Kansas has a 6.5% statewide sales tax rate , but also has 376 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.555% on top. All of these fees vary by state, so these kansas state taxes are something to compare and to take into consideration when choosing an rv domicile.

Faqs On Personal Property – Crawford County Ks

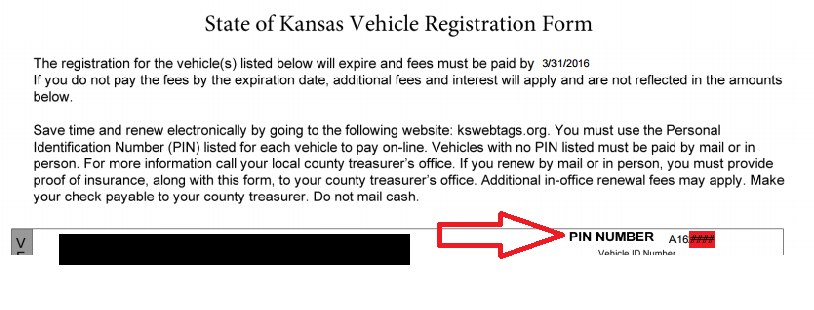

Several weeks before your registration is set to expire, you should receive a kansas dor renewal notice that contains:

Kansas dmv sales tax calculator. Remember to convert the sales tax percentage to decimal format. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. The december 2020 total local sales tax rate was also 7.500%.

Dealerships may also charge a documentation fee or doc fee, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. Sales tax receipt if kansas dealer. Under 21 = $12 for 4 yrs.

Use this calculator to estimate the property tax due on a new vehicle purchase. The rate in sedgwick county is 7.5 percent. A $5.00 fee will be applied to each transaction handled at any of the tag offices.

The state general sales tax rate of missouri is 4.225%. Use this online tool from the kansas department of revenue to help calculate the amount of property tax you will owe on your vehicle. The fees include registration fees, personal property taxes, title fees, and sales tax, if applicable.

Property tax must be paid at time of registration/title application (exceptions heavy trucks, trailers and motorbikes) 6. Select a calculator to begin. For lookup by zip code only, click here.

If out of state dealer, county will collect tax, and a bill of sale or invoice is required. Registration fees for new vehicles that will be purchased in california from a licensed california dealer. Subtract these values, if any, from the sale.

Official website of the kansas department of revenue. For example, if your state sales tax rate is 4%, you would multiply your net purchase price by 0.04. For additional information click on the links below:

Every 2021 combined rates mentioned above are the results of missouri state rate (4.225%), the county rate (0% to 3.125%), the missouri cities rate (0% to 5.454%. Most of these fees are reoccurring. Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator.

For the sales tax use our sales tax rate lookup. While tax rates vary by location, the auto sales tax rate typically ranges anywhere from two to six percent. There may be additional sales tax based on the city of purchase or residence.

The cherokee county treasurer's office is an agent for the state of kansas for registering and titling motor vehicles. We issue license plates upon receipt of proper documentation and submission of the correct fees. If purchased from a kansas dealer with the intention to register the vehicle in kansas, the sales tax rate charged is the combined state and local (city, county, and.

Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Wichita, ks 67213 email sedgwick county tag office; Home » motor vehicle » sales tax calculator.

Sales tax rate by address. Registration fees for new resident vehicles registered outside the state of california. (the sales tax in sedgwick county is.

These fees are separate from. The introduction of this testing service adds to the department's expanding online services it provides. Disregard transportation improvement fee (tif) generated for commercial vehicles with unladen weight of 10,001 pounds or.

Multiply the net price of your vehicle by the sales tax percentage. Motor vehicle titling and registration. Cities and/or municipalities of missouri are allowed to collect their own rate that can get up to 5.454% in city sales tax.

Kansas law requires that a vehicle must be registered and display a tag or plate along with the corresponding decals. The current total local sales tax rate in linn county, ks is 7.500%.

Pay Vehicle Taxregistration – Crawford County Ks

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Missouri Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska Sales Tax – Small Business Guide Truic

Faqs Riley County Civicengage

Kansas Car Registration Everything You Need To Know

Sales Tax On Cars And Vehicles In Kansas

Dmv Fees By State Usa Manual Car Registration Calculator

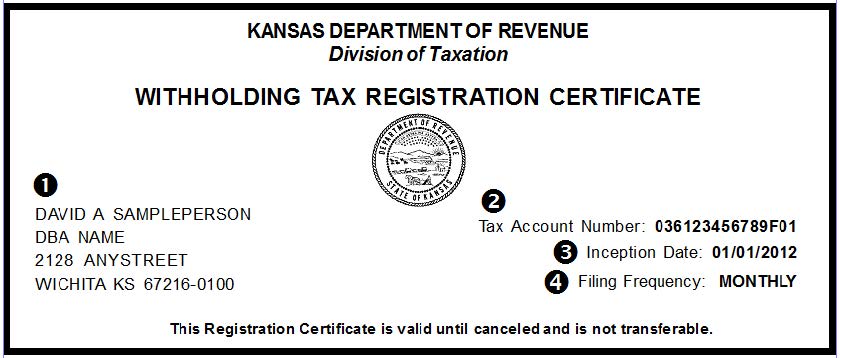

Kansas Department Of Revenue – Kw-100 Kansas Withholding Tax Guide

Car Tax By State Usa Manual Car Sales Tax Calculator

Kansas Sales And Use Tax Rates Lookup By City Zip2tax Llc

Connecticut Sales Tax Calculator Reverse Sales Dremployee

States With Highest And Lowest Sales Tax Rates

Dmv Fees By State Usa Manual Car Registration Calculator

Dmv Fees By State Usa Manual Car Registration Calculator