A successful appeal results in an average savings of $650. Government building 200 derbigny, 4th floor, suite 4200 gretna, la 70053 phone:

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nolacom

The tax approved by voters would add an additional $117.71 annually to the average sales price of a home in jefferson parish, which is a property valued at $224,000.

Jefferson parish property tax rate. The average yearly property tax paid by jefferson parish residents amounts to about 1.25% of their yearly income. Millage rate (for this example we use the 2018 millage rate for ward 82, the metairie area) x.11340: 3.5% on the sale of prescription drugs and medical devices prescribed by a physician

Tax on a $200,000 home: Tax on a $200,000 home: The jefferson parish sales tax rate is %.

Houses (6 days ago) the tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection, law enforcement, education, recreation, and other functions of parish government. On average, a homeowner pays $5.05 for every $1,000 in home value in property taxes with the average louisiana property tax bill adding up to $832. You can use the louisiana property tax map to the left to compare jefferson parish's property tax to other counties in louisiana.

3.50% on the sale of food items purchased for preparation and consumption in the home; The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection, law enforcement, education, recreation, and other functions of parish government. The jefferson parish tax assessor is the local official who is responsible for assessing the taxable value of all properties within jefferson parish, and.

Our success rate is 37% better than the jefferson parish, louisiana average. Located in southeast louisiana adjacent to the city of new orleans, jefferson parish has a property tax rate of 0.52%. The 2018 united states supreme court decision in south dakota v.

6 hours ago the tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection, law enforcement, education, recreation, and other functions of parish government. The following local sales tax rates apply in jefferson parish: (504) 364 2900 (phone) the jefferson parish tax assessor's office is located in gretna, louisiana.

Tax on a $200,000 home: This is the total of state and parish sales tax rates. Jefferson parish sheriff’s office 200 derbigny street, suite 1200 gretna, la 70053 residents with questions about their property tax collection.

Our research shows that the majority of people that appeal successfully reduce their property tax bill. Tax on a $200,000 home: The minimum combined 2021 sales tax rate for jefferson parish, louisiana is.

The louisiana state sales tax rate is currently %. Jefferson parish real estate tax homes for sale. Jefferson parish assessor's office services.

4.75% on the sale of general merchandise and certain services; Jefferson parish, louisiana property tax rates. This rate is based on a median home value of $180,500 and a median annual tax payment of $940.

What is the rate of jefferson parish sales/use tax? The calculator will automatically apply local tax rates when known, or give you the ability to enter your own rate. “this vote is validation of the bold steps we have taken and the ambitious course we have set for our children,” said new superintendent cade brumley.

0.12145 old metairie & metairie: The jefferson parish assessor's office determines the taxable assessment of property. Jefferson parish is ranked 2326th of the 3143 counties for property taxes as a percentage of median income.

Property tax overview jefferson parish sheriff, la. Houses (4 days ago) online property tax system. Tax rate tax amount ;

If your homestead/mortgage company usually pays your property taxes, please. Take the yearly taxes, and. The jefferson parish assessor's office determines the taxable assessment of property.

On december 11, 2021, voters in jefferson parish will decide whether to renew two property tax millages on the ballot that directly impact the quality of life for jefferson parish residents. Property tax overview jefferson parish sheriff, la. The jefferson parish assessor's office determines the taxable assessment of property.

$755.00 6 hours ago the median property tax (also known as real estate tax) in jefferson parish is $755.00 per year, based on a median home value of $175,100.00 and a median effective property tax. Get driving directions to this office. *due to the annual tax sale this site can only be used to view and/or order a tax research certificate.

The median property tax (also known as real estate tax) in jefferson parish is $755.00 per year, based on a median home value of $175,100.00 and a median effective property tax rate of 0.43% of property value. However, because of the varying tax rates between taxing districts, the average tax bill fluctuates from parish to parish. Use this louisiana property tax calculator to estimate your annual property tax payment.

Millages

St Charles Parish Louisiana Covid-19 Information From The Data Center

Online Property Tax System

Flood Insurance Rate Maps

Which Louisiana Parishes Pay The Highest Lowest Property Taxes Local Politics Nolacom

Xtxn54cvfe0zym

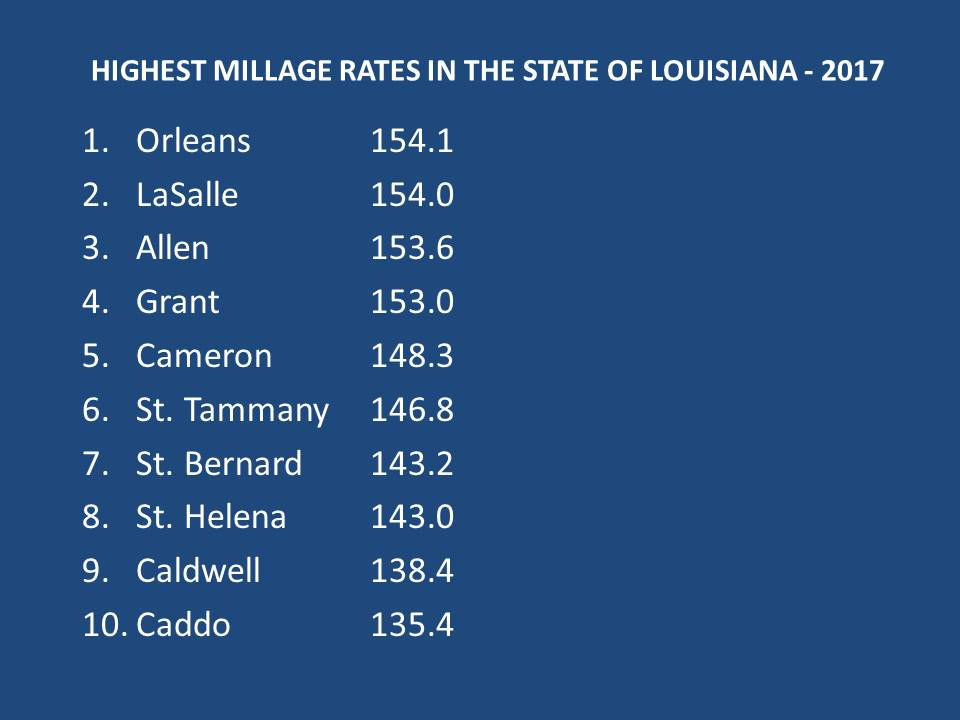

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans

Jefferson Parish School Leader Sings Praises Of Proposed Millage For Teacher Raises Wwno

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Jefferson Parish Voters Approve Water Sewer Taxes Westwego Picks New Mayor

Heres Whats On The Ballot Saturday In Your Parish Wwltvcom

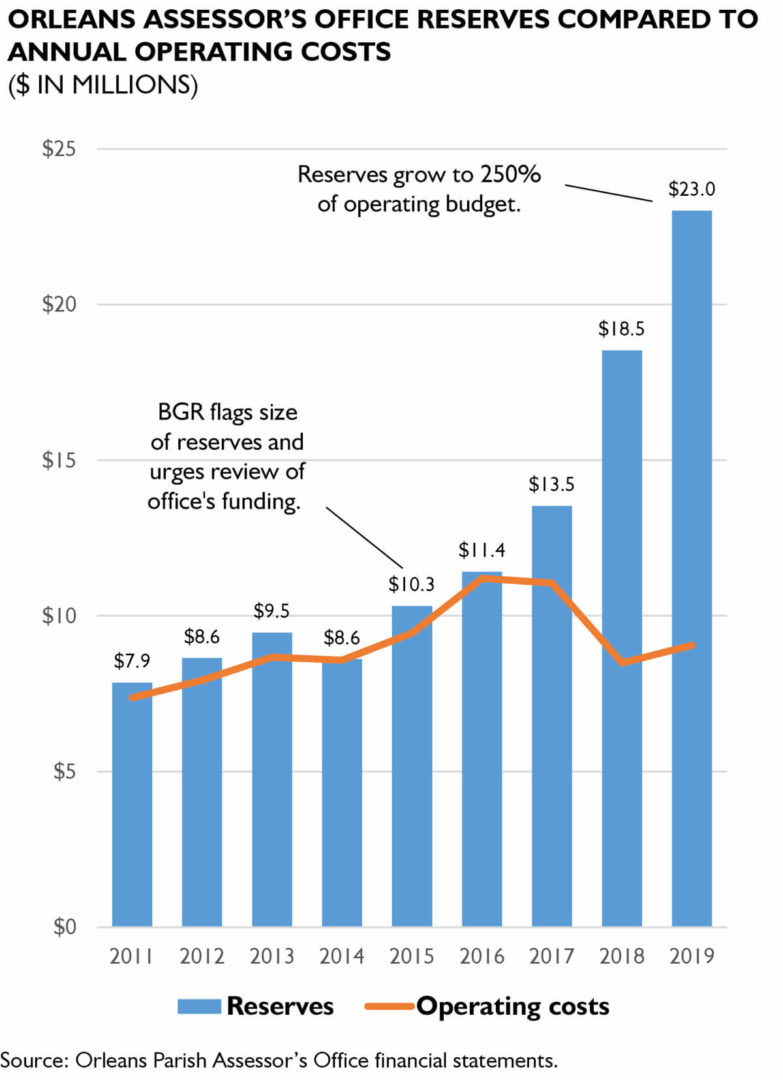

Policywatch Revisiting Assessment Issues In New Orleans

Jefferson Parish Public Flood Portal Geoportal

Yubbnohrcfya_m

Tax Assessment Reductions Available To Some Property Owners

10 Louisiana Parishes With The Highest Property Tax Rates – 3 Are In Metro New Orleans Archive Nolacom

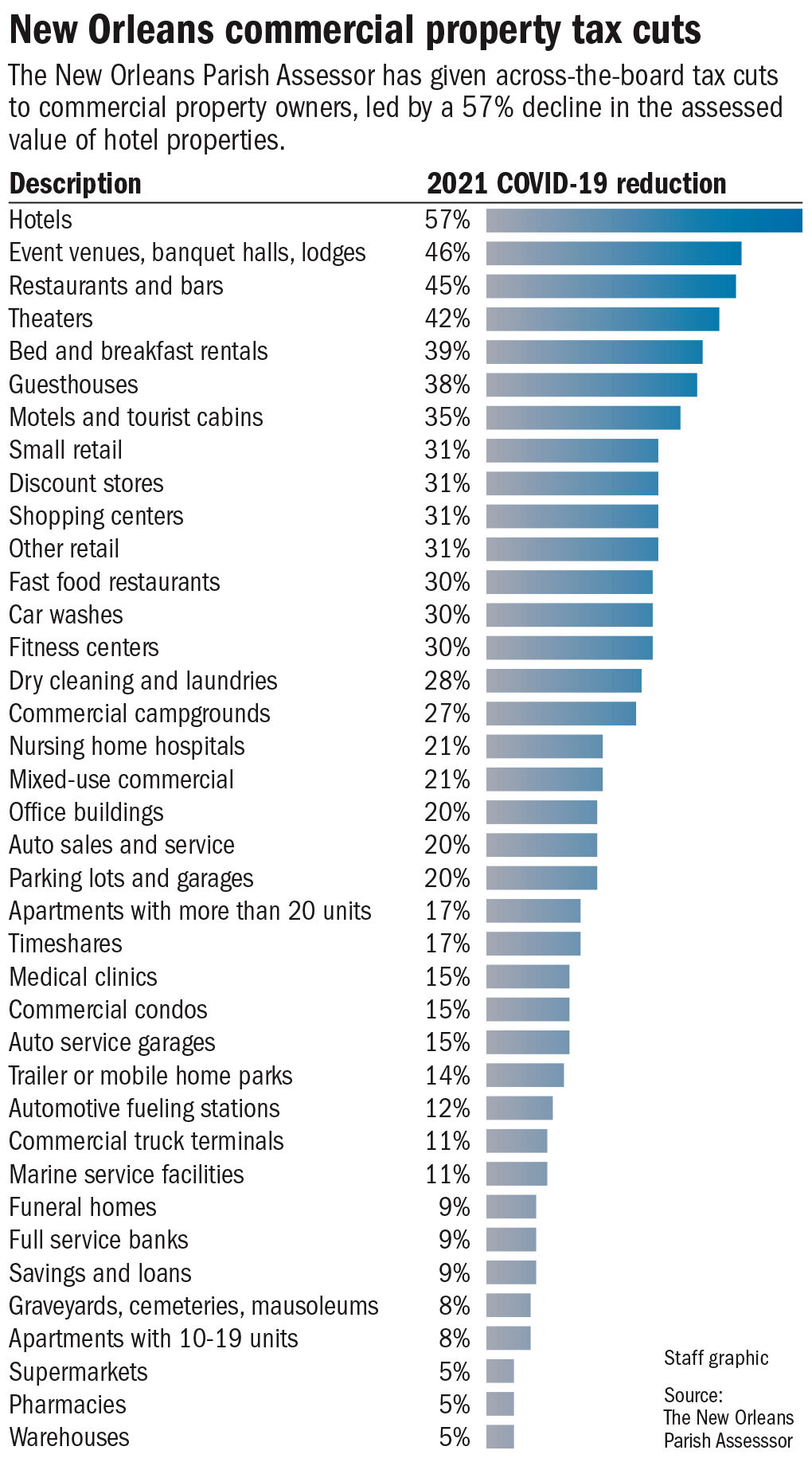

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nolacom

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Louisiana Property Tax Calculator – Smartasset