The property tax calendar provides for delivery of the tax bills to the sheriff by september 15 of each year. After a few seconds, you will be provided with a full breakdown of the tax you are paying.

Clerk Network – Department Of Revenue

To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price).

Kentucky property tax calculator. The median property tax on a $169,500.00 house is $1,220.40 in kentucky. Grant county collects, on average, 0.73% of a property's assessed fair market value as property tax. For most counties and cities in the bluegrass state, this is a percentage of taxpayers.

Real property tax rates current real estate tax rates. The tax estimator above only includes a single $75 service fee. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

History a brief history of property tax in kentucky. 121 rows · kentucky property tax rules. Homestead exemption apply for a tax discount if you are at least 65 or totally disabled.

The median property tax on a $169,500.00 house is $1,779.75 in the united states. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Most kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property;

We'll try to find your property's assessed value for you. This section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the public can petition to recall a tax rate. State real property tax rate.

Aside from state and federal taxes, many kentucky residents are subject to local taxes, which are called occupational taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes. Therefore, the dor inventory tax credit calculator is the best tool to correctly compute the tax credit.

(annual) how your property taxes compare based on an assessed home value of $250,000. Campbell county collects, on average, 1.01% of a property's assessed fair market value as property tax. Tangible property need the current tangible property form?

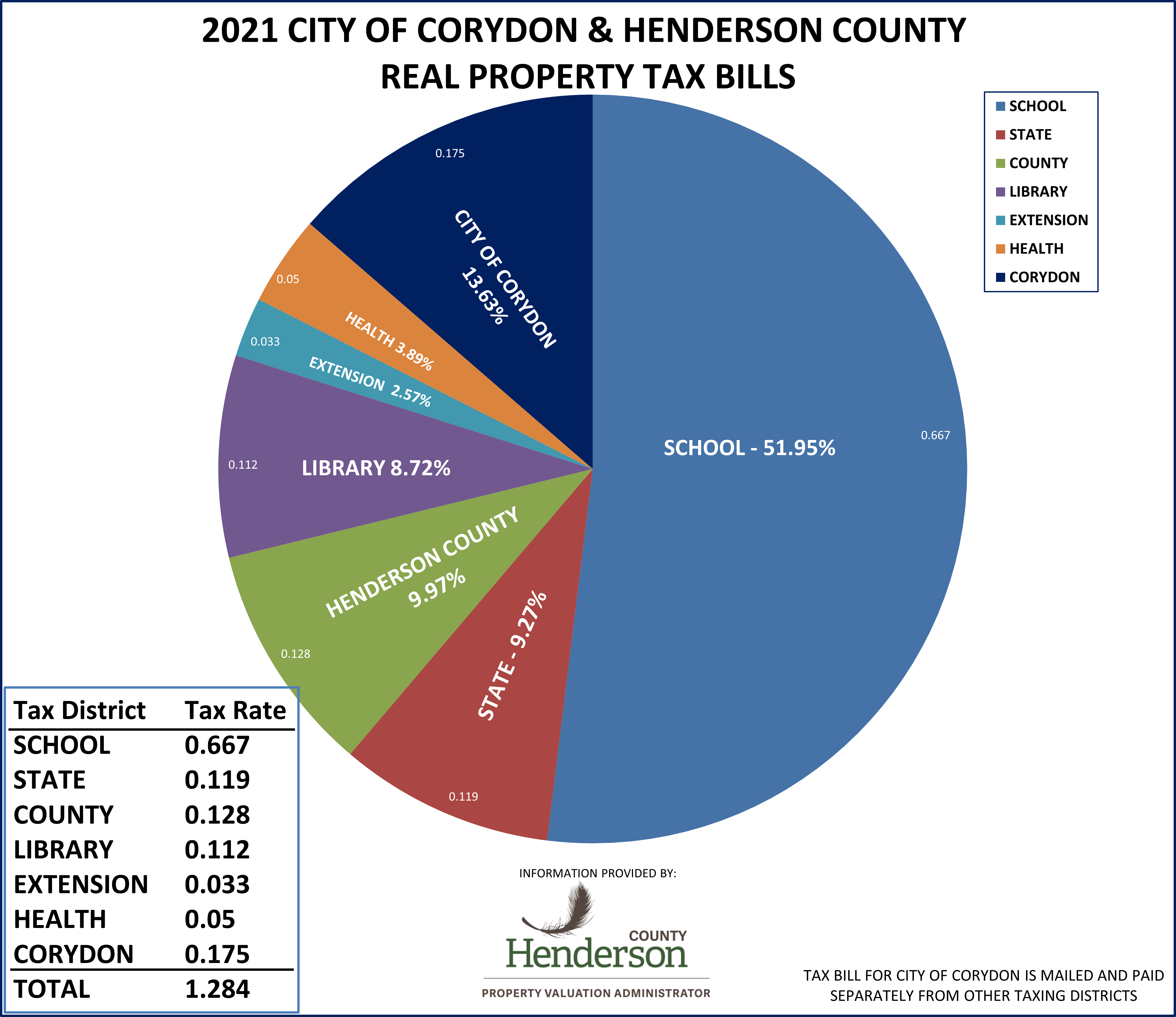

When ownership in kentucky is transferred, an excise tax of $.50 for each $500 of value or fraction thereof, is levied on the value of the property. Fy 2021 kentucky city property tax rates (excel) 2021 city property tax rate calculation workbook (excel) klc research report: Our kentucky property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kentucky and across the entire united states.

Kentucky is ranked 815th of the 3143 counties in the united states, in order of the median amount of property taxes collected. The median property tax in grant county, kentucky is $856 per year for a home worth the median value of $117,900. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price).

Counties in kentucky collect an average of 0.72% of a property's assesed fair market value as property tax per year. The median property tax on a $117,900.00 house is $1,237.95 in the united states. Enter your street address and click.

