Please check the appropriate box on the front of this form to let us know if you are making an estimated, extension, or composite payment. This is in case the vouchers that are automatically issued (after we receive your first payment) don’t get to you by the next payment’s due date.

Pin On My Best Direct Mail Sales Letters

Enter the amount of the payment to be made as an extension payment and mail it to the address on the form.

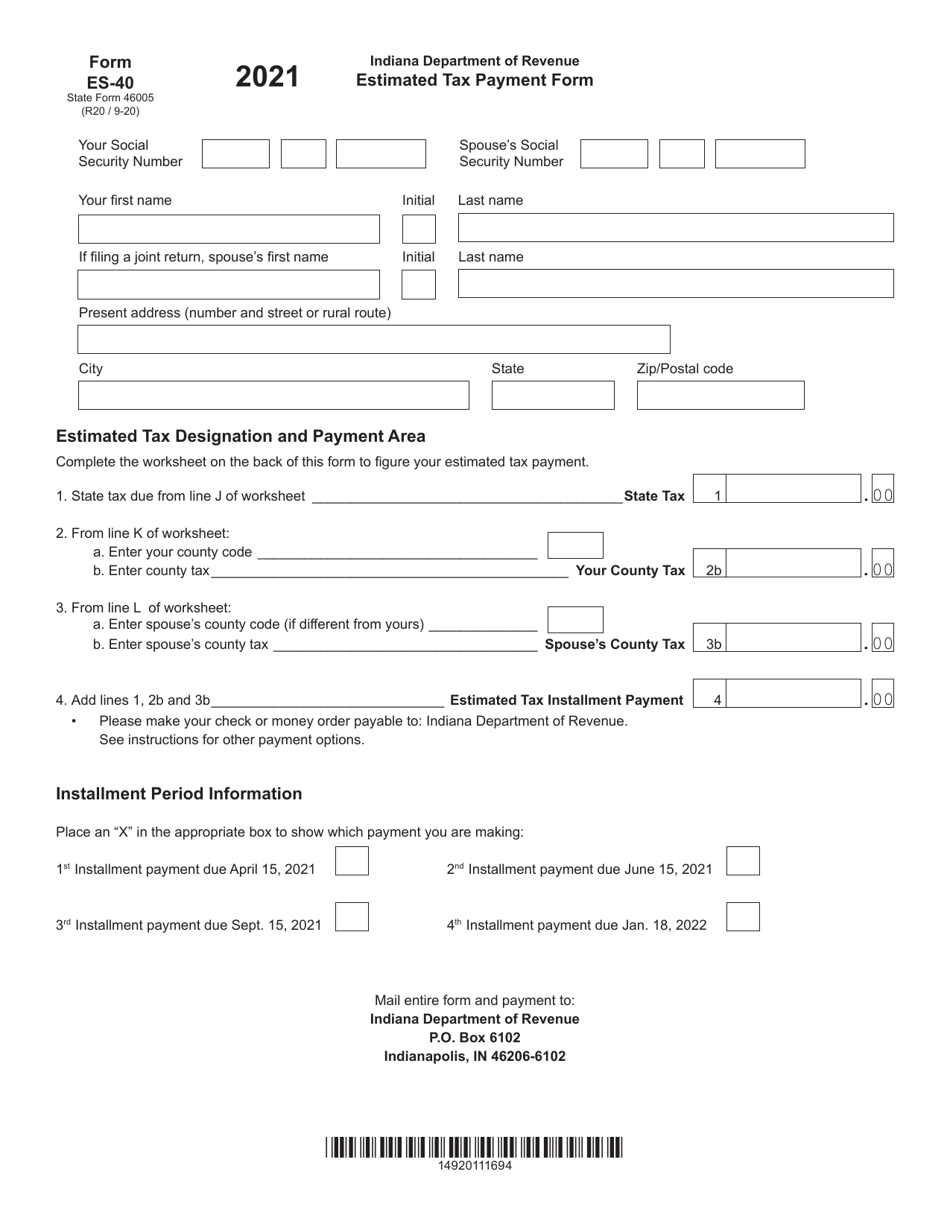

Indiana tax payment voucher. If the due date falls on a national or state holiday, saturday or sunday, payment postmarked by the day following that holiday or sunday is considered on time. Indiana corporate estimate quarterly income tax return/extension payment: To pay by credit card, you may make your estimated tax payment online.

While some tax obligations must be paid with eft, several thousand businesses use the program for its speed and convenience. Intime offers a quick, safe and secure way to submit payments at your convenience. Pay the amount due on or before the installment due date.

You may also pay using the electronic echeck payment method. Eft allows our business customers to quickly and securely pay their taxes. Use this form to make an estimated tax payment.

Using a preprinted estimated tax voucher that is issued by the indiana department of revenue (dor) for taxpayers with a history of paying estimated tax; A representative can research your tax liability using your social security number. Pay the amount due on or before the installment due date.

For more information about estimated tax, get income tax Use this form to make an estimated tax payment. Make a payment online with intime by credit card or electronic check.

All payments must be made with u.s. For estates, residence is based on the decedent’s. Write your social security number on the check or money order.

Contact the indiana department of revenue (dor) for further explanation if you do not understand the bill. The credit will be reflected on the schedule in k. To learn more about the eft program, please download and read the eft information guide.

Download or print the 2020 indiana (fiduciary estimated tax and extension payment voucher) (2020) and other income tax forms from the indiana department of revenue. Estimated payments can be made by one of the following methods: Enclose your check or money order made payable to the indiana department of revenue.

Write your social security number on the check or money order. You will receive a confirmation. Beneficiary's share of indiana adjusted gross income, deductions, modifications, and credits:

Other indiana sales tax forms: Entity's composite adjusted gross income tax return: To pay by credit card, you may make an estimated tax payment online.

For purposes of filing the indiana fiduciary income tax return, estates and trusts are classified as either resident or nonresident. This form is for income earned in tax year 2020, with tax returns due in april 2021. Send in a payment by the due date with a check or money order.

Indiana does not require trusts and estates to make estimated payments. If you owe indiana state taxes, a post filing coupon (pfc) will print with your return. Economic development for a growing economy retention credit:

To access this payment voucher, from the main menu of the indiana fiduciary return select miscellaneous forms > total payments > indiana extension voucher. You can print other indiana tax forms here. Department of revenue fiduciary section.

Indiana — estimated tax payment voucher. Enclose your check or money order made payable to the indiana department of revenue. Economic development for a growing economy credit:

This service uses a paperless check and may be used to pay the tax due with your indiana individual income tax return, as well as any billings issued by the indiana department of revenue for any tax type. When you receive a tax bill you have several options: All payments must be made with u.s.

This is in case the vouchers that are automatically issued (after we receive your first payment) don’t get to you by the next payment’s due date. (if you expect to receive a refund, there is nothing to mail and the pfc will not print.) this form must accompany any payment you make to the indiana department of revenue. You can print other indiana tax forms here.

There are several ways you can pay your indiana state taxes. For more information about estimated tax, get income tax Indiana fiduciary income tax return:

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the ssn/ein of the taxpayer who sent it. Fill in the form, save the file, print, and mail to the indiana department of revenue.

Love When I Get My Scentsy Bonuses Early-annual Sales Of 30kmentor-makes It A Fun Friday Bles Internet Marketing Small Business Owner Marketing Tips

Payment Voucher Pdf – Fill Out And Sign Printable Pdf Template Signnow

Form Es-40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form – 2021 Indiana Templateroller

The Great Voucher Fraud Americans United Greatful Fraud Greats

Ap – Bozos Pizza – February 1977 Vintage Ads Old Country Stores Italian Style

Salary Slip Format In Excel Free Download Excel Templates Payroll Template Excel Templates Letter Template Word

Pin By Joana Halder On Circular Flow Of Income In Four Sector Economy Circular Flow Of Income Income Goods And Services

2

Download Instructions For Form St-103 Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Pdf Templateroller

Pin On Teacher Teacher

Homepage Gestaltung Raum Gestaltung Webdesign Grafik Und Drucksachen Gestaltungswerkstatt Yoga Day International Yoga Day Happy International Yoga Day

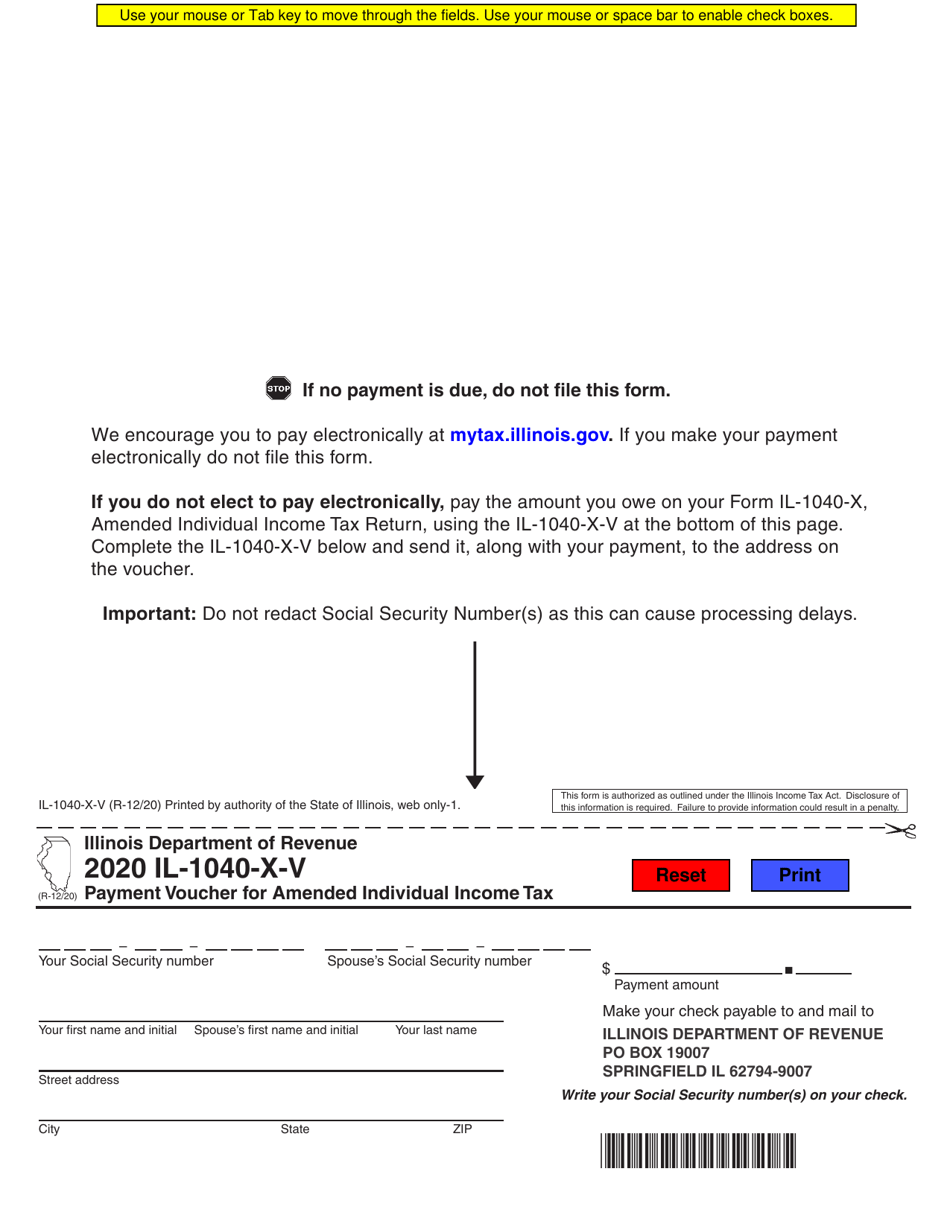

Form Il-1040-x-v Download Fillable Pdf Or Fill Online Payment Voucher For Amended Individual Income Tax – 2020 Illinois Templateroller

2

State Returns – Estimated Tax Vouchers Direct Debit

2009 Estimated Tax Payment Voucher

Indiana Quarterly Estimated Tax Voucher For 2020 – Fill Online Printable Fillable Blank Pdffiller

