The december 2020 total local sales tax rate was also 9.250%. $2.12 per $100 assessed value.

Ohio Sales Tax Rates By City County 2021

Average sales tax (with local):

Knoxville tn sales tax rate 2019. Your brand can grow seamlessly with wix. Local sales and use taxes are filed and paid to the department of revenue in the same manner as the state sales and use taxes. This leaves $80 due at the time of registration to be paid by the registrant.

There are approximately 966 people living in the knoxville area. Utilize quick add to cart and more!. 2021 cost of living calculator for taxes:

All local jurisdictions in tennessee have a local sales and use tax rate. Tennessee sales and use tax county and city local tax rates county city local tax rate effective date situs fips code ^ county city local tax. This tax is generally applied to the retail sales of any business, organization, or person engaged

The 2018 united states supreme court decision in south dakota v. The knox county sales tax rate is %. 9.25% (7% state, 2.25% local) city property tax rate:

The knoxville, tennessee, general sales tax rate is 7%. Knoxville, tennessee and greenville, south carolina. However, every taxpayer must pay at least a minimum tax of $22.

Sales or use tax [tenn. • $1,600 x 2.25% (local sales tax) = $36 • $1,600 x 2.75% (single article tax rate) = $44 • total tax due on the vehicle = $1,851 • clerk negotiates check for $1,771 tn sales tax paid by dealer if county clerk has received the payment from dealer. Purchases in excess of $1,600, an additional state tax of 2.75% is added up to a.

Ad create an online store. $2.4638 per $100 assessed value. Your brand can grow seamlessly with wix.

State sales tax is 7% of purchase price less total value of trade in. Free online 2019 q2 us sales tax calculator for 37998, knoxville. Tax sale dates are determined by court proceedings and will be listed accordingly.

The local sales tax rate and use tax rate are the same rate. Although the majority of property owners pay their taxes on time, the five or six percent that do not force us to take extreme measures. The minimum combined 2021 sales tax rate for knox county, tennessee is.

The local tax rate may not be higher than 2.75% and must be a multiple of.25. The current total local sales tax rate in knoxville, tn is 9.250%. The purpose of tax auctions is to collect delinquent revenues and put properties back into productive use.

City of knoxville revenue office. The knoxville, arkansas sales tax rate of 7.5% applies in the zip code 72845. Our premium cost of living calculator includes, state and local income taxes, state and local sales taxes, real estate transfer fees, federal, state, and local consumer taxes (gasoline, liquor, beer, cigarettes), corporate taxes, plus auto sales.

Ad create an online store. Depending on the zipcode, the sales tax rate of knoxville may vary from 7% to 9.25% depending on the zipcode, the sales tax rate of knoxville may vary from 7% to 9.25% The tennessee state sales tax rate is currently %.

There is no applicable city tax or special. Fast and easy 2019 q2 sales tax tool for businesses and people from 37998, knoxville, tennessee, united states. The 9.25% sales tax rate in knoxville consists of 7% tennessee state sales tax and 2.25% knox county sales tax.

This is the total of state and county sales tax rates. Knoxville, tn sales tax rate. There are a total of 234 local tax jurisdictions across the state, collecting an average local tax of 2.547%.

This amount is never to exceed $36.00. Utilize quick add to cart and more!. The business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler.

Tennessee has state sales tax of 7% , and allows local governments to collect a local option sales tax of up to 2.75%. Local sales tax is 2.25% of the first $1,600. Remember that zip code boundaries don't always match up with political boundaries (like knoxville or johnson county ), so you shouldn't always rely on something as imprecise as zip codes to determine the sales tax rates at a given.

Histogram Of Sales Tax Revenue Total State Revenue For The 50 Download Scientific Diagram

