The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. State tax commission — if you are still not satisfied with the assessment on your property, you have a right to appeal to the state tax commission by september 30 or 30 days after the final action of the board of equalization — whichever is later.

Pin On 1st Wave Feminism

In many states, the homeowner can redeem the home after a tax sale by paying the buyer from the tax sale the amount paid (or by paying the taxes owed), plus interest, within a limited amount of time.

How long can you go without paying property taxes in missouri. Some states allow the property tax authority to foreclose on the home directly if taxes go unpaid. However, some sell a lien certificate on the property instead. Within 90 days if the property was sold at a third offering.

You could lose your property in a tax sale. Pay taxes or request payment plan; So that $15,000 turns into $16,050.

Due dates for inheritance taxes vary by state. For example, you could inherit property from an heir in one of the six states that do impose an inheritance tax, like kentucky. If not paid, these taxes and penalties can be recovered by civil suit.

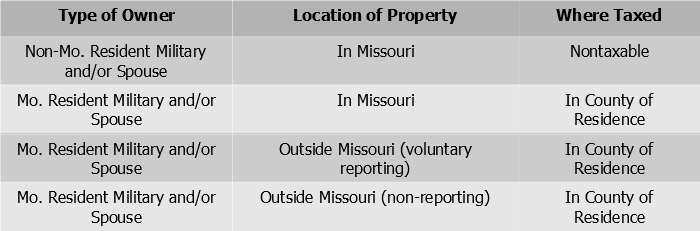

If you have questions about how property taxes can affect your overall financial plans, a financial advisor in. Sales and use tax exemptions; Most personal property is taxed in the county and city where the taxpayer lives.

You should get your property tax bill in november, and payment is due by january 31. If you fall so far behind on your property taxes that you receive notice of a tax sale, speak with an attorney as soon as possible. You'll get a bill from the.

Other ways paying taxes can get you a property. If you continue to be delinquent in your property tax payments, your taxing authority will schedule your home for a tax sale, which is like a foreclosure. Therefore, even a relatively modest estate cannot make it through probate in less than six months and about 10 days.

There is another obscure way to potentially gain title to a property by paying its taxes called adverse possession. with adverse possession, a third party must publicly occupy and maintain a property for a significant period of time (usually two to five years or more) including paying property taxes. Check return status (refund or balance due) file and pay your taxes online; This can play out in different ways.

There are a few exceptions. Debit cards are accepted and processed as credit cards. Personal property of missouri residents

Unpaid property taxes become a lien against the real estate. Then you’d need to pay that inheritance tax. That ranks it among the most expensive counties in missouri when it comes to property tax payments.

As for property taxes, the homeowner forfeits the property to the agency in the second year of a tax delinquency. If your tax bill is not mailed out until after january 10, your delinquency date will get pushed out. Corporate property, houseboats, cabin cruisers, floating boat docks and manufactured homes are assessed where they are located on january 1.

Pay taxes or request payment plan; This means that were a house to be sold, the taxes would be paid first out of the proceeds. In missouri, you can redeem the property:

For example, if you get a $15,000 residential property tax bill, and don’t pay it by january 31, you could face 7% in penalties and interest. All estates are potentially subject to federal gift and estate taxes, payable at the rate of 40 percent. A property owner can retain ownership of his real estate by paying off the lien with interest and penalties, as long as the payoff happens within a specific period of time set by law.

In missouri, you can ordinarily redeem your home within one year after the tax sale and up until the purchaser gets the deed to your home—if the property sells on the collector's first or second sale attempt. Look out for legal changes Not all states sell property when taxes are delinquent;

According to the texas comptroller’s office, taxing units are required to give property owners at least 21 days after their original tax bills are mailed to pay the amount due. (in fact, you might be surprised to learn that i don’t have to pay property taxes at all currently.) if you don’t bother to learn what incentives are available to you, or if there is a pilot program open to you where you have properties, you may as well stand in front of an open window, peel away hundreds or even thousands of dollars from your wallet and toss them out into the wind. A typical resident here pays an annual property tax bill of $2,629.

The probate process cannot conclude until any federal gift and estate taxes due are paid. Please note that your payment will be postmarked the date you submitted payment, unless your payment is scheduled for a future date. Exactly how long the redemption period lasts varies from state to state, but usually, the homeowner gets at least a year from the sale to redeem the property.

If your inheritance is more than $11.58 million, you will be taxed on the overage, not the. If you'd rather not pay through your mortgage company, you can pay your taxes on your own. Within one year after the sale and up until the deed is issued, if it was sold at a first or second offering, or;

The missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. If it’s not received by then, you could start accruing penalties on february 1.

Missouri State Treasurers Office – About

I Am No Longer A Missouri Or A County Resident Do I Still Owe Clay County Missouri Tax

Search Missouri Public Property Records Online Courthousedirectcom

Personal Property Tax – Jackson County Mo

Missouri Property Tax Calculator – Smartasset

Free Missouri Commercial Lease Agreement Pdf Template – Commercial Lease Agreement Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

Missouri State Treasurer – Unclaimed Property Postcard Recipients

By Chris Butler Tennessee Watchdog Nashville Tennessee Auditors Gave The Town Of Ridgely What Mayor Steve Jones Property Tax Watch Dogs Tennessee

Missouri State Tax Commission

2

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Missouri State Treasurer – Unclaimed Property Postcard Recipients

Missouri Property Tax Calculator – Smartasset

Assessor Pettis County

Surprising Data Reveals The Top 25 Tax-friendly States To Retire Retirement Retirement Planning Tax

Pin On Misc Library

Assessor Jefferson County Mo

Individual Income Tax

Individual Income Tax