What are michigan inheritance tax laws? Michigan does not have an inheritance tax.

Michigan Estate Tax Everything You Need To Know – Smartasset

Mom recently passed and left an ira with me listed as beneficiary.

Is an inheritance taxable in michigan. But, if you live in certain states, you may pay state taxes. It is a tax on the amount received and is paid by the heir. This is a frequently misunderstood question related to taxation and can be complicated.

If there is interest earned on the proceeds due to taking them in installments rather than a lump sum, the interest on the proceeds are taxable,. Michigan does not have an inheritance tax. I will be splitting it with my sisters.

What is an inheritance tax? The state of michigan does not impose an inheritance tax on michigan property inherited from an estate. It does have an inheritance tax, but only for bequests made by decedents who died on or before september 30, 1993.

If you inherit money, you assume you’ll pay taxes on it, after all, we’re taxed on everything right? Like the majority of states, michigan does not have an inheritance tax. For federal tax purposes, inheritance generally isn’t considered income.

Inheritance taxes do not end because you paid a sum after you received your inheritance. Mom had opted to have federal taxes withheld at 10%, but not have michigan state tax withheld. Inheritance tax is a state tax on assets inherited from someone who died.

An inheritance tax is a tax on the right to receive property by inheritance. Only five states have inheritance taxes, and one (iowa) will eliminate its inheritance tax by 2025. If you indicate which state you are resident of, i can confirm whether you have an inheritance tax issue.

Its estate tax technically remains on the books, but since 2005 there has been no mechanism for it to collect it. Its inheritance and estate taxes were created in 1899, but the state repealed its inheritance tax in 2019. Regarding your question, “is inheritance taxable income?” generally, no, you usually don’t include your inheritance in your taxable income.

Life insurance is passed to the beneficiary income tax free when the beneficiary is a person. Life insurance is generally not taxable to the beneficiary in michigan or in any other state. If you happen to profit off of an asset that was sold, you will have to pay taxes on that profit.

Reporting inheritance income in respect of a decedent includes gross income items. The state of michigan levies no inheritance tax or estate tax as of 2015, reports the michigan department of treasury. With inheritance money, though, you may be in luck.

However, the state in which you reside may have an inheritance tax (if you live in a state other than mi). Massachusetts and oregon have the lowest threshold for estate taxes, as they impose taxes on all. Is there still an inheritance tax?

What is michigan tax on an inherited ira. The only death tax for michigan residents is the federal estate tax levied on estates worth more than $5.43 million, according to nolo. He had a 401k account and named my sister as beneficiary and also left her a note that she is to split the money in that account with me (we are his only two children and he was not married).

Inheritance taxes are levied by the states. This list serves as a guide and is not intended to replace the law. What does “in respect of a decedent” mean?

Taxable income is all income subject to michigan individual income tax. However, if the inheritance is considered income in respect of a decedent, you’ll be subject to some taxes. The michigan inheritance tax was eliminated in 1993.

We will be opting for the lump sum payment, i believe the total was $30,000. An inheritance tax is levied against an individual beneficiary or heir who inherits from the deceased and it's based on the value of the gift. But whether you need to pay taxes — and the amount you could end up paying — are based on a variety of different factors.

But in some states, an inheritance can be taxable. The deceased’s state of residence, your relationship to them and the amount you’re inheriting can all play a role in determining the taxes you may need to pay. Michigan does not have an inheritance tax, with one notable exception.

A frequent question is whether inheritances are taxable. It’s applied to an estate if the deceased passed on or before sept. Michigan does not have an estate tax.

That’s because michigan’s estate tax depended on a. View a list of items included in michigan taxable income. Ad an inheritance tax expert will answer you now!

Of course, once a beneficiary (also referred to as an heir) receives the inherited asset, any income generated by that property—be it interest from cash, rent from real estate, dividends from stocks, etc.—will be taxable to the beneficiary, just as if the property had always been the beneficiary’s. Although michigan does not impose a separate inheritance or estate tax on heirs, you may have to pay state taxes on your annuity income. The economic impact payments are not included in federal adjusted gross income (agi) or in michigan taxable income.

Let’s take a look at a brief example. Inheritance tax occurs after the heirs receive their payouts. In pennsylvania, for example, the inheritance tax can apply to heirs who live out of state if the decendant lives in the state.

When someone passes away, all of their assets will be subject to inheritance taxation, and whatever is left over after paying the inheritance tax passes to the decedent’s beneficiaries. If you stand to inherit money in michigan, you should still make sure to check the laws in the state where the person you are inheriting from lives. Died on or before september 30, 1993.

Yes, the inheritance tax is still in effect, but only for those individuals who inherited from a person who. The estate includes cash on hand, bank accounts. Both of them resided in the state of michigan at the time of her death.

For individuals who inherited from a person who passed away on or before september 30, 1993, the inheritance tax remains in effect. Does michigan have an inheritance tax or estate tax?

Pdf Inheritance Tax Regimes A Comparison

Wheres My State Refund Track Your Refund In Every State

2

Divorce And Inherited Property – How To Keep It

Michigan Retirement Tax Friendliness – Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Home Heating Credit Claim Instruction Book

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Michigan Estate Tax Everything You Need To Know – Smartasset

What Taxes Are Associated With An Inheritance – Rhoades Mckee

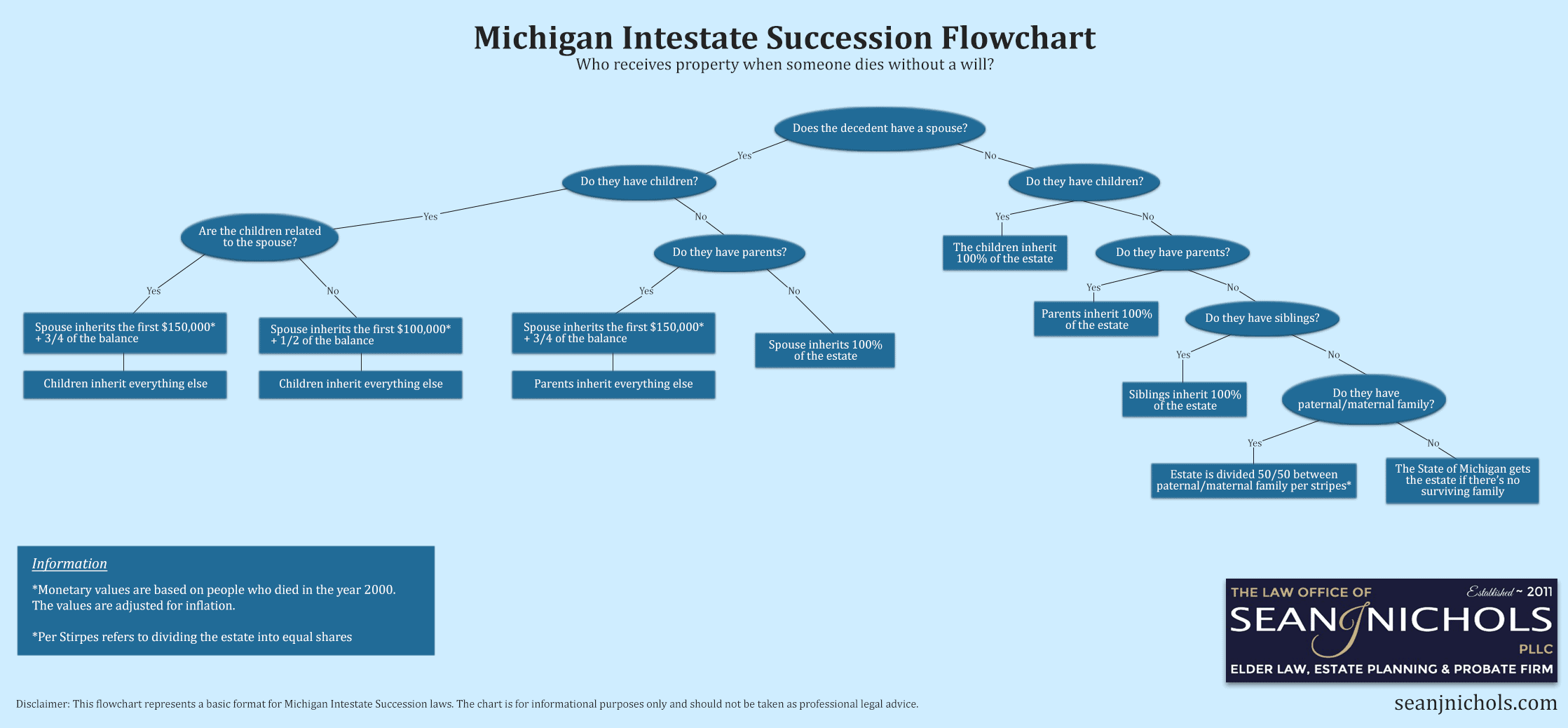

Michigan Probate Laws What You Need To Know

State Estate And Inheritance Taxes Itep

Federal And Michigan Estate Tax Amounts On Inheritances

Michigan Property Tax Uncapping Update – Tuesley Hall Konopa Llp

Michigan Estate Tax Everything You Need To Know – Smartasset

Is There An Inheritance Tax In Michigan – Axis Estate Planning

Will Vs Trust In Michigan Why The Wrong Choice Could Cost You

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc