Hawaii tax id number prefixes also make it possible to know the associated tax type at a glance. If you have questions about the general excise tax license, the hawaii department of taxation has a guide to sales taxes in hawaii.

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Rental Application Templates Hawaii Rentals

Hawaii tax id number (e.g.

Hawaii general excise tax id number. For online applications, an email is sent to you with the general excise identification number within three to five days and after this process you should receive your license within a week. Individual income • 01201 : Use this search engine to find the latest hawaii tax id numbers for cigarette and tobacco, fuel, general excise, seller’s collection, transient accommodations, use, and withholding tax accounts.

The get is a privilege tax imposed on business activity in the state of hawaii. The general excise tax license is sometimes referred to as a seller’s permit, sales tax number, or sales tax license. If you received a letter saying that you owe hawaii general excise tax or transient accommodations tax, click here for help.

What is the general excise tax (get)? General excise (ge) • 07420 : If you have more than one business

To avoid inconveniencing taxpayers, the department will continue to process returns and payments received with old hawaii tax id numbers. The license certificate must be displayed at your place of business. And if your partnership ends and a different one is formed, the.

If you think you might want to hire us to help prepare your hawaii ge taxes, please contact us here. Transient accommodations (ts) • 01130 : To learn more about hawaii tax i.d.

General excise tax license search. You also need to obtain any additional (and required) tax licenses. Application, you will receive your general excise tax license certificate in the mail.

Rental vehicle (rv) • 01311 : The ge account type stands for general excise/use and county surcharge tax. The general excise tax license and resale certificate are commonly thought of as the same thing, but they are actually two separate documents.

For example, if you have incorporated your llc, you may need a new hawaii tax id number. Individual estimated • 02230 : The hawaii state tax id:

Register for various tax licenses and permits with the department of taxation (dotax) and to obtain a corresponding hawaii tax identification number (hawaii tax i.d. Tax services hawaiʻi tax online. You need to obtain a hawaii tax id number (from the hi department of taxation) after your llc is formed.

Licenses and certificates of registration reflecting new hawaii tax id numbers were mailed to taxpayers with active ge, rv,. You will receive your hawaii tax id immediately. This id number should not be associated with other types of tax accounts with the state of hawaii, such as income tax.

This is your license or registration number for your general excise/use and county surcharge tax (ge) account. Do it yourself in hawaii. Check on whether a business or individual has a general excise tax license with the state of hawaii department of taxation.

Yes, type in name of vendor in hawaii department of taxation's website and see if a general excise tax license numbers is found. Public service ( ps ) Is there written guidance by the state of hawaii department of taxation that explains general.

While hawaii tax id numbers have changed for corporate income, franchise, and public service company tax accounts, existing federal employer i.d. Is there a way to find out if vendor is licensed for general excise tax purposes? The tax is imposed on the gross income received by the person engaging in the business activity.

Withholding (wh) • 20070 : Or if you have received a new charter from the secretary of state, your corporation will need a new id. Your license certificate will be printed with your hawaii tax identification number, taxpayer name, business name (dba) if you have one, and address.

If you rent out real property located in hawaii, you are subject to hawaii income tax and the general excise tax (get). You can register online and receive your tax i.d. Is a resale certificate the same as a sales tax id?

Your “gross income” is the total of all your business income before you deduct your business expenses. General excise ( ge ) 15095 : It offers a number of online resources for consumers including licensee status and licensing complaints, tax and business registration, and other educational materials.

Hawaii Tax License Search

Hawaii Tax License Search

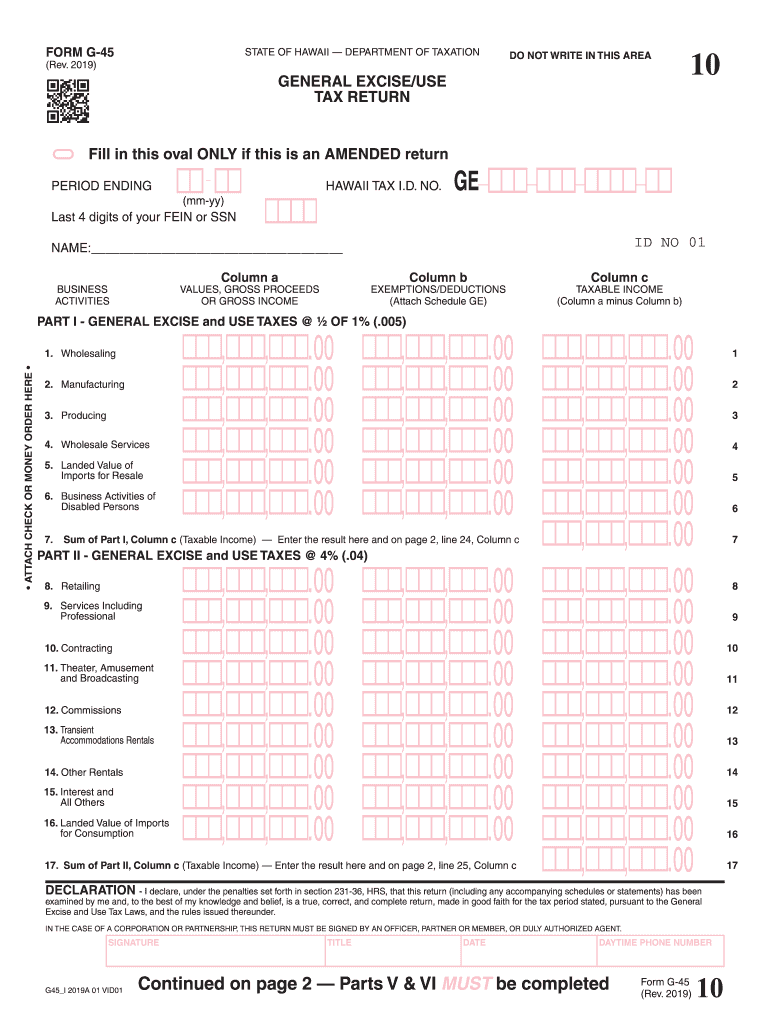

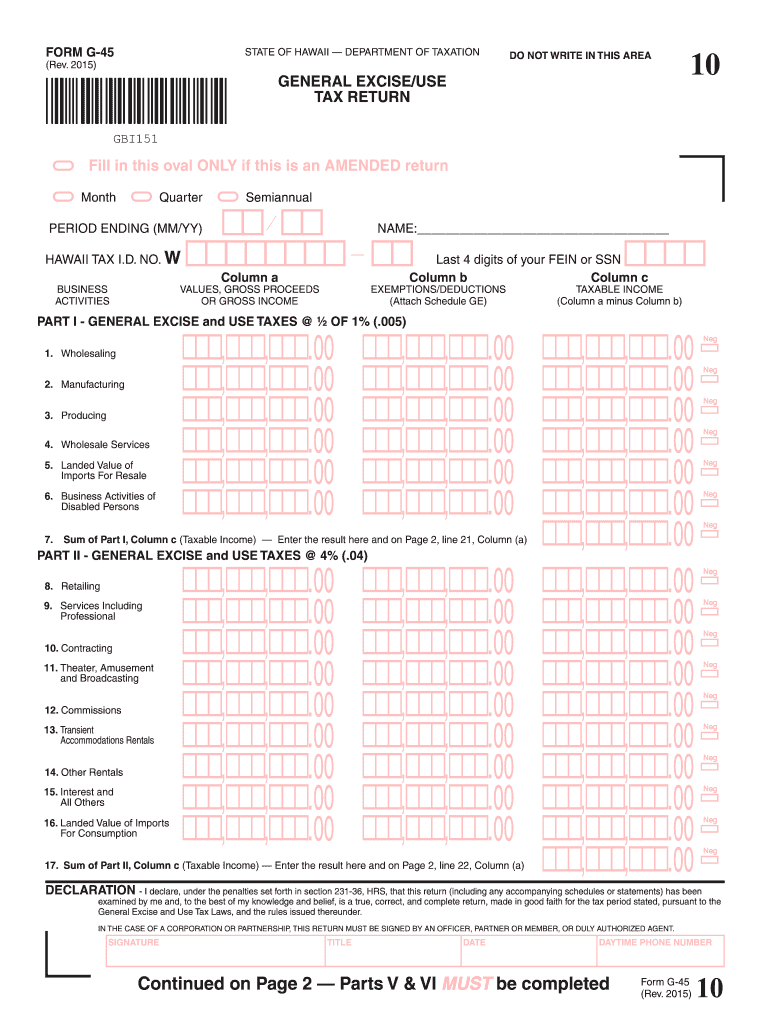

General Instructions For Filing General Excise Use Tax – Hawaiigov

2019-2021 Form Hi Dot G-45 Fill Online Printable Fillable Blank – Pdffiller

Hawaii State Tax – Golddealercom

Tax Clearance Certificates Department Of Taxation

Hawaii General Excise Tax Everything You Need To Know

