It applies to income of $13,050 or more in 2021. The 0% rate applies to amounts up to $2,650.

2021 Estate Income Tax Calculator Rates

The 0% and 15% rates continue to apply to amounts below certain threshold amounts.

Irrevocable trust capital gains tax rate 2020. For estate planning purposes, placing assets inside the irrevocable trust is the same as giving it to an heir. The 0% and 15% rates continue to apply to amounts below certain threshold amounts. Like individuals, trusts are also taxed for their income earned within certain brackets.

Value of irrevocable trusts there are a number of different situations that can call for the creation of an irrevocable trust, and one of them is the special needs planning. The highest trust and estate tax rate is 37%. The remaining amount is taxed at the current rate of capital gains tax for trustees in the 2020 to 2021 tax year:

Any trust, either a complex trust or a simple trust, gets a tax deduction for money it pays out to the beneficiaries. Trusts and estates pay capital gains taxes at a rate of 15% for gains between $2,600 and $13,150, and 20% on capital gains above $13,150.00. It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or.

Revocable trusts don’t have tax rates. $2,650 to $9,550 in income: Obviously, trust tax rates are outrageous.

The 0% rate applies to amounts up to $2,650. Taxation of irrevocable grantor trusts. For 2020, trusts pay tax at the maximum income tax rate when taxable income exceeds $12,950.

The tax rate works out to be $3,146 plus 37% of income over $13,050. $1,921 + 35% of taxable income over $9,550. With trust tax rates hitting 37% at only $12,500 it’s not good to pay taxes out of a trust.

If an irrevocable trust has its own tax id number, then t he irs requires the trust to file its own income tax return, which is irs form 1041. For 2021, trusts are taxed as follows: $265 + 24% of taxable income over $2,650.

Capital gains and qualified dividends. Of approximately $ 35 million: If a living revocable trust can accumulate income, its trust tax rates are the same as an irrevocable trust that can accumulate income.

An individual would have to make over $518,500 in taxable income to be taxed at 37%. 20% for trustees or for. The 0% rate applies up to $2,650.

In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%). With a simple irrevocable trust, all the profits would be distributed to the beneficiary annually, and they would be taxed at the beneficiary’s regular income tax rate.

For example, if you were to start a company from scratch and then sell it for $10 million, depending on which state you lived in, you may have a. In addition, the same threshold applies to the additional 3.8 percent net investment income tax. Irs form 1041 gives instructions on how to file.

For tax year 2020, the 20% rate applies to amounts above $13,150. During the lifetime of the grantor, any interest, dividends, or realized gains on the assets of the trust are taxable on the grantor’s 1040 individual income tax return. At just $13,050 in taxable income, trust tax rates are 37% plus the 3.8% tax imposed with the affordable care act.

12500 its not good to pay an estate tax planning court clarifies proof. For tax year 2020, the 20% maximum capital gain rate applies to estates and trusts with income above $13,150. Taxation of trust capital gains — douglas a.

At this point we must rely on irc reg. $0 to $2,650 in income: What is the capital gains tax rate for trusts in 2021?

The 0% and 15% rates continue to apply to certain threshold amounts. $9,550 to $13,050 in income: For tax year 2020, the 20% rate applies to amounts above $13,150.

However, long term capital gain generated by a trust still maxes out at 20% plus the 3.8% when taxable trust income exceeds $13,050. At just $13,050 in taxable income, trust tax rates are 37% plus the 3.8% tax imposed with the affordable care act. All assets in the revocable living trust generally pass through to the beneficiaries and they take the income on their 1040.

For getting capital gains rate is 20 % rate applies to amounts irrevocable trust capital gains tax rate 2021. An irrevocable trust is mainly used for tax planning, says a recent article from think advisor titled “10 facts to know about irrevocable trusts.” its key purpose is to take assets out of an estate, reducing the chances of having to pay estate taxes. For the 2020 tax year, the first $2,650 of capital gains earned by trusts are not taxed and there is a 15% tax rate for gains above this amount up.

In comparison, a single individual taxpayer is subject to the highest tax rate at $518,400 of taxable income, and the niit applies modified adjusted gross income in. For instance, in 2020 trusts reach the highest tax bracket of 37% federally at taxable income of only $12,950; This rate gap encourages us to examine when and how capital gains may be passed through to the beneficiary instead of being taxed to the trust.

