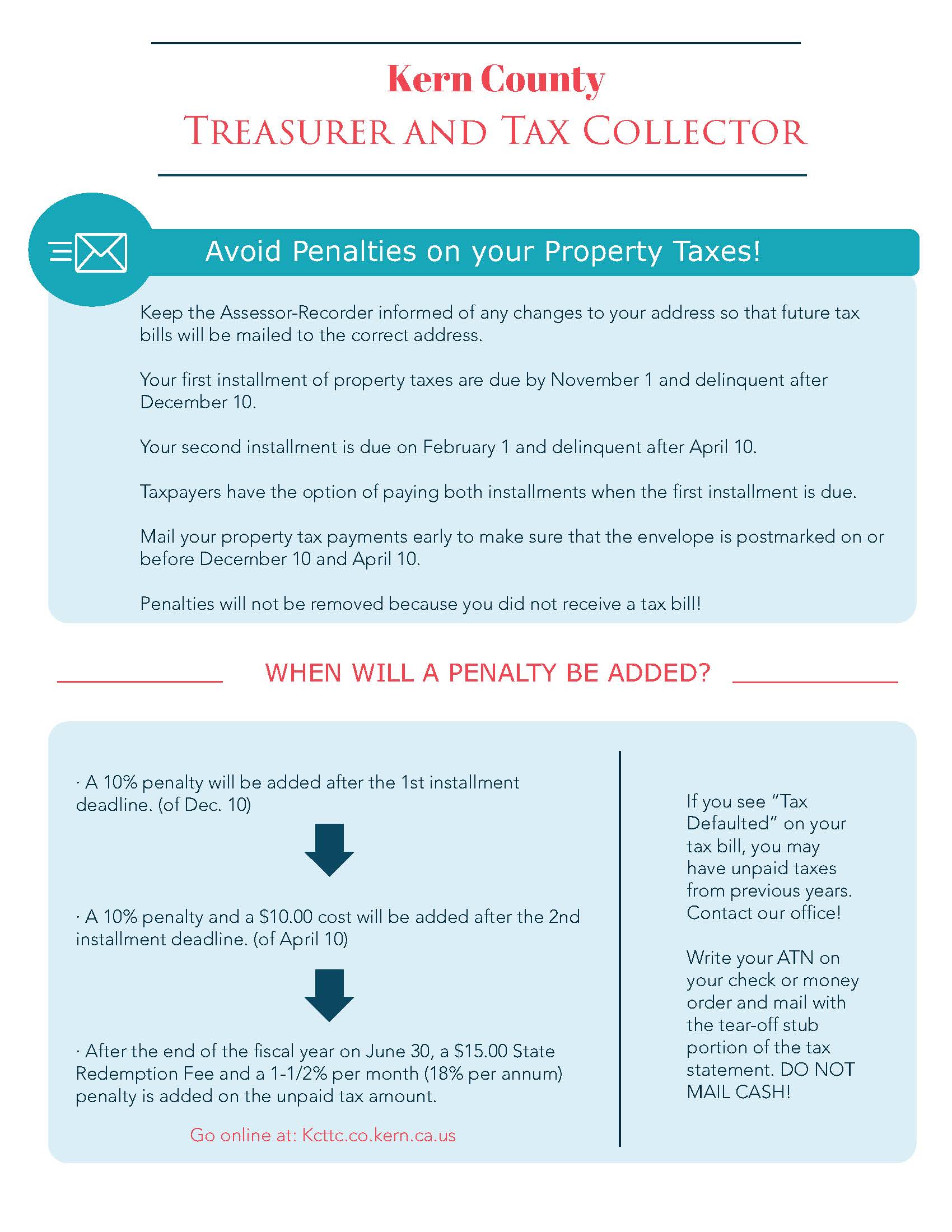

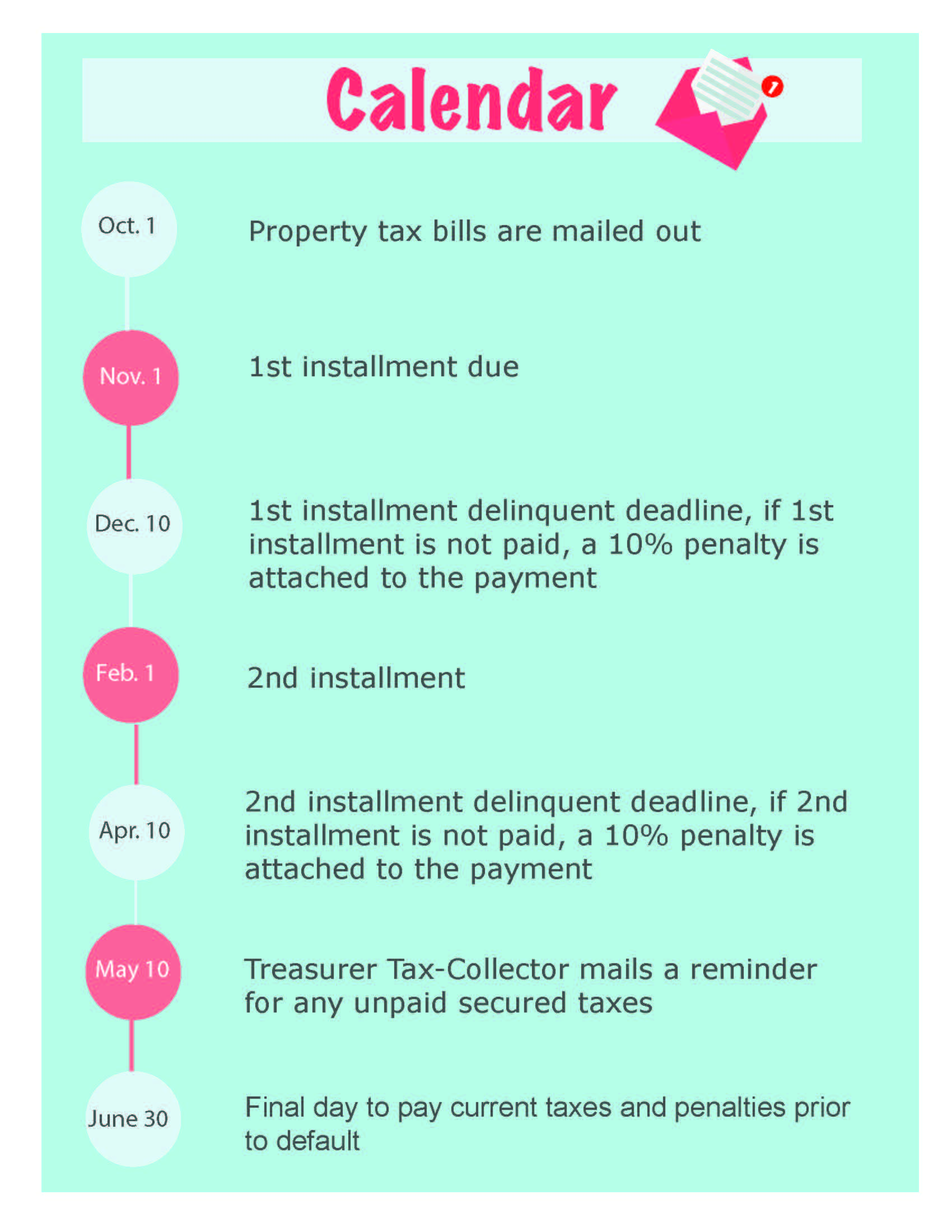

The first round of property taxes is due by 5 p.m. The first installment of kern county property tax bills will become delinquent if not paid b….

Property Tax Portal Kern County Ca

Do not include correspondence with your payment.

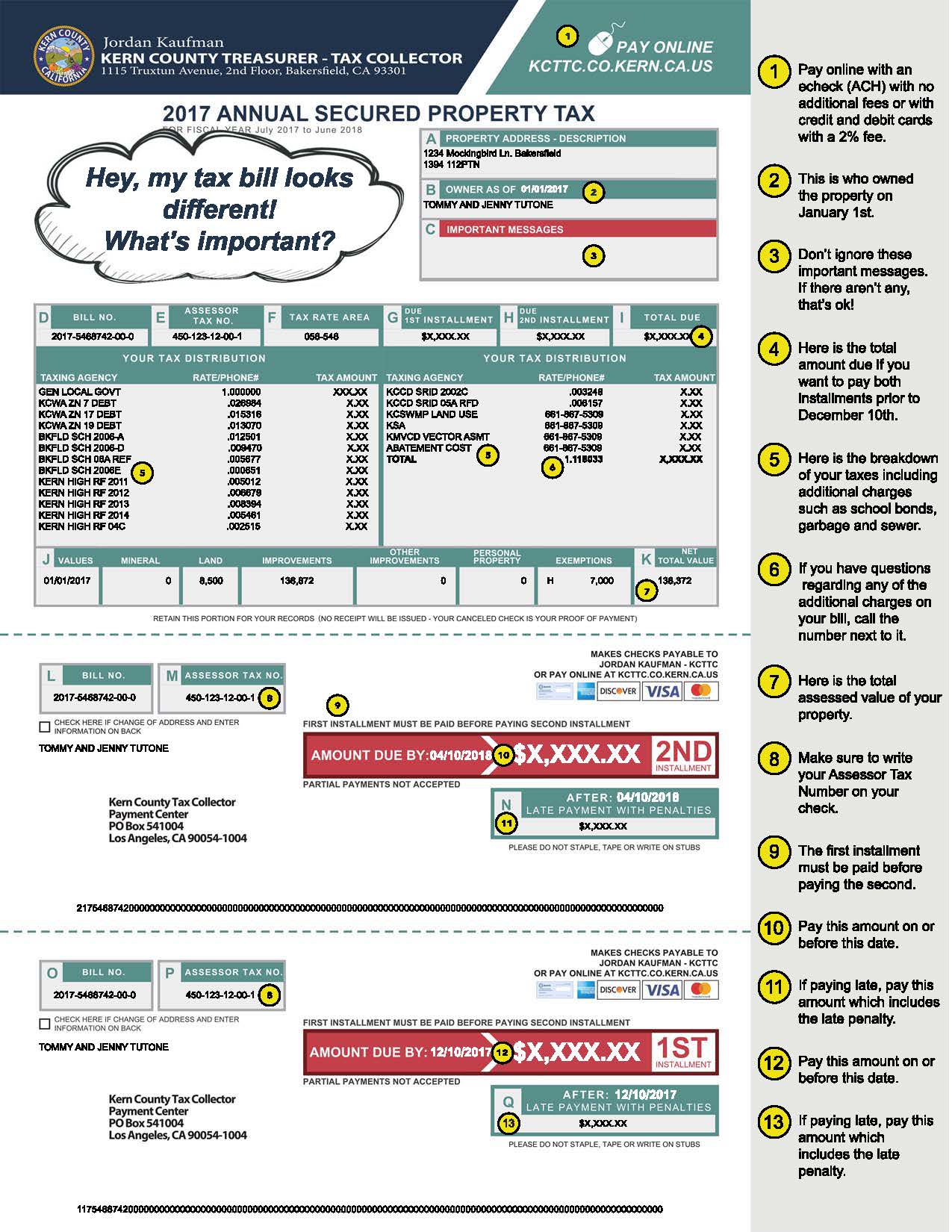

Kern county tax collector payment center. County of kern adminstrative center. The kern county treasurer and tax collector's office is part of the kern county finance department that encompasses all. Secured tax bills are paid in two installments:

Section 2503.2 of the california revenue and taxation code authorizes tax collectors of any city, county, or city and county to require a taxpayer whose property tax payment equals or exceeds an aggregate payment of $50,000.00 to make payments. Office hours are monday through friday. — the kern county kern county treasurer and tax collector has released a statement regarding upcoming property tax deadlines and solutions for those struggling due to.

With easy access to tax sale information and auction results, you can research properties and enter bids from anywhere in the world. The kern county treasurer and tax collector has mailed around 403,000 property tax bills totaling around $1.4 billion to local property owners. Check out our new site for information about kern county government.

Recorded document search by grantee/grantor. Deedauction® is part of our office's. Officials suggest that you pay the tax without.

Banking hours are monday through friday. Payments can be made on this website or mailed to our payment processing center at p.o. Recorded document search by document number, date, or class.

Please type the text from the image. A 10% penalty is added if the payment is not made as of 5:00 p.m. Correspondence must include the assessor tax number and be mailed to:

Kern county property records are real estate documents that contain information related to real property in kern county, california. The kern county treasurer and tax collector is warning people not to be late otherwise a 10 percent fee will be tacked on. Kern county business recruitment & job growth incentive initiative.

The various payment methods available include mailing a check, cash, or money order to the kcttc payment center, p.o. Here, you’ll find many opportunities to learn kern county’s story through digital content, news releases, community events, and updates from our departments. Tax payments only must be mailed to:

Press enter or click to play code. The first installment is due on 1st november with a payment deadline on 10th december. — the kern county treasurer and tax collector (kcttc) is reminding kern residents that the first installment of property tax is due next week.the county agency is urging residents to make sure they pay the first installment of their property tax by 5 p.m.

Credit cards and debit cards have a 2% card processing fee based on the amount of taxes paid. Property tax payment due on by dec. Welcome to the kern county online tax sale auction website.

This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property. 10 or it will become delinquent. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds, an additional $27 returned payment fee for each duplicate.

