If you are a new homeowner, please remember to go online and apply for star as soon as possible. The property tax relief credit has expired.

Senator Daphne Jordan Reminds Senior Citizen Homeowners To Enroll In The Income Verification Program By This Friday March 1 To Receive A Valuable Property Tax Break Ny State Senate

If you expect to receive a star credit check and.

Http://tax.ny.gov/pit/property/star/default.htm. You do not need to register for star if you are a longtime homeowner with an existing star exemption. The star program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. Star credit check (receive check from state) homeowners purchasing property after march 1, 2015 or have not received a star exemption prior to march 1, 2015, must register with the new york state department of taxation and finance for the star credit program.

You can register to switch to the star credit from the star exemption anytime during the year. First and third tuesdays 5:00 pm to 7:00 pm, for any special hours see posted hours. However, by law, the program expired after 2019.

You should register for the star credit if you are: Most residents who own and live in their home are eligible for the nys basic star property tax exemption on their primary residence. You only need to register for the star credit once, and the tax department will send you a star credit check each year, as long as you’re eligible.

Star (nys school tax relief program) provides tax relief off of your school tax for your primary residence, but you need to apply for it. These changes will impact many nassau county homeowners seeking relief from high property tax bills. If you expect to receive a star credit check and.

By switching to the star credit, your benefit could grow by as much as 2% each year, and it can never be lower than the star exemption benefit. If you are using a screen reading program, select listen to have the number announced. If a street light is out or not working properly, please call the town office at (518.

The following security code is necessary to prevent unauthorized use of this web site. Basic star works by exempting the first $30,000 of the full value of a home from school taxes. All exemption applications are due by march 1st.

Homeowners currently receiving a star exemption on their school bill may switch to the star credit. It’s important to know exactly what these changes are, and what you need to do to continue participating in these programs. See property tax and assessment administration for important updates and access to new york state resources for assessors, county real property tax directors, and their staff.

See the star resource center to learn more about the star program. Whether claverack is your primary or secondary home, you need to let the tax collector know when your address changes so you can receive your property tax bill without incident. Property taxes pay for things such as public schools, community colleges, libraries, local government employees' salaries, parks and recreation, sanitation, sewer, police and fire protection, roads and other local needs.

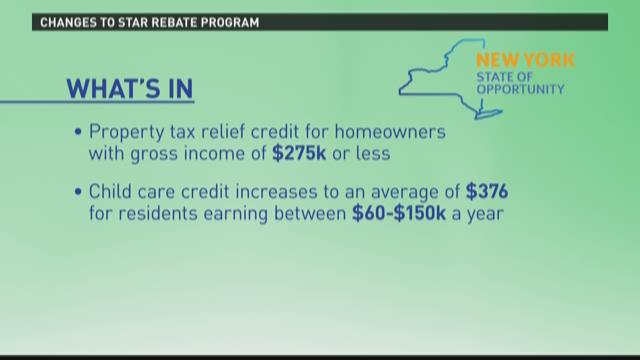

New recipients, and current recipients whose annual income is between $250,000 and $500,000, will be issued a check directly from new york state instead of receiving a school property tax exemption. If you can’t make it, call to schedule an appointment at your convenience. Or, log in to online assessment community.

The property tax relief credit has expired. Senior citizens meeting specific income criteria are eligible for “enhanced” star. In practice, property tax rates can vary widely from county to county even within the same state.

However, by law, the program expired after 2019. New york state recently made several important changes to its star (school tax assessment relief) program. But the timing of your first star credit check will depend on whether you register before or after the deadline below.

Sherri lyn falcone po box 308, portlandville, ny 13834. Star credit the star program has been changed by new york state. How do i report a street light that is out or is not working properly?

New applicants who qualify for star will register with new york state instead of applying with their assessor. The budgets determine the tax rates and the amount of taxes each property owner must pay. School tax relief program (star).

The star program can save homeowners hundreds of dollars each year. Your income needs to be below $500,000 to qualify. New recipients, and current recipients whose annual income is between $250,000 and $500,000, will be issued a check directly from new york state instead of receiving a school property tax exemption.

Available for senior citizens (age 65 and older) with yearly household incomes not exceeding. If you register before the deadline, you will receive your first check in the year that you registered as long as you are eligible. Enter the security code displayed below and then select continue.

Eligible homeowners received property tax relief checks in 2017, 2018, and 2019. Residents may receive only one of the following: Comparison of vermont’s property taxes to property taxes in peer states property tax rate estimates how do vermont’s property taxes compare with property taxes in the other new england states and new york?

Eligible homeowners received property tax relief checks in 2017, 2018, and 2019.

Townofchazyweeblycom

Lincolninstedu

Nyassemblygov

Irp-cdnmultiscreensitecom

Senator Obrien Reminds Homeowners To Reapply For Star Property Tax Exemption Ny State Senate

Bethlehemschoolsorg

Steubenconyorg

Rebate Checks Are Coming What To Know This Year Wgrzcom

Senator Obrien Reminds Homeowners To Reapply For Star Property Tax Exemption Ny State Senate

Empirejusticeorg

Budget Fact Sheets Marcellus School District

Townofauroracom

Townofswedenorg

Nncsk12org

Srk12org

Ny01913833schoolwiresnet

Onteorak12nyus

Real Property

Star Resource Center