Charitable tax deductions are the irs's way of rewarding you for making donations to organizations that help people in need. It's four different categories of donations.

Qualified Charitable Organizations – Az Tax Credit Funds

What organizations can receive a qualified charitable tax credit donation?

How does the arizona charitable tax credit work. But for a married couple, $400. Phoenix children’s hospital is a 501(c)(3) organization that qualifies for the charitable tax credit. Under a state of arizona tax credit program that benefits charitable organizations that serve the working poor, donors to arizona’s children association can claim a personal tax credit for the amount of their contribution (up to $400 for individuals and $800 for couples filing jointly).

Charitable contributions can take many forms. Only organizations that have been approved by the state of arizona to operate as a qualified charitable organization. Individuals or head of household filers can claim a tax credit of up to $400.

If you donate to the salvation army in arizona by tax day 2020, you can claim a tax credit for 2019 that reduces dollar for dollar what you pay in state income tax. Charitable donations impact the az tax returns if tp is not itemizing. How does the arizona charitable tax credit work?

Couples who file jointly can reduce their state taxes by up to $800; Any credits for charitable contributions to qualifying charitable organizations (qcos) and qualifying foster care charitable organizations (qfcos) not claimed in a tax year carry forward up to five years. Individuals or head of household filers can claim a tax credit of up to $400.

For a single taxpayers or heads of household the maximum credit is $400. Giving through the arizona charitable tax credit is an easy way to redirect the money you would otherwise be paying in taxes. If you donate to a public or private school or to a qualifying charity, you claim a credit on your arizona state income tax return.

How the arizona tax credit works. Arizona law provides an income tax credit for cash contributions made to certain charities that provide help to the working poor. The categories are the arizona military family credit, and that's a very specific one, but again, that limit for singles is $200.

For 2019, mary is allowed a maximum credit of $400. Arizona simultaneously allows three types of tax credit, including one for organizations like habitat who serve the working poor. In az, a taxpayer will get a 25% increase to the standard deduction for charitable donations not claimed on the federal return because they did not itemize.

You’ve probably heard of the az charitable tax credit,. During 2019, mary, a single person, gave $600 to a qualified charity. By leveraging the arizona charitable tax credit, you take control of where your tax dollars go.

Every year, hundreds of people make donations to paz de cristo and receive their money back when they file their state taxes. Here is a great example, from the arizona department of revenue’s website: Couples who file jointly can reduce their state taxes by up to $800;

Beginning in 2016, the amount of this credit is $800 for married taxpayers filing jointly. If you give $400 to the arizona military family relief fund, you get $400 back when you file your tax return. Mary can apply $250 of the credit to her 2019 tax liability and carryover $150 of the unused $400 credit to.

The good news is, you no longer have to itemize your deductions in order to receive this credit! Complete az form 321 and include it when you file your 2021 state taxes. Mary’s 2019 tax is $250.

With the arizona charitable tax credit, your gift will keep giving for children, while generating real returns on your state income taxes. Qualifying charitable organization tax credit, single filers maximum gift $400 and married filers up to $800. For every contribution you make (cash or otherwise) to a qualified charity, you can shave a little (or a lot) off your adjusted gross income and reduce your own tax burden.

The state of arizona provides a variety of individual tax credits, including the arizona charitable tax credit and the public school tax credit.

Socialblade Can Help You Track Youtube Channel Statistics Twitch User Stats Instagram Stats And Much More You C Instagram Stats Youtube Subscribers Youtube

Arizona Charitable Tax Credit Fund Paradise Valley Community College

What Is An Arizona Tax Credit Donationcampaign Pages

Arizona Charitable Tax Credit Guide 2020 – St Marys Food Bank

Whiteboard Animation Character Whiteboard Animation Whiteboard Video Animation Best Photoshop Actions

