The aclu foundation is a 501(c)(3) nonprofit, which means donations made to it are tax deductible. The main aclu is a 501(c)(4), which means donations made to it are not tax deductible—though you do get a nifty membership card if you donate there.

Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And

More ways to give see the aclu's grade a rating on charity watch the aclu is an accredited charity approved by the better business bureau

Is aclu a tax deductible charity. Gifts to the aclu's guardian of liberty monthly giving program are not tax deductible. Is the american civil liberties union tax deductible? You can defend and advance civil liberties by donating to either the american civil liberties union (aclu) or the aclu foundation.

Contributions to aclu foundation are tax deductible for charitable purposes, while aclu membership dues are not. To make a bequest that qualifies for a federal estate tax charitable deduction, you may direct your gift to the aclu foundation as follows. Yes, for people who have taxable income in usa, plus a few more people (see below).

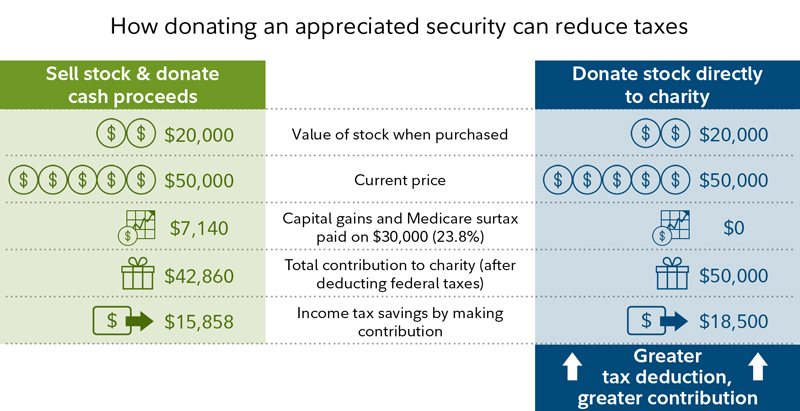

More ways to give see the aclu's grade a rating on charity watch the aclu is an accredited charity approved by the better business bureau Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. We need you with us to keep fighting — donate today.

Access the nonprofit portal to submit data and download your rating toolkit. Making a gift to the aclu via a wire transfer allows you to have an immediate impact on the fight for civil liberties. The aclu and aclu foundation share office space and employees.

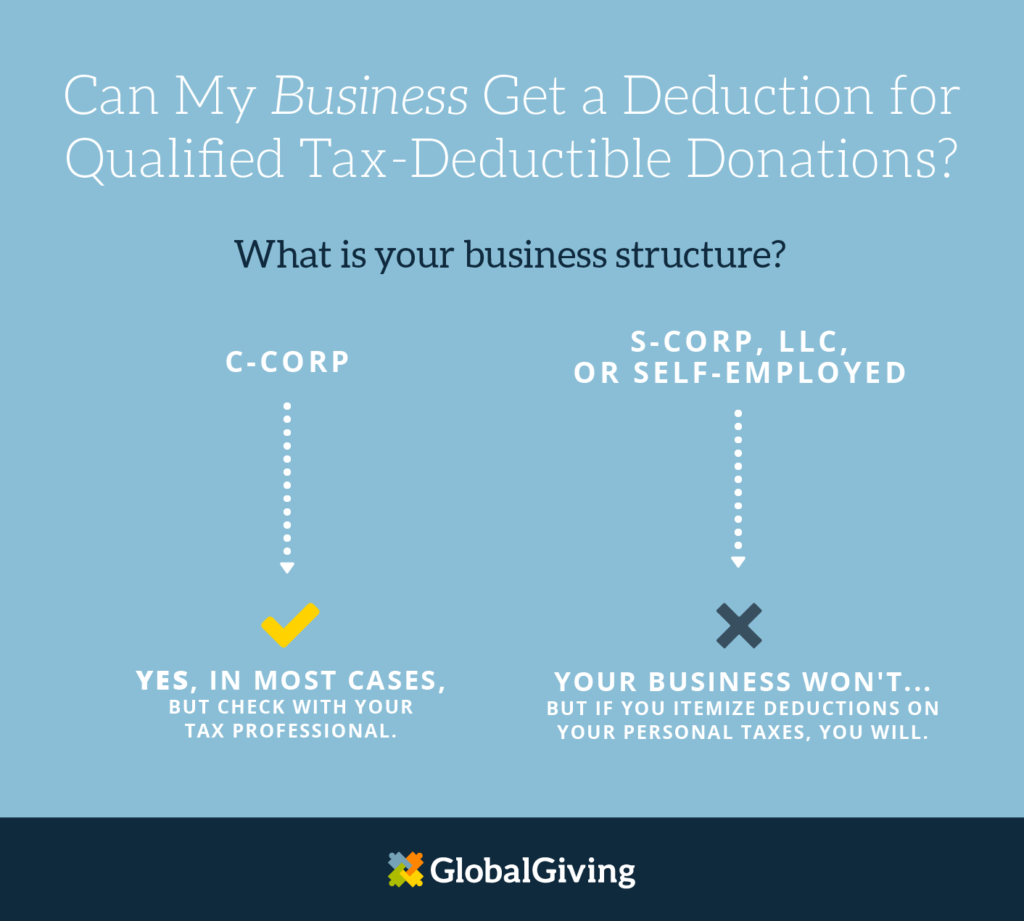

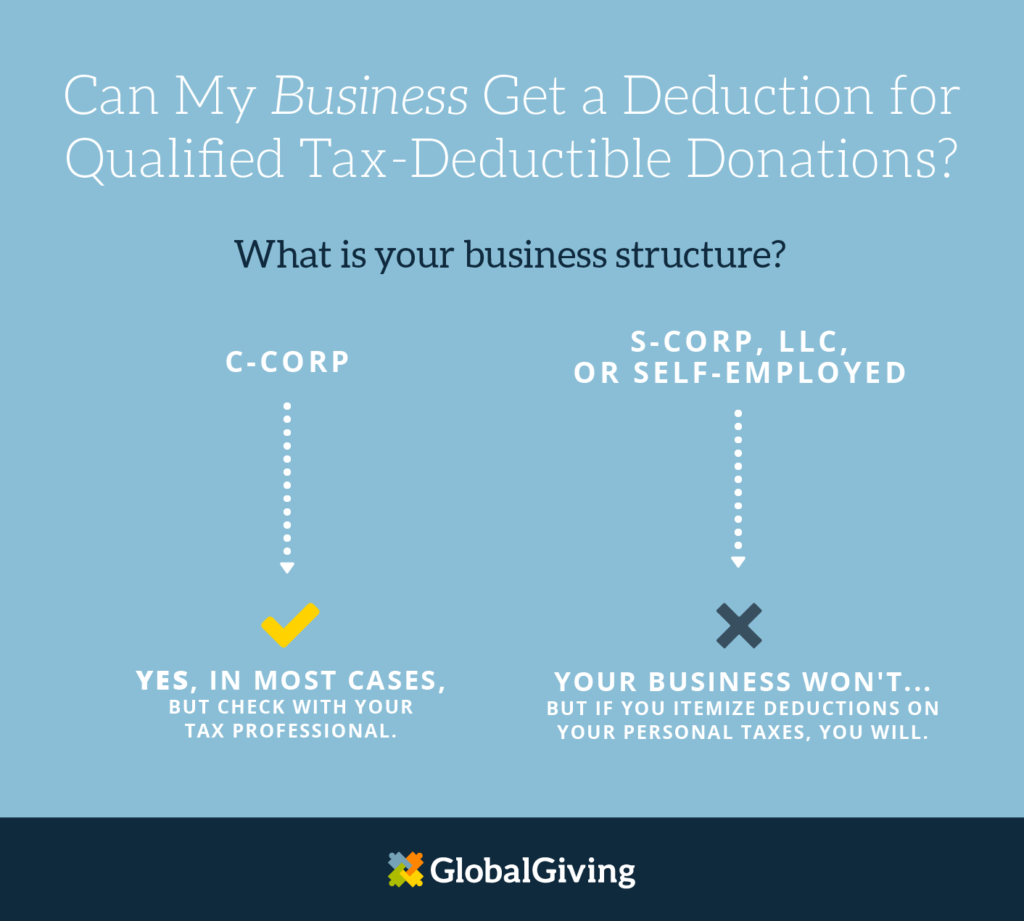

The aclu actually has two arms, the lobbying organization and the foundation—and particularly if you itemize your taxes, it pays to be aware of the difference. Taken together, these changes mean many taxpayers who previously itemized their deductions (including charitable donations) are now simply taking the standard. Here is how to find out for yourself.

The aclu has been at the center of nearly every major civil liberties battle in the u.s. This vital work depends on the support of aclu members in all 50 states and beyond. It is the membership organization, and you have to be a member to get your trusty aclu card.

While not tax deductible, they advance our extensive litigation, communications and public education programs. The aclu is a 501(c)(4) = allowed to engage in political lobbying, donations not tax deductible. Gifts to the aclu allow us the greatest flexibility in our work.

While you may think of the aclu as one giant nonprofit, the irs does not. The new law also capped state and local tax deductions at $10,000. For more details, please email us.

It is the membership organization, and you have to be a member to get your trusty aclu card. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. The aclu foundation is a 501(c)(3) nonprofit, which means donations made to it are tax deductible.

Yes, i've already included the aclu in my estate plans! Contributions to aclu foundation are tax deductible for charitable purposes, while aclu membership dues are not. Gifts to the foundation fund our litigation, communications, advocacy, and public education efforts in maryland and across the country.

Contributions to the aclu are not tax deductible. Depending on how you donate, your gift may or may not be tax deductible. This is because donations in support of legislative advocacy (supporting specific bills that enhance civil liberties protections or opposing bills that seek to erode them) are not tax deductible.

Gifts to the aclu foundation , on the other hand, are deductible, because that arm of the organization engages solely in legal representation and communications efforts. The 2017 tax cuts and jobs act doubled the standard deduction from roughly $12,000 to $24,000 for a married couple filing jointly. Aclu foundation of georgia inc.

The aclu foundation is a 501(c)(3) = not allowed to engage in political lobbying, donations are tax deductible. The aclu is comprised of two organizations, the american civil liberties union and the aclu foundation. Contributions to the aclu are not tax deductible.

The main aclu is a 501(c)(4), which means donations made to it are not tax deductible—though. The aclu is comprised of two organizations, the american civil liberties union and the aclu foundation. Contributions to the aclu are not tax deductible.

Donate Aclu Of Iowa

Charitable Giving And Taxes Fidelity

American Civil Liberties Union Foundation Of Rhode Island – Aclu Foundation Of Ri

Make A Tax-deductible Gift To The Aclu Foundation American Civil Liberties Union

Donation – Thank You – Aclu

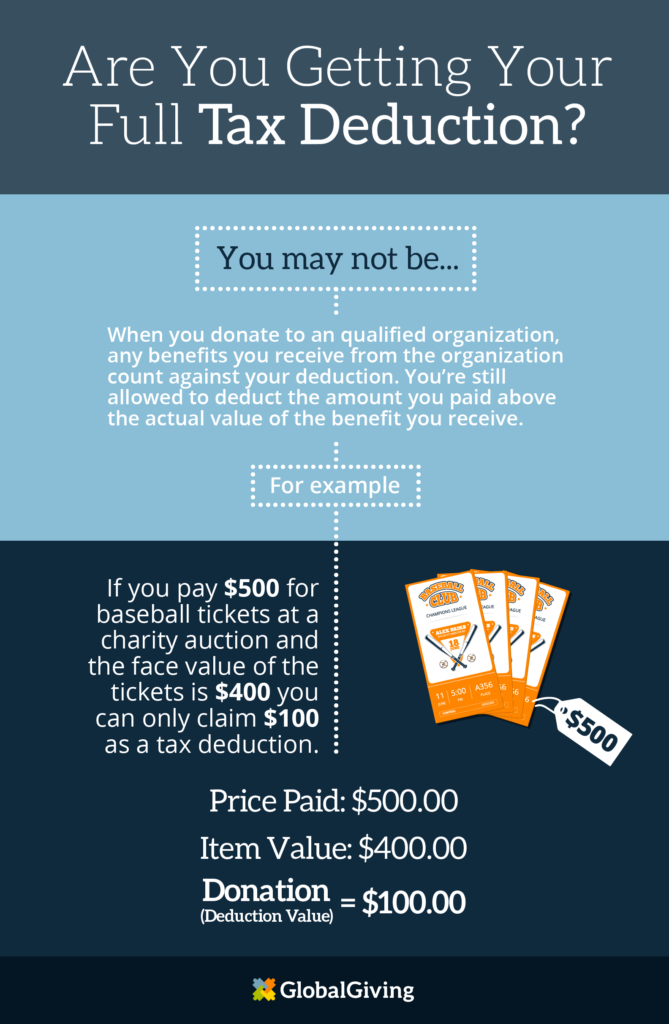

Everything You Need To Know About Your Tax-deductible Donation – Learn – Globalgiving

/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)

Donations To Charities Are Still Tax Deductible

Aclu Impact Society American Civil Liberties Union

Everything You Need To Know About Your Tax-deductible Donation – Learn – Globalgiving

Support The Aclu Foundation Of Texas American Civil Liberties Union

Give American Civil Liberties Union

Donate Aclu Of Oklahoma

Aclu Donations How To Make A Tax-deductible Gift Money

Financial Info And Annual Reports American Civil Liberties Union

According To Charity Navigator First 100 Days Of Trump Administration Changed A Pattern In Charitable Donations Charity Navigator

Charity Navigator – Rating For Aclu Foundation Of Texas

Aclu Of Washington

Ways To Support Our Work – Aclu Of Georgia

Tax Id Number American Civil Liberties Union