Property taxes in broward county get reassessed when the property changes ownership. It has one of the highest average effective property tax rates of any florida county at 1.07%.

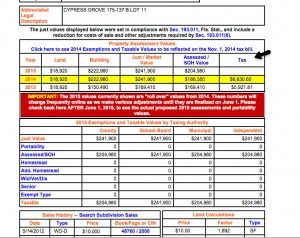

Explaining The Tax Bill For Copb

The median property tax (also known as real estate tax) in broward county is $2,664.00 per year, based on a median home value of $247,500.00 and a median effective property tax rate of 1.08% of property value.

How are property taxes calculated in broward county florida. If a deed states an amount, such as “in consideration of $10.00.”, that amount is taxed, even when the transfer is not otherwise taxable. This estimator is a tool which does not capture every scenario of how portability is calculated by our office. Florida properties aren’t assessed each year, but when they are the notices are mailed out in august.

The amount of property taxes you owe in broward county is determined by two things: This taxable value is the value on which taxes are. The taxes are due by the following march 31.

* this tax estimator is based on the average millage rate of all broward municipalities. Property tax appeal and property tax reduction broward county residents trust. Counties in florida collect an average of 0.97% of a property's assesed fair market value as property tax per year.

The median property tax in florida is $1,773.00 per year for a home worth the median value of $182,400.00. Enter your home price and down payment in the fields below. The median property tax in broward county, florida is $2,664 per year for a home worth the median value of $247,500;

Broward county collects, on average, 1.08% of a. Typically, they are paid on a yearly or monthly basis. Using the broward county property appraiser's website, bcpa.net, you can calculate the amount of annual taxes that you can expect.

The millage rate is a dollar amount per $1,000 of a home's taxable property value. The estimated tax amount using this calculator is based upon the average millage rate of 19.9609 mills (or 1.99609%) and not the millage rate for a specific property. In seconds, our broward county, florida mortgage calculator will have an estimate of your monthly payment.

Homeowners in broward county pay a median property tax bill. There are times when the portability benefit has to be split due to divorce or when an applicant had partial ownership interest in the prior home, has partial ownership interest in the new home, or had/has partial ownership interest in both the prior and new homes. The broward county tax assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis, based on the features of the property and the fair market value of comparable properties in the same neighbourhood.

Usually, property taxes are not levied by the federal government. Broward county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections. When it comes to property tax appeal in broward county, we walk our clients through each step of this often stressful and overwhelming process.

If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the broward county tax appraiser's office. These are the real estate taxes for the current owner and will not be what the property taxes will end up being. Typically, property taxes are imposed by state and local governments.

Broward county, florida calculates property taxes simply by taking a percentage of the property's value. The median property tax on a $247,500.00 house is $2,673.00 in broward county. Property taxes in august to each property owner.

I always suggest to budget 2% when looking at property in broward county. (section 1(a) + applicable % of section 1(b) $ minimal tax: Tax amount varies by county.

This applies to everywhere in the u.s. You can see the differences when you claim this property as your primary residence and receive the homestead exemption or other exemptions based on various issues. The broward county property appraiser’s office assesses the value of your property and applies eligible tax exemptions that can lower the taxable value of your property.

After the local governments determine their annual budgets, the county tax collector sends a tax bill to each property owner in late october or november. If you would like to calculate the estimated taxes on a specific. Broward county government taxes and fees property taxes skip to main content

After the assessor deducts the soh assessment from a property’s just value to arrive at its assessed value, the tax collector calculates a property’s taxable value after also deducting any eligible homestead exemption. Broward legal directory is a free resource for anyone wanting information about legal issues in broward county, florida. Please see this infographic for more information on florida’s property tax system.

Use this broward county, florida mortgage calculator to estimate your monthly mortgage payment, including taxes and insurance. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. How property tax is calculated in broward county, florida

The assessor's office can provide you with a copy of your property's most recent. The assessed value of the property, and the tax rate. How are property tax bills calculated in broward county, fl?

Broward-county Property Tax Records – Broward-county Property Taxes Fl

Will Broward Miami-dade Property Taxes Go Up In 2021 Miami Herald

Broward-county Property Tax Records – Broward-county Property Taxes Fl

Florida Property Tax Hr Block

2021 Florida Sales Tax Rates For Commercial Tenants – Winderweedle Haines Ward Woodman Pa

Explaining The Tax Bill For Copb

Property Tax By County Property Tax Calculator Rethority

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

What Is The Basic Star Property Tax Credit In Nyc Hauseit In 2021 Tax Credits Nyc Annuity Retirement

Calculating Your Miami-dade Or Broward County Property Taxes

Your Guide To Prorated Taxes In A Real Estate Transaction

Pin On Neat Wallpaper

What Is The Basic Star Property Tax Credit In Nyc In 2021 Tax Credits Nyc Real Estate Property Tax

Broward County Property Taxes What You May Not Know

Georges Excel Mortgage Calculator Pro V40 Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization

Broward-county Property Tax Records – Broward-county Property Taxes Fl

How To Calculate Property Taxes Real Estate Scorecard

Soon After Taking The Oath Dehraduns New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Property Tax By County Property Tax Calculator Rethority