Alabama Sales Tax Rates By City County 2021

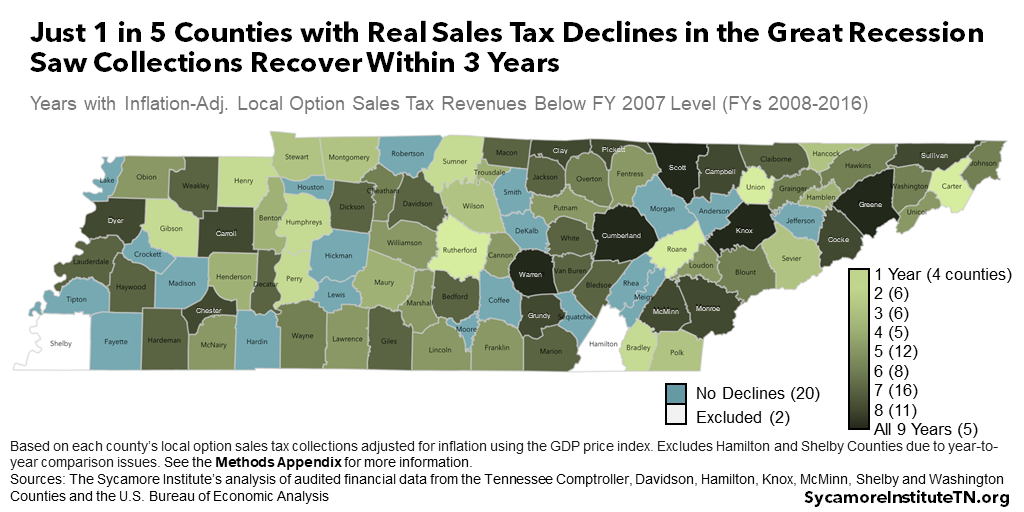

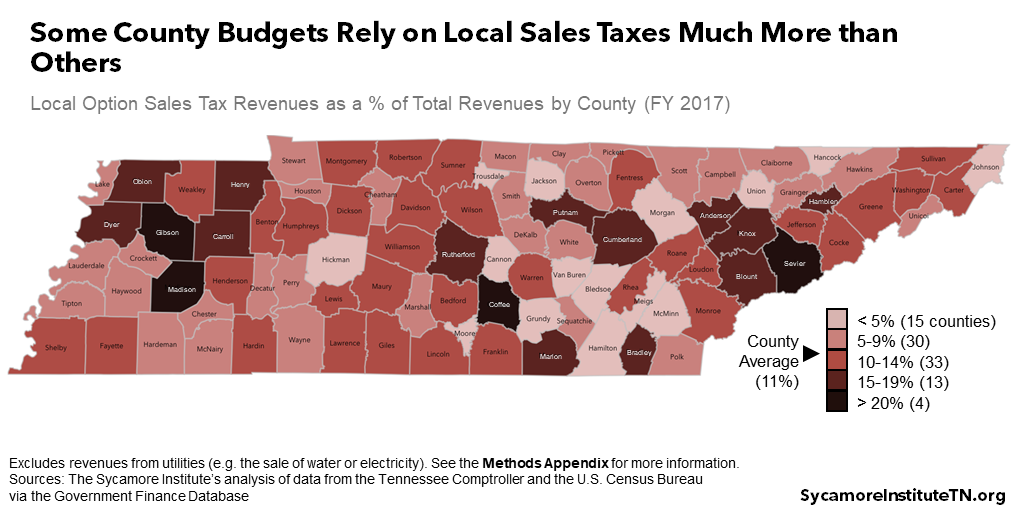

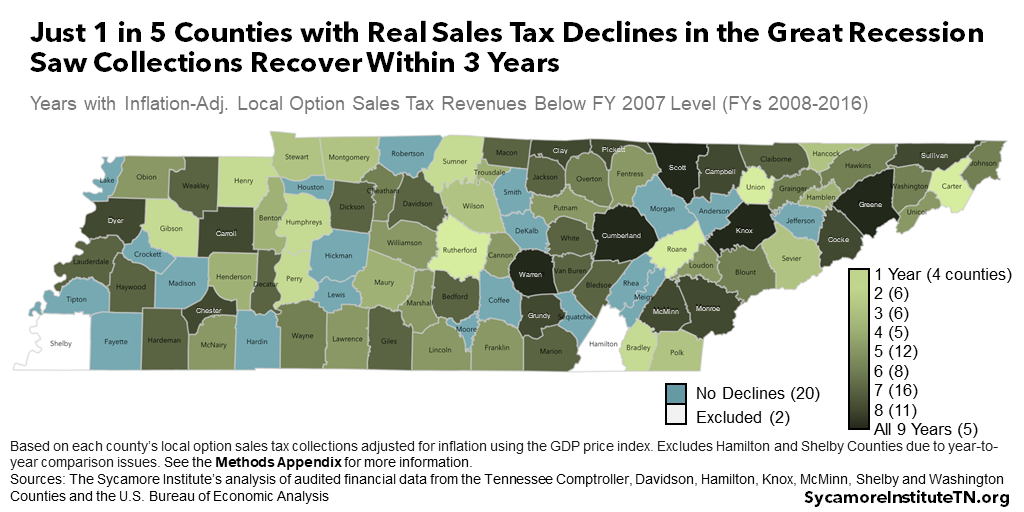

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Iowa Sales Tax Rates By City County 2021

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

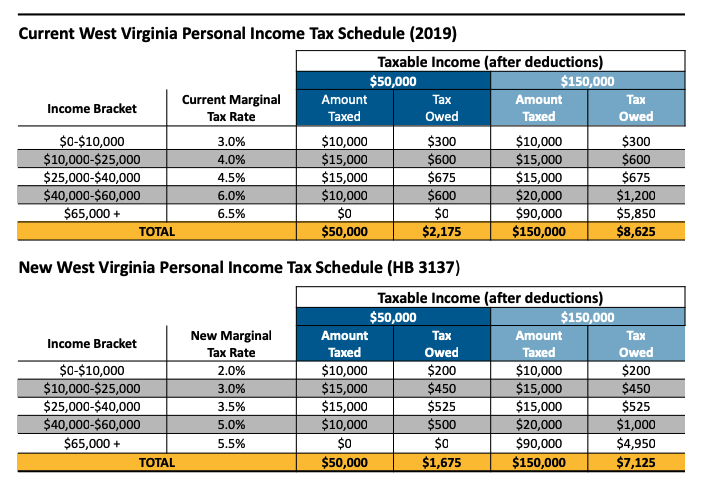

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 – West Virginia Center On Budget Policy

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2021

Desirable Features Of A State Corporate Income Tax Download Table

Historical Tennessee Tax Policy Information – Ballotpedia

Year-specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Tennessee Car Sales Tax Everything You Need To Know

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Illinois Sales Tax Rates By City County 2021

Year-specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee County Tax Statistics Ctas

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue