Ad compare top 50 expat health insurance in indonesia. O there are no tax consequences to the insured person (employee or shareholder).

Longterm Care Tax Issues The Health Insurance Portability

There are no limits or caps on deductibility.

Is long term care insurance tax deductible in canada. Long term care isn't just for seniors. Financial consumer agency of canada. If an employer pays all or a portion of ltc premiums for employees, the entire amount is deductible as a business expense to the employer.

Furthermore, any premium, contribution or other consideration — including sales and premium taxes — that you pay to a private health services plan for yourself, your spouse or your minor children, is an. Get the best quote and save 30% today! Attendant care costs, including those paid to a nursing home, can be used as medical expense deductions on your tax return.

As a rule, premiums that are paid to private health services plans including medical, dental and hospitalization plans are considered to be eligible medical expenses by the canada revenue agency. Get the best quote and save 30% today! Long term care insurance can provide coverage if you become unable to care for yourself and need assistance to manage daily living activities.

For preventive, therapeutic, treating, rehabilitative, personal care, or other services. Ad compare top 50 expat health insurance in indonesia. The breakdown should also take into account any subsidies that reduce the attendant care expenses (unless the subsidy is included in income and is not deductible from income).

You need to include a detailed statement of the nursing home costs. The amount of the deduction depends on the age of the covered person. If you require long term care, it might be tax deductible.

A tax deduction is allowed for the ltc insurance premium paid by a taxpayer for long term care insurance which is for the benefit of the taxpayer; Provided pursuant to a plan of care prescribed by a licensed health care practitioner. In addition, the employer contribution is not included in the employee’s taxable income.

Unless you have access to a group disability plan through an association or your company, you'll have to purchase your own disability coverage. You may become unable to care for yourself for 90 days or more at any point in your life. Only the portion of your monthly bill used to pay attendant care salaries can be deducted.

O the premiums aren’t deductible.

Is Long-term Care Insurance Worth It How To Decide

Are Benefits From A Long-term Care Insurance Policy Taxable Ltc News

Medicaid Is Never The Goal Or Solution For Long-term Care Planning Ltc News

Best Long-term Care Insurance Planning Strategies For 2022 Reduce Costs Get Tax Deductions Business

Long Term Care Facilities Insurance Chubb

Top 10 Long Term Care Insurance Pros And Cons Is Ltci Worth It For You

Longterm Care Tax Issues The Health Insurance Portability

Longterm Care Tax Issues The Health Insurance Portability

Allianz Long Term Care Insurance Life Insurance Blog

Pdf Research On Long-term Care Insurance Status Quo And Directions For Future Research

Germany Taxing Wages 2021 Oecd Ilibrary

The Tax Deductibility Of Long-term Care Insurance Premiums

I Have Car Insurance Buy Health Insurance Cheap Health Insurance Rental Insurance

Allianz Long Term Care Insurance Life Insurance Blog

Longterm Care Tax Issues The Health Insurance Portability

Longterm Care Tax Issues The Health Insurance Portability

Best Long-term Care Insurance Planning Strategies For 2022 Reduce Costs Get Tax Deductions Business

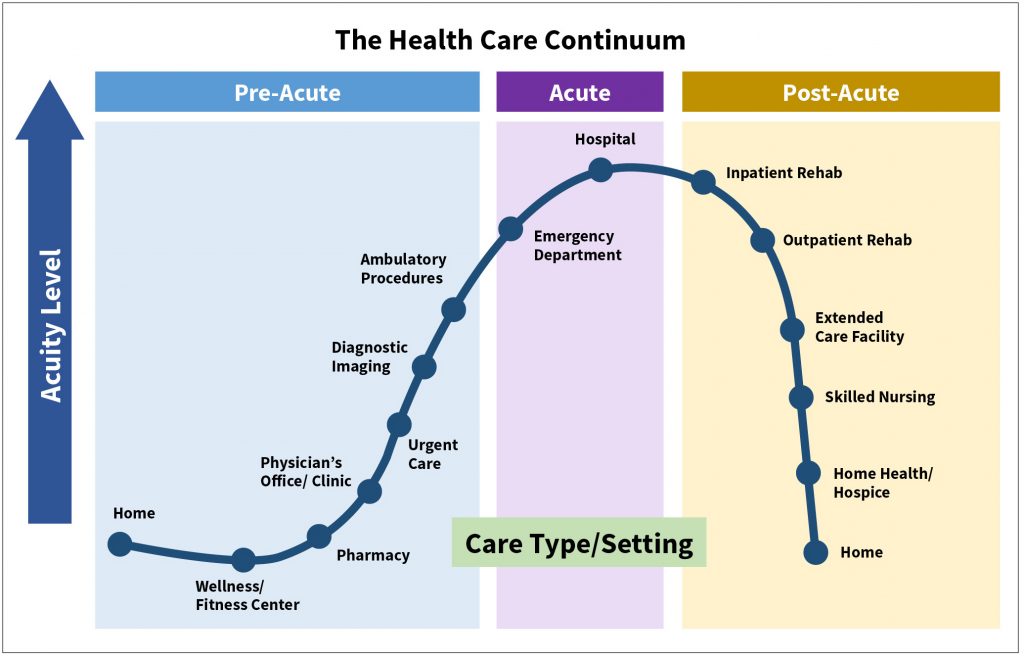

Realigning Ltciprivate Long-term Care Insurance And The Health Care Continuum Contingencies Magazine

Longterm Care Tax Issues The Health Insurance Portability