If you have a salary, an hourly job, or collect a pension, the tax withholding estimator is for you. Fica taxes (% of employee gross pay) employee pays:

New Massachusetts Paid Family Leave Tax Human Resources Umass Amherst

It also varies based on the number of withholding

How much federal tax is deducted from a paycheck in ma. Federal insurance contributions act tax (fica) 2022: Employer know how much money to withhold from your paycheck for federal income taxes. Median household income in 2019 was $65,712.

Get federal tax answers online & save time! Select your location and add a salary amount to find out how much federal and state taxes. If your household has only one job then just click exit.

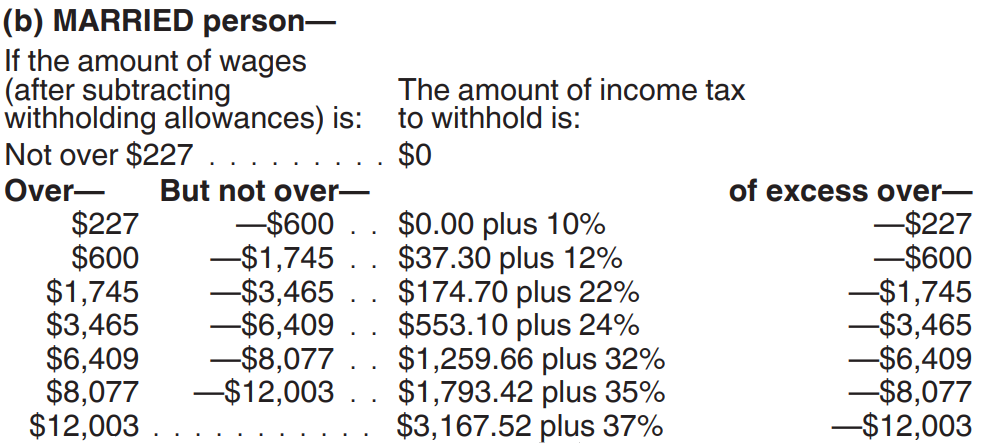

If you have a household with two jobs and both pay about the same click this button and exit. This amount depends on allowances for things such as your marital status (because married and unmarried people pay different amounts of taxes) or if you have dependent children. Your effective tax rate is just under 14% but you are in the 22% tax bracket.

There are seven federal tax brackets for the 2020 tax year: Add your state, federal, state, and voluntary deductions to determine your net pay. 1.45% 1.45% additional medicare tax 0.9% on gross pay over $200,000:

It’s important to revisit your tax withholding, especially if major changes from the tax cuts and jobs act affected the size of your refund this year. This calculator is intended for use by u.s. Even if you did a paycheck checkup last year, you should do it again to account for differences from tcja or life changes.

You’d pay a total of $6,858.60 in taxes on $50,000 of income, or 13.717%. Census bureau) number of cities that have local income taxes: Everyone should check their withholding.

Social security tax 12.4% (up to annual maximum) 6.2% 6.2% medicare tax 2.9% up to $200,000: Total federal income tax due: States impose their own income tax for tax year 2020.

22% on the last $10,526 = $2,315.72. The amount of federal and massachusetts income tax withheld for the prior year. However, working with calculators and understanding how payroll taxes work.

Neuvoo salary and tax calculator. If your household has only one job then just click exit. If you have a household with two jobs and both pay about the same click this button and exit.

Check out our new page tax change to find out how federal or state tax changes affect your take home pay. 12% on the next $29,774 = $3,572.88. Alabama tax law stipulates that your federal taxes may be deducted from your gross income for purposes of computing the state income tax.

Social security tax and medicare tax are two federal taxes deducted from your paycheck. This massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis. Of course, how much individual states are getting back from the federal government is also unequal.

Ad questions answered every 9 seconds. The next dollar you earn is. Use the tax withholding estimator

The percentage rate for the medicare tax is. Supports hourly & salary income and multiple pay frequencies. Federal income tax total from all rates:

Contacting the department of unemployment assistance to fulfill obligations for state employment security taxes. Your bracket depends on your taxable income and filing status. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Exit and check step 2 box otherwise fill out this form. The social security tax is 6.2 percent of your total pay until you reach an annual income threshold. Maryland and hawaii are among the top 3 highest income states, and they both pay over 25% in taxes.

Federal unemployment tax act (futa) is another type of tax withheld, however, futa is paid solely by employers. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. This free, easy to use payroll calculator will calculate your take home pay.

Federal income tax rates range from 10% up to a top marginal rate of 37%. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Calculates federal, fica, medicare and withholding taxes for all 50 states.

Take home pay for 2022 Exit and check step 2 box otherwise fill out this form.

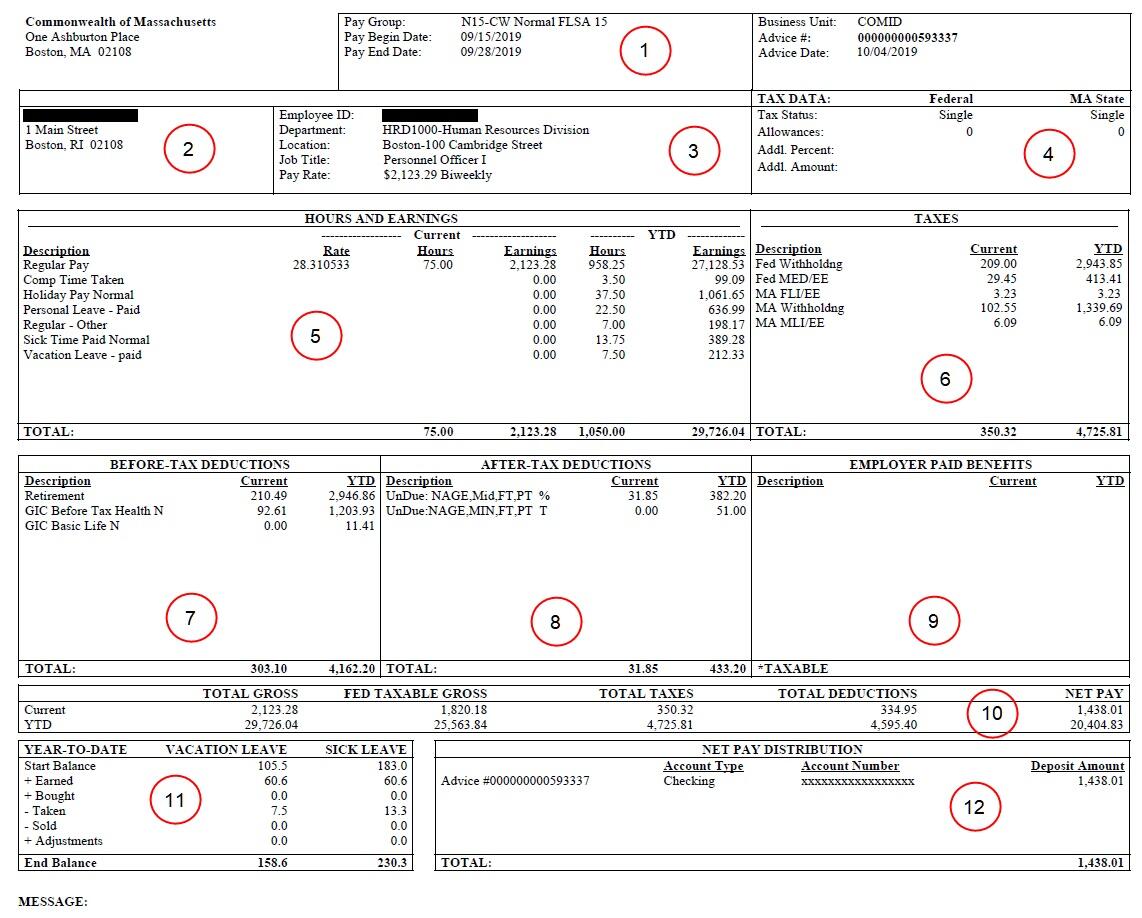

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Irs Releases Tool You Can Use To Check If Your Employer Is Messing Up Your Taxes – Chicago Tribune

Visualizing Taxes Deducted From Your Paycheck In Every State

Umledu

Pay And Recordkeeping Massgov

Massachusetts Paycheck Calculator – Smartasset

State Conformity To Cares Act American Rescue Plan Tax Foundation

Massachusetts Paycheck Calculator – Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

Where Does All Your Money Go Your Paycheck Explained

Employer Payroll Tax Calculator Gusto

Payroll Software Solution For Massachusetts Small Business

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Paycheck Calculator – Take Home Pay Calculator

New Tax Law Take-home Pay Calculator For 75000 Salary

Paycheck Calculator For 100000 Salary What Is My Take-home Pay

How Much Tax Is Deducted From A Paycheck In Ma

Payroll Software Solution For Massachusetts Small Business

How To Calculate Payroll And Income Tax Deductions – Peo Human Resources Blog