Are you in urgent need of cash but have a bad credit score? High risk personal loans guaranteed approval direct lenders may be your answer.

Editor’s Note: This guide on “high risk personal loans guaranteed approval direct lenders” was published on [date] to provide up-to-date information on this important topic.

We understand that finding a loan with bad credit can be a challenge. That’s why we’ve done the research and compiled a list of the best high risk personal loans guaranteed approval direct lenders. These lenders specialize in providing loans to borrowers with bad credit, and they offer a variety of loan options to choose from.

In this guide, we’ll cover everything you need to know about high risk personal loans guaranteed approval direct lenders, including:

- The different types of high risk personal loans available

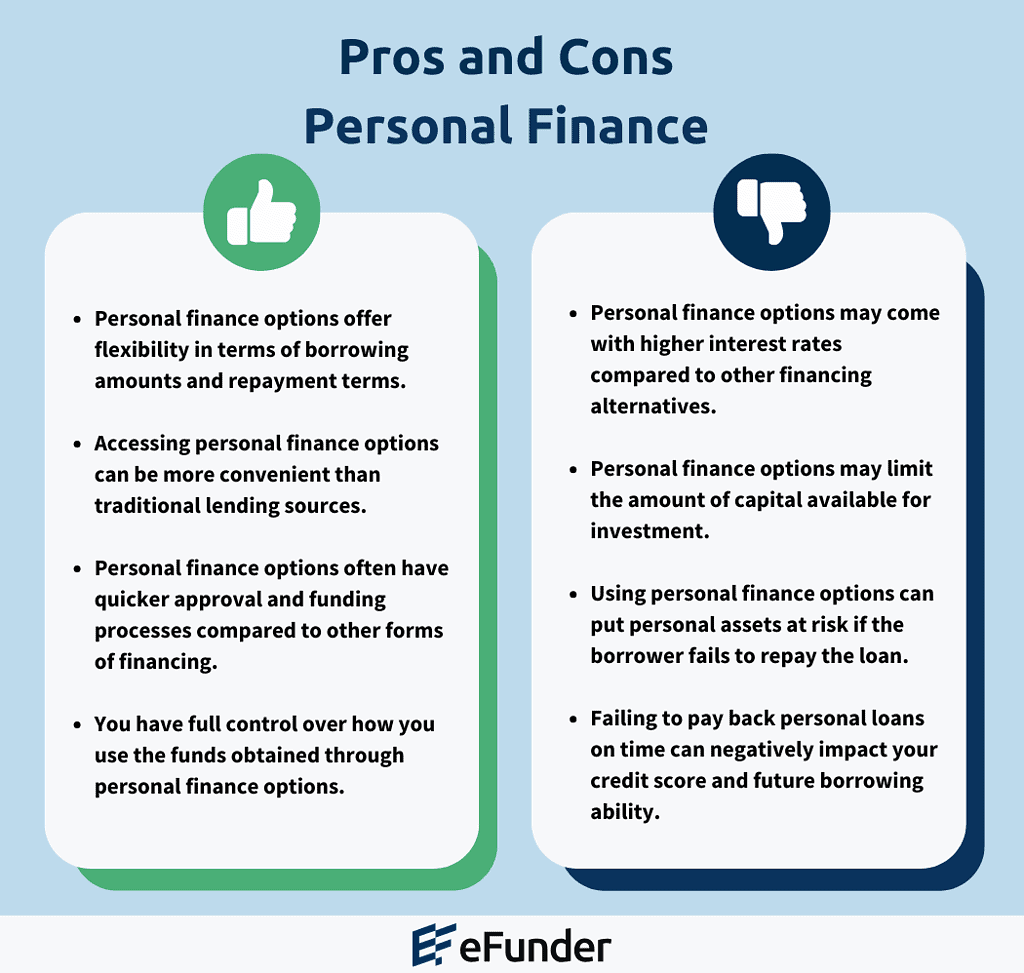

- The pros and cons of high risk personal loans

- How to compare high risk personal loans

- How to apply for a high risk personal loan

By the end of this guide, you’ll have all the information you need to make an informed decision about whether a high risk personal loan is right for you.

High Risk Personal Loans Guaranteed Approval Direct Lenders

High risk personal loans guaranteed approval direct lenders offer a variety of loan options for borrowers with bad credit. These loans are typically more expensive than traditional loans, but they can be a lifesaver for borrowers who need cash quickly and have no other options.

- High risk: These loans are considered high risk because the borrower has a bad credit score.

- Personal: These loans are used for personal expenses, such as debt consolidation, medical bills, or home repairs.

- Guaranteed approval: These loans are guaranteed to be approved, regardless of the borrower’s credit score.

- Direct lenders: These lenders provide loans directly to borrowers, without the use of a broker.

