When david sold these cars, he collected the sales tax rate in effect at his place of business within the city limits of topeka (9.15% when this guide was published). Kansas has state sales tax of 6.5% , and allows.

Vehicle Tags

The minimum combined 2021 sales tax rate for johnson county, kansas is.

Kansas vehicle sales tax rate. $10,000, de soto in johnson county (9.725%). $26,500 + $385 + $75 + $950 = $27,910. Kansas has a 6.5% statewide sales tax rate, but also has 376 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.555% on top of the state tax.

Kansas imposes a 3.5 percent vehicle rental excise tax on the rental or lease of a motor vehicle for 28 consecutive days or less. This is the total of state and county sales tax rates. 6.35% for vehicle $50k or less.

The dealer also charges an administrative fee of $75 for processing the title, paper work, etc., and installs a spoiler for an additional $950. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. Every 2021 combined rates mentioned above are the results of kansas state rate (6.5%), the county rate (0% to 2.25%), the kansas cities rate (0% to 3%), and in some case, special rate (0% to 1.375%).

If purchased from a kansas dealer with the intention to register the vehicle in kansas, the sales tax rate charged is the combined state and local (city, county, and. Total tax rate 9.475% special taxing districts are used in olathe, and throughout kansas, where additional sales tax is collected to fund new development areas. There is no applicable county tax or special tax.

Sales tax is due at the 7.5% anytown sales tax rate on $27,910: Sales tax rate by address. Higher sales tax than 84% of kansas localities.

For lookup by zip code only, click here. An anytown, ks car dealer sells a new auto with a sticker price of $28,995 to a kansas resident for $26,500 plus freight of $385. Kansas has a lower state sales tax than 82.7% of states

This table shows the total sales tax rates for all cities and towns in logan county, including all local taxes. Which states have low car sales tax rates? The kansas's tax rate may change depending of the type of purchase.

4.25% motor vehicle document fee. This site provides information on local taxing jurisdictions and tax rates for all addresses in the state of kansas. The butler county, kansas sales tax is 6.75%, consisting of 6.50% kansas state sales tax and 0.25% butler county local sales taxes.the local sales tax consists of a 0.25% county sales tax.

Use this online tool from the kansas department of revenue to help calculate the amount of property tax you will owe on your vehicle. Kansas has 677 special sales tax jurisdictions with local sales taxes in addition to the state sales tax; 2% lower than the maximum sales tax in ks.

If you need access to a database of all kansas local sales tax rates, visit the sales tax data page. Counties and cities can charge an additional local sales tax of up to 3.5%, for a maximum possible combined sales tax of 10%; The sales price, customer’s residence, and sales tax rate for each are as follows:

Choose one of the following options: You can print a 8.5% sales tax table here. The 2018 united states supreme court decision in south dakota v.

In addition to taxes, car purchases in kansas may be subject to other fees like registration, title, and plate fees. Has impacted many state nexus laws and sales tax. The states with the highest car sales tax rates are:

Fortunately, there are several states with low car sales tax rates, at or below 4%: 7.75% for vehicle over $50,000. This means that, depending on your location within kansas, the total tax you pay can be significantly higher than the 6.5% state sales tax.

A $5.00 fee will be applied to each transaction handled at any of the tag offices. Home » motor vehicle » sales tax calculator. Kansas has 677 cities, counties, and special districts that collect a local sales tax in addition to the kansas state sales tax.click any locality for a full breakdown of local property taxes, or visit our kansas sales tax calculator to lookup local rates by zip code.

The johnson county sales tax rate is %. The rate in sedgwick county is 7.5 percent. There are also local taxes up to 1% , which will vary depending on region.

This is the total of. Butler county clerk 2016 proposed amended ex enditures 1 760 000 actual tax rate page no. Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles.

The kansas state sales tax rate is currently %. The vehicle rental excise tax is in addition to the state and local retailers’ sales tax. Kansas sales and use tax rate locator.

Andover, ks sales tax rate. There may be additional sales tax based on the city of purchase or residence. For best results, use complete and accurate address information when submitting your query.

Kansas has a 6.5% sales tax and logan county collects an additional 1.5%, so the minimum sales tax rate in logan county is 8% (not including any city or special district taxes). 31 rows total sales tax rate. The kansas state sales tax rate is 6.5%, and the average ks sales tax after local surtaxes is 8.2%.

638 rows average sales tax (with local): The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. The 8.5% sales tax rate in lebo consists of 6.5% kansas state sales tax and 2% lebo tax.

For the sales tax use our sales tax rate lookup.