County Surcharge On General Excise And Use Tax Department Of Taxation

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners – 2019 – Youtube

Sales Tax Tuesday 2018 Hawaii Special Edition – Insightfulaccountantcom

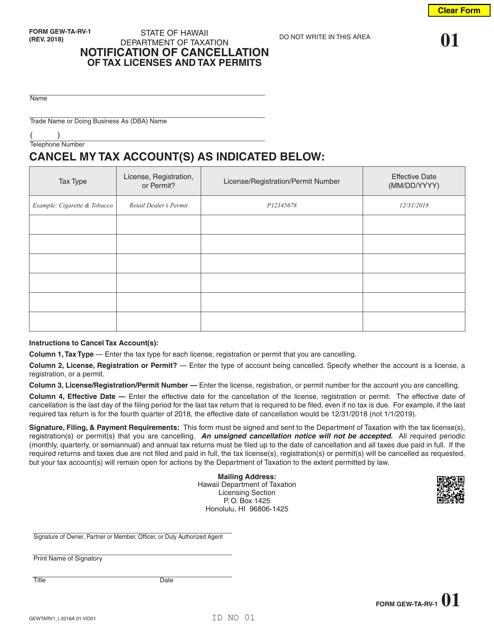

Hawaii Tax Form Gew Ta Rv 1 – Tax Walls

Hawaii General Excise Tax Everything You Need To Know

How To File And Pay Sales Tax In Hawaii Taxvalet

Licensing Information Department Of Taxation

Tax Preperation On Oahu Executive Accounting Solutions

Videos Department Of Taxation

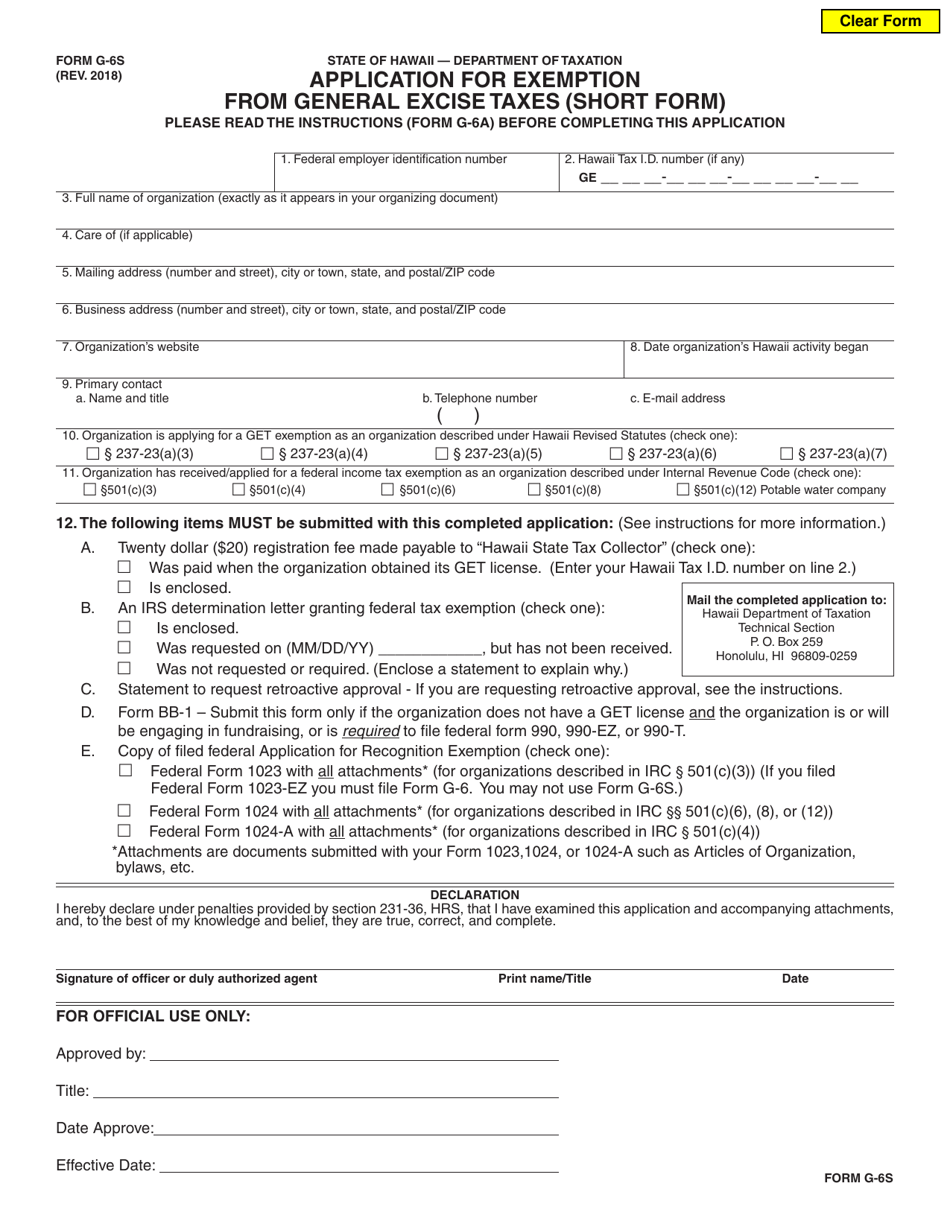

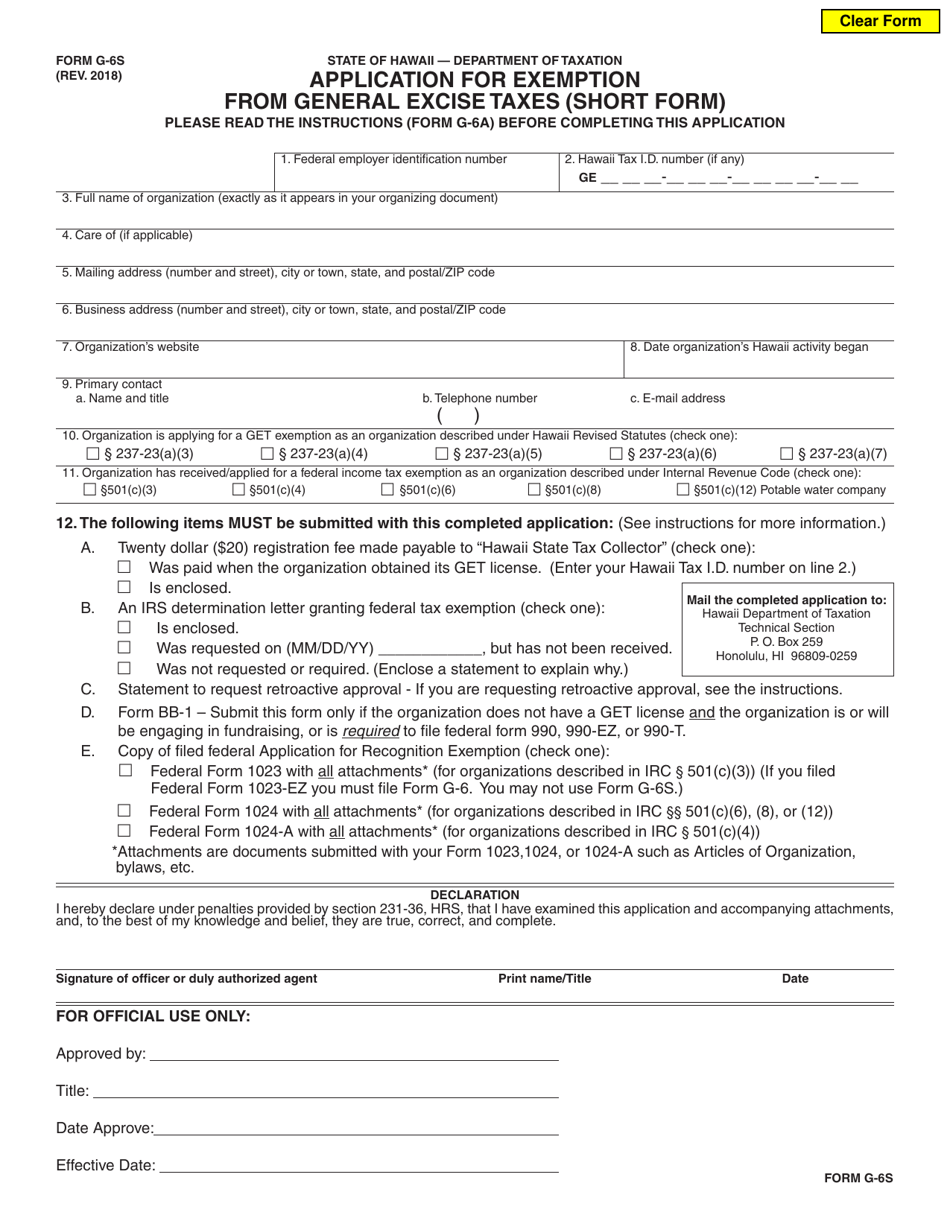

Form G-6s Download Fillable Pdf Or Fill Online Application For Exemption From General Excise Taxes Short Form Hawaii Templateroller

Pin On Limited Liability Company Llc

Form G 45 Hawaii General Excise Tax – Tax Walls