county wheel tax is $36.00 and may apply when purchasing a new plate.

Although the majority of property owners pay their taxes on time, owners who do not pay their property taxes force us to take extreme measures. The minimum combined 2021 sales tax rate for knoxville, tennessee is. • $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (single article tax rate) = $44 • total tax due on the vehicle = $1,851 • clerk negotiates check for $1,771 tn sales tax paid by dealer if county clerk has received the payment from dealer.

While there is no current proposal to raise the rate, erik wiatr, a petition.

Year-specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Tennessee Car Sales Tax Everything You Need To Know

Tennessee Sales Tax – Taxjar

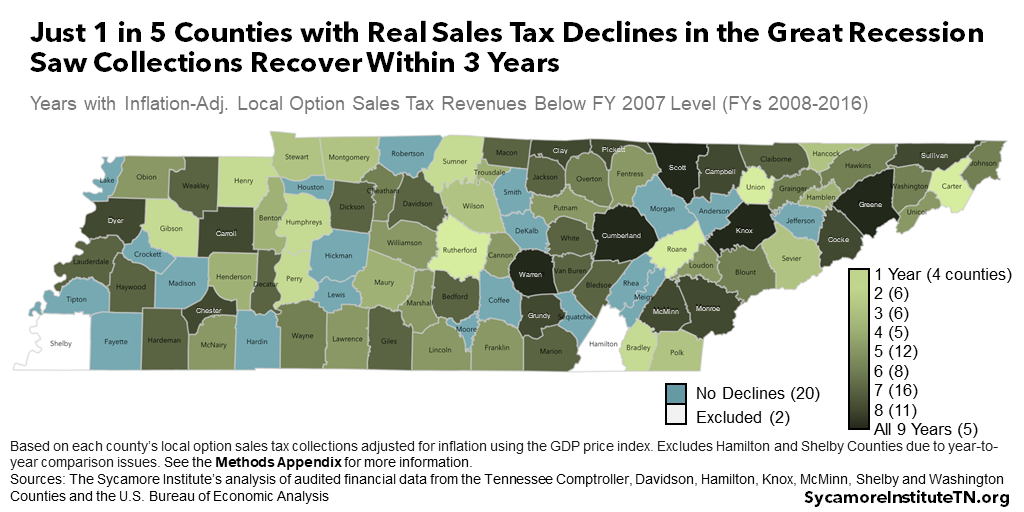

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Tax On Grocery Items – Taxjar

Sample Boutique Business Plan – Google Search Business Plan Template Free Business Plan Template Retail Business Plan Template

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

United Methodist Church 2021 Lectionary Events Broadway United Methodist Church With United

Tennessee County Tax Statistics Ctas

Histogram Of Sales Tax Revenue Total State Revenue For The 50 Download Scientific Diagram

Economy Of Tennessee – Wikipedia

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Historical Tennessee Tax Policy Information – Ballotpedia

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax – Small Business Guide Truic

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2021

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue