The tax and/or fees you pay on products purchased through the instacart platform are calculated the same way as in a physical store. In the instacart shopper app, tap the account icon in the bottom right corner.

What Is A Gsthst Number Canada Only Instacart Onboarding

Once you are approved, you will see orders near your current location in the app.

Instacart tax form canada. When you’re ready, tap next: Does instacart take out taxes for its employees? This is a standard tax form for contract workers.

Hi folks, i joined instacart in february 2018 and this is my first full year with instacart, which means it's time to do my taxes. Instacart will review your application and notify you when you are approved. We’re constantly modifying and improving the services.

It shows your total earnings, plus how much of your owed tax has already been sent to the. This can make for a frightful astonishment when duty time moves around. Gig platforms don’t withhold or take out taxes for you.

They're required to send them by jan 31st though. This is a standard tax form for contract workers. If you make more than $500 per tax year as an instacart shopper in winnipeg, mb, we will send you a t4a tax form.

Eligible to work in the u.s. For instacart shoppers in winnipeg, mb, your taxes will not be withheld from your pay. New shoppers usually receive their cards within 5 to 7 business days.

Except despite everything you have to put aside a portion of the cash you make every week. Get your instacart payment card registered: Fill in the form with your first name,.

He should use the industry code for instacart in his t2125 form. And (3) relevant information about. As you’re liable for paying the essential state and government income taxes on the cash you make delivering for instacart.

Not file on a quarterly basis. Ad ask verified tax pros anything, anytime, 24/7/365. Ad ask verified tax pros anything, anytime, 24/7/365.

You can also try heading to payable via this link and you may be able to download your form: If you have other business activities that are registered under a different business number, you file a separate t2125 form for it. All companies, including instacart, are only required to provide this form if they paid you $600 or more in a given tax year.

(2) proof of a claim of identity theft (e.g., police report or ftc issued identity theft report); You won’t send this form in with your tax return, but you will use it to figure out how much business income to report on your schedule c. In the menu, select tax identification.

Enter your phone number in the box and appears, and a download link will be sent to your mobile device. So i just have to file when i get my 2018 1099 in jan 2019. When you work for instacart, you’ll get a 1099 tax form by the end of january.

You won’t send this form in with your tax return, but you will use it to figure out how much business income to report on your schedule c. Top 5 things to know about the canada child tax benefit At least 18 years old.

Enter your gst/hst registration number. From there, the application will prompt you to download the instacart shopper app. Confirm once you confirm you’re registered for gst/hst.

Someone we know owed $700 in taxes being it. Sharing your gst or hst number with instacart: For instacart shoppers in edmonton south, ab, your taxes will not be withheld from your pay.

Whether you're an independent contractor or an employee, you'll use form 1040 to file your tax return as a delivery driver. If you use tax filing software like turbotax. Instacart is good but come tax time it isn’t.

Instacart shoppers use a preloaded card when they check out with a customer’s order. Fortunately you can still file your taxes without it and regardless of whether or not you receive a. In possession of a functioning, registered vehicle with insurance.

The taxes on your instacart income won’t be high since most drivers are making around $11 every hour. In canada, we usually get a tax form called a t4 from the employer which can be used to file the taxes. All companies, including instacart, are only required to provide this form if they paid you $600 or more in a given tax year.

You’ll include the taxes on your form 1040 due on april 15th. Taxes and fees like any other service or product, taxes are included in the order total on your delivery receipt that’s emailed to you upon the completion of your order. This is a standard tax form for contract workers.

Do instacart, shipt, postmates, doordash, or other platforms take out taxes? Quebec residents have to apply for gst/hst and qst numbers. Your earnings exceed $600 in a year

Where can i find my 1099? Last year i received my electronic 1099 from instacart (via payable) on jan 17th, but i haven't heard a specific date from instacart or payable yet for 2017 taxes. Here is the link you'll need to contact instacart:

Pursuant to section 609(e) of the fcra, instacart requires victims to provide: If you make more than $500 per tax year as an instacart shopper in edmonton south, ab, we will send you a t4a tax form. (1) verification of identity (e.g., valid government issued id);

You don’t send the form in with your taxes, but you use it to figure out how much to report as income when you file your taxes. I got one from uber since i also work for them part time and it's super simple and easy. This is a standard tax form for contract workers.

How To Get Instacart Tax 1099 Forms – Youtube

Paying Your Taxes In The Age Of Covid-19 Heres What Every Canadian Needs To Know Financial Post

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Paying Your Taxes In The Age Of Covid-19 Heres What Every Canadian Needs To Know Financial Post

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Review 10k As A Part-time Instacart Shopper

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Instacart Driver Jobs In Canada What You Need To Know To Get Started

What You Need To Know About Instacart 1099 Taxes

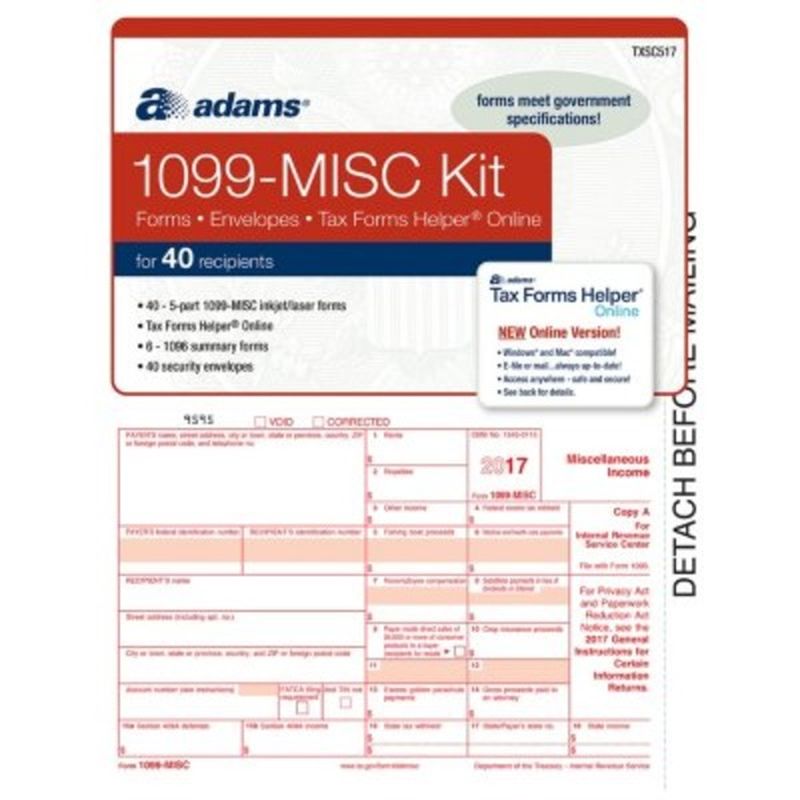

Adams 1099 Misc Forms Kit With Tax Forms Helper Online 2017 Each – Instacart

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Does Instacart Track Mileage – The Ultimate Guide For Shoppers

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors – Youtube

Instacart Driver Jobs In Canada What You Need To Know To Get Started

When Does Instacart Pay Me A Contracted Employees Guide

Instacart Driver Jobs In Canada What You Need To Know To Get Started