Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the irs next april. You'll then get your estimated take home pay, a detailed breakdown of your potential tax liability, and a quick summary down here so you can have a better idea of what to expect when planning your budget.

Tax Withholding For Pensions And Social Security Sensible Money

0% would also be your average tax rate.

Kentucky income tax calculator. After a few seconds, you will be provided with a full breakdown of the tax you are paying. The kentucky tax calculator is designed to provide a simple illlustration of the state income tax due in kentucky, to view a comprehensive tax illustration which includes federal tax, medicare, state tax, standard/itemised deductions (and more), please use. With these phase outs, adding $1,000 to your income would result.

Kentucky state tax calculation for $30,000.00 salary. The table below details how kentucky state income tax is calculated in 2022. Kentucky collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets.

1040 tax calculator enter your filing status, income, deductions and credits and we will estimate your total taxes. Both kentucky's tax brackets and the associated tax rates were last changed three years ago in 2017. This increases your tax bill and your marginal tax rate.

This includes changes to tax rates, apportionment calculations, group filing methods, nol provisions, electronic filing requirements, and tax credits. Also see line 27 of form 740 and the optional use tax table and use tax calculation worksheet in the 740 instructions. Kentucky imposes a flat income tax of 5%.

The taxes that are taken into account in the calculation consist of your federal tax, kentucky state tax, social security, and medicare costs, that you will be paying when earning $60,000.00. Switch to kentucky hourly calculator. The federal income tax, in contrast to the kentucky income tax, has multiple tax brackets with varied bracket width for single or joint filers.

Your taxes are estimated at $0. The sum of your kentucky taxable income is the final calculation of certain subtractions and additions to the federal adjusted gross income (agi). To keep things simple and help with kentucky tax return calculations and comparisons, we have split the calculations into separate tables for federal tax and state tax calculations:

In order to calculate the precise amount of taxes owed, taxpayers in kentucky need to make these adjustments. Please click here to see if you are required to report kentucky use tax on your individual income tax return. The kentucky income tax calculator is designed to provide a salary example with salary deductions made in kentucky.

No matter the income of the individual, the state income tax is 5%. For the best estimate you will need information from all your families employer's paychecks. At higher incomes many deductions and many credits are phased out.

Will you get a refund or owe money at the end of the year? This tool was created by 1984 network. Notably, kentucky has the highest maximum marginal tax bracket in the united states.

The kentucky tax calculator is updated for the 2021/22 tax year. Your income puts you in the 10% tax bracket. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

216 rows overview of kentucky taxes. This kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis. The provided information does not constitute financial, tax, or legal advice.

The kentucky salary calculator is a good calculator for calculating your total salary deductions each year, this includes federal income tax rates and thresholds in 2022 and kentucky state income tax rates and thresholds in 2022. Your average tax rate is 22.2% and your marginal tax rate is 36.1%.this marginal tax rate means that your immediate additional income will be taxed at this rate. This is 0% of your total income of $0.

We strive to make the calculator perfectly accurate. To use our kentucky salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. Grab your latest paystub and use this calculator to make a quick estimate.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. If you would like to help us out, donate a little ether (cryptocurrency) to. If you make $55,000 a year living in the region of new york, usa, you will be taxed $12,213.that means that your net pay will be $42,787 per year, or $3,566 per month.

Calculate your net income after taxes in kentucky. Enter your salary into the calculator above to find out how taxes in kentucky, usa affect your income. You can learn more about how the kentucky income.

Unlike the federal income tax, kentucky's state income tax does not provide couples filing jointly with expanded income tax brackets. The ky tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in kys. Kentucky has a flat income tax rate which applies to both single and joint filers.

Our kentucky state tax calculator will display a detailed graphical breakdown of the percentage, and amounts, which will be taken from your $60,000.00 and. Details of the personal income tax rates used in the 2022 kentucky state calculator are published below the.

Kentucky Retirement Tax Friendliness – Smartasset

Kentucky Income Tax Brackets 2020

Llc Tax Calculator – Definitive Small Business Tax Estimator

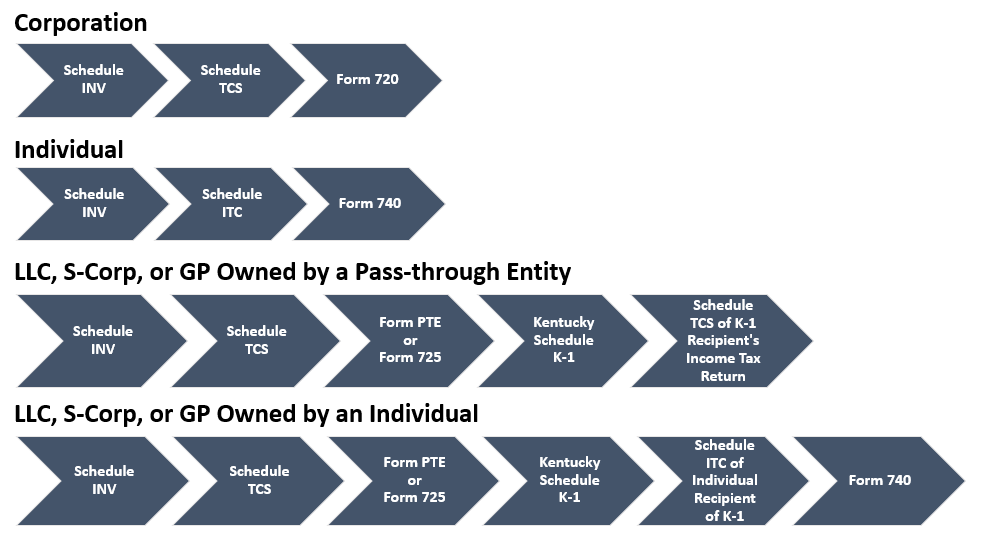

How To File The Inventory Tax Credit – Department Of Revenue

![]()

Individual Income Tax – Department Of Revenue

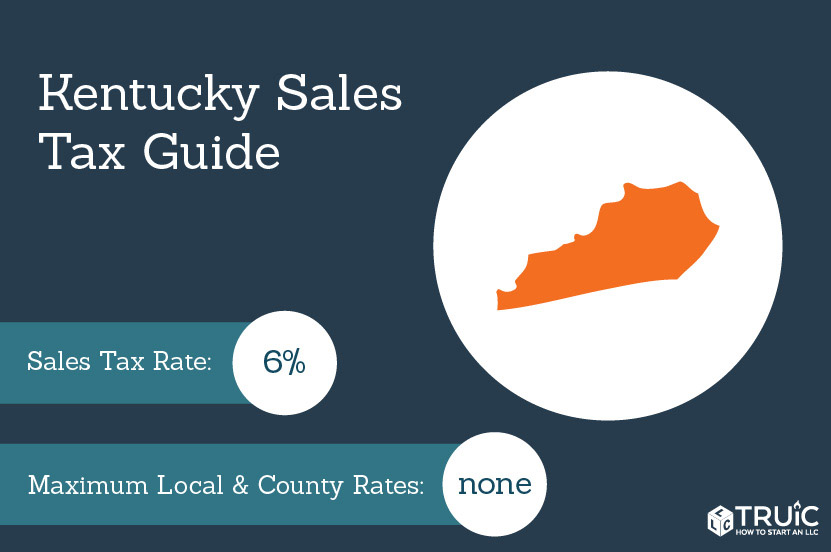

Kentucky Sales Tax – Small Business Guide Truic

Kentucky Income Tax Calculator – Smartasset

Kentucky State Tax Refund – Ky State Tax Brackets Taxact Blog

Kentucky Income Tax Calculator – Smartasset

Payroll Calculator – Free Employee Payroll Template For Excel

Tax Credits – Department Of Revenue

The Kentucky Income Tax Rate Is 5 – Learn How Much You Will Pay On Your Earnings

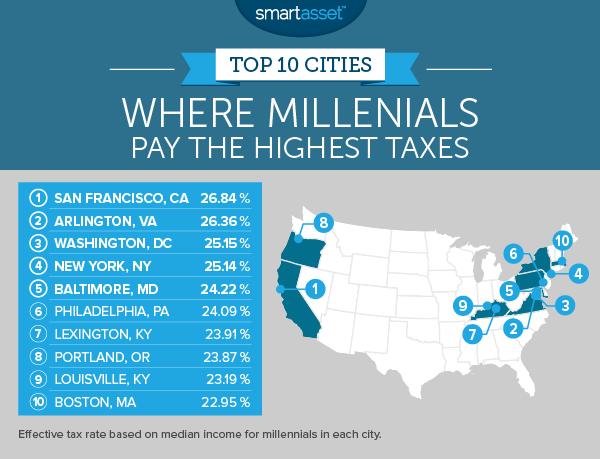

Where Millennials Pay The Highest Taxes In 2016 – Smartasset

Kentucky Paycheck Calculator – Smartasset

North Central Illinois Economic Development Corporation – Property Taxes

The Kentucky Income Tax Rate Is 5 – Learn How Much You Will Pay On Your Earnings

2

States With Highest And Lowest Sales Tax Rates

Kentucky Paycheck Calculator – Smartasset