Properties in jefferson county are subject to an average effective property tax rate of 0.93% The median property tax on a $117,900.00 house is $848.88 in kentucky. For example, the sale of a $200,000 home would require a $200 transfer tax to be paid.

Kentucky has one of the lowest median property tax rates in the united states, with only seven states collecting a lower median property tax than kentucky. It is based only upon the taxes regarding inventory. Vehicle tax rates current vehicles tax rates;

To use our kentucky salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. All rates are per $100.

Property taxes in jefferson county are slightly higher than kentucky’s state average effective rate of 0.83%. Personal property tax rate calculation worksheet pursuant to krs 68.248, krs 132.024, krs 132.029. The median property tax in kentucky is $843.00 per year for a home worth the median value of $117,800.00.

The median property tax on a $71,400.00 house is $514.08 in kentucky. **all property that is not vacant is subject to a 911 service fee of $75 for each dwelling or unit on the property. The median property tax in campbell county, kentucky is $1,473 per year for a home worth the median value of $146,300.

The median property tax on a $117,900.00 house is $860.67 in grant county. Kentucky imposes a flat income tax of 5%. Maximum property tax levels also vary based on the size of the city, and house bill 44 (1979) placed strict limits on raising property tax rates from year to year.

Find your property's assessed value. 216 rows kentucky has a flat income tax rate of 5%, a statewide sales tax of 6% and. Keep in mind, a deed cannot be recorded unless the real estate transfer tax has been collected.

Our allen county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in kentucky and across the entire united states. More than 767,000 residents call jefferson county, kentucky home. That’s the assessment date for all property in the state, so taxes are based on the value of the property as of jan.

However, many counties wait until october 1 or november 1 to mail their tax bills. The median property tax on a $71,400.00 house is $456.96 in johnson county. Actual amounts are subject to change based on tax rate changes.

The median property tax on a $71,400.00 house is $749.70 in the united states. The tax rate is the same no matter what filing status you use. 2.160% of assessed home value.

If tax bills are mailed by october 1, taxpayers have until november 1 to pay their bill with a 2% discount. 2.100% of assessed home value. Kentucky is ranked 1751st of the 3143 counties in the united states, in order of the median amount of property taxes collected.

*please note that this is an estimated amount.

