How it is taxed depends on the payout structure and whether you are the surviving. Based on our example, 60% of each payment would be taxable at susan’s ordinary income tax rate and 40% would not.

9 Reasons Why People Buy Annuities The Annuity Expert

Learn more about taxes at bankrate.com.

Inherited annuity tax rate. How inherited annuities are taxed. The part of the annuity payment representing return of capital is not taxable, but the earnings are. Like any other type of income, inherited annuities are taxable.

Depending on the type of annuity, the tax will have to be paid on the lump sum received or on the regular fixed payments. The different inherited annuity rules, options, and taxes are complicated. If the annuitant’s spouse dies before the annuitant, the annuity will stop paying after the annuitant’s death.

If you have an annuity contract, you can choose a beneficiary to receive the remaining payments or lump sum death benefit if you die. The timing of the tax event depends on the payout structure and your status as a beneficiary. Principal that was not taxed and earnings will be subject to taxation as income.

Assuming an annual 0% rate of return, gross distributions would be $300,000, and do not reflect any applicable annuity fees or underlying fund or charges. If someone has inherited an annuity they will have to pay taxes on it. How taxes are paid on an inherited annuity will depend on the payout structure selected and the status of the beneficiary.

To begin to withdraw funds after age 72. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Tax rules for inheriting an annuity.

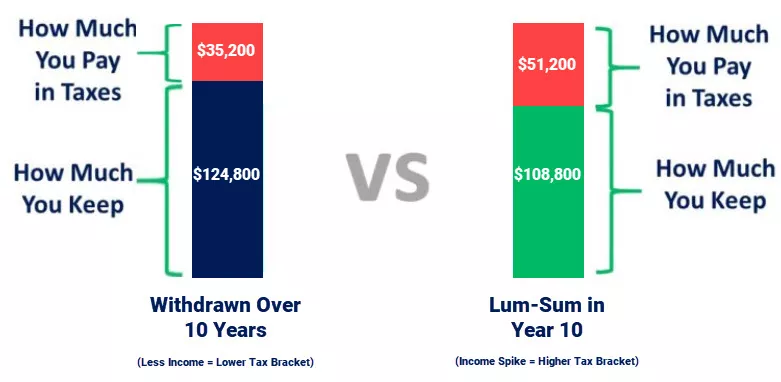

28% income tax rate assumed in the lump sum and distribution over five years example; Any distributions paid to the. You'll pay tax on everything above the cost that the original annuity owner paid.

Each state has its own rules, rates and thresholds, but all exempt spouses from paying inheritance tax. The estimated number of payments from your annuity are divided equally by the principle and tax exclusions. How much tax do you pay on annuity income?

In that case, the taxation is much simpler. Earnings are taxed as ordinary income and are not subject to the capital gains tax. An early withdrawal penalty of 10% usually applies if you take money out of your annuity before the age of 59 1/2.

Generally, you’ll owe income tax on the difference between the principal paid into the annuity the annuity’s value when the owner died. A 24% tax rate assume in the stretch option, where smaller distributions could place toni. This guide will explain how annuities work for beneficiaries when an annuity owner dies.

So, if you are trying to have a more tax efficient distribution, you might want to get payout annuity rates. If they choose a lump sum, beneficiaries must pay owed taxes immediately. If you inherit an annuity from your father, you'll pay taxes on the portion of the account that represents the earnings on the amount paid in.

The amount you contributed to the annuity is not taxed when you make withdrawals, but your earnings are taxed at your usual income tax rate. For other beneficiaries, the closer the family relationship to the. Now, keep in mind, when you go the inherited rmd route on a nq annuity, all the historical deferred gains have to come out 1st as taxable before you can access any of the cost basis tax free.

If the decedent lived in one of these states at the time of death, any money he left, including annuities, is subject to inheritance tax, which is generally deducted from the amount due to the beneficiary. Do beneficiaries pay taxes on inherited annuities? If the deceased paid $100,000 into the annuity.

The payments received from an annuity are treated as ordinary income, which could be as high as a 37% marginal tax rate depending on your tax bracket. When someone inherits the annuity from the original owner, a few different tax implications arise. Please note, the first dollars out would be considered your gain and taxed at ordinary income tax rates.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitant’s death. When a person inherits an annuity, the gains stay with the policy. However, an inherited annuity is taxable.

Annuities 15 Things You Must Know To Save You Time And Money – Due

Fixed Index Annuity Review Pros Cons And Problems 2021

Annuities Or Drawdown Which Is Right For You Moneyfactscouk

Generation-skipping Trust Gst What It Is And How It Works

Annuitization An Epic Mistake In Retirement 2021

2

2

Form It-r Download Fillable Pdf Or Fill Online Inheritance Tax Resident Return New Jersey Templateroller

Even With No Estate Tax Some Tax May Be Due On Inheritance – Fleming And Curti Plc

Understanding The Different Values In Annuities The Annuity Expert

Tax Friendly States For Retirees Best Places To Pay The Least

9 Reasons Why People Buy Annuities The Annuity Expert

Annuity Taxation – Advisorworldcom

Pdf Taxation Of Wealth And Wealth Transfers

Annuities 11 Solutions To Enhance Your Retirement In 2021 Annuity Life Annuity Lifetime Income

Pdf Taxation Of Wealth And Wealth Transfers

Inheritance Tax Rules How Will They Affect You 20192020 Update

New Inherited Ira Rules 2020 How To Avoid A Major Beneficiary Mistake

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow