For example, if jose passed away and left behind an estate valued at $15 million, the full amount (minus the lifetime exemption) would be subject to federal (and sometimes state) estates taxes and the tax must be paid prior to the. Form 706 is used by the executor of a decedent's estate to figure the estate tax imposed by chapter 11 of the internal revenue code.

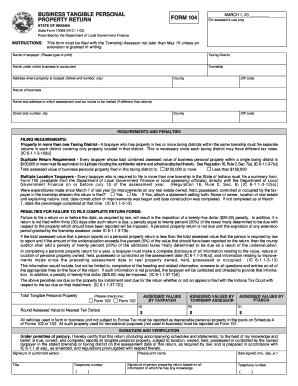

Form 104 – Fill Out And Sign Printable Pdf Template Signnow

Ad perfect pdf signer to add signatures, initials, dates or text on pdf forms online so easy

Indiana estate tax form. There is also a tax called the inheritance tax. The tax is imposed on the recipient of the inheritance, but many estate. Anthem blue cross ppo plan;

If you need to contact the internal revenue service, you can access the irs website at www.irs.gov to download forms and instructions. Dying with a will in indiana. Indiana inheritance and gift tax.

Counties in indiana collect an average of 0.85% of a property's assesed fair market value as property tax per year. Indiana inheritance tax is imposed on the transfer of property from an indiana decedent to a beneficiary. There is no inheritance tax in indiana either.

Whereas the estate of the deceased is liable for the estate tax, beneficiaries pay the inheritance tax. Enter your indiana county of residence and county of principal employment as of january Indiana department of revenue estimated tax payment form estimated tax designation and payment area complete the worksheet on the back of this form to figure your estimated tax payment.

Instructions for inheritance tax general: The median property tax in indiana is $1,051.00 per year for a home worth the median value of $123,100.00. Print or type your full name, social security number or itin and home address.

Therefore, you must complete federal form 1041, u.s. Estate tax is one of two ways an estate may be taxed. This form must be printed on gold or yellow paper.

Tax withholding forms for vanderburgh. State tax due from line j of worksheet _____state tax. For a will to be considered valid under indiana inheritance laws, it must not only be handwritten or printed, but also contain the decedent’s signature along with those of.

Listed below are certain deductions and credits that are available to reduce a taxpayer’s property tax liability. Inheritance tax applies to assets after they are passed on to a person’s heirs. If a decedent’s estate does owe estate taxes, that tax must be paid during the probate of the estate using available estate assets.

Many of the necessary determinations are done at the federal level by the irs. Appeals may be filed in person, monday through friday, between the hours of 8:30 am and 4:00 pm, or by mail at the address above. Assessment appeals shall be in writing on a form supplied by the board, and shall be filed with the indiana county assessment office, 825 philadelphia street, indiana, pa 15701.

Indiana has one of the lowest median property tax rates in the united states, with only ten states collecting a lower median property tax than indiana. The amount of tax is determined by the value of those. While federal estate tax is assessed on a decedent’s total combined asset value, indiana inheritance tax is a transfer tax assessed on each separate transfer.

Ad perfect pdf signer to add signatures, initials, dates or text on pdf forms online so easy

