It explains the exemptions currently authorized by kansas law and includes the exemption certificates to use. 11/15) this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as sellers.

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue

It explains the exemptions currently authorized by kansas law and includes the exemption certificates to use.

Kansas sales tax exemption certificate. Indiana, iowa, north dakota, south dakota, tennessee, and wyoming. Other kansas sales tax certificates: Kansas department of revenue sales and use tax entity exemption certificate the kansas department of revenue certifies this entity is exempt from paying kansas sales and/or compensating use tax as stated below.

Nonprofit groups or organizations exempt by law from collecting tax on their retail sales of tangible personal property (such a s a pta or a nonprofit youth development organization) should use the exemption certificate issued to it by the kansas department of revenue when buying items for resale. Box city state zip + 4. For other kansas sales tax exemption certificates, go here.

See exemption certificate frequently asked questions for more information. This is a streamlined sales tax certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the streamlined sales and use tax agreement.please note that kansas may have specific restrictions on how exactly this form can be used. Businesses with a general understanding of kansas sales.

We have provided a list of qualified entities. For project exemption certificates (a project specific sales tax exemption number to be provided. Kansas department of revenue agricultural exemption certificate the undersigned purchaser certifies that the tangible personal property or service purchased from:

It explains the reason for the exemption. How to use sales tax exemption certificates in kansas. The department issues numbered exemption certificates to a specified group of entities and organizations exempt from sales tax under k.s.a.

Nonprofit groups or organizations exempt by law from collecting tax on their retail sales of tangible personal property (such a s a pta or a nonprofit youth development organization) should use the exemption certificate issued to it by the kansas department of revenue when buying items for resale. While the kansas sales tax of 6.5% applies to most transactions, there are certain items that may be exempt from taxation. Was collected, or 2) be accompanied by a kansas exemption certificate.

Enter your sales or use tax registration number and the exemption certificate number you wish to verify. Is exempt from kansas sales and compensating use tax for the following reason: Sales tax exemptions in kansas.

Ingredient or component part consumed in production propane for agricultural use the property purchased is farm or aquaculture machinery or equipment, repair or replacement parts, or labor services on farm An exemption certificate is a document that a buyer presents to a retailer to claim exemption from kansas sales or use tax. Properly use kansas sales and use tax exemption certificates as buyers and as sellers.

Complete and submit an exemption certificate application. It shows why sales tax was not charged on a retail sale of goods or taxable services. This page discusses various sales tax exemptions in kansas.

It is designed for informational purposes only. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kansas sales tax. Salestaxhandbook has an additional three.

Your kansas tax registration number. Streamlined sales tax exemption certificate. The certificate is required to be presented by kansas based entities to retailers to purchase goods and/or services tax exempt.

All construction materials and prescription drugs. Is exempt from kansas sales and compensating use tax for the following reason (check one box):

Printable Kansas Sales Tax Exemption Certificates

2

Kansas Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

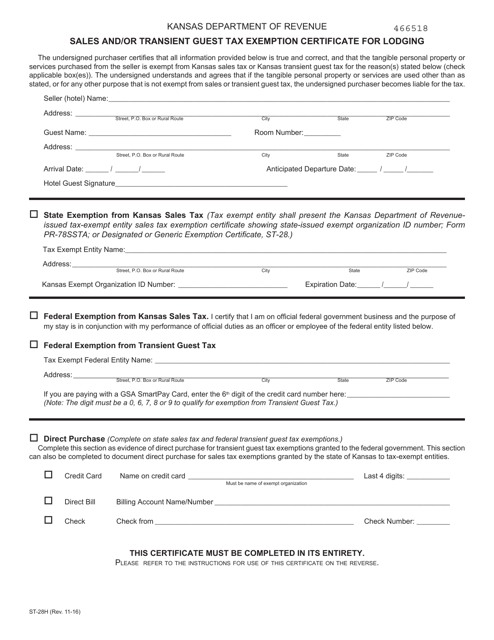

Form St-28h Download Fillable Pdf Or Fill Online Sales Andor Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Form St-28h Download Fillable Pdf Or Fill Online Sales Andor Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

2

Costum Conditional Offer Of Employment Letter Sample In 2021 Letter Templates Employment Letter Sample Professional Cover Letter Template

2

How To Get A Sales Tax Exemption Certificate In Colorado – Startingyourbusinesscom

2

2

How To Get A Resale Exemption Certificate In Kansas – Startingyourbusinesscom

2

Subpoena California Judge California State

1500 Claim Form Free Cms 1500 Template Car Insurance Claim Doctors Note Template Fillable Forms

2

Page Not Found Cessna 172 Cessna Aircraft Interiors

Acceptance Waiver Of Service Of Process Virginia Acceptance Party Names

Marketing Assistant Resume Example Assistant Marketing Manager Resume Examples 2019 Marketing Assistant Resume Objective Examples 2020 Digital Marketing Assi