In idaho, jet fuel is subject to a state excise tax of $0.06/gal (as of 7/1/2008) point of taxation: The idaho sales tax rate is currently %.

Sales Tax On Grocery Items – Taxjar

1, 2021, while the new sales tax rate would kick.

Idaho sales tax rate 2021. Idaho has a statewide sales tax rate of 6%, which has been in place since 1965. Detailed idaho state income tax rates and brackets are available on this page. You can print a 8% sales tax table here.

There is no applicable county tax or special tax. The corporate income tax rate is now 6.5%. Boise, idaho sales tax rate details.

Use leading seo & marketing tools to promote your store. The boise sales tax rate is %. This is the total of state, county and city sales tax rates.

The maximum local tax rate allowed by idaho law is 3%. 270 rows 2021 list of idaho local sales tax rates. Start yours with a template!.

Higher sales tax than 99% of idaho localities. Depending on local municipalities, the total tax rate can be as high as 9%. Someone making between $1,568 and $3,136 a year in taxable income would pay 2.8% instead of 3.125%.

Plus 6.625% of the amount over. Keep in mind that some states will not update their tax forms for 2021 until january 2022. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.there are a total of twenty states with higher marginal corporate income tax rates then idaho.

31 rows with local taxes, the total sales tax rate is between 6.000% and 8.500%. Be sure to verify that the form you are downloading is for the correct year. If you need access to a database of all idaho local sales tax rates, visit the sales tax data page.

The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent), new york (4.52 percent), and oklahoma (4.45 percent). Start yours with a template!. Sales or use tax is due on the sale, lease, rental, transfer, donation or use of a motor vehicle in idaho unless a valid exemption applies.

2021 idaho state sales tax rates the list below details the localities in idaho with differing sales tax rates, click on the location to access a supporting sales tax calculator. The 8% sales tax rate in ketchum consists of 6% idaho state sales tax and 2% ketchum tax. Idaho has a 6% statewide sales tax rate, but also has 124 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.044% on top of the state tax.

Use leading seo & marketing tools to promote your store. At the terminal (rack) when loaded into transportation equipment or when the shipment first crosses the border into idaho. Idaho's income tax rates have been reduced.

Ad earn more money by creating a professional ecommerce website. *the idaho state tax commission administers the greater boise auditorium district, idaho falls auditorium district, and pocatello/chubbuck auditorium district taxes. Lower tax rates, tax rebate.

1% lower than the maximum sales tax in id. This guide is for individuals, leasing companies, nonprofit organizations, or any other type of business that isn't a motor vehicle dealer registered in idaho. Let more people find you online.

This means that, depending on your location within idaho, the total tax you pay can be significantly higher than the 6% state sales tax. 2021 local sales tax rates. The minimum combined 2021 sales tax rate for boise, idaho is.

The idaho (id) state sales tax rate is currently 6%. Idaho has state sales tax of 6% , and. Monthly filers (sales/use, travel & convention, auditorium districts, e911, and withholding) 2020 filing period due date 2021 filing period due date

Idaho has a flat corporate income tax rate of 7.600% of gross income. Let more people find you online. The county sales tax rate is %.

The idaho sales tax rate is 6% as of 2021, with some cities and counties adding a local sales tax on top of the id state sales tax. For individual income tax, rates now range from 1% to 6.5%, and the number of tax brackets dropped from seven to five. The idaho income tax has seven tax brackets, with a maximum marginal income tax of 6.92% as of 2021.

No states saw ranking changes of more than one place since july. Exemptions to the idaho sales tax will vary by state. Click any locality for a full breakdown of local property taxes, or visit our idaho sales tax calculatorto lookup local rates by zip code.

Ad earn more money by creating a professional ecommerce website. Plus 5.625% of the amount over. Income tax rates would be retroactive to jan.

Census 2020 Data Illustrates Idahos Urban Rural Divide – Idaho Capital Sun

Historical Idaho Tax Policy Information – Ballotpedia

Idaho State Tax Commission Adjusted Return Letter Sample 1

Idaho Tax Forms And Instructions For 2020 Form 40

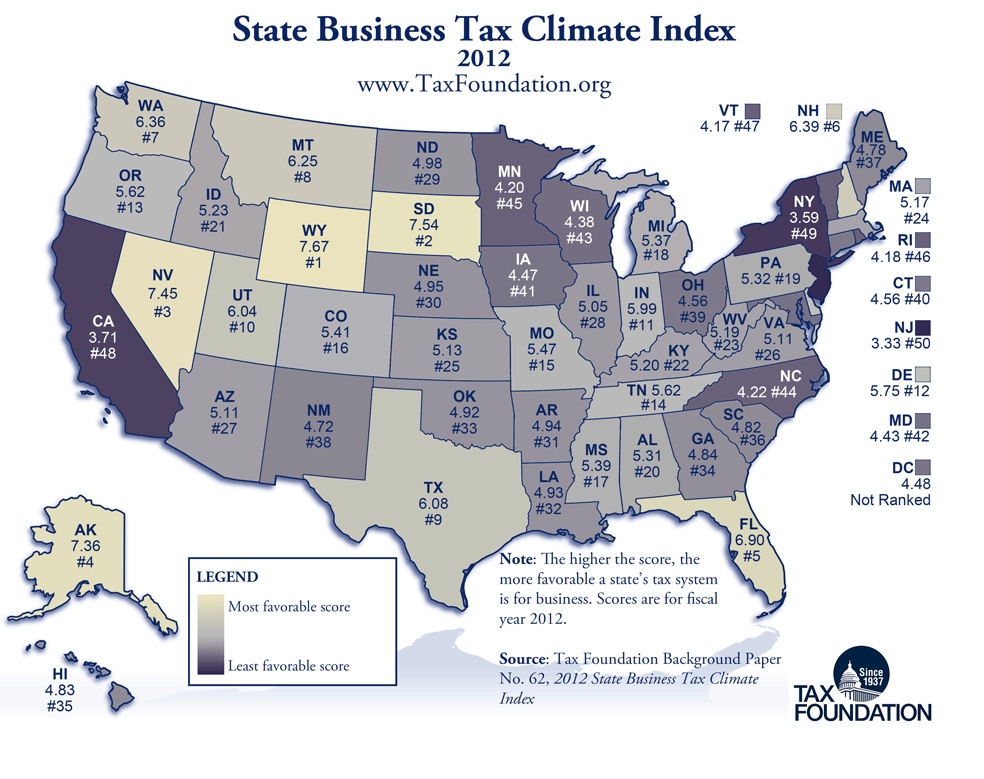

Idaho Ranks 21st In The Annual State Business Tax Climate Index Stateimpact Idaho

Idaho Begins New Fiscal Year Eyeing Record 800 Million-plus Budget Surplus – Idaho Capital Sun

Maps Itep

How Idahos Taxes Compare To Other States In The Region Boise State Public Radio

Idaho Income Tax Rates For 2021

How High Are Cell Phone Taxes In Your State Tax Foundation

How Idahos Taxes Compare To Other States In The Region Boise State Public Radio

Idaho Property Tax Shift Impacts Residential Commercial Properties

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

State Corporate Income Tax Rates And Brackets Tax Foundation

Idaho Sales Tax – Small Business Guide Truic

Idaho Sales Tax Rates By City County 2021

Idaho Sales Tax – Taxjar

Idaho State Tax Commission – Home Facebook

States With Highest And Lowest Sales Tax Rates