Qualified Charitable Organizations – Az Tax Credit Funds

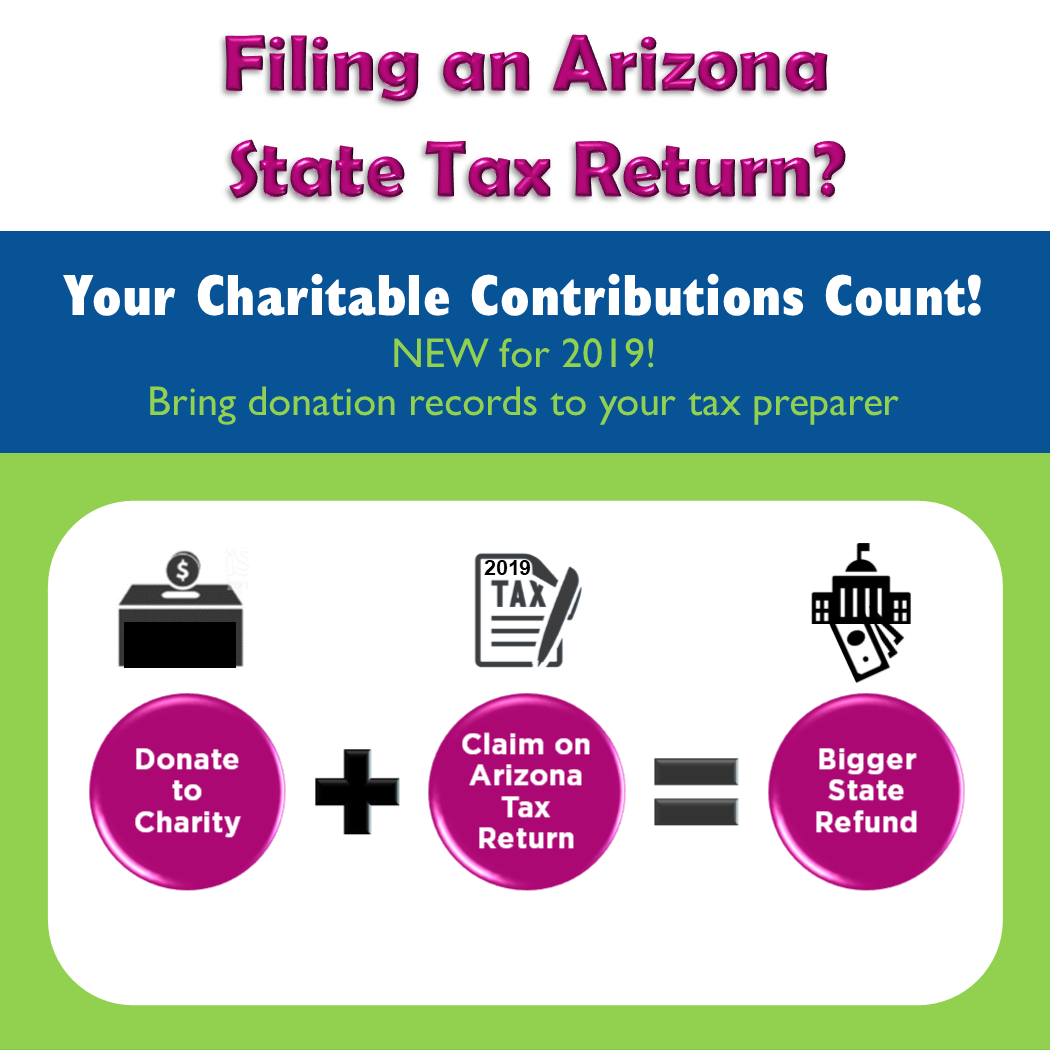

Charitable Contributions Count In Arizona – Tempe Community Council

Arizona Charitable Tax Credit – Lions Camp Tatiyee

Celebrating Breastfeeding Month – Noah Health Center Breastfeeding Emotional Wellness Health Education

Tax Credit Central Arizona Shelter Services

Qualified Charitable Organizations – Az Tax Credit Funds

Qualified Charitable Organizations – Az Tax Credit Funds

Arizona Charitable Tax Credit – Lions Camp Tatiyee

Arizona Tax Credit Donation 2021 – Control Alt Delete

Camp Wildcat – The University Of Arizona Tucson Az Student Volunteer University Of Arizona University Of Arizona Tucson

Tax Credit Central Arizona Shelter Services

Arizona Charitable Tax Credit – Lions Camp Tatiyee

Qualified Charitable Organizations – Az Tax Credit Funds

Logo Web Design Company Logo Design Website Design Best Logo Design