If you are a sibling or child’s spouse, you don’t pay taxes on inheritance under $25,000. Cat is a tax on gifts and inheritances.

How To Avoid Inheritance Tax In The Uk December 2021 A Guide

The estate and gift tax exemption is $11.4 million per individual, up from $11.18 million in 2018.

How much money can you inherit without paying inheritance tax. There’s no inheritance tax at the federal. The person who gives you the gift or inheritance is. How much can you inherit without paying inheritance tax?

An inheritance tax is a state levy that americans pay when they inherit an asset from someone who’s died. You can deduct these amounts from the value of your estate, which means no inheritance tax is due on them. The estate of the deceased person itself is eligible for federal taxes if it is worth above a certain level, which is $11,580,000 in the 2020 tax year.

When a person dies, their legal representative, the executor, has to file a deceased tax return to the cra. Do you have to report inheritance money to irs? How much can you inherit without paying taxes in 2019?

The federal estate tax exemption for 2021 is $11.7 million. Whether you inherit one dollar or a million dollars, it's unlikely you'll have to pay tax on it. You will not have to pay tax on inheritance if you are the person’s spouse or civil partner.

What are the 6 states that impose an inheritance tax? When it comes to paying capital gains taxes on inherited money, there's not much you can do to minimize the tab. The internal revenue service announced today the official estate and gift tax limits for 2019:

Married couples who have joint ownership of property can give away up to $30,000. The internal revenue service announced today the official estate and gift tax limits for 2019: In general, you can think of inherited assets in six general categories:

There are circumstances that require you to pay tax on your inheritance, but they're the exception rather than the rule. Anything over this threshold is charged at a rate of 40%. There is no inheritance tax levied on the beneficiaries;

This amount is called the annual exemption. However, the full story is more complicated than a simple yes or no answer. How much money can you have before probate?

Whether you’ll pay inheritance tax and how much you’ll pay depends on a variety of factors, including which state the deceased lived in and what your relationship to the deceased was. If you are a spouse, child, parent, stepchild, or grandchild, you’ll pay no inheritance tax as the entire amount is exempt. The estate tax exemption is adjusted for inflation every year.

Consider selling some shares (e.g. Once due, it is charged at the current rate of 33% (valid from 6 december 2012). For more information on previous rates see cat thresholds, rates and rules.

As a guide, you can pass on your estate free from tax if it worth less than £325,000, plus an additional £175,000 if you are passing on your main residence to your direct descendants. If you inherit more than £325,000 you will need to pay tax. €80,000 which the child’s threshold will be enough to cover cat leaving nil tax liability).

No, canada does not have a death tax or an estate inheritance tax. The estate pays any tax that is owed to the government. The short answer is that you can inherit a significant sum of money without paying state or federal income taxes.

How much can you inherit tax free 2019? The size of the estate tax exemption means very few (fewer than 1%) of estates are affected. How much can you inherit without paying taxes in 2019?

You don’t usually pay tax on anything you inherit at the time you inherit it. You won’t have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income. How much can you inherit without paying inheritance tax?

In short, yes, your inheritance is taxable. The federal government does not have an inheritance tax, but half a dozen states do: How do canadian inheritance tax laws work?

Income tax on profit you later earn from your inheritance, eg dividends from shares. You can inherit £325,000 or an estate worth £500,000 without paying inheritance tax. The estate and gift tax exemption is $11.4 million per individual, up from $11.18 million in 2018.

In 2021, anyone can give another person up to $15,000 within the year and avoid paying a gift tax. At the federal level, you can make annual gifts worth up to $15,000 (per person) in 2020 and 2021 without paying any gift taxes. As a plus, you can carry this exemption forward, but only for one year.

One option is convincing your relative to give you a portion of your inheritance money every year as a gift. The due date of this return depends on the date the person died. How much can you inherit without paying taxes in 2021?

You may need to pay: Even if you give assets worth more than the annual limit, you don’t actually have to pay gift tax unless you have exceeded your lifetime exemption, which is the same as the estate tax exemption. Inheritance isn't subject to income tax, there's no federal inheritance tax and any estate tax is owed by the estate, not you.

The internal revenue service announced today the official estate and. You may receive gifts and inheritances up to a set value over your lifetime before having to pay cat.

8 Tips For Avoiding Inheritance Tax Iht Advice Compare Uk Quotes

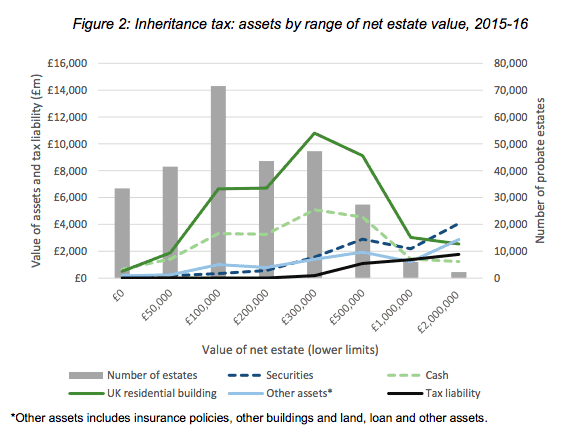

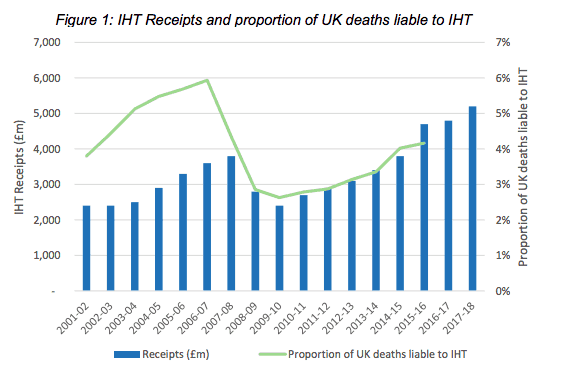

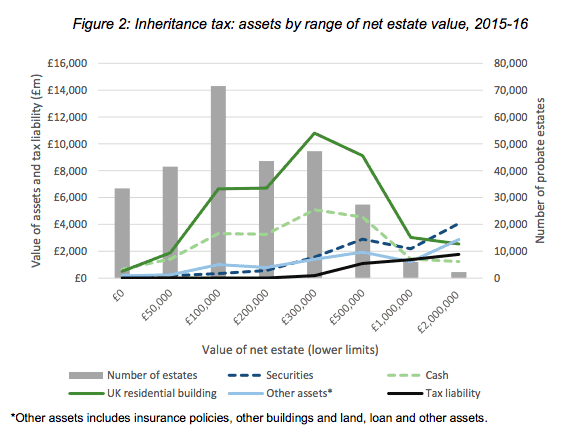

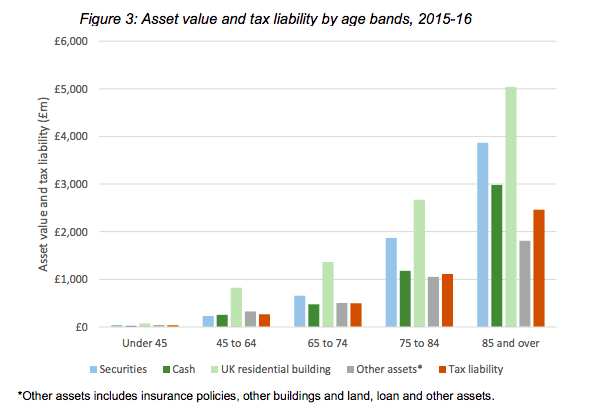

Uk Inheritance Tax Statistics Threshold Exemptions Patrick Cannon

Inheritance Tax Understanding The New Rules 2017 – Sell House Fast

How To Easily Prepare For Inheritance Tax In Ireland Lionie

Understanding Inheritance And Estate Tax In Asean – Asean Business News

How Much Is Inheritance Tax Community Tax

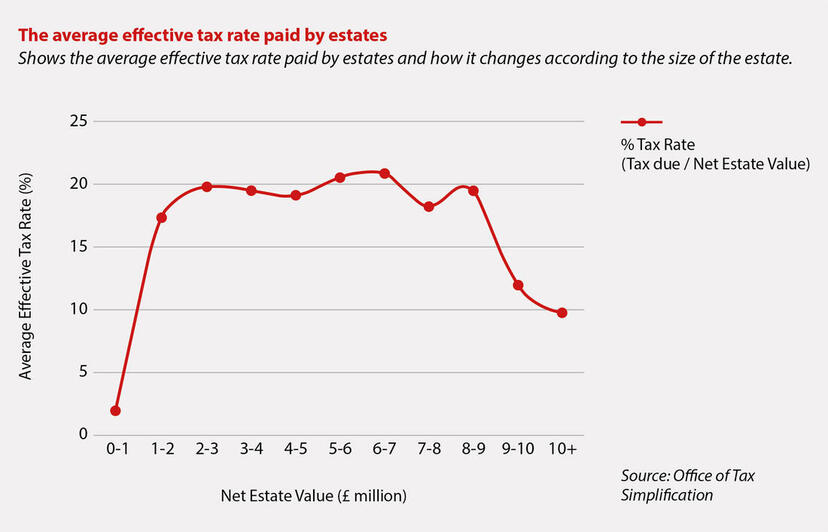

Uk Inheritance Tax Statistics Threshold Exemptions Patrick Cannon

Inheritance Tax Rules On Gifts Should Be Replaced With Single Personal Allowance This Is Money

