The median property tax in jones county, mississippi is $527 per year for a home worth the median value of $79,500. Real and personal property within jones county is subject to a tax levy of 104.74 mills per $1,000 of assessed value.

Jones County Tax Assessorcollector – Laurel Ms – Government Organization Facebook

The jones county tax assessor, located in ellisville, mississippi, determines the value of all taxable property in jones county, ms.

Jones county tax assessor laurel ms. In mississippi, jones county is ranked 59th of 82 counties in assessor offices per capita, and 3rd of 82 counties in assessor offices per square mile. 501 n 5th ave laurel, ms 39441. Jones county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in jones county, mississippi.

Government press releases pay my water bill. Jones county continues to grow both economically and in population. Jones county has one of the lowest median property tax rates in the country, with only two thousand three hundred sixty of the 3143 counties collecting a lower.

According to our records, this business is located at 501 n 5th ave. In laurel (in jones county), mississippi 39440, the location gps coordinates are: Jones county tax assessor/collector's office property records (www.deltacomputersystems.com) about the jones county recorder of deeds the jones county recorder of deeds, located in laurel, mississippi is a centralized office where public records are recorded, indexed, and stored in jones county, ms.

Jones county tax assessor is categorized under budget agency, government (sic code 9311). Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. Jones county, the 30th county formed in georgia, was created in 1807.

The assessor’s office establishes tax assessment values only. The acrevalue jones county, ms plat map, sourced from the jones county, ms tax assessor, indicates the property boundaries for each parcel of land, with information about the landowner, the parcel number, and the total acres. Mailing address jones county tax.

Find jones county tax records. Calendar of events how to get here ask the mayor! More details about jones county tax assessor.

Jones county collects, on average, 0.66% of a property's assessed fair market value as property tax. To begin your search, choose a the links below. There are 2 assessor offices in jones county, mississippi, serving a population of 68,328 people in an area of 695 square miles.there is 1 assessor office per 34,164 people, and 1 assessor office per 347 square miles.

Remember to have your property's tax id number or parcel number available when you call! This has allowed the county to maintain a steady growth in tax revenues without a significant tax increase. The jones county assessor, located in laurel, mississippi, determines the value of all taxable property in jones county, ms.

The county government tax rate has increased an average of only 4% over the last 10 years. Building permits & zoning ms. This form may be obtained at laurel city hall.

Physical address 501 n 5th ave, laurel, ms 39440. 25.1 miles covington county tax collector (registration & title) Susan norman 401 north 5th avenue laurel, ms 39441 first floor phone:

Laurel meals & occupancy tax a 2% meals & occupancy tax is submitted with state sales tax of 7% within the city of laurel. Get property records from 2 assessor offices in jones county, ms. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property.

This search engine will return judgment roll, appraisal, property tax, etc. Dps & mvl locations near jones county tax collector (laurel) 0.7 miles dps driver's license location. At the jones county tax assessors office:

(601) 428 3139 (phone) (601) 428 3602 (fax) get. Acrevalue helps you locate parcels, property lines, and ownership information for land online, eliminating the need for plat books. Enter the information into one of the fields below then click on the submit button.

Welcome to the jones county, mississippi online record search. The oil industry is very important to jones county’s economy as well. To view your property information:

Information of record in jones county. These records can include jones county property tax assessments and assessment challenges, appraisals, and income taxes. Originally part of baldwin county, it was named for james jones, an early.

The jones county tax assessor is the local official who is responsible for assessing the taxable value of all properties within jones county, and may establish the amount of tax due on that property based on the fair market value appraisal.

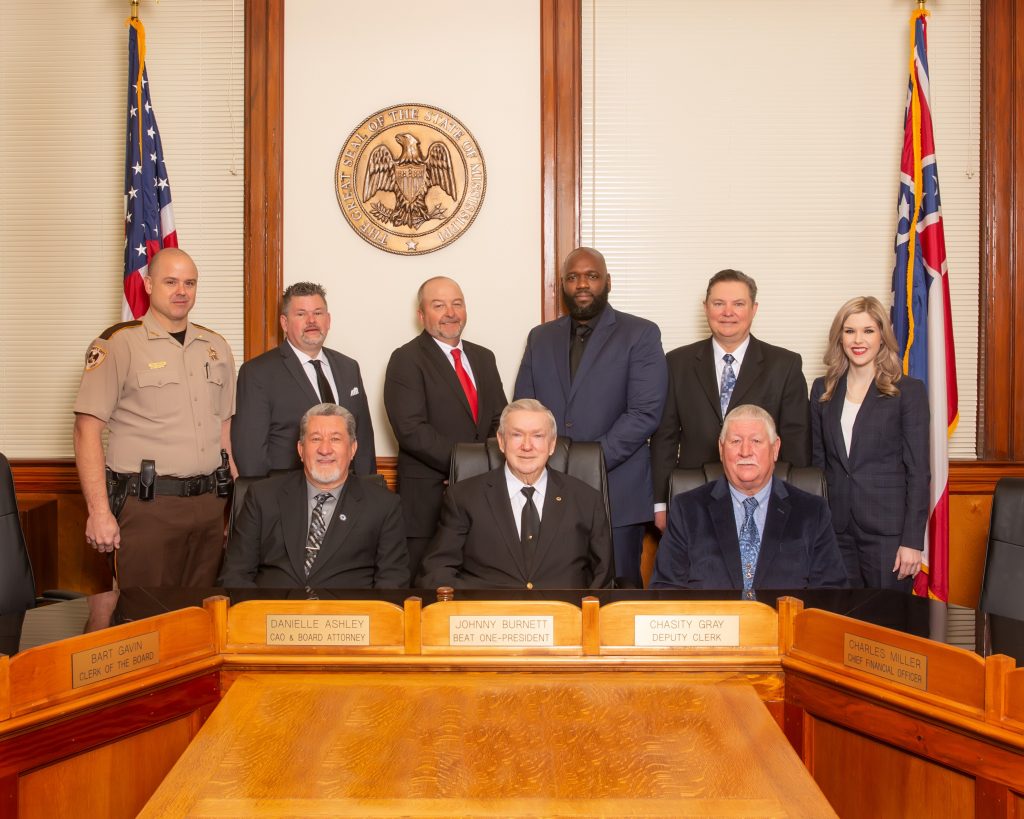

Board Of Supervisors Jones County Ms

Jones County Tax Assessorcollector – Laurel Ms – Government Organization Facebook

Current Jones County Supervisors Meet For Final Time News Impact601com

Jones County Board Of Tax Assessors Official Website Of Jones County Ga Board Of Tax Assessors

Tax Assessor Collector Jones County Ms

C Spire To Compete With Comcast In County News Leader-callcom

![]()

Taxes Incentives Jones County Ms

/cloudfront-us-east-1.images.arcpublishing.com/gray/CNLB3D73SZBHNBXD2KKGMOYQ7I.jpg)

Jones County Residents Vote Whether To Maintain Two Courthouses

Tax Assessor Collector Jones County Ms

Tax Assessor Collector Jones County Ms

Jones County – Effective Year 2021

Taxes Incentives Jones County Ms

Tax Assessor Collector Jones County Ms

Tax Assessor Collector Jones County Ms

Frequently Asked Questions The City Of Laurel Ms

Jones County Set To Receive 13 Million In Funding From American Recovery Act News Impact601com

Jones County Board Of Tax Assessors Official Website Of Jones County Ga Board Of Tax Assessors

Jones County Tax Assessorcollector – Laurel Ms – Government Organization Facebook

Tax Assessor Collector Jones County Ms