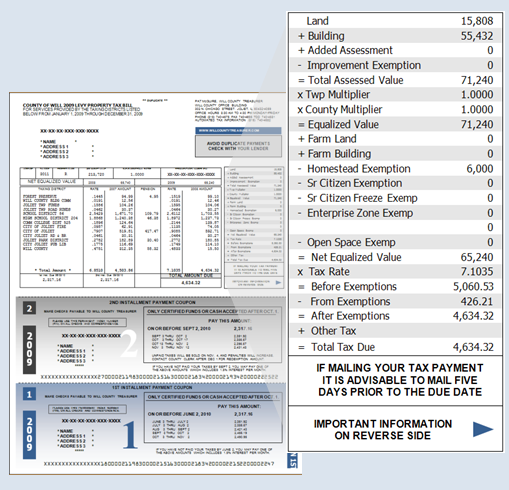

Illinois has one of the highest average property tax rates in the country, with only six states levying higher property taxes. In most counties, property taxes are paid in two installments, usually june 1 and september 1.

Property Taxes Lake County Il

“ad valorem” is a latin phrase meaning “according to worth”.

Illinois property tax due dates 2021 lake county. 50% (remainder) of first installment normally due on june 8; Below is a listing of 2021 deadlines for appealing your lake county property taxes with the board of review. Starting on january 4, 2021, lake county property owners can use the electronic check payment option without paying a fee by accessing the electronic payment read more.

Lake county, il property tax information. Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year. County boards may adopt an accelerated billing method by resolution or ordinance.

Property owners may pay their property taxes under the following schedule without penalty: Douglas st, suite 503, freeport, il 61032. Lake county property tax appeal deadlines & due dates 2021.

2021 (taxes payable in 2022). If the tax bills are mailed late (after may 1), the first installment is due 30 days after the date on your tax bill. Learn more about consolidation efforts and how your property tax dollars are used to help make lake county a great place to live, work and visit.

Questions answered every 9 seconds. Under the ordinance, lake county property owners must still pay the full amount of property taxes due. By mail with a check or money order sent to:

Stephenson county treasurer, 50 w. The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00. Dates in green have been announced (the window to appeal is now open) dates in red have passed (the window to appeal has closed) dates in gray are estimated based on previous years

Lake county news sun : What if i have multiple sites where i sell motor fuel at retail? The first installment of lake county property taxes is due thursday, june 2.

Questions answered every 9 seconds. We recognize the postmark as the date paid but ask that you mail prior to that date due to differences in local post office processing. Ad a tax advisor will answer you now!

If the due date falls on a weekend or holiday, your payment is due the next business day. Coupon must be presented with payment. Learn how the county board has kept the tax levy flat for fiscal years 2020 and 2021.

Ad valorem taxes are levied on real estate property and are based on the assessed value of the. The second installment is due sept. Ad a tax advisor will answer you now!

Banks cannot accept payments past the due dates. 50% of first installment normally due in full on june 8;

333 Foster Pl Lake Forest Il Floor Plans How To Plan Lake Forest

Pin On My Dream Houses

Property Taxes Lake County Il

333 Foster Pl Lake Forest Il Lake Forest Mansions Historic Homes

Cook County Il Property Tax Calculator – Smartasset

Property Tax Prorations – Case Escrow

333 E Foster Pl Lake Forest Il 60045 Mls 09971751 Redfin Lake Forest Luxury House Plans The Fosters

333 E Foster Pl Lake Forest Il 60045 Mls 10333975 Zillow Lake Forest Classic Mansion The Fosters

Property Taxes Lake County Il

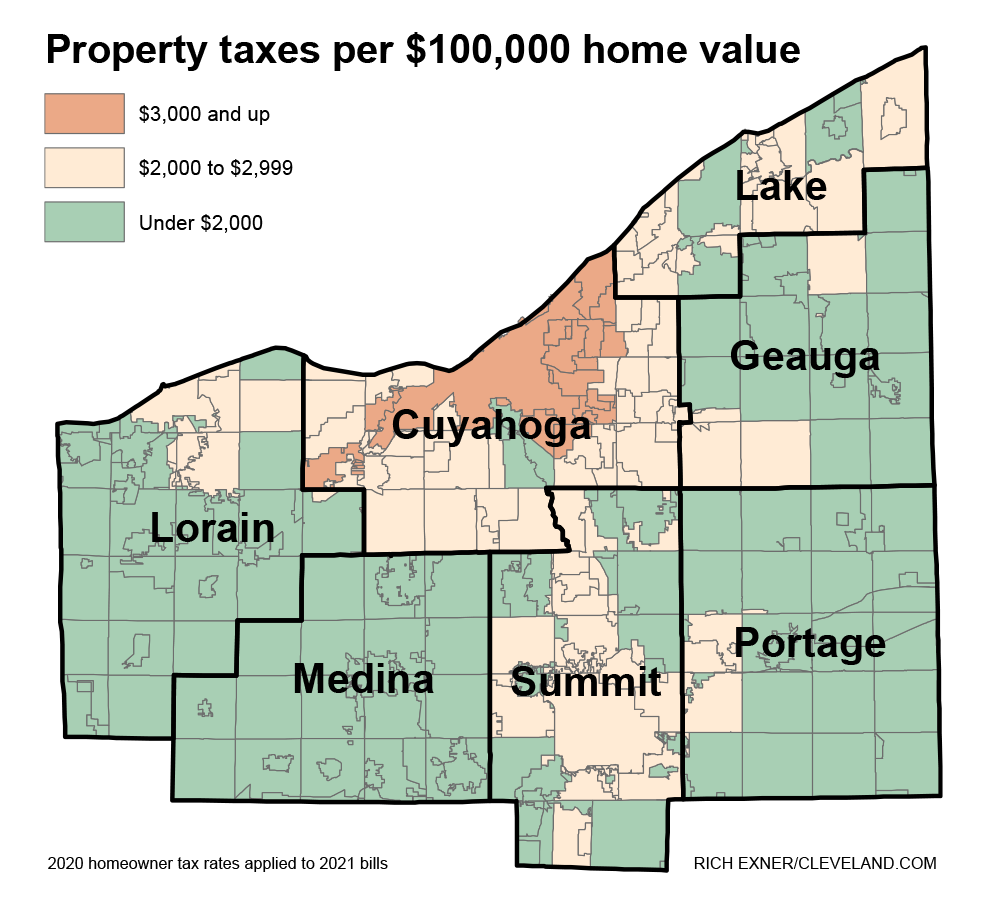

These Cuyahoga County Places Have Ohios 6 Highest Property Tax Rates Thats Rich Recap – Clevelandcom

Are There Any States With No Property Tax In 2021 Free Investor Guide

Home – Clinton Illinois

Appraisal Hazel Crest Il 60429 Water Tower Chicago Illinois Chicago Suburbs

Exemptions

Wisconsin Property Tax Calculator – Smartasset

16 Top-rated Attractions Places To Visit In Switzerland Planetware In 2021 Switzerland Tourist Attractions National Parks Map Tourist Attraction

Pin On House Ideas

How To Determine Your Lake County Township Kensington Research

Data Hk Togel Hongkong Keluaran Hk Pengeluaran Hk Hari Ini House Styles Outdoor Structures Home