Kern County Treasurer And Tax Collector

Pay Up First Installment Of Property Taxes Coming Due News Tehachapinewscom

Jordan Kaufman Kern County Treasurer-tax Collector – Home Facebook

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer-tax Collector – Home Facebook

Kern County Treasurer And Tax Collector

Property Tax Payment Due On By Dec 10 News Taftmidwaydrillercom

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer-tax Collector – Beranda Facebook

Kern County Treasurer And Tax Collector

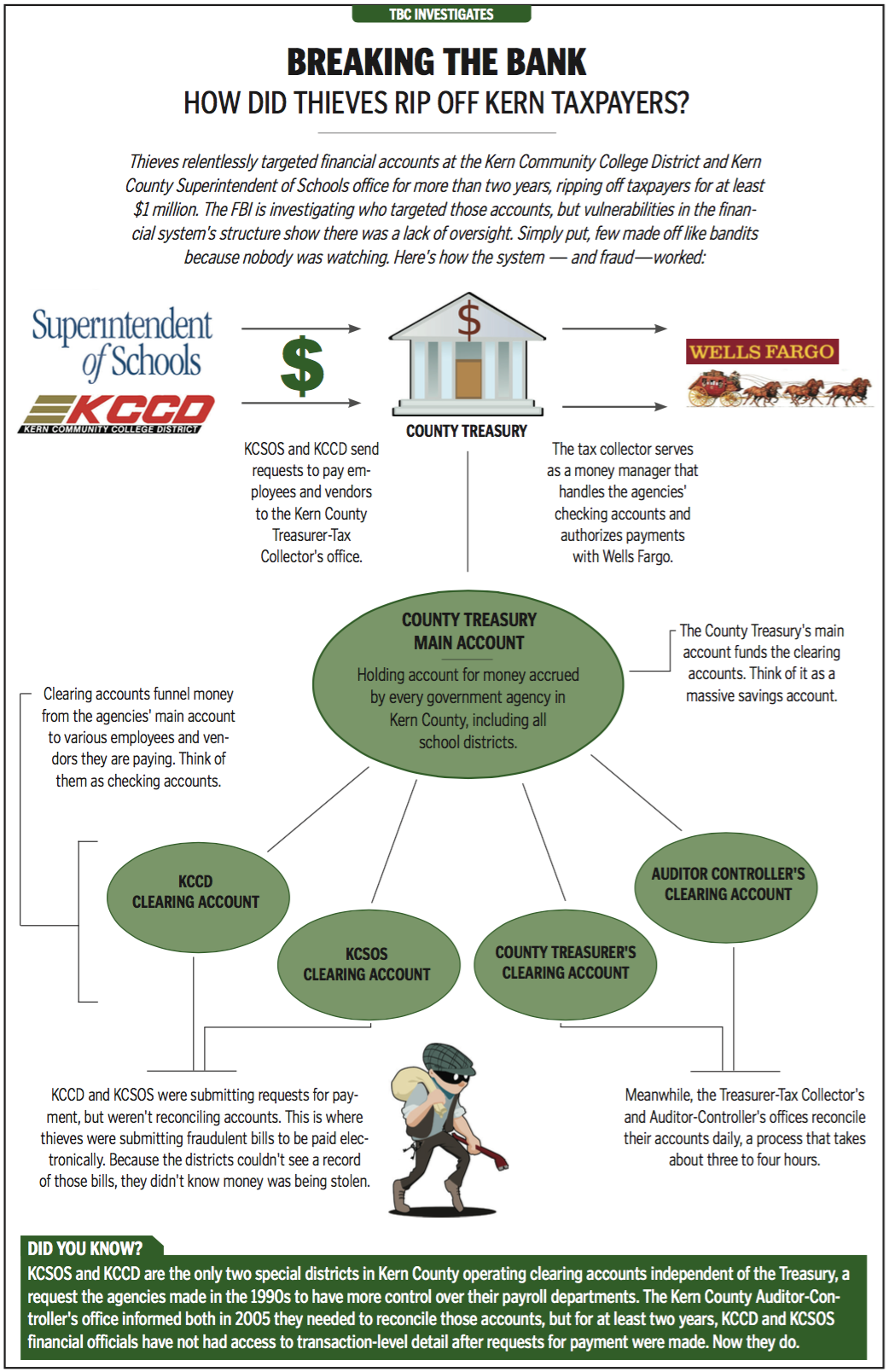

Lack Of Oversight Kept At Least 1 Million Of Taxpayer Losses Hidden News Bakersfieldcom

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer-tax Collector – Home Facebook

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector