This form is for income earned in tax year 2020, with tax returns due in april 2021. Makes it easy to pay state estimated quarterly taxes using your favorite debit or credit card.

Dor Keep An Eye Out For Estimated Tax Payments

For additional information, refer to publication 505, tax withholding and estimated tax.

How to pay indiana state estimated taxes online. There are a variety of options of paying estimated taxes. Enter your financial details to calculate your taxes. If you did make estimated tax payments, either they were not paid on time or you did not pay enough to.

Try it now & grow your business! If the amount on line i also includes estimated county tax, enter the portion on lines 2 and/or 3 at the top of the form. They should also tell you how to make tax payments.

To file and/or pay business sales and withholding taxes, please visit intime.dor.in.gov. Pay with american express at officialpayments.com. There are no fees but you would have to enroll with your payment method.

Check the irs' list of state's department of revenue sites to see your state's requirements. You may also electronically file your indiana tax return through a tax preparer or using online tax software, and pay your taxes instantly using direct debit or a credit card (an additional credit card fee may apply). To pay by credit card, you may make an estimated tax payment online.

The tax bill is a penalty for not making proper estimated tax payments. To learn more about the eft program, please download and read the eft information guide. To file and/or pay business sales and withholding taxes, please visit intime.dor.in.gov.

Electronic funds transfer (eft) eft allows our business customers to quickly and securely pay their taxes. However, many counties charge an additional income tax. Pay online using mastercard, visa or discover at the indiana state government epay website (see resources).

Try it now & grow your business! We will update this page with a new version of the form for 2022 as soon as it is made available by the indiana government. If you owe $1,000 or more in state and county tax that's not covered by withholding taxes, or if not enough tax was withheld, you need to be making estimated tax payments.

Aside from mailing the payment, you can pay taxes online using a debit or credit card. While some tax obligations must be paid with eft, several thousand businesses use the program for its speed and convenience. Indiana has a flat statewide income tax.

Visit our website at www.in.gov/dor/4340 and follow. In 2017, this rate fell to 3.23% and has remained there through the 2020 tax year. As of september 7, 2021 individual estimated payments can be made using intime.

Create your own online store and start selling today. Get started by creating your logon at intime.dor.in.gov. The statewide sales tax is 7% and the average effective property tax rate is 0.81%.

If you don't see your state, reach out to your state's tax franchise board or department of. It's fast, easy & secure, and your payment is processed immediately. Estimated indiana income tax due, enter the amount from line i on line 1, state tax due, at the top of the form.

Visit irs.gov/payments to view all the options. Only break out your spouse’s estimated county tax if your spouse owes tax to a county other than yours. Get state quarterly tax info.

You may even earn rewards points from your card. You should also know the amount due. Your tax will depend on your business structure.

To get started, click on the appropriate link: When prompted, provide your taxpayer identification number or social security number and your liability number or warrant number. It’s quite easy and all you need is your ssn and a mailing address.

This is in case the vouchers that are automatically issued (after we receive your first payment) don’t get to you by the next payment’s due date. However, it doesn't calculate state estimated quarterly taxes. You can also use the eftps system.

Create your own online store and start selling today. There's nothing better than knowing your state estimated taxes are paid on time, on your time, every time. You can mail your return to the at the correct address below, and include your payment by check or money order.