There are a number of factors to consider when choosing a high risk personal loan guaranteed approval direct lender. These factors include:

- Interest rates: These loans typically have higher interest rates than traditional loans.

- Loan terms: These loans typically have shorter loan terms than traditional loans.

- Fees: These loans may have additional fees, such as origination fees or late payment fees.

- Repayment options: These loans may have flexible repayment options, such as the ability to make bi-weekly or monthly payments.

It is important to compare multiple lenders before choosing a high risk personal loan guaranteed approval direct lender. This will help you find the best loan for your needs.

High risk

The connection between “High risk: These loans are considered high risk because the borrower has a bad credit score.” and “high risk personal loans guaranteed approval direct lenders” is clear: bad credit scores are the primary reason why borrowers seek out high risk personal loans.

Credit scores are used by lenders to assess the creditworthiness of a borrower. A bad credit score indicates that the borrower has a history of late payments, defaults, or other negative credit events. This makes lenders more likely to view the borrower as a high risk, and therefore more likely to charge higher interest rates and fees.

High risk personal loans guaranteed approval direct lenders are willing to lend to borrowers with bad credit because they know that these borrowers have limited options. Traditional lenders, such as banks and credit unions, typically have strict credit requirements and will not approve loans for borrowers with bad credit. This leaves high risk personal loans guaranteed approval direct lenders as the only option for many borrowers who need cash quickly.

While high risk personal loans guaranteed approval direct lenders can be a lifesaver for borrowers with bad credit, it is important to be aware of the risks involved. These loans typically have high interest rates and fees, and they can be difficult to repay. Borrowers should only consider a high risk personal loan if they are confident that they can make the payments on time.

Personal

High risk personal loans guaranteed approval direct lenders offer loans for various personal expenses, addressing common financial challenges faced by individuals. These loans can be used for:

- Debt consolidation: Combining multiple debts into a single loan with a lower interest rate, simplifying repayment and potentially reducing overall debt.

- Medical bills: Covering unexpected medical expenses or ongoing treatments, providing access to necessary healthcare without the burden of high medical bills.

- Home repairs: Financing essential home repairs or renovations, maintaining the safety and value of a property and ensuring a comfortable living environment.

By providing loans for these personal expenses, high risk personal loans guaranteed approval direct lenders offer a lifeline to individuals who may have limited access to traditional financing options due to bad credit.

Guaranteed approval

Guaranteed approval personal loans are a type of high risk personal loan that is specifically designed for borrowers with bad credit. These loans are guaranteed to be approved, regardless of the borrower’s credit score. This makes them a popular option for borrowers who have been turned down for a traditional loan.

- No credit check: Guaranteed approval personal loans do not require a credit check. This means that borrowers can get approved for a loan even if they have bad credit or no credit history.

- High interest rates: Guaranteed approval personal loans typically have high interest rates. This is because lenders are taking on more risk by lending to borrowers with bad credit.

- Short loan terms: Guaranteed approval personal loans typically have short loan terms. This means that borrowers will have to pay back the loan quickly, which can be difficult for borrowers who are already struggling financially.

- Fees: Guaranteed approval personal loans may have additional fees, such as origination fees or late payment fees.

Guaranteed approval personal loans can be a good option for borrowers who need cash quickly and have no other options. However, it is important to be aware of the risks involved before taking out a guaranteed approval personal loan.

Direct lenders

This aspect of “high risk personal loans guaranteed approval direct lenders” is significant because it eliminates the involvement of intermediaries, such as brokers or middlemen, in the loan process. Direct lenders handle the entire loan process, from application to approval and disbursement, which offers several advantages:

- Lower costs: By cutting out the middleman, direct lenders can often offer lower interest rates and fees to borrowers.

- Faster processing: Without the need to go through a broker, the loan application and approval process can be streamlined, resulting in faster access to funds for borrowers.

- Greater control: Direct lenders have complete control over the loan process, which allows them to make decisions quickly and efficiently, increasing the likelihood of loan approval, even for high-risk borrowers.

The absence of brokers in the lending process also reduces the risk of fraud and scams, as borrowers are dealing directly with the lender and can verify their legitimacy.

For borrowers with bad credit, direct lenders offer a crucial lifeline to financial assistance, providing access to loans that may not be available through traditional lending institutions.

In summary, the direct lending model employed by “high risk personal loans guaranteed approval direct lenders” empowers borrowers with greater access, affordability, and efficiency in obtaining financing, despite their credit challenges.

Interest rates

The higher interest rates associated with “high risk personal loans guaranteed approval direct lenders” are a direct consequence of the elevated risk these lenders assume by providing loans to borrowers with poor credit histories. Traditional lenders, such as banks and credit unions, typically assess a borrower’s creditworthiness through a comprehensive credit check and assign interest rates based on the borrower’s credit score and other financial factors.

In contrast, direct lenders offering “high risk personal loans guaranteed approval direct lenders” often bypass traditional credit checks and rely on alternative data sources to evaluate a borrower’s ability to repay. This approach increases the lender’s risk as they may extend credit to borrowers who have a history of missed payments, defaults, or other negative credit events.

To compensate for this increased risk, direct lenders charge higher interest rates on their loans. These higher interest rates reflect the lender’s assessment of the borrower’s risk profile and the potential for default. As a result, borrowers with poor credit scores may find that the interest rates on “high risk personal loans guaranteed approval direct lenders” are significantly higher than those offered by traditional lenders.

It is important for borrowers to carefully consider the interest rates and fees associated with “high risk personal loans guaranteed approval direct lenders” before taking out a loan. While these loans can provide access to much-needed funds, the high interest rates can make them a costly option in the long run.

Loan terms

The shorter loan terms associated with “high risk personal loans guaranteed approval direct lenders” are a result of the higher risk these lenders assume by providing loans to borrowers with poor credit histories.

- Reduced risk for lenders: By limiting the loan term, lenders reduce their exposure to the risk of default. Shorter loan terms mean that borrowers have less time to fall behind on payments or default on the loan, which lowers the lender’s risk.

- Increased cost for borrowers: Shorter loan terms result in higher monthly payments for borrowers. This is because the total amount of interest charged over the life of the loan is spread out over a shorter period of time. As a result, borrowers may find that the monthly payments on a high risk personal loan are higher than they would be on a traditional loan with a longer term.

- Pressure to repay: The shorter loan terms on high risk personal loans can put pressure on borrowers to repay the loan quickly. This can be a challenge for borrowers who are already struggling financially and may not have the resources to make the higher monthly payments.

Borrowers should carefully consider the loan terms and monthly payments associated with “high risk personal loans guaranteed approval direct lenders” before taking out a loan. While these loans can provide access to much-needed funds, the shorter loan terms and higher monthly payments can make them a costly and challenging option for some borrowers.

Fees

The additional fees associated with “high risk personal loans guaranteed approval direct lenders” are a significant consideration for borrowers, as they can add to the overall cost of the loan.

Origination fees are a one-time fee charged by the lender to cover the costs of processing and approving the loan. These fees can range from 1% to 10% of the loan amount, and they are typically deducted from the loan proceeds before the borrower receives the funds.

Late payment fees are charged to borrowers who fail to make their loan payments on time. These fees can range from $25 to $50 per late payment, and they can add up quickly if the borrower is consistently late with their payments.

For borrowers with poor credit, the fees associated with “high risk personal loans guaranteed approval direct lenders” can be a significant burden. These borrowers may already be struggling financially, and the additional fees can make it even more difficult to repay the loan.

It is important for borrowers to carefully consider the fees associated with “high risk personal loans guaranteed approval direct lenders” before taking out a loan. These fees can add to the overall cost of the loan and make it more difficult to repay.

| Fee | Description |

|---|---|

| Origination fee | A one-time fee charged by the lender to cover the costs of processing and approving the loan. |

| Late payment fee | A fee charged to borrowers who fail to make their loan payments on time. |

Repayment options

The flexible repayment options offered by “high risk personal loans guaranteed approval direct lenders” are a critical component of these loans, providing borrowers with greater control over their repayment schedules and making it easier to manage their finances.

For borrowers with poor credit, traditional lenders may offer limited repayment options, such as monthly payments only. This can be a challenge for borrowers who are already struggling financially and may not have the resources to make large monthly payments.

“High risk personal loans guaranteed approval direct lenders” offer more flexible repayment options, such as the ability to make bi-weekly or monthly payments. This gives borrowers more flexibility in managing their finances and can make it easier to repay the loan on time.

For example, a borrower who receives a high risk personal loan of $1,000 with a 10% interest rate and a one-year loan term would have the following repayment options:

| Repayment Frequency | Monthly Payment | Total Interest Paid |

|---|---|---|

| Monthly | $87.23 | $97.00 |

| Bi-weekly | $40.24 | $70.44 |

As shown in the table, making bi-weekly payments can save the borrower a significant amount of money in interest charges. This is because bi-weekly payments are made 26 times per year, while monthly payments are made only 12 times per year. The more frequent payments reduce the amount of interest that accrues on the loan.

The flexible repayment options offered by “high risk personal loans guaranteed approval direct lenders” can be a valuable tool for borrowers with poor credit who are looking for a way to manage their finances and repay their debt.

FAQs on “High Risk Personal Loans Guaranteed Approval Direct Lenders”

This section addresses frequently asked questions regarding “high risk personal loans guaranteed approval direct lenders” to provide comprehensive information and clarify misconceptions.