School Vouchers Get 2 New Report Cards Report Card School Cards

Download Instructions For Form St-103 Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Pdf Templateroller

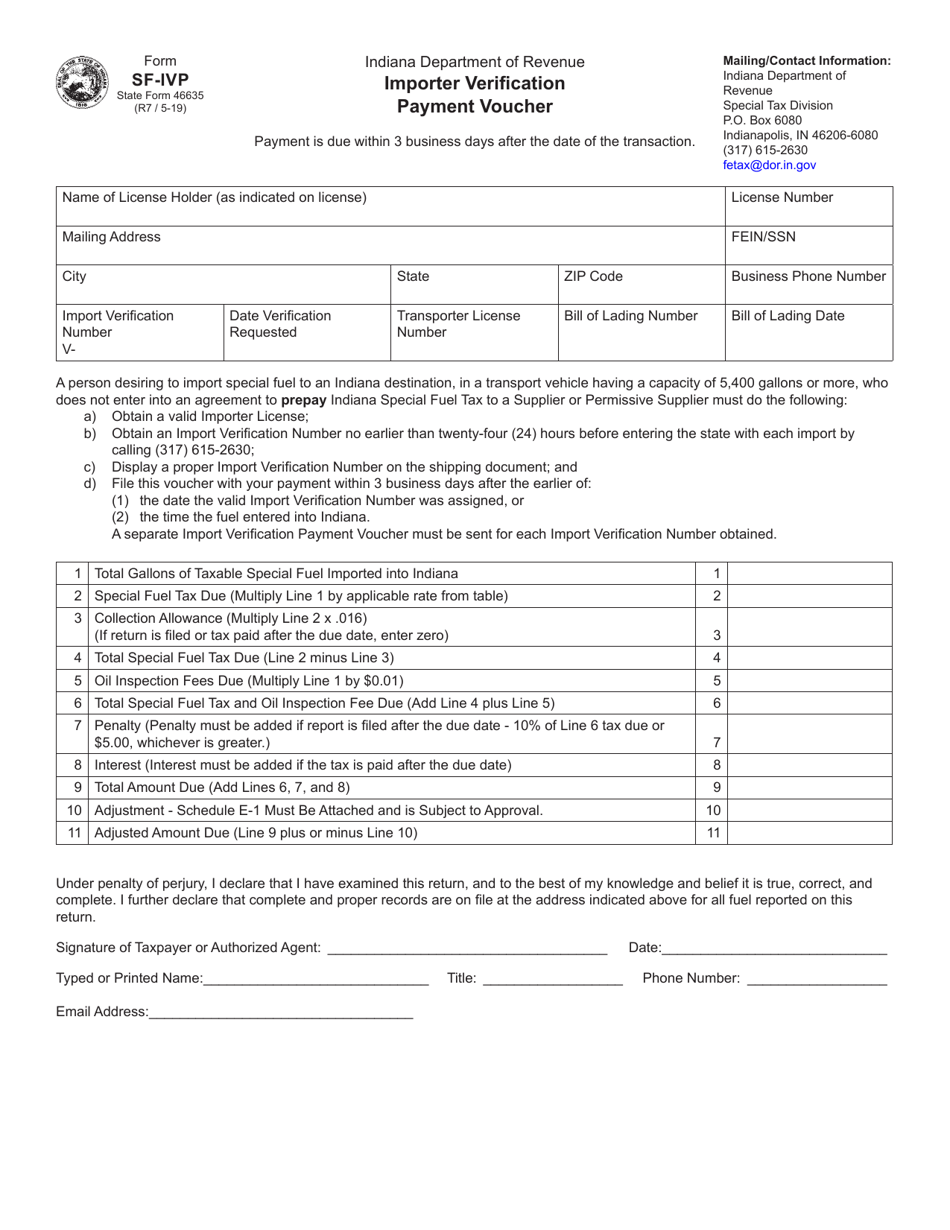

Form Sf-ivp State Form 46635 Download Fillable Pdf Or Fill Online Important Verification Payment Voucher Indiana Templateroller