Indiana State Tax Information Support

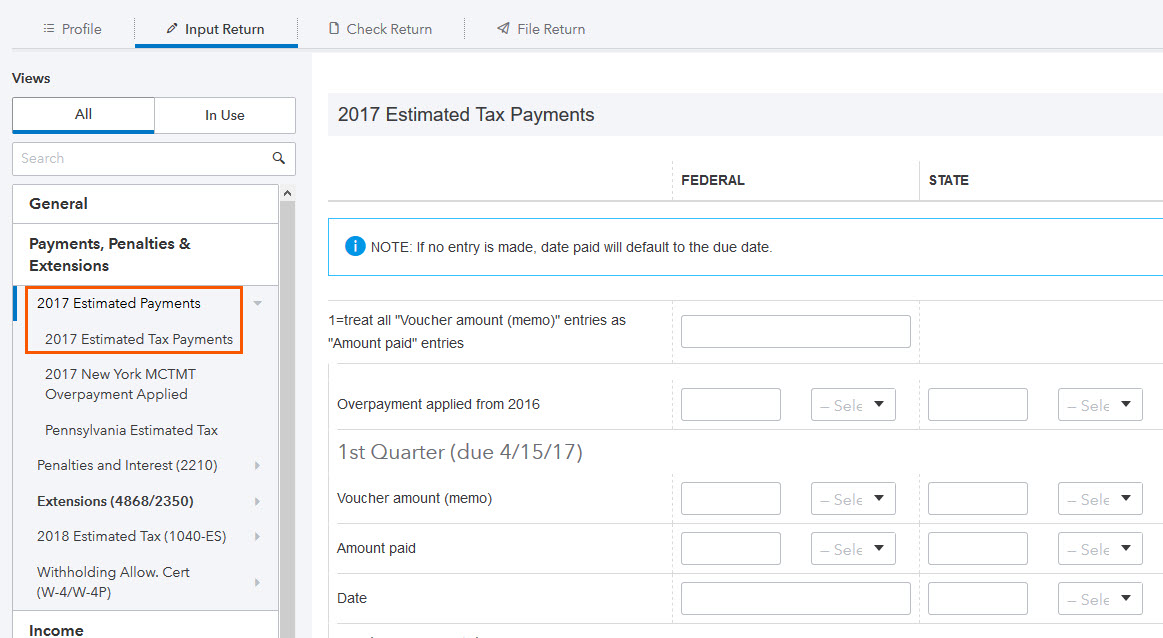

How Do I Enter Estimated Tax Payments In Proconnec – Intuit Accountants Community

Quarterly Tax Calculator – Calculate Estimated Taxes

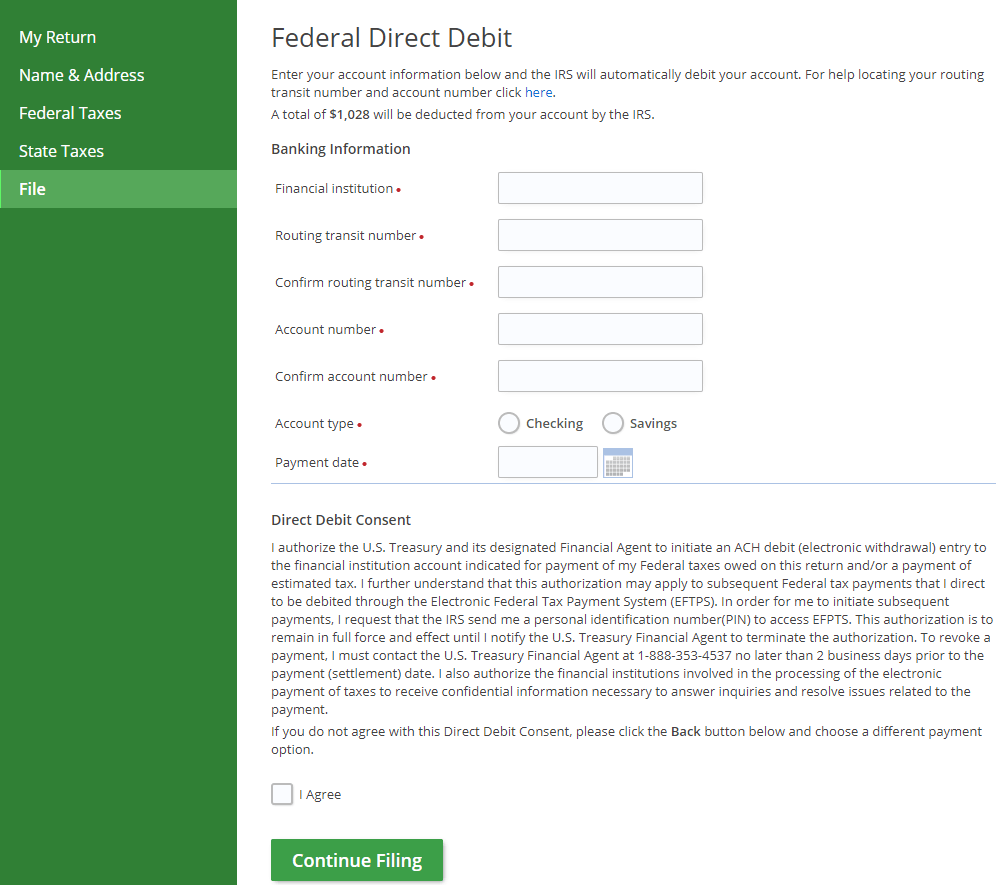

Pay Your Federal State Taxes On Efilecom Debit Check

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2

2

How To Register For A Sales Tax Permit In Indiana Taxvalet

Business Taxes Annual V Quarterly Filing For Small Businesses – Synovus

Indiana Sales Tax – Small Business Guide Truic

Quarterly Tax Calculator – Calculate Estimated Taxes

2

Dor Indiana Extends The Individual Filing And Payment Deadline

Dor Stages Of Collection

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

State Returns – Estimated Tax Vouchers Direct Debit

2

2