The homeowner's exemption will exempt 50% of the value of your home and up to one acre of land (maximum: Counties and cities can charge an additional local sales tax of up to 2.5%, for a maximum possible combined sales.

Idaho Property Tax Calculator – Smartasset

If the first spouse does not use the entire exemption amount, what remains may be added to the surviving spouse’s allowance under the “portabilityrules”

Idaho estate tax exemption 2021. $3,500,000 for decedents dying in. 2021 idaho state sales tax. If your estate is large enough, you still may have to worry about the federal estate tax though.

There is an $11.18 million exemption for the federal estate tax, a figure that recently increased when the government passed the new tax bill in 2017. The buyer bears the primary responsibility and liability for any subsequent audit. Right off the bat, if you are single, they will allow you to exclude $250,000 of capital gains.

The estate tax exclusion is $4,000,000 as of 2021, after the district chose to lower it from $5,762,400 in 2020. The estate tax has been around for decades, but it is evolved over time and the exemption has changed. George's property is a house located in the fictitious city of new town, idaho.

Idaho will treat some organizations as nonresidents Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or elections, or jointly held property) do not require the filing of an estate tax return. During the waning days of the 2021 legislative session, lawmakers altered the ability of municipalities to adjust their budgets based on new growth.

The republican governor expressed his own doubts in approving the legislation that was. In addition to raising the homeowner’s exemption, the bill would do several other things. Currently, the exemption is $11.7 million for calendar year 2021.

However, with the democrats in office, we could see a reduction as early as 2022. How idaho property taxes compare to other states. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.

Exact tax amount may vary for different items. The farm bureaus says the current exemption covers the transfer of assets up to $11.5 million. Prescription drugs are exempt from the idaho sales tax.

The tax cuts and jobs act includes the estate tax exemption. In particular, we may see changes to the estate tax. Homeowners in idaho can take advantage of a property tax exemption as long as they occupy the home as their primary residence.

The district of columbia moved in the opposite direction, lowering its estate tax exemption from $5.8 million to $4 million in 2021, but simultaneously dropping its bottom rate from 12 to. If your estate is in the ballpark of the estate tax limits and you want to leave the maximum amount to your heirs, you’ll want to do some estate tax planning. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold:

Buyers rather than sellers now have the burden to establish a sales tax exemption when they give the seller an exemption or resale certificate. Like most taxes, idaho's property taxes are lower than the national average. The farm bureau’s john newton.

So if you bought an idaho house for $200,000 five years ago and then sold it today for $475,000, you would make $200,000 in. So now, if a property were valued at $400,000, the taxable value would be $275,000 thanks to the new exemption amount. But this could be changing in the future.