West Virginia Property Tax Calculator – Smartasset

Kentucky Property Tax Calculator – Smartasset

How To File The Inventory Tax Credit – Department Of Revenue

Combined State And Local General Sales Tax Rates Download Table

Kentucky Sales Tax – Small Business Guide Truic

Jefferson County Ky Property Tax Calculator – Smartasset

Tax Rates Henderson County Pva

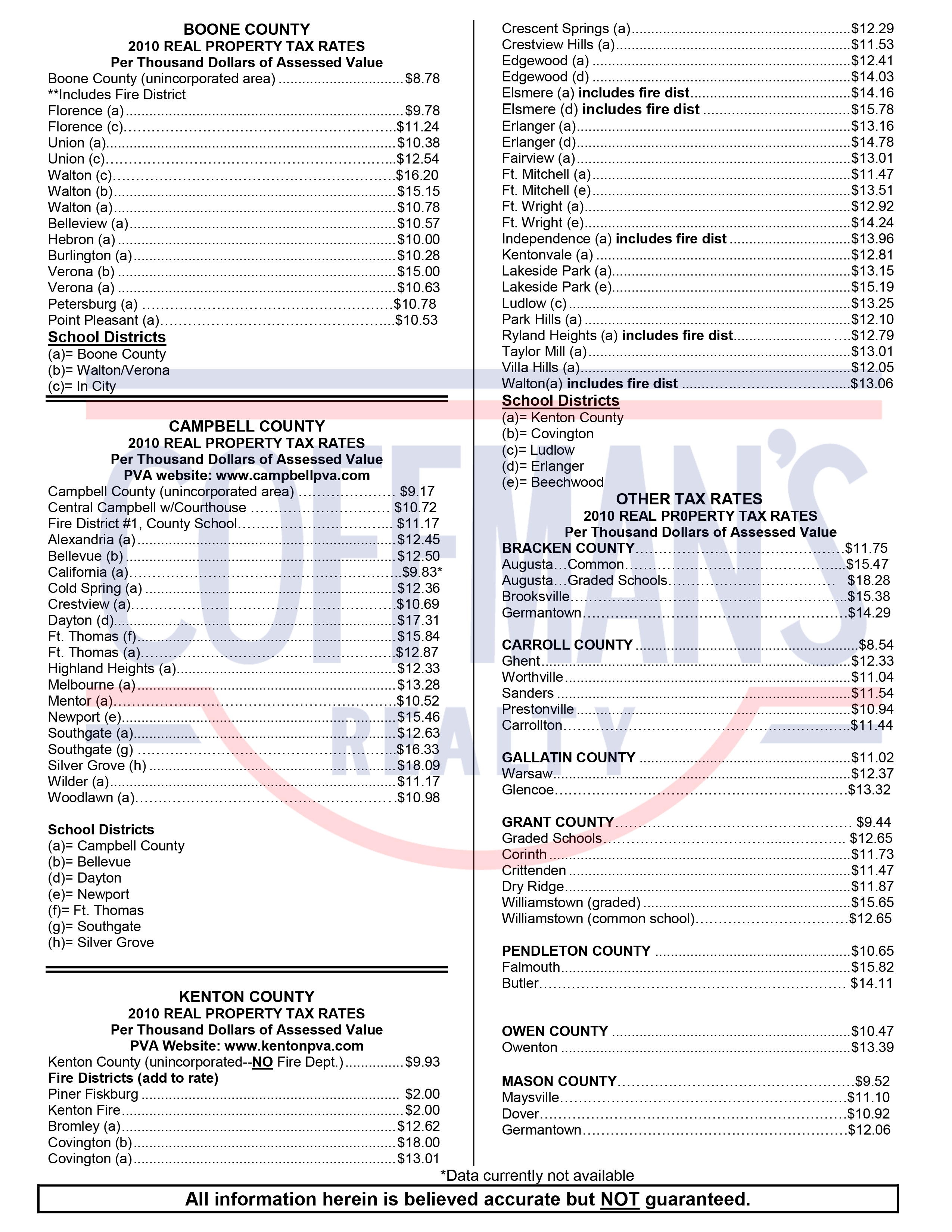

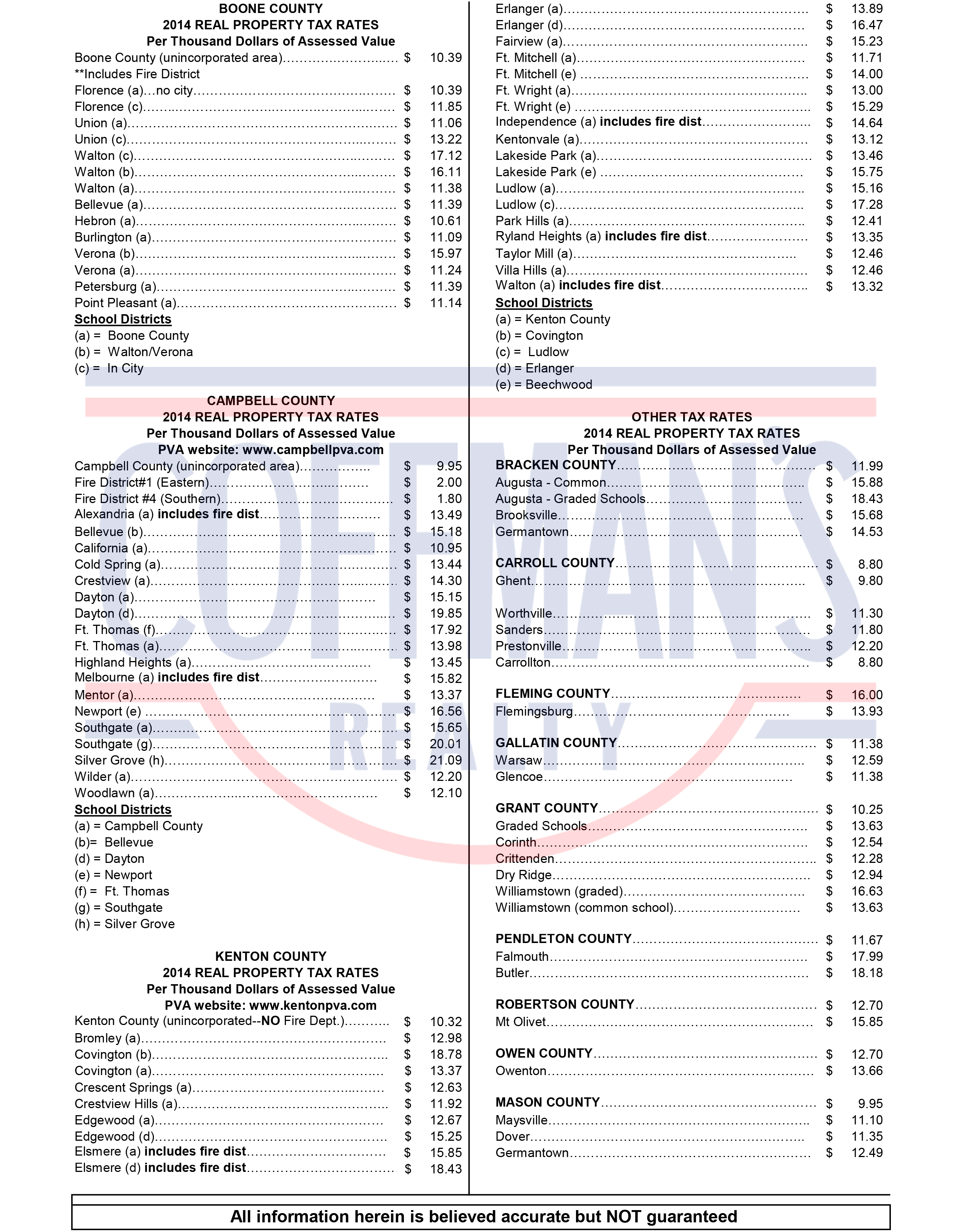

Property Tax Coffmans Realty

Jefferson County Ky Property Tax Calculator – Smartasset

![]()

Property Tax – Department Of Revenue

Property Tax Coffmans Realty

Kentucky Property Taxes By County – 2021

Kentucky Property Tax Calculator – Smartasset

Property Tax – Department Of Revenue

Sales Tax On Grocery Items – Taxjar

2

Jefferson County Ky Property Tax Calculator – Smartasset

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

How Is Tax Liability Calculated Common Tax Questions Answered