Question 1: Are high risk personal loans guaranteed approval direct lenders legitimate?

Answer: Yes, high risk personal loans guaranteed approval direct lenders are legitimate financial institutions that offer loans to borrowers with poor credit. These lenders typically have less stringent credit requirements than traditional lenders and can provide quick access to funds.

Question 2: What are the drawbacks of high risk personal loans guaranteed approval direct lenders?

Answer: High risk personal loans guaranteed approval direct lenders typically come with higher interest rates, shorter loan terms, and additional fees compared to traditional loans. Borrowers should carefully consider these factors before taking out a loan.

Question 3: Can I get a high risk personal loan guaranteed approval direct lender with no credit check?

Answer: While some high risk personal loans guaranteed approval direct lenders may not perform a traditional credit check, they will likely use alternative methods to assess a borrower’s creditworthiness. This may involve reviewing bank statements, income information, or other financial data.

Question 4: What is the maximum loan amount I can borrow from a high risk personal loan guaranteed approval direct lender?

Answer: The maximum loan amount offered by high risk personal loans guaranteed approval direct lenders varies depending on the lender and the borrower’s financial situation. Borrowers should contact specific lenders to inquire about their loan limits.

Question 5: How quickly can I get approved for a high risk personal loan guaranteed approval direct lender?

Answer: Approval times for high risk personal loans guaranteed approval direct lenders can vary. Some lenders offer instant approval, while others may take a few days to process an application.

Question 6: What are the repayment options for high risk personal loans guaranteed approval direct lenders?

Answer: High risk personal loans guaranteed approval direct lenders typically offer flexible repayment options, including monthly or bi-weekly payments. Borrowers should discuss repayment terms with the lender before finalizing a loan agreement.

Summary: High risk personal loans guaranteed approval direct lenders provide a financial lifeline to borrowers with poor credit, but it is important to understand the potential drawbacks and costs associated with these loans. Borrowers should carefully consider their financial situation and explore all available options before taking out a loan.

Next Article Section: Evaluating High Risk Personal Loans Guaranteed Approval Direct Lenders

Tips for Evaluating High Risk Personal Loans Guaranteed Approval Direct Lenders

For individuals with poor credit seeking financial assistance, high risk personal loans guaranteed approval direct lenders can provide a lifeline. However, carefully evaluating these loans is crucial to make informed decisions and avoid potential pitfalls.

Tip 1: Compare Multiple Lenders:

Don’t settle for the first lender you come across. Take the time to compare interest rates, loan terms, fees, and repayment options from several direct lenders. This comparison will help you secure the most favorable loan for your financial situation.

Tip 2: Check Lender Reputation:

Research the reputation of potential lenders. Read online reviews, consult consumer protection agencies, and verify their licensing and accreditation. A reputable lender will provide transparent information and operate ethically.

Tip 3: Understand Loan Terms and Fees:

Thoroughly review the loan agreement before signing. Pay attention to the interest rate, loan term, monthly payment amount, and any additional fees or charges. Ensure you fully comprehend the loan’s financial implications.

Tip 4: Consider Your Repayment Ability:

High risk personal loans typically have shorter loan terms and higher interest rates. Calculate your monthly payments and assess your ability to repay the loan on time. Avoid borrowing more than you can afford to repay.

Tip 5: Explore Alternative Options:

Before committing to a high risk personal loan, consider exploring alternative financing options. Credit unions, community development organizations, and government assistance programs may offer loans with more favorable terms for individuals with poor credit.

Summary: Carefully evaluating high risk personal loans guaranteed approval direct lenders is essential to make informed decisions and secure the best possible loan for your financial needs. By comparing lenders, checking reputations, understanding loan terms, considering repayment ability, and exploring alternative options, you can increase your chances of obtaining a loan that meets your requirements and supports your financial goals.

Next Article Section: Benefits of High Risk Personal Loans Guaranteed Approval Direct Lenders

Conclusion

High risk personal loans guaranteed approval direct lenders offer a lifeline to individuals with poor credit, providing access to financial assistance that may not be available through traditional lending institutions. By understanding the unique characteristics, benefits, and drawbacks associated with these loans, borrowers can make informed decisions and utilize them effectively to address their financial challenges.

It is crucial for borrowers to carefully compare multiple lenders, evaluate their reputation and trustworthiness, and thoroughly review the loan terms and fees before committing to a loan agreement. Additionally, borrowers should assess their repayment ability and explore alternative financing options to ensure they secure the best possible loan for their specific financial situation.

High risk personal loans guaranteed approval direct lenders can be a valuable tool for individuals with poor credit to improve their financial well-being. By utilizing these loans responsibly and adhering to repayment commitments, borrowers can rebuild their credit scores over time and access more favorable loan options in the future.