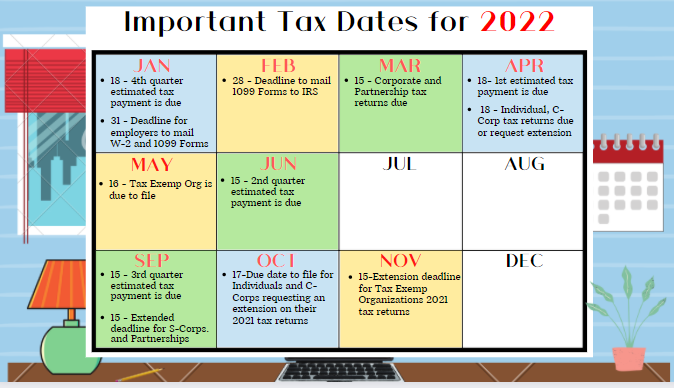

Listed below are typical tax filing deadlines for each month, some may fall on a holiday or saturday or sunday. The state of indiana has issued the following guidance regarding income tax filing deadlines for individuals:

Quarterly Tax Calculator – Calculate Estimated Taxes

Pay as you go, so you won't owe:

Indiana estimated tax payment due dates 2021. 15, 2021 mail entire form and payment to: M m d d y y y y 1 payment: You are not required to make an estimated tax payment if you choose indiana department of revenue underpayment of estimated tax by individuals

January 1 to march 31. Those individuals will have an unpaid tax liability that is $1000 or more in any of the following tax types: If you indicate on your timely filed 2020 indiana individual income tax return that all or part of an overpayment should be applied to your 2021 income tax.

April 15 is the deadline for the first quarterly estimated tax payment for 2021, if you’re required to make one. 18, 2011 mail entire form and payment to: This estimated payment is for tax year ending december 31, 2021, or for tax year ending:

Due dates for the 2021 tax season are: The payment deadline is also may 17, 2021. For recent developments, see the tax year 2021 publication 505, tax withholding and estimated tax, and electing to apply a 2020 return overpayment from a may 17 payment with extension request to 2021 estimated taxes.

June 15, 2021 3rd payment. 18, 2022 (4 th installment) not properly. Pay all your estimated tax by jan.

Second quarterly estimated tax payment for. September 1, 2021 to december 31, 2021. 18, 2022 mail entire form and payment to:

April 15, 2021 2nd payment. Due date for deposit of tax deducted/collected for the month of october, 2021. If the irs extension is granted, the indiana extension is automatically granted.

1st installment payment due april 15, 2010 2nd installment payment due june 15, 2010 3rd installment payment due sept. A guide to withholding, estimated taxes, and ways to avoid the estimated tax penalty. accessed sept. The filing deadline has been extended until may 17, 2021.

Penalties and interest on underpayments will be calculated from that date; The extension only shifts the filing deadline and not the payment deadline. The due dates are generally april 15, june 15, september 15, and january 15 but if they fall on a weekend or holiday, the deadline is moved to the next workday.

A timely filed extension moves the federal tax filing deadline to october 15, 2021, and the indiana filing deadline to november 15, 2021. You can pay all of your estimated tax by april 15, 2021, or in four equal amounts by the dates shown below. You must round your estimated payment to a whole dollar (no cents).

A taxpayer who uses a taxable year that ends on december 31 shall. The due dates are the 15th of april, june, and september. It is important to note that the extension only shifts the filing deadline and not the payment deadline.

Dor has extended the individual income tax filing and payment deadline to may 17, 2021. 1st installment payment due april 15, 2020 2nd installment payment due june 15, 2020 3rd installment payment due sept. 15, 2010 4th installment payment due jan.

15, 2020 4th installment payment due jan. 15, 2021 4th installment payment due jan. A timely filed extension moves the federal tax filing deadline to october 15, 2021, and the indiana filing deadline to november 15, 2021.

Ninety percent of the taxes owed are still. September 1, 2021 to december 31, 2021. Indiana department of revenue p.o.

April 15, 2021 (1 st installment) june 15, 2021 (2 nd installment) sept. First quarterly estimated tax payment for corporations due. 18, 2022* * you don’t have to make the payment due january 18,

This relief does not apply to estimated tax payments that were due on. No, first quarter 2021 estimated tax payments are still due on april 15, 2021. The estimated tax payments are due on a quarterly basis.

15, 2021 (3 rd installment) jan. Payment of estimated taxes is due in installments. Penalties (a) except as provided in subsections (c) through (e), a taxpayer shall file utility receipts tax returns with, and pay the taxpayer's utility receipts tax liability to, the department by the due date of the estimated return.

Estimated tax payments are due periodically throughout the year. Calendar year farmers and fishermen. Indiana adjusted gross income tax;

When income earned in 2021. Indiana department of revenue p.o. Due date is april 15, 2021.

In that case, it will need to be postmarked on the. First quarter estimated tax payments remain due on april 15th Indiana department of revenue p.o.

Due dates for 2021 estimated tax payments. 1st installment payment due april 15, 2021 2nd installment payment due june 15, 2021 3rd installment payment due sept. Taxes must be paid as you earn or receive income during the year, either through withholding or estimated tax payments.

Indiana Sales Tax Filing Due Dates For 2021

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

2

Dont Mix Up Tax Deadlines Wbiw

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

Dor Stages Of Collection

2

Dor Keep An Eye Out For Estimated Tax Payments

Dor Keep An Eye Out For Estimated Tax Payments

2

Here Are Key Tax Due Dates If You Are Self-employed Forbes Advisor

How To Pay Your Taxes With A Credit Card In 2021 Forbes Advisor

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

Indiana Sales Tax – Small Business Guide Truic

2020 Tax Deadline Extension What You Need To Know Taxact

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Tax Deadlines Hr Block

Dor Keep An Eye Out For Estimated Tax Payments