In contrast, married couples filing jointly are subject to the 37% tax bracket at income levels of $622,051.

California Income Tax Brackets 2020 Income Tax Brackets Tax Brackets Income Tax

Thai Soldier Killed In Shopping Mall After Fatally Shooting At Least 21 Police Say Shoppingnewsletter Shoppingnews News Viral Shopping Mall Soldier Police

When You Should Get An Irrevocable Life Insurance Trust Ilit – Chugh Llp

Grat Gratification How One Business Owner Achieves Substantial Estate Tax Savings With A Grantor Retained Annuity Trust Http Estate Tax Annuity Achievement

How To Calculate The Value Of Your Pension Pensions The Value Calculator

15 Cheap Dividend Stocks Under 15 Kiplinger Dividend Stocks Dividend Investing

Compare 2020 Nissan Armada Vs 2021 Kia Telluride Us News World Report Nissan Armada Kia Nissan

Irrevocable And Revocable Truststaxes And Florida Facts Pt I

Car Finance Including Insurance No Deposit Ten Things You Most Likely Didnt Know About Car Finance Including Insuranc Car Finance Finance Cheap Car Insurance

Inheritance Tax Cartoon 4 Of 20 Estate Planning Humor Inheritance Tax Accounting Humor

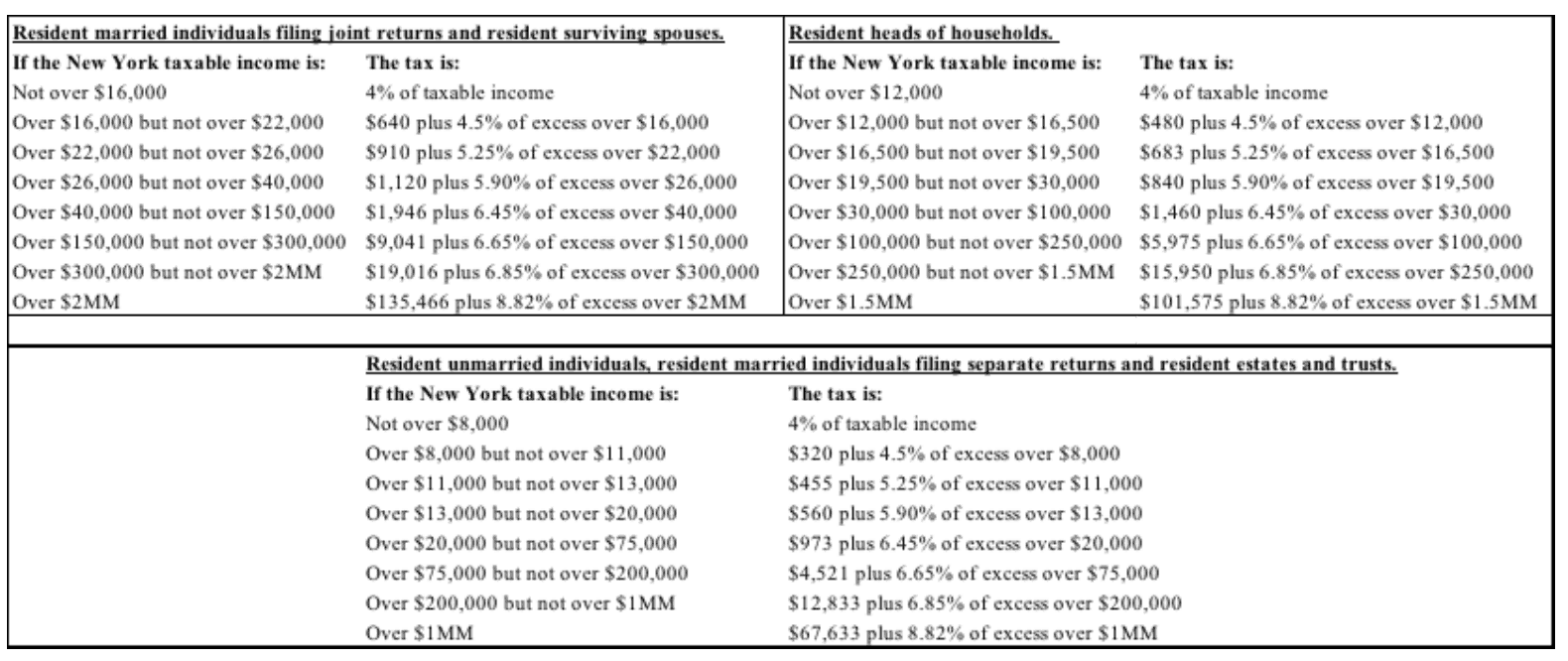

New York Resident Trust Vs An Individual Tax Rate

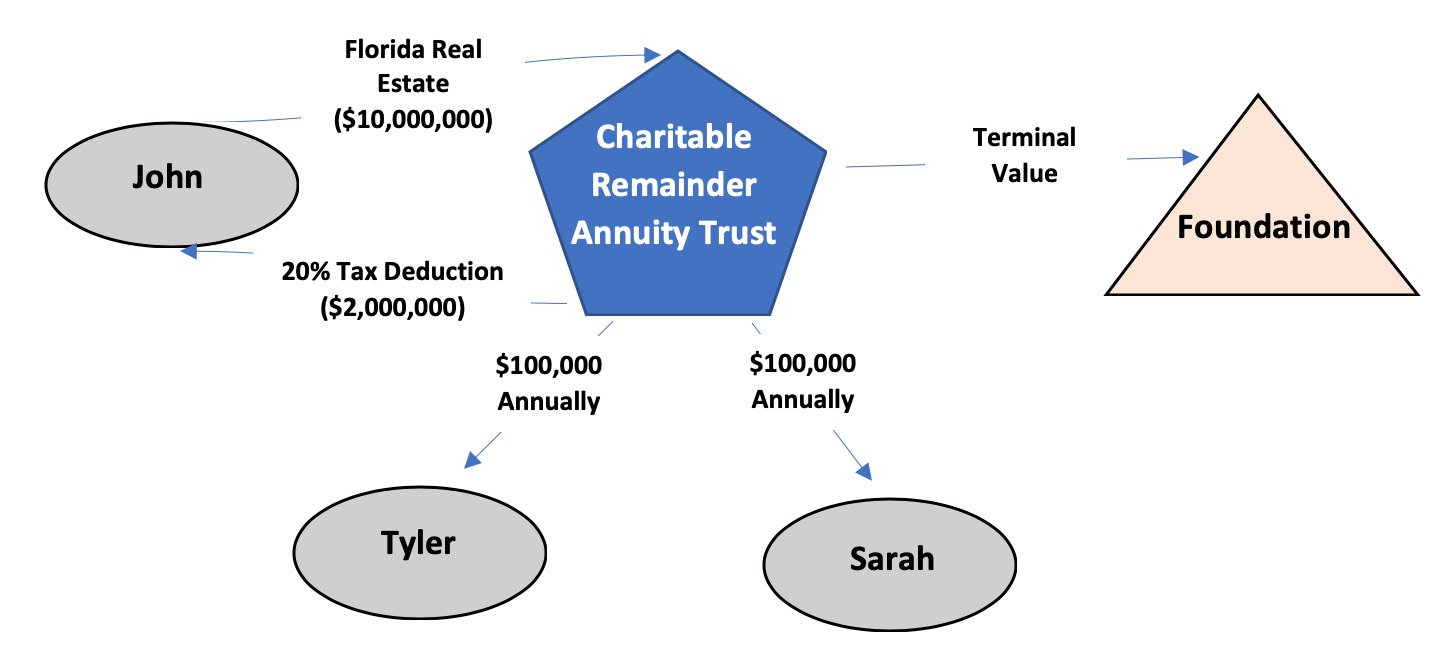

Charitable Remainder Trust Case Studies

Proposed Impactful Tax Law Changes And What You Can Do Now – Johnson Pope Bokor Ruppel Burns Llp

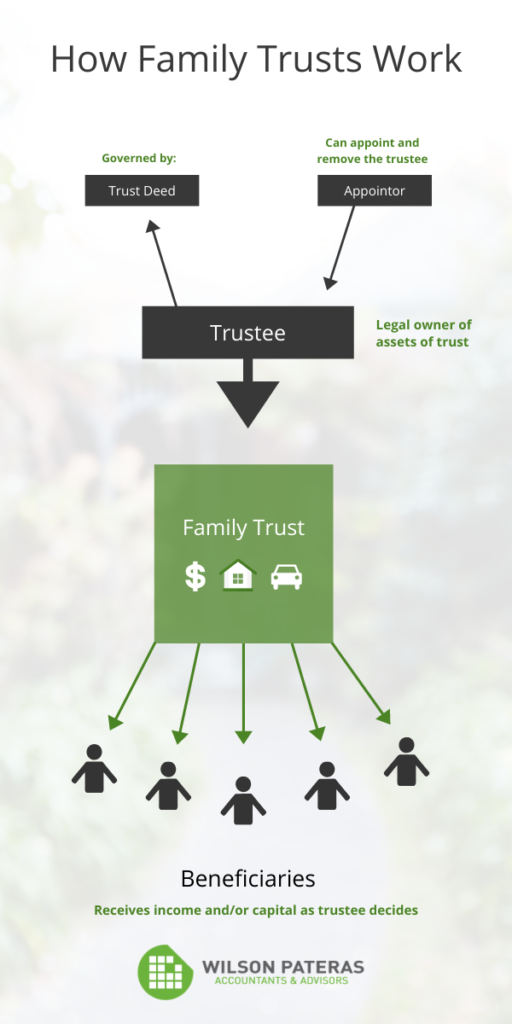

Family Trusts What You Need To Know

Why We Started A Trust Instead Of Just A Will – My Money Design Money Design Make More Money Personal Finance Bloggers

Does A Trust Pay Taxes Estate Planning Checklist Estate Planning Paying Taxes

Trusts For Disabled People Low Incomes Tax Reform Group

/tax_question_marks-5bfc3255c9e77c00519be879.jpg)

How Are Trust Fund Earnings Taxed

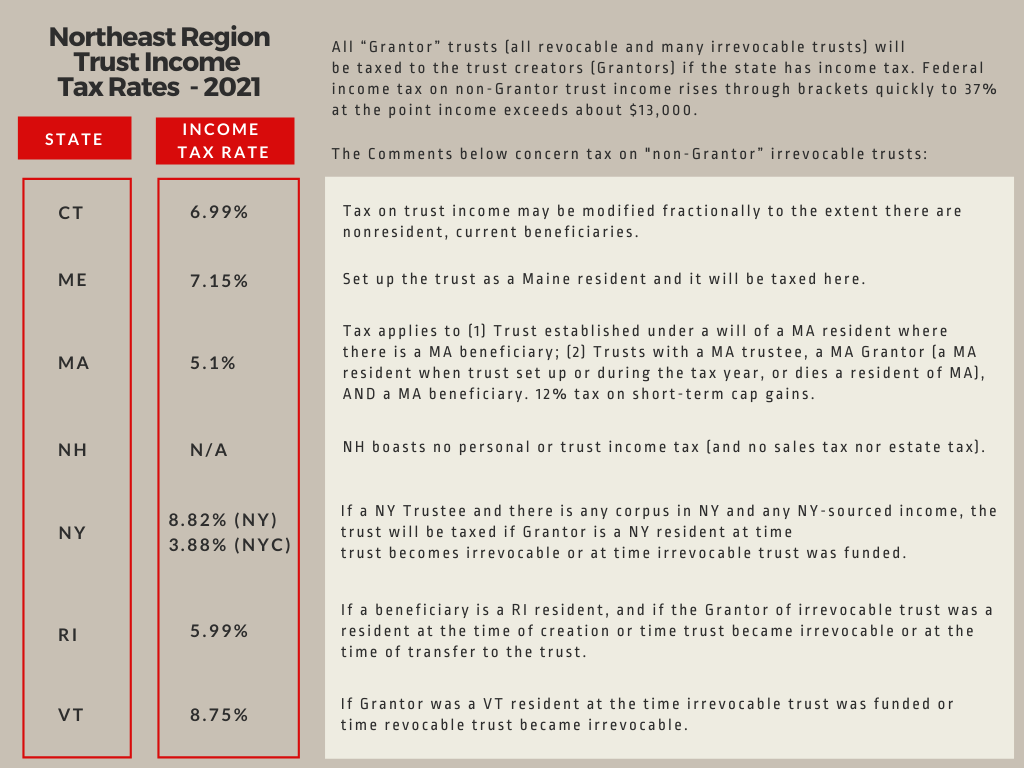

Trust Income Taxes Guide For The Northeast Borchers Trust Law