The cra can also take away your provincial medical plan or your gst cheques/ other benefits if you don’t pay this on time. Not filling out your tax each year is not seen as if you criminally lied or cheated on your tax by committing fraud.not doing your taxes will cost interest owing but is not fraud.you have a good reason which with a letter from a medical person could in theory result in a medical tax refund in some form…not to fear in other words but just call up and explain the situation and they will.

What To Do If You Havent Filed Taxes In 10 Years – Debtca

If you haven't filed your taxes in several years, try not to worry too much.

Haven't filed taxes in 5 years canada. I'd strongly suggest that you proceed with the earliest practical open year first which would be. The cra doesn’t need some elaborate reason. Haven’t filed tax returns in years / voluntary disclosure program (vdp) you want to file your income taxes but you haven’t done so for years.

Failure to file a tax return. I didn't file for 5 years in my early 20s and i was able to sort it out on my own, but that's because i didn't have any rrsp or tfsa contributions at the time, and only had regular employment income with nothing else special except school deductions. That said, you’ll want to contact them as soon as possible to explain the situation of your case.

Give yourself credit for getting it done and await receipt of your notice(s) of assessment. I moved to holland 13 years ago from canada and worked here for 9 years. People fall behind on their taxes all the time for various reasons, and the situation may not be as bad as you think.

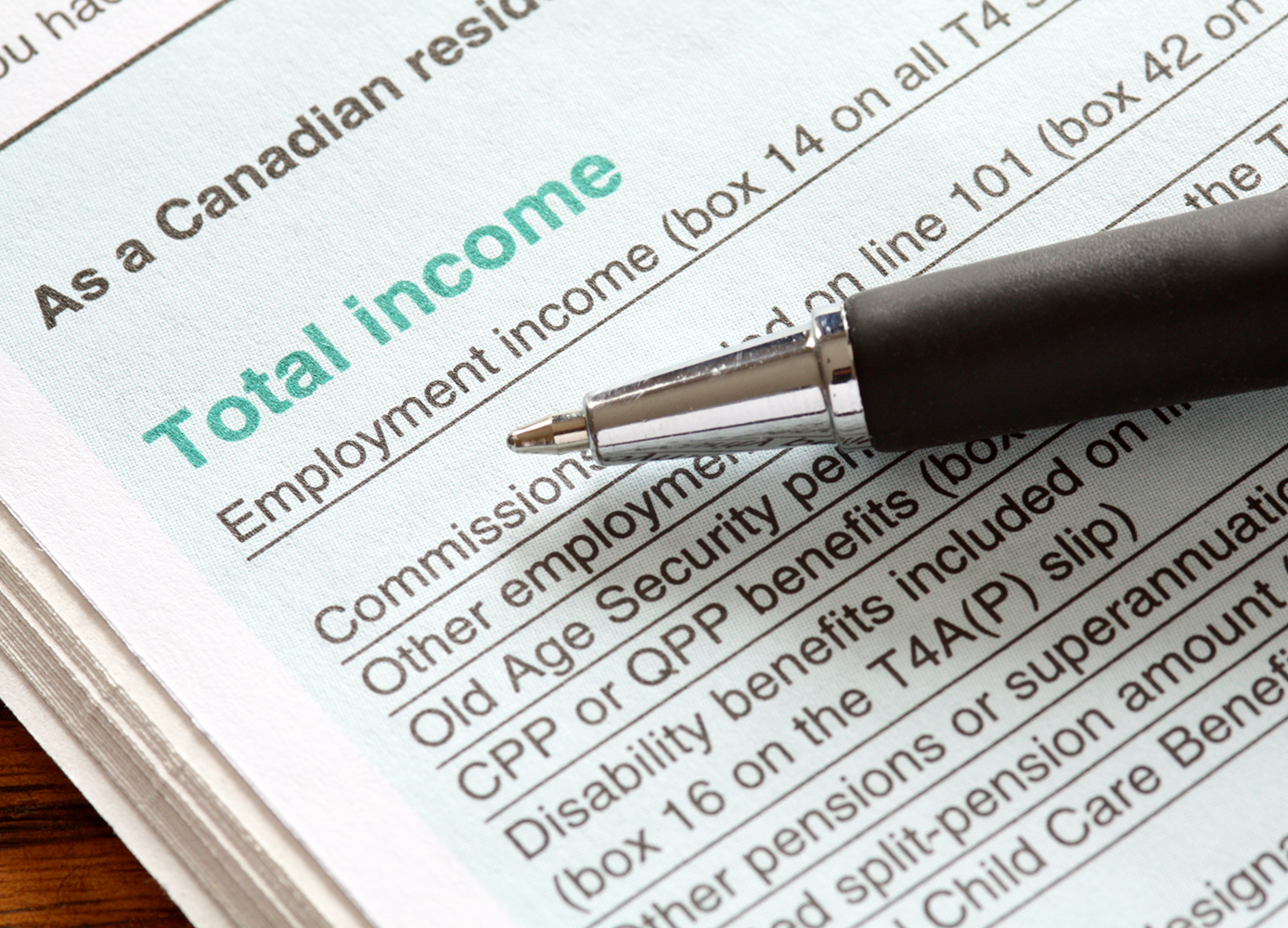

If you are required to file your taxes, you should file your taxes in full and on time. 1/ if you already have a cra account you will be able to see the past assessments and amounts from tax slips there. If you owe taxes and did not file your income tax return on time, the cra will charge you a late filing penalty of 5% of the income tax owing for that year plus 1% of your balance owing for each full month your return is late to a maximum of 12 months.

Last year, more than 10.92 million refunds were issued, totalling more than $30.91 billion with an average refund of $2829, says chapman. No matter how long it’s been, get started. To see when you last filed and to get missing tax slips, like t4s or t5s, you have a few options.

The first thing you should do is contact the cra. Just tell them the truth. Visit the dave ramsey store today for resources to help you take control of your money!

Finalize returns and submit to cra. Individuals who owe taxes for 2017 have to pay by april 30, 2018. Yes, file your taxes and if you haven’t filed for a year or two—or more—speak with a tax professional who can help you get it resolved.

What motivates people to file tax returns? If you haven’t filed your taxes with the cra in many years, or if you haven’t paid debt that you owe, you should act to resolve the situation. Haven't filed taxes in 3 years canada.

In general, most people get a refund from their tax return. We, as chartered professional accountants (cpa, ca’s) have successfully […] If you haven’t filed in years and the cra has not yet contacted you about your late taxes, apply to the voluntary disclosure program as soon as possible.

If you haven't filed tax returns in 3 years? But now i'm worried again. This is a story we hear all too often.

I am married with one. Ok, i thought i had this sorted. I mean, it’s not something that i would personally want to do, but it’s possible.

If convicted of tax evasion, you must repay the full amount of taxes owing, plus interest and any civil penalties assessed by the canada revenue agency (cra). Now i'm working on getting my life back together and i need to do taxes. Get in contact with an accountant who specializes in taxes, explain the situation, and get your paperwork in.

Have you been contacted by or acted upon canada revenue agency (cra) including a request to file or a notional assessment (of exaggerated estimated amounts owing just to get yo the failure to file. (if you don't have a cra account you will need to numbers from a 2018 or 2019 tax return to apply for a password.) If you owe money to the cra, you will endure a late filing penalty of 5% of your unpaid taxes, plus 1% a month for 12 months from the filing due date.

But if you’re due a tax refund in canada, technically you have up to 10 years to file your tax returns. I haven't filed taxes in 5 years! If the cra hasn’t been trying to contact you for the years that you haven’t filed taxes, consider that a good sign.

I went through a pretty bad mental health crisis a while ago and through the period and recovery i neglected a lot in my life. Feb 15th, 2017 12:01 pm. Therefore all 15 years are technically open.

Most canadian income tax and benefit returns must be filed no later than april 30, 2018. The longer you wait to file your taxes, the more penalties you will owe, and the likelihood of the cra seeing your avoidance as tax evasion increases. I haven't filed taxes for over 5 years and can't do it online, and i'm scared to ask the government what to do.

Did you miss the latest ramsey show episode? March 19, 2021 sonora nbij. Say goodbye to debt forever.

Note that the liability for multiple years is accumulated on the assessment. Ignoring tax time year on year may cheat you out of a lot of money. You don’t know where to start and you’re worried about the consequences.

Your assessments should be matched to what was filed and reviewed for penalties and interest inclusions. Without returns being filed the statue of frauds never starts running.

Itax Canada – Home Facebook

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

What If I Cant Pay My Taxes In Canada – Loans Canada

Is There A Penalty For Filing Taxes Late If You Dont Owe Late Tax Filing Liu Associates Edmonton Calgary

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

Self-employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Income Tax Business Tax Finance Bloggers

How Are Tax Refunds Affected In A Bankruptcy – Bankruptcy Canada

2 Million Canadians Who Havent Yet Filed Taxes Could Face Benefits Interruption Cra Warns – National Globalnewsca

Filing Your Taxes When You Have No Income – Loans Canada

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

How To File Overdue Taxes – Moneysense

When Is Too Late To File A Canadian Tax Return

Pin On Tax Tips

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

2 Million Canadians Who Havent Yet Filed Taxes Could Face Benefits Interruption Cra Warns – National Globalnewsca

Dont Wait Any Longer To File Your Taxes – Good Times

Filing Back Taxes And Old Tax Returns In Canada – Policyadvisor

Canadian Tax Requirements For Nonprofits And Charitable Organizations