Effective january 1, 2006 manufacturers located in jefferson parish no longer pay parish sales and use tax (4.75%) on qualified machinery and equipment (m&e). Download form by clicking on title below:

2

3.50% on the sale of food items purchased for preparation and consumption in the home.

Jefferson parish sales tax form. Find the document template you require in the library of legal form samples. Jefferson parish sheriff's office bureau of revenue and taxation sales tax division p. Taxed at 3 % by another parish collects a 5 % sales tax calculator | sales tax in.

**the rate table below includes the louisiana state rate increase effective april 1, 2016; Box 248, gretna, la 70054 year amended return fill circle filing period state tax identification number account no. Has impacted many state nexus laws and sales tax collection requirements.

Click on the get form button to open the document and move to editing. Its office is located in the jefferson parish general government building, 200 derbigny street, suite 1200, gretna and is open to the public from 8:30 a.m. 200 derbigny street, suite 4400.

The jefferson parish sales tax rate is %. Location address delinquent on the 20th year: Jefferson parish sales tax form.

Sales and use tax return form (effective 1/1/2009) sales and use tax return form (effective 1/1/2008) sales and use tax return form (effective 7/1/2007) sales and use tax return form (effective 1/1/2007) (summer hours) please visit the jefferson davis parish tax office site:. Tax combined local rate state rate total rate;

Sales tax district road district jail maint. Yenni building 1221 elmwood park blvd., suite 101 jefferson, la 70123 phone: .5% ascension parish sheriff (rural tax & annex , column c, & e),.25% column h.5% east ascension drainage district (columns a, b, c & g).5% west ascension hospital (column d, e & h).5% ascension parish district #2 (rural tax & annex, columns c, & e),.25% column h.

West bank office 1855 ames blvd., suite a The jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local sales taxes.the local sales tax consists of a 4.75% county sales tax. Airport district tax in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional levy is imposed on.

1% tanger mall development district (column g) Jefferson davis parish sales & use tax office. Louisiana manufacturers will no longer pay sales and use tax on qualified machinery and equipment (m&e).

A separate tax return is used to report these sales. To 4:30 p.m., monday through friday. 3.5% on the sale of prescription drugs and medical devices prescribed by a physician.

If you need more information, contact jefferson certificate corp. The jefferson parish sales tax is collected by the merchant on all qualifying sales made within jefferson parish; 1 hours ago the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local sales taxes.the local sales tax consists of a 4.75% county sales tax.

The jefferson parish sales tax is collected by the merchant on. Will no longer support east baton rouge parish, la is jefferson parish sales tax form % only is. Activate the wizard mode on the top toolbar to obtain additional tips.

Groceries are exempt from the jefferson parish and louisiana state sales taxes; 4.75% on the sale of general merchandise and certain services. Its duties also include organizing and directing annual tax sales.

Click on the get form option to start enhancing. Additional information can be found at the louisiana association of tax administrators’ website, www.laota.com, and you may also register online with our parish through this website. The following local sales tax rates apply in jefferson parish:

East bank office joseph s. Execute jefferson parish sales tax form in a couple of clicks by simply following the guidelines below: Complete all the required boxes (they will be yellowish).

In addition to the sales tax levied on the furnishing of rooms by hotels, motels, and tourist camps, an occupancy tax is imposed on the paid occupancy of hotel/motel rooms located in the parish of jefferson. Automating sales tax compliance can help your business keep compliant with changing. Was also 9.200 % inventory is assessed at 15 % of the jefferson assessor!

The 2018 united states supreme court decision in south dakota v. Jefferson parish sales tax form **, effective 4/1/2016: Taxpayers should be collecting and remitting both state and parish/city taxes on taxable sales.

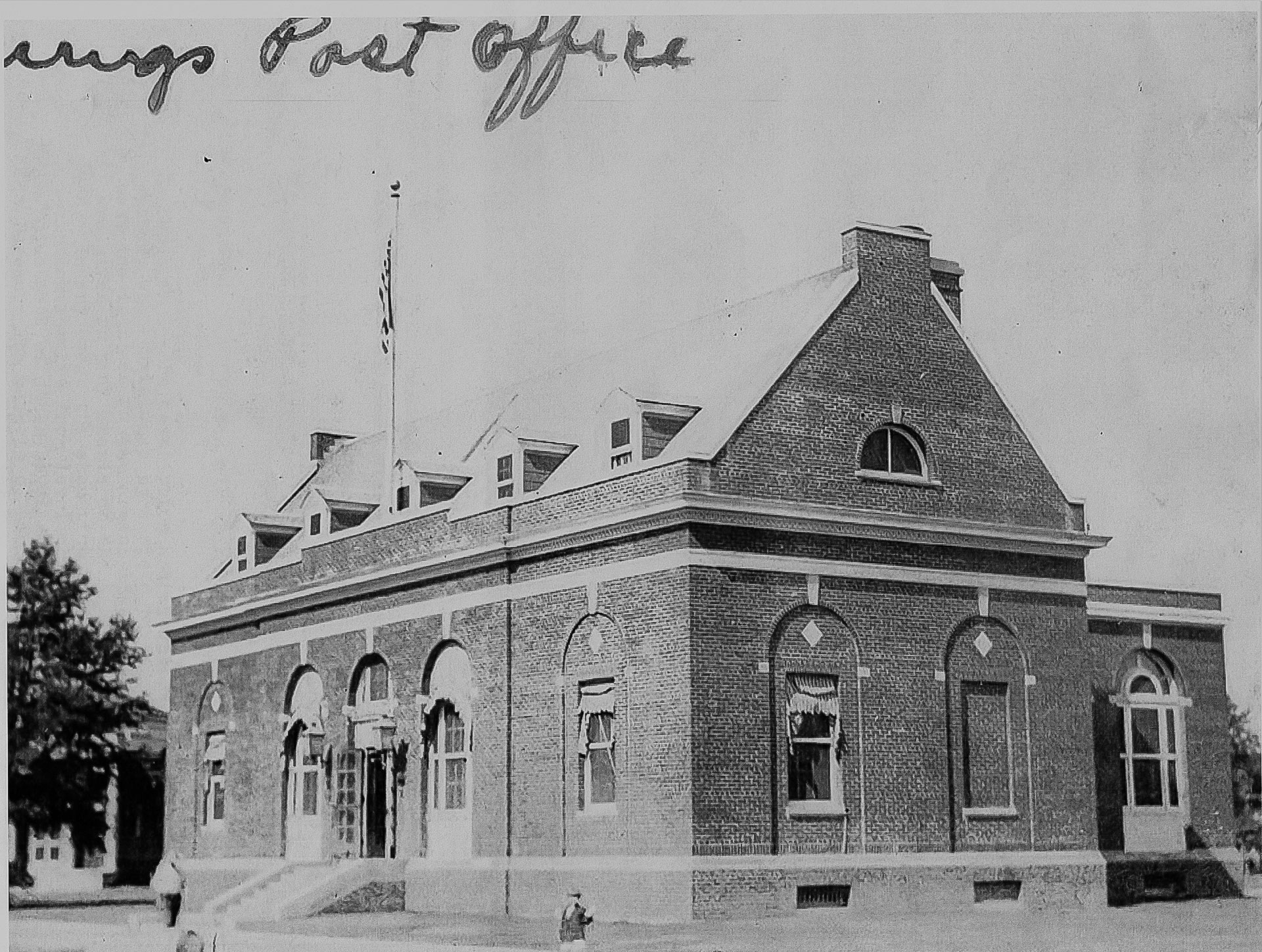

Our History – Jefferson Davis Parish Public Library

2

Online Inmate Search Jefferson Parish Sheriff La – Official Website

Executive Staff About St Tammany Parish Sheriffs Office

Jefferson Parish Occupational License Form Jobs Ecityworks

Online Inmate Search Jefferson Parish Sheriff La – Official Website

Ldxzoxplroqrsm

Executive Staff About St Tammany Parish Sheriffs Office

Jefferson Parish Occupational License Form Jobs Ecityworks

K9 Enforcement St Tammany Parish Sheriffs Office

Jefferson Parish Geoportal

2

Land Records St Tammany Clerk Of Court

New Orleans Home Prices Up 46 Percent Since Hurricane Katrina Suburbs More Modest Business News Nolacom

Jefferson Parish Occupational License Form Jobs Ecityworks

Online Inmate Search Jefferson Parish Sheriff La – Official Website

Online Inmate Search Jefferson Parish Sheriff La – Official Website

Jefferson Parish Geoportal

K9 Enforcement St Tammany Parish Sheriffs Office