As mentioned above, property taxes are not assessed until november of the year in which they are due. Real property taxes are paid in arrears (meaning at the end of the year) in florida and are not assessed until november of the year for which they are due.

Hauskauf Zum Ersten Mal Von Einem Erstkaeufer Privathaeuser A Einem Leben Hausdekoration Checkliste

Therefore, when a closing takes place between january and the first week in november, the amount of the current years property taxes are unknown.

How are property taxes calculated at closing in florida. You are refinancing your existing loan. In florida, similarly to other states, closing costs are charges that applied to both parties in a real estate transaction, the buyer and the seller. Here’s how to calculate property taxes for the seller and buyer at closing:

How are property taxes handled at a closing in florida. Instead, the seller will typically pay between 5% to 10% of the sales price and the. In florida, you should expect to pay around 1.7% of your home's final sale price in closing costs — although your exact charges will vary based on your home's value, local fees, and your arrangements with the buyer.

Taxes are due and payable on november 1 st with discounts for early payments: As a buyer, you’ll have to cover most of the fees and taxes. The cost basis of the property is basically what you had to pay in order to acquire the property, and is used to arrive at the amount of capital gains taxes you'll owe.

Your taxes are $3,600 a year, and your homeowner’s insurance is $600 a year. The median property tax in florida is $1,773.00 per year for a home worth the median value of $182,400.00. $4,200 / 12 = $350 per month divide the total monthly amount due by 30:

Although florida real estate attorneys fully understand the real estate closing process as they are involved in real estate closings every day, many of the other participants in florida real estate agency transactions often experience some confusion as to everything that happens between the time the purchase and sale contract is signed to the. 1% discount if paid in february; A number of different authorities, including counties, municipalities, school boards and special districts, can levy these taxes.

Ad valorem taxes are based on the property value. Though all the taxes, fees, lender charges and insurance add up, generally neither party pays 100% of all the closing costs. Florida tax appraisers arrive at a property’s assessed value by deducting the save our homes assessment limitations (soh) from the property’s just value.

At the moment, you can expect to pay between 2.05% and 2.74% of the total purchase price before taxes. After the local governments determine their annual budgets, the county tax collector sends a tax bill to each property owner in late october or november. The gross amount is due by march 31 st;

Please see this infographic for more information on florida’s property tax system. Homestead exemption every parcel of real property has a just value, an. In florida, taxes are due once a year, and there is a discount if taxes are paid by november 1, so your lender or servicer will assume you want to pay your taxes by that date.

Multiply the number of months by 30 days. How are real estate taxes prorated at the closing? Your capital gains are arrived by deducting the cost basis of your property from the total price, so including the cost of the doc stamps can be helpful in lowering these taxes.

Whether selling or buying real property before the end of this year, you will want to look closely at the prorations of taxes on the closing documents. This means that if your closing takes place anywhere between january and the first week of november, the amount of the current years property. 09/13 page 2 of 3 how is the tax calculated?

The way in which these charges are being split, is based upon the county in which the property is located in and the contractual terms negotiated in your purchase and sales agreement Average closing costs in florida Property taxes in august to each property owner.

4% discount if paid in november; Beginning with the first year after you receive a homestead exemption when you purchase property in florida, an appraiser determines the property’s just value.with each subsequent annual assessment, your property taxes are prohibited by. In the state of florida, property taxes are sent at the end of a calendar year and are paid in arrears (i.e., one year behind the current year).

Property taxes in florida are implemented in millage rates. The actual amount of the taxes is $4,779.65; 2% discount if paid in january;

This means that though the seller is responsible for paying property taxes for every day they owned their home, closing costs will typically include a prorated property tax credit to the buyer. The taxes are due by the following march 31. For florida residents if all the estate property was located in florida, the amount shown as the credit for state death taxes on the federal return (federal form 706) is the amount of florida estate tax due.

If you add in florida real estate commission, which is typically 6% of the sale price, closing costs in florida can range up to 9% of the final sale price. This is the amount of prorated tax the seller owes at closing. For perspective, the median home value in florida is just over $252,000, according to zillow ;

You close on your loan on july 15. While they vary from state to state, the amount you’ll pay in florida depends on both the property and the county it sits in. Generally, at closing, the seller pays property taxes dating from january 1 of that year until the date of closing.

How much are closing costs in florida? Let’s look at the 2015 ad valorem taxes in detail. A millage rate is one tenth of a percent, which equates to $1 in taxes for every $1,000 in home value.

Property taxes at a closing in floridain florida, property taxes are paid in arrears. If you have not received your 2018 tax bill from the tax collector yet, be assured it will be arriving soon. 3% discount if paid in december;

9% closing costs for a home that sold for that amount would come to $22,680. The taxes are assessed on a calendar year from jan through dec (365 days). Count the number of full months from closing day to june 30.

Counties in florida collect an average of 0.97% of a property's assesed fair market value as property tax per year. Florida estate tax filing requirements r. If a closing is occurring before property tax bills are released, our office relies on the taxes from the prior year as an estimate of what the taxes will be for the existing year.

Divide the total annual amount due by 12 months to get a monthly amount due:

This Is A Question That Remains Ever Popular Among Home Buyers Closing Costs Are The Fees Associate Real Estate Infographic Buying First Home Real Estate Tips

Property Tax Prorations – Case Escrow

Im Going To Execute This Once I Can Manufactured Home Remodel Closing Costs Fha Loans Mortgage Loans

Midpoint Realty Cape Coral Florida Brochure Call Us 239-257-8717 Or Email Adminmidpointrealestatecom Cape Coral Florida Condos For Sale Cape Coral

What Are Mortgage Closing Costs – Nerdwallet Closing Costs Mortgage Cost

Florida Income Tax Calculator Mortgage Loan Calculator Mortgage Calculator Home Ownership

How To Calculate Your Profit In 2021 When Selling Your Rental Property – Mortgage Blog

First Time Home Buyer Vocabulary Cheat Sheet Buying First Home Home Buying Buying Your First Home

What Is The Basic Star Property Tax Credit In Nyc Hauseit In 2021 Tax Credits Nyc Annuity Retirement

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Your Guide To Prorated Taxes In A Real Estate Transaction

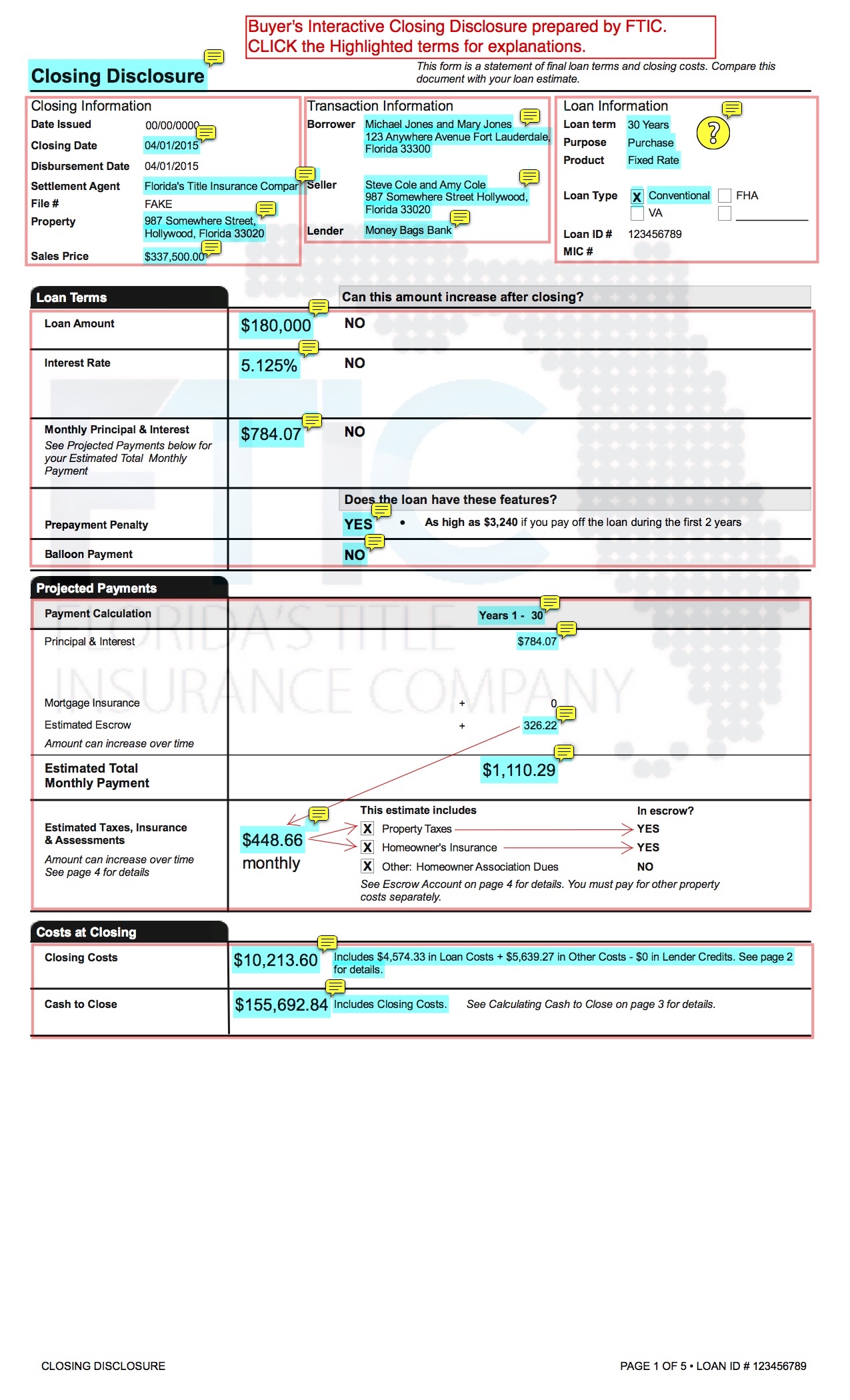

Escrows Prepaids At Closing What You Should Know Us Mortgage Calculator

Buying A Home Isnt Just A Possible 20 Down Payment And A Monthly Check For The Mortgage There A Buying Your First Home Home Buying Process Buying First Home

Florida Property Tax Hr Block

Understanding Property Taxes At Closing American Family Insurance

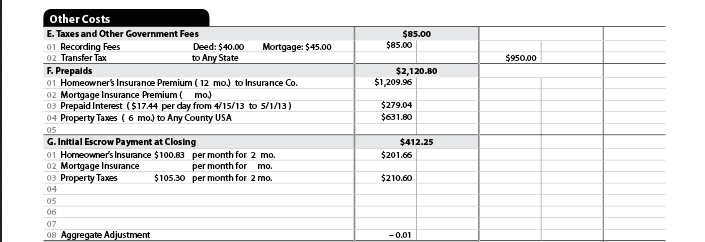

How To Read A Buyers Closing Disclosure Floridas Title Insurance Company

Homes For Sale – Real Estate Listings In Usa Buying First Home Home Buying Real Estate

Account Suspended Real Estate Infographic Selling Real Estate Buying First Home

What Is The Basic Star Property Tax Credit In Nyc In 2021 Tax Credits Nyc Real Estate Property Tax