Inheritance Tax Threshold Frozen Until 2026 But Why Is Iht Planning Still Important – Company News – Wollens

Inheritance Tax On A House Parachute Law

9 Ways To Pay Less Inheritance Tax – Financial Advisor Bristol

Inheritance Tax Do You Qualify For The New 1m Allowance Brewin Dolphin

Inheritance Tax Planning Guide Burt Brill Cardens Solicitors

Inheritance Tax What It Is And What You Need To Know

Is Inheritance Tax Payable When You Die In Singapore – Singaporelegaladvicecom

Its Time Politicians Read The Last Rites For Inheritance Tax Reliefs For The Wealthy – Tax Justice Uk

Uk Inheritance Tax Statistics Threshold Exemptions Patrick Cannon

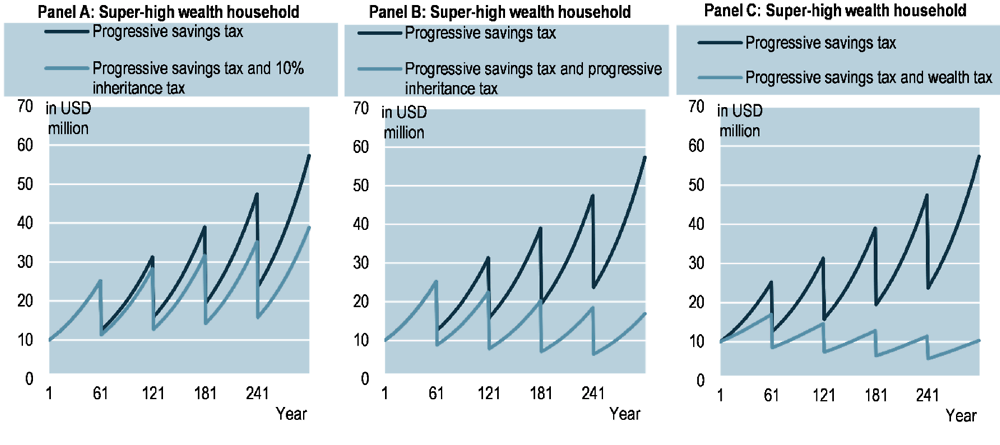

2 Review Of The Arguments For And Against Inheritance Taxation Inheritance Taxation In Oecd Countries Oecd Ilibrary

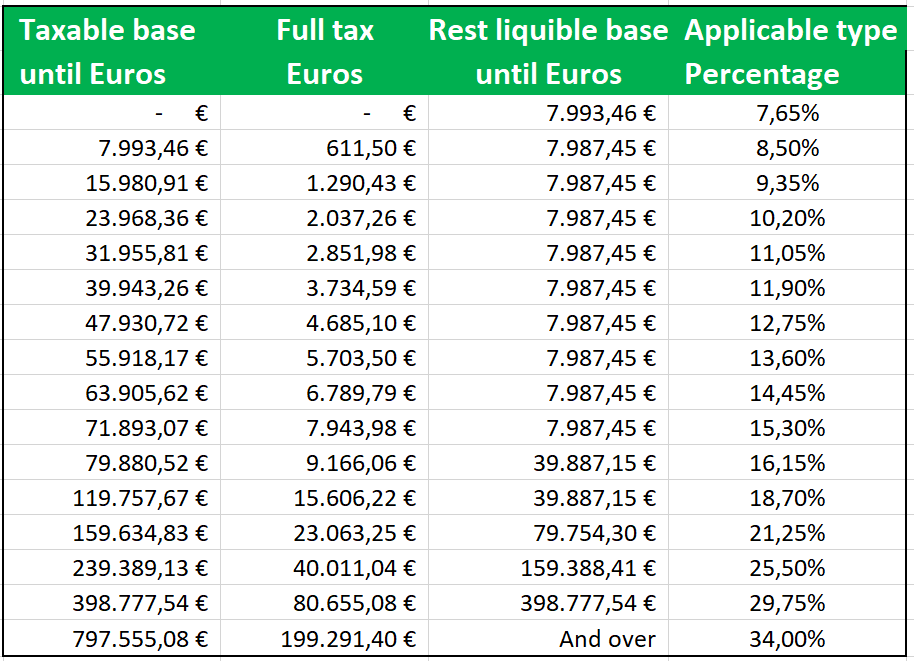

Spanish Inheritance Tax 2021 10 Things You Need To Know Cd Solicitors