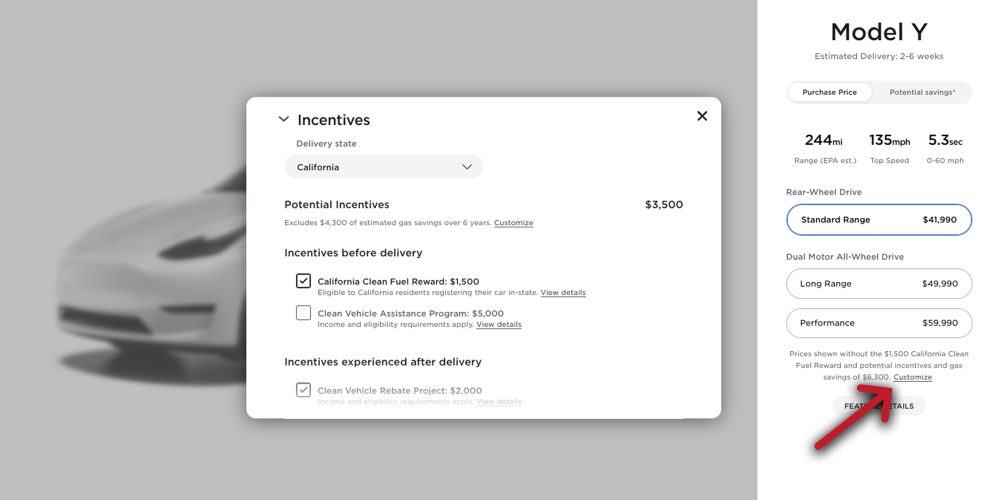

From april 2019, qualifying vehicles are only worth $3,750 in tax credits. A buyer of a new electric car can receive a tax credit valued at between $2,500 and $7,500.

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers – Forbes Wheels

The irs tax credit for 2021 taxes ranges from $2,500 to $7,500 per new electric vehicle (ev) purchased for use in the u.s.

Illinois electric car tax credit 2022. Note that in some events new electric vehicles must be purchased from a licensed auto dealer. To determine how much you owe, consult the sos vehicle license plate guide. This irs tax credit can be worth anywhere from $2,500 to $7,500.

This mayer brown legal update discusses the criteria to qualify for the program and the related tax credits. The agency shall issue rebates consistent with the provisions of this act and any implementing regulations adopted by the agency. The clean energy legislation includes a $4,000 rebate for illinois residents to purchase an electric vehicle, starting july 1st, 2022.

A clean energy bill that just passed in the state of illinois has set a goal of adding 1 million electric cars to roadways by the end of the decade, and to that end, the state is offering $4,000. Of an electric vehicle during the taxable year is entitled to a : (a) beginning july 1, 2022, and continuing as long as funds are available, each person shall be eligible to apply for a rebate, in the amounts set forth below, following the purchase of an electric vehicle in illinois.

The illinois legislature has passed a series of tax incentives for makers of electric vehicles that law makers hope will turn the state into an ev assembly hub. Currently, the federal government offers a $7,500 tax credit. Taxable years that begin on and after january 1, 2022 and begin :

Small neighborhood electric vehicles do not qualify for this credit, but they may qualify for another credit. It offers a $4,000 rebate for electric vehicle purchases starting in 2022, but hastings said that’s only in counties covered by the preexisting alternative fuels act, meaning cook and collar counties, because they pay into a fund from which the rebates will be paid. The build back better bill includes a $12,500 ev tax credit, up from the current $7,500 available to qualifying cars and buyers.

Federal tax credit up to $7,500! Illinois vehicle registration fees for electric cars is $251 per registration year. How much is the electric vehicle tax credit worth?

From july 1 st until the end of the year, the credit is only worth $1,875. This nonrefundable credit is calculated by a base payment of $2,500, plus an additional $417 per. There are programs providing separate rebates and/or tax credits for both ev cars (including tesla models, chevrolet bolt, nissan leaf or even hybrid models, such as toyota prius and ford hybrid) and ev charging stations.

These tax credits are to be made available with respect to qualifying costs incurred on or after january 1, 2022, but the credits may only be used to offset taxes imposed for the taxable year. Illinois’ new climate legislation makes available a $4,000 rebate per resident as a way to incentivize them to purchase electric vehicles starting july 1, 2022. Visit fueleconomy.gov for an insight into the types of tax credit available for specific models.

8 (a) notwithstanding any other provision of law, for : Registration fees for il electric vehicles. The credit amount will vary based on the capacity of the battery used to power the vehicle.

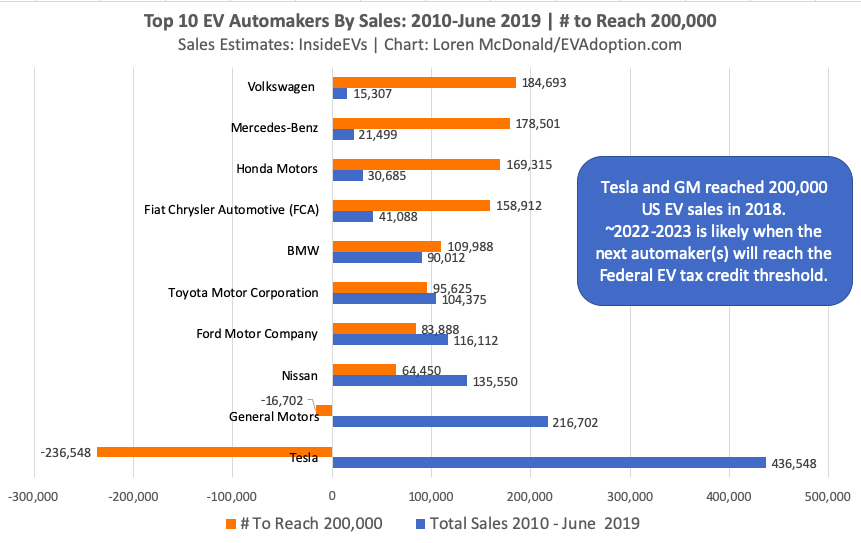

Jb pritzker signed illinois’ clean energy law on wednesday, which includes a $4,000 rebate for residents to buy an electric vehicle (ev). For more on registering your vehicle with the il vehicle services. General motors became the second manufacturer to hit this milestone in the final financial quarter of 2018.

Section 30c of the irc provides a nonrefundable investment tax credit equal to 30 percent of the. State and/or local incentives may also apply. Prior to january 1, 2027, each taxpayer that makes a purchase :

Credit against the tax imposed under subsections (a. The amount of credit you are entitled to depends on the battery capacity and size of the vehicle. Its inclusion comes as the bill sheds multiple other elements to.

From 2020, you won’t be able to claim tax credits on a tesla. In november 2021, illinois governor jb pritzker signed the reimagining electric vehicles act, which establishes the reimagining electric vehicles in illinois program to incentivize the production of electric vehicles in the state. Beginning on january 1, 2021.

The amount is determined by the power storage of the battery.

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Reserve A 2022 Ford F-150 Lightning In Frankfort Il – Currie Ford

Electric Vehicle Tax Credits What You Need To Know Edmunds

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22946683/Behind_the_Wheel_The_5_to_Drive_in_2022.jpg)

Pritzker Touts Job Training Program To Spur Electric Vehicle Industry In Illinois – Chicago Sun-times

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers – Forbes Wheels

A3spypssl3ruwm

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Rebates And Tax Credits For Electric Vehicle Charging Stations

A3spypssl3ruwm

2022 Hyundai Kona Electric Prices Reviews And Pictures Edmunds

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers – Forbes Wheels