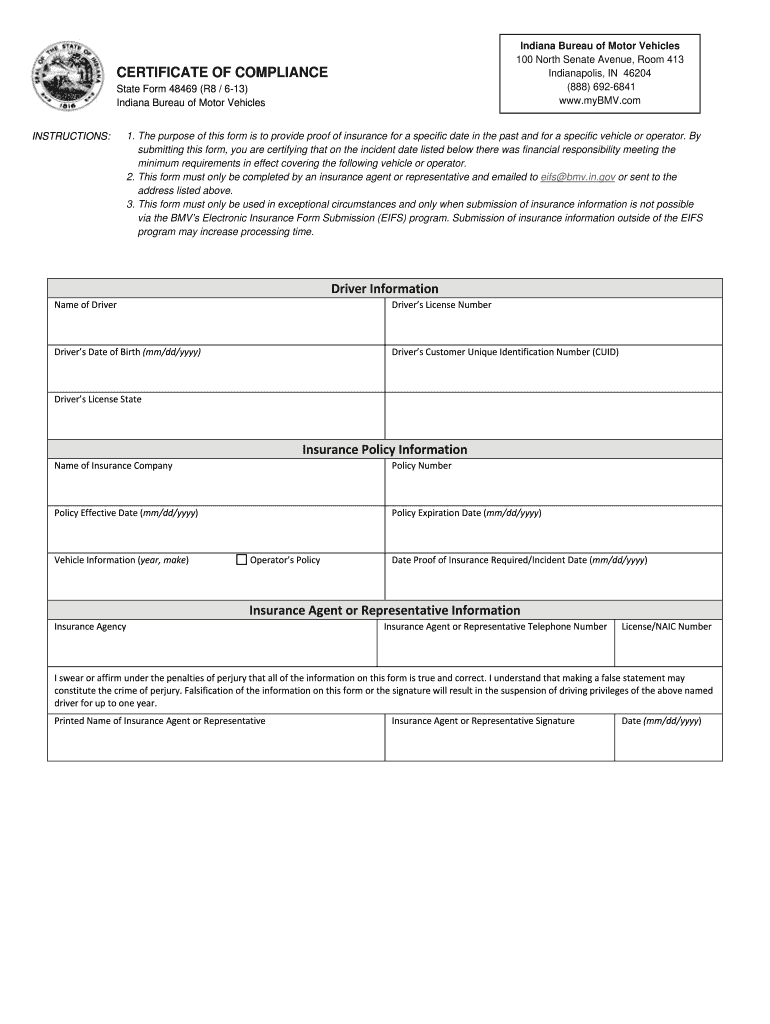

Certificate Of Compliance Indiana – Fill Online Printable Fillable Blank Pdffiller

How Do State Estate And Inheritance Taxes Work Tax Policy Center

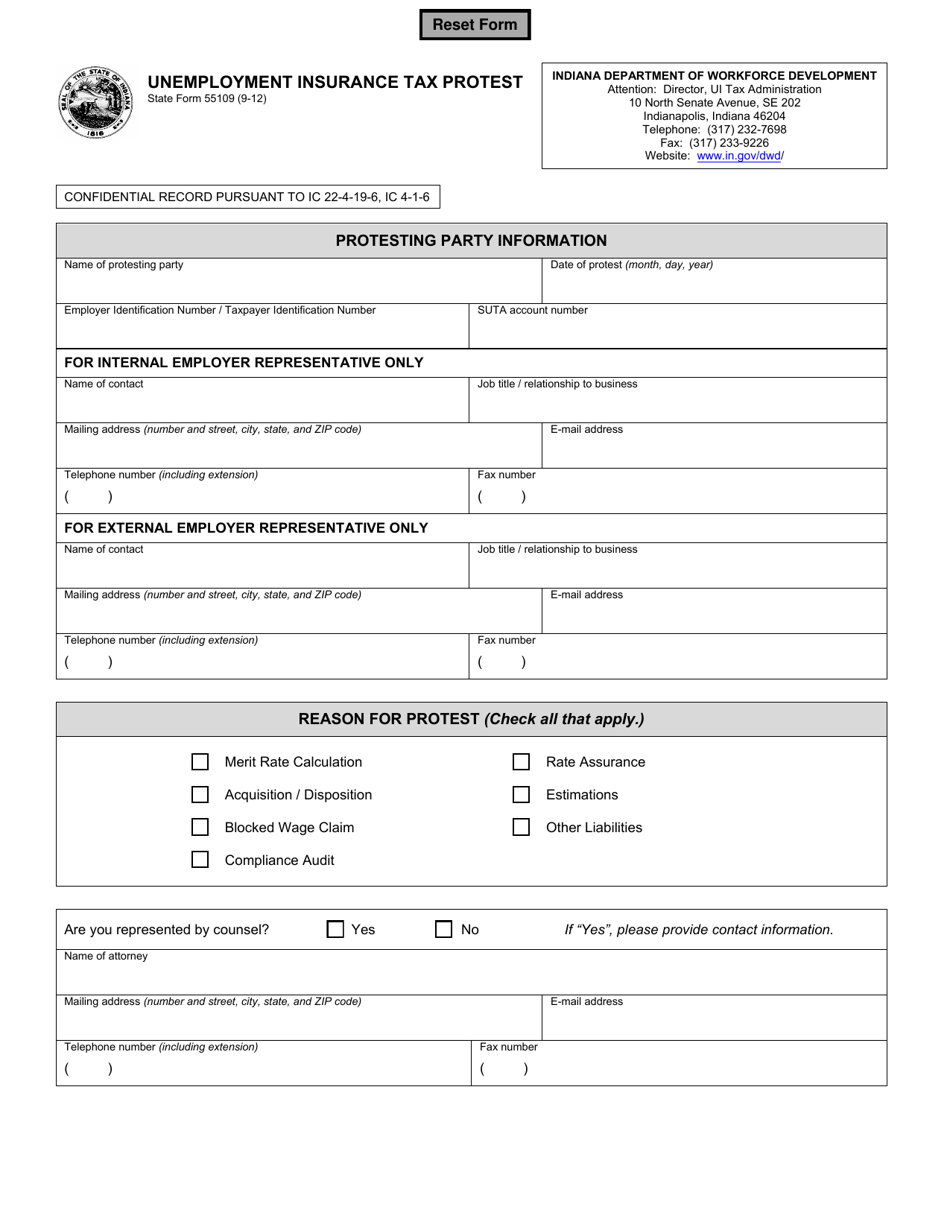

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

Free Medical Power Of Attorney Indiana Form 56184 Pdf

Free Indiana Small Estate Affidavit Form Pdf Word Template Sample Resume Format Letter Addressing Resume Format

How To Obtain A Tax Id Number For An Estate With Pictures

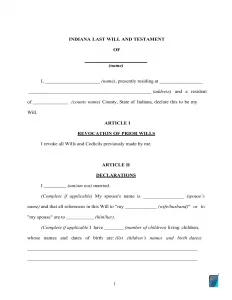

Indiana Last Will And Testament Template Download Printable Pdf Templateroller

Fillable Indiana Last Will And Testament Form Free Formspal

65 Essential Agreements Contracts Leases Letters For Running A Small Business This Book Includes Downloada Legal Forms Business Ebook How To Start Running

Pin By Indiana Tech On Prepare For Life After College Probate Will And Testament Last Will And Testament

How To Obtain A Tax Id Number For An Estate With Pictures

Webster Garino Have Experience With Real Estate Law In Indiana – Landlords Guide To Legally Evicting A Tenant – Webster Being A Landlord Legal Estate Law

How To Obtain A Tax Id Number For An Estate With Pictures

State Form 49969 – Fill Out And Sign Printable Pdf Template Signnow

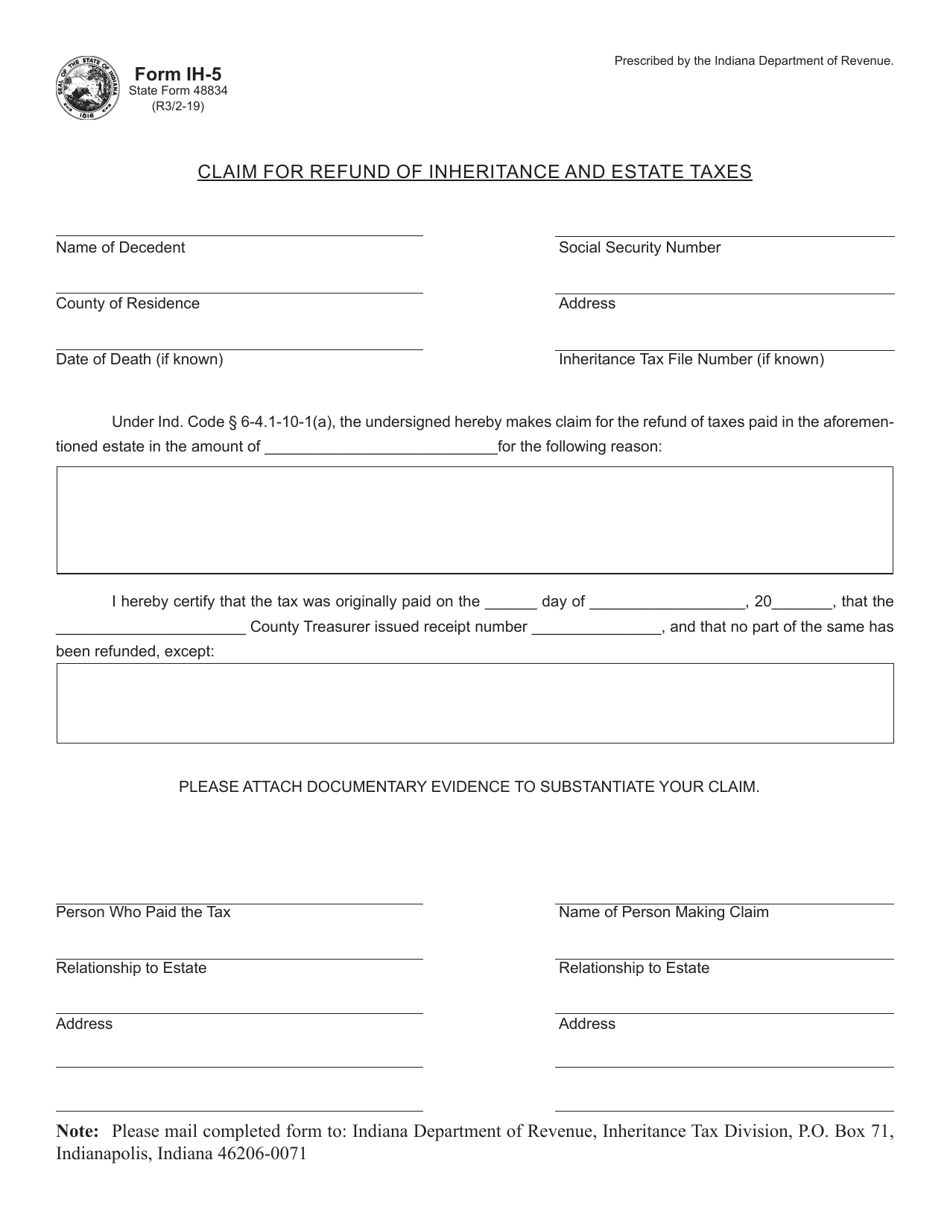

Form Ih-5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

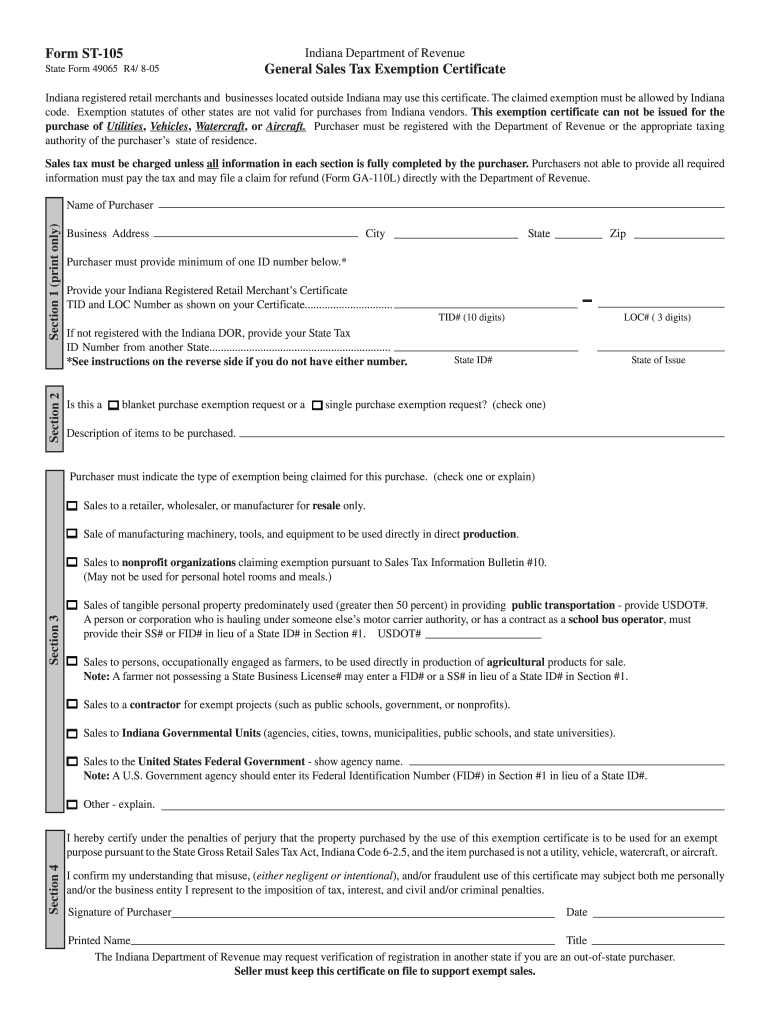

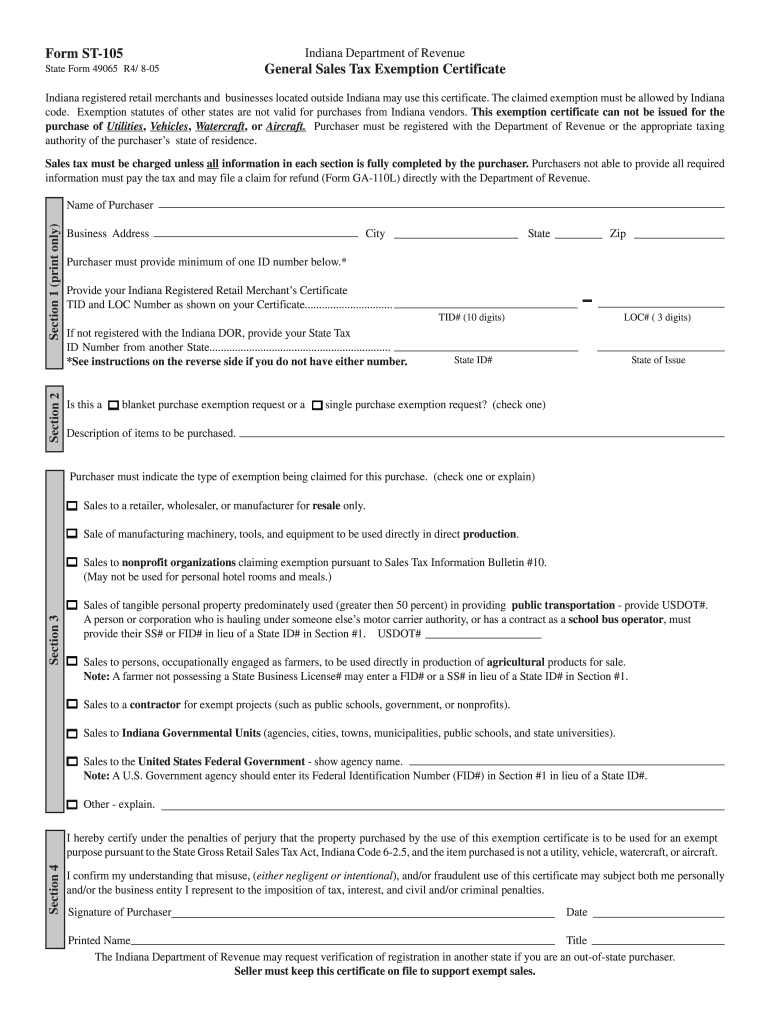

St 105 – Fill Online Printable Fillable Blank Pdffiller

Pin On End Of Life

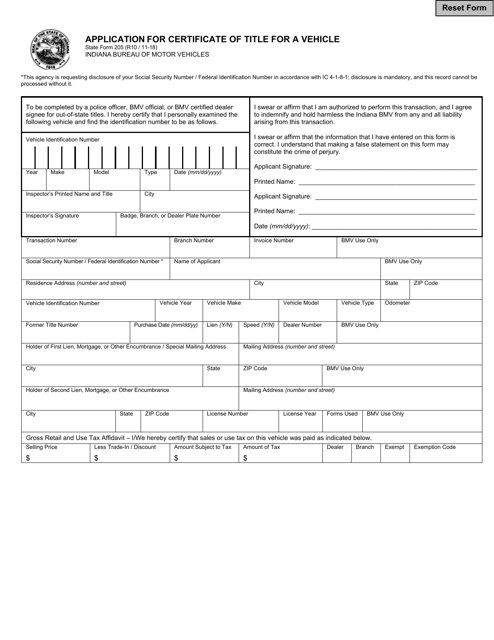

State Form 205 Download Fillable Pdf Or Fill Online Application For Certificate Of Title For A Vehicle Indiana Templateroller

Free Indiana Revocable Living Trust Form – Word Pdf Eforms