Kansas Car Registration Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax On Cars And Vehicles In Kansas

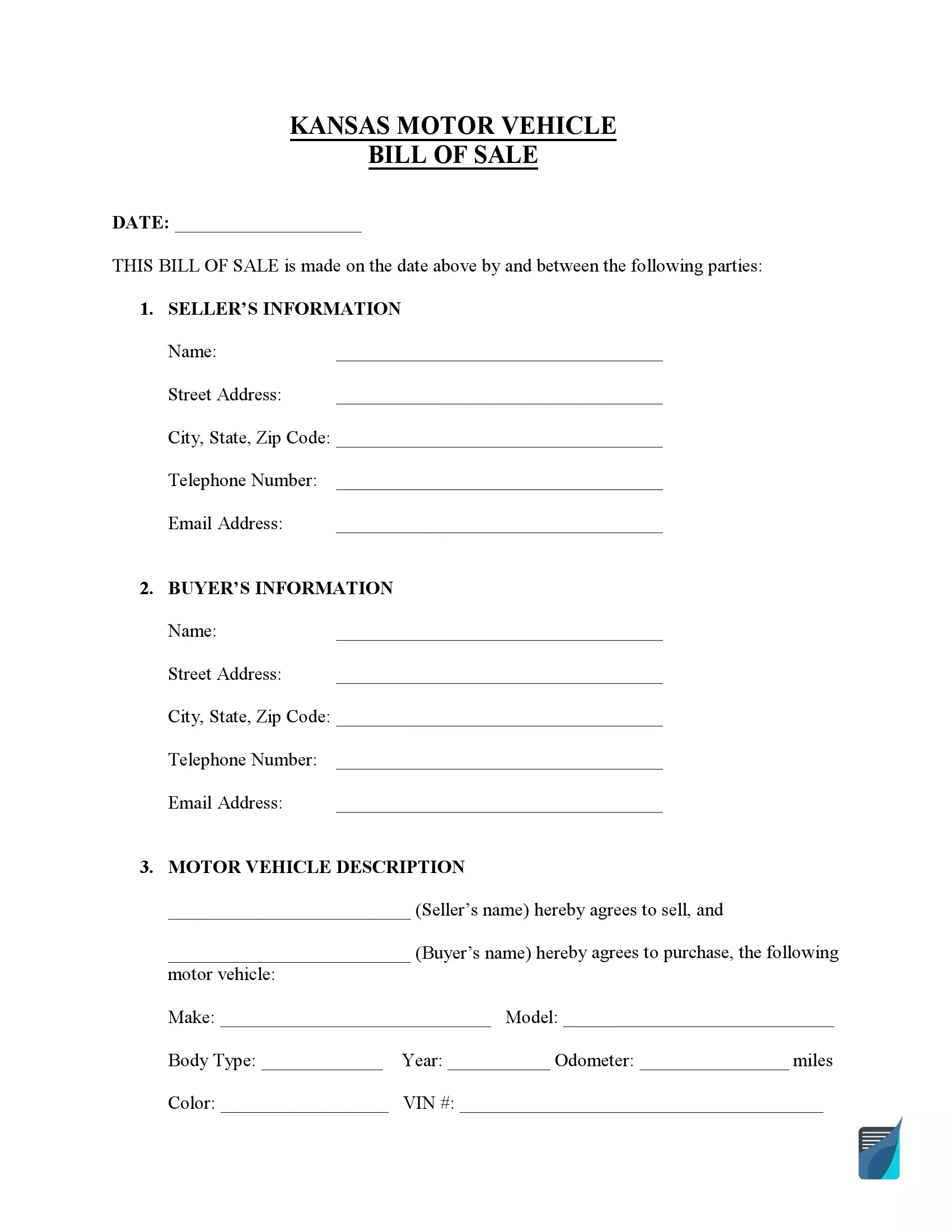

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Car Tax By State Usa Manual Car Sales Tax Calculator

Free Kansas Bill Of Sale Form – Pdf Template Legaltemplates

Dmv Fees By State Usa Manual Car Registration Calculator

The States With The Lowest Car Tax The Motley Fool

Missouri Car Sales Tax Calculator

Calculate Auto Registration Fees And Property Taxes Geary County Ks

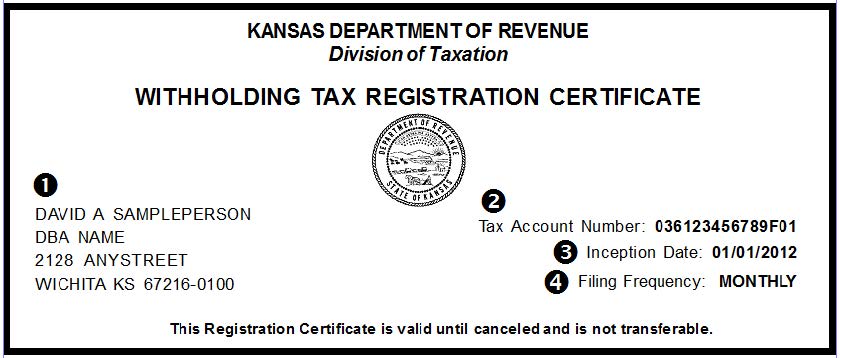

Kansas Department Of Revenue – Kw-100 Kansas Withholding Tax Guide

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

Kansas Car Registration Everything You Need To Know

States With Highest And Lowest Sales Tax Rates

Free Kansas Bill Of Sale Forms Formspal

Kansas Car Registration Everything You Need To Know

2

2

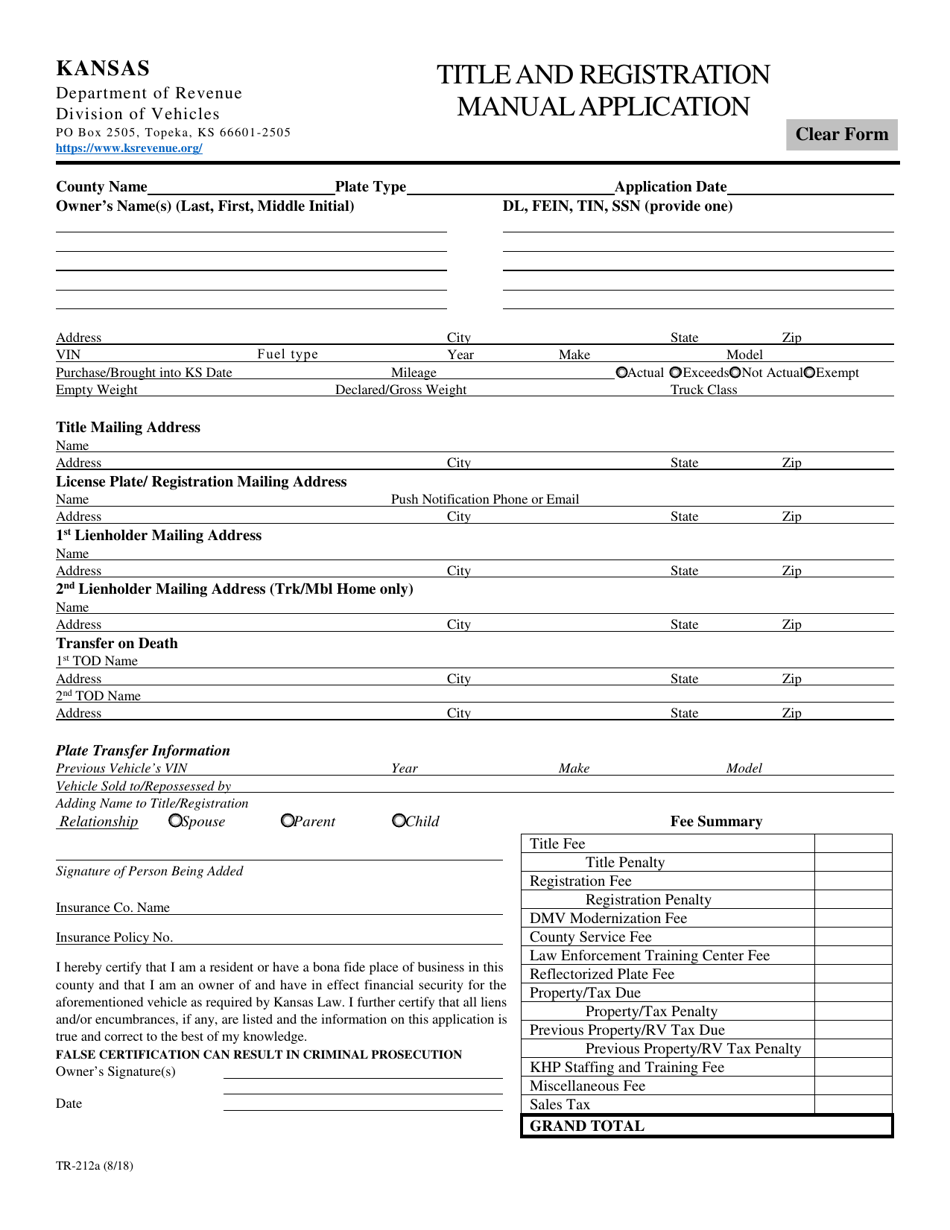

Form Tr-212a Download Fillable Pdf Or Fill Online Title And Registration Manual Application Kansas Templateroller