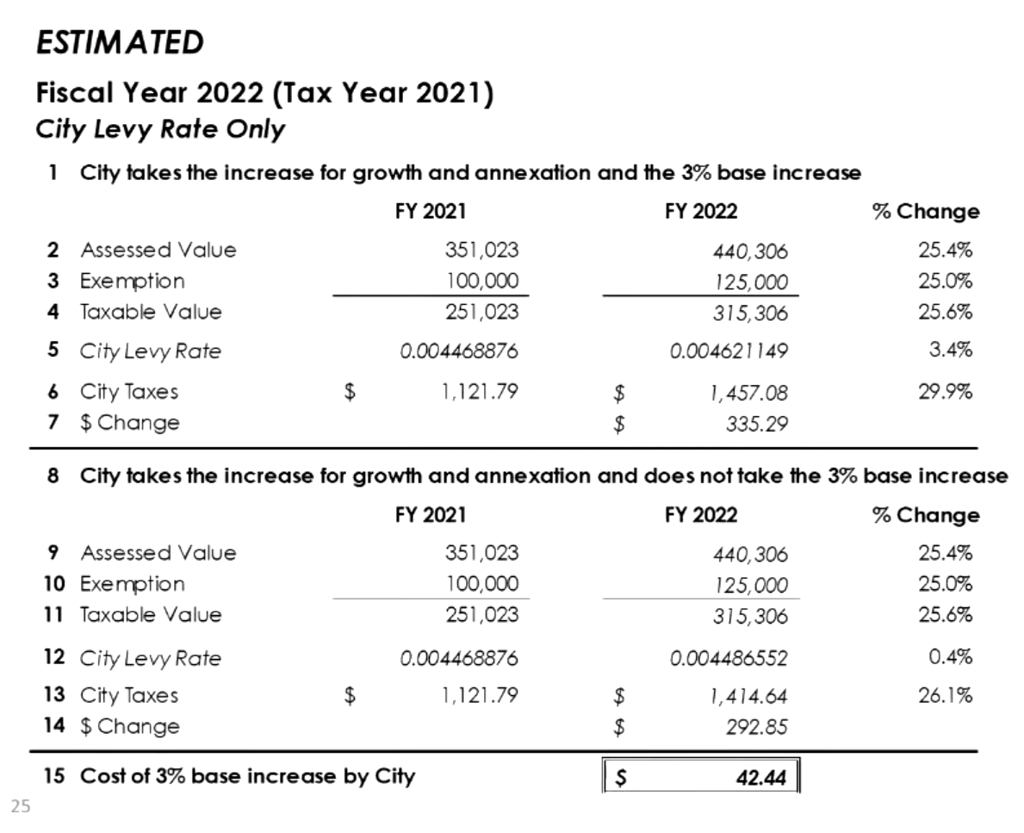

A recent report from the idaho state tax commission shows that for a typical family of three in boise earning $75,000 per year, income taxes were 3% lower than the national average, sales taxes 7% lower, and property taxes 26% lower. Boise, idaho (ap) — idaho gov. Additionally, they increased the maximum homeowners’ tax exemption to $125,000.

Starting in 2022, the exclusion amount will increase annually based on a cost of. Idaho has no estate tax. The exemption affords homeowners a tax break of 50% of the house's value and up to one acre of land from property tax.

Twenty four hours after it first saw the light of day, the idaho house of representatives passed a sweeping property tax reform package despite bipartisan opposition. The estate tax exemption is $11,700,000, less any prior reportable gifts, for those that die in 2021, and increases with the “chainedcpi. If you are married and file jointly, you can exclude $500,000 of capital gains.

This means that when you pass away, the value of your estate is calculated and any. So, if we don’t get a permanent extension of the 11.58 million, or we go back to a lower exemption level, that really. Those tax exemptions are currently set to be reduced to $5,700,000, or less, by 2025.

However, the new tax plan increased that exemption to $11.18 million for tax year 2018, rising to $11.4 million for 2019, $11.58 million for 2020, and now $11.7 million for 2021. By keith ridlermay 12, 2021 gmt. Before the official 2021 idaho income tax rates are released, provisional 2021 tax rates are based on idaho's 2020 income tax brackets.

Brad little signed a property tax relief bill wednesday that opponents describe as deeply flawed but supporters say is better than nothing. According to an analysis from the state tax commission, the exemption would be nearly $150,000 if it had been tied to idaho’s housing price index. For 2021, the personal federal estate tax exemption amount is $11.7 million (it was $11.58 million for 2020).

Idaho governor signs property tax relief legislation. In 2021, the exemption is $11,700,000 per individual and $23,400,000 for a married couple. The idaho state sales tax rate is 6%, and the average id sales tax after local surtaxes is 6.01%.

Property exempt from taxation — homestead.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Idaho Democrats Float Property Tax Proposals Ahead Of 2021 Session Boise State Public Radio

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have An Estate Or Inheritance Tax

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

4 Things You Need To Know About Inheritance And Estate Taxes

Recent Changes To Estate Tax Law Whats New For 2019

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Biden Estate Tax A 61 Tax On Wealth Tax Foundation

Boise To Take 3 Increase In Tax Base Heres What That Means For Property Taxes Complete News Coverage Idahopresscom

State-by-state Guide To Taxes On Retirees

How Many People Pay The Estate Tax Tax Policy Center

State-by-state Estate And Inheritance Tax Rates Everplans

2021 State Corporate Tax Rates And Brackets Tax Foundation

The Complete List Of States With Estate Taxes Updated For 2021

Sales Taxes In The United States – Wikipedia

Idaho Inheritance Laws What You Should Know

Historical Idaho Tax Policy Information – Ballotpedia

2021 State Income Tax Cuts States Respond To Strong Fiscal Health