Potential federal and state income tax deductions for the appraised value of the easement as a charitable gift; 4% of the next $4,000 of income;

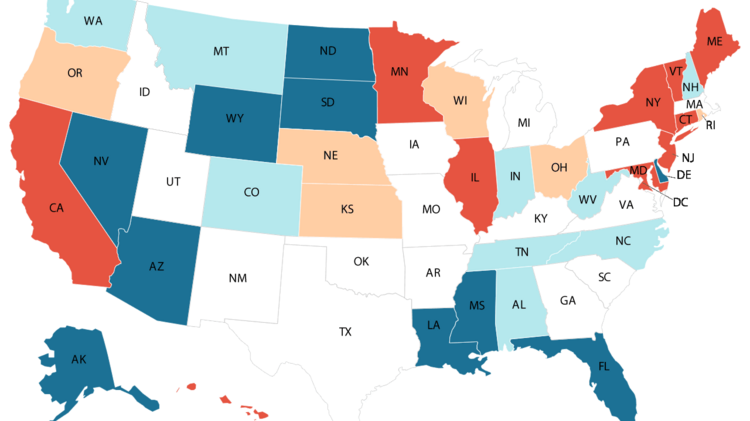

Maryland Named No 2 Least Tax-friendly State By Kiplinger – Baltimore Business Journal

For comparison, the median home value in maryland is $318,600.00.

How to lower property taxes in maryland. The tax levies are based on property assessments determined by the maryland department of assessments and taxation (sdat). Baltimore's overall property tax rate of $2.248 per $100 of assessed value is still about twice that of surrounding counties. There’s a filing fee of $300.

Finally, a concrete plan to reduce baltimore property taxes. Just like the income tax savings you aim for, taking a few actionable steps may make it possible to lower your property taxes by several hundred or thousand dollars a year. Here’s how to make a case to lower your property tax bill:

[except for properties in frederick city and the municipality of myersville. 0% of the first $8,000 of the combined household income; Lower estate and inheritance taxes to reflect the reduced development potential of the property;

You may also review the baltimore county code as well as. Look for local and state exemptions, and, if all else fails, file a tax appeal to lower your property tax bill. Property tax rates can vary by state, but it's important for l.

Review the credits below to determine if any can reduce your tax obligation. $100,000 divided by 100 times $1.08, which equals $1,080.00. Rates levied by counties drop to $7.05 per $1,000 in assessed value, and to just $4.59 per $1,000 in assessed value for town rates.

It’s the only state where businesses pay a fee to file their returns. Property taxes are quite possibly the most widely unpopular taxes in the u.s. Appeal if your home value is too high for tax.

Property tax rates imposed by school districts tend to be the highest at an average of $17.64 per each $1,000 in assessed value as of 2019. Property tax credits and tax relief. Maryland's 23 counties, baltimore city and 155 incorporated cities issue property tax bills during july and august each year.

For maryland businesses, that means fewer mailings compared to other states. Frederick md real estate taxes are based on the property assessment. Homeowners' property tax credit application form htc (2021) distributed by maryland department of assessments & taxation the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income.

Of course, they also feature some of the highest property values in the country, so a low tax rate still yields a hefty total sum. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. A homeowner paying property taxes on a home worth $250,000 would pay $2,700 annually at that rate.

Listen has bob explains how the process to appeal prope. Since the comptroller's office does not process property tax, we have provided the following links to maryland property tax information: Counties in maryland collect an average of 0.87% of a property's assesed fair market value as property tax per year.

Maryland’s lower standard deduction, extra local income tax rates bundled with higher real estate tax rates push it past virginia as the highest taxes of the three for each income level we analyzed. Baltimore county offers a variety of real property tax credits designed to allow property owners to limit their tax exposure and take advantage of savings offered by the county. For more information and key dates regarding maryland personal property tax, read the full article.

How to lower your property taxesproperty taxes can be a big expense for real estate investors. Using an effective tax rate of $1.08 per $100 for this example ($1.00 local property tax plus $.08 state property tax), the amount of property taxes due would be calculated like this: This is mostly due to virginia’s income tax cap at 5.75% compared to washington dc’s highest rate of 8.5% for the bulk of his income.

To check the assessed value of a home, enter the address in the tool at the frederick county. Located in northern maryland, harford county has property tax rates slightly lower than the state average, but more or less even with the national average. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact your county or city's property tax assessor.

Since 2003, the state of maryland has mandated the withholding of income tax on the sale of all real property. The real property tax rate in frederick county is presently 1.060 per every $100 of assessed value. The ten states with the lowest property taxes in the us (by rate) are:

8 ways to lower your property taxes and get some money back now that you understand the rhyme and reason to property taxes, you can also see that there’s a potential to save. The median property tax in maryland is $2,774.00 per year for a home worth the median value of $318,600.00. Maryland has one of the highest average property tax rates in the country, with only ten states levying higher property taxes.

The median property tax on a $318,600.00 house is $2,771.82 in maryland. The county’s average effective property tax rate is 1.08%. Another highlight related to maryland personal property tax:

The state property tax contributes 30.08% towards the overall income. The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula:

Whats The Key To Business Success In Africa Success Business Business Africa

Maryland Business Personal Property Tax A Guide

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

New Jersey Education Aid How Maryland Does It How Another Deep-blue State Has Much Lower Property Taxes Than New Jersey

Maryland To Issue Millions Of Dollars In Property Tax Credit Refunds Before The End Of The Year

Maryland To Issue Millions Of Dollars In Property Tax Credit Refunds Before The End Of The Year

Maryland Homeowners Overtaxed Millions Of Dollars

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnowcom

I Love This Place In 2021 Bay Window Living Room Deck Views Large Sheds

Maryland Estate Tax Everything You Need To Know – Smartasset

What Can Maryland Do If I Owe Taxes –

Maryland Property Tax Calculator – Smartasset

Pin On Misc Library

July Issue Storm Break Commercial Property Executive Commercial Property Commercial Real Estate Real Estate News

Who Pays The Highest Property Taxes Property Tax Real Estate Staging Denver Real Estate

What Is Marylands Homestead Tax Credit Law Blog

Understanding Your Property Assessment Notice City Of Takoma Park

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Pin By Renee Batson On Maryland Real Estate Maryland Real Estate Investment Property Investing