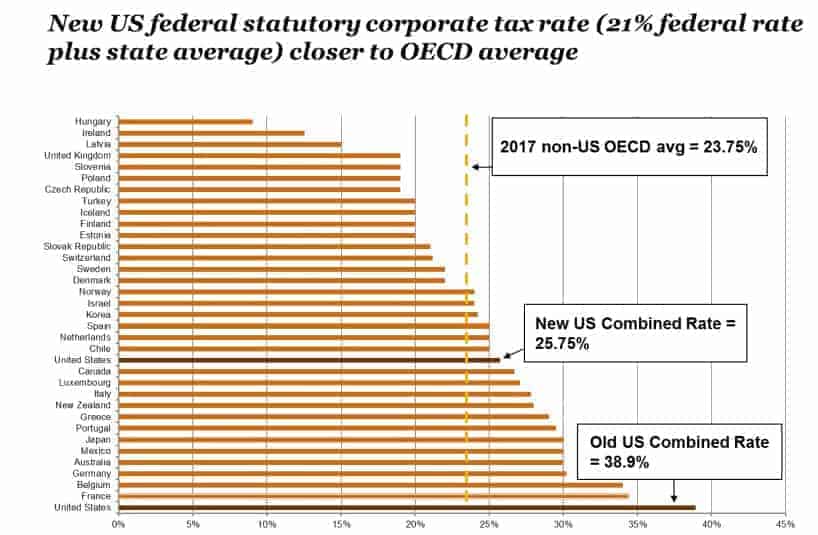

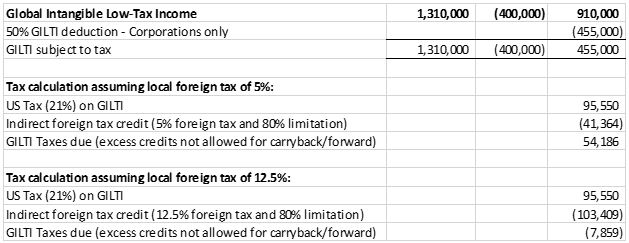

As discussed in a prior pwc insight, section 951a requires a us shareholder to include in income the gilti of its cfcs. Corporate income tax rate were retained.

Tax Readiness The High Tax Exception – Gilti And Subpart F Pwc

Gilti as charged (3rd booking):

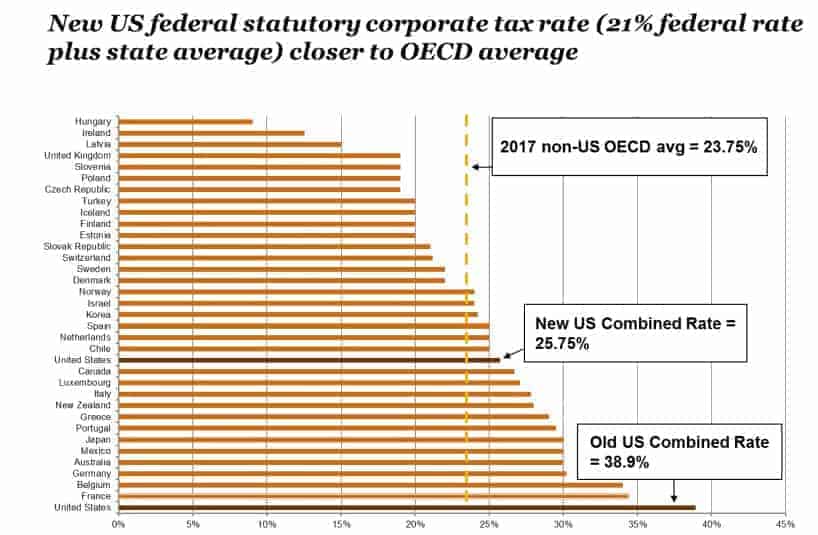

Gilti high tax exception pwc. The proposed regulations provide guidance on carving out an exception from gilti gross tested income for certain income subject to ‘high tax’ in a foreign jurisdiction, as well as amending the treatment of domestic partnerships for purposes of determining a foreign corporation’s status as a cfc and 954(b)(4) was significantly affected by the law known as the tax cuts and jobs act (tcja), p.l. While the full amount of gilti is includible in the us shareholder’s income, the net gilti inclusion is reduced through a 50% deduction in tax years beginning after december 31, 2017, and before january 1, 2026 (and a 37.5% deduction in tax years beginning after december 31,.

What is the gilti high tax exception? If the cfc earns income from a foreign jurisdiction with a high tax rate, the high tax exception rules acknowledge that intangible property allocated to that. On july 23, 2020, the u.s.

Shareholders in which or with which those tax years of foreign corporations end. While the full amount of gilti is includible in the us shareholder’s income, the net gilti inclusion is reduced through a 50% deduction in tax years beginning after december 31, 2017, and before january 1, 2026 (and a 37.5% section 163(j) business interest expense limitation. Mary van leuven, j.d., ll.m.

Shareholder that owns a cfc. The gilti high foreign tax exception allows a complete exclusion of gilti tested income from the federal taxable income of a u.s. Federal corporate income tax rate.

While the full amount of gilti is includible in the us shareholder’s income, the net gilti inclusion is reduced through a 50% deduction in tax years beginning after december 31, 2017, and before january 1, 2026 (and a 37.5% section 163(j) business interest expense limitation. High tax exception gilti pwc. Kpmg observation however, in certain cases it may still prove beneficial for a taxpayer to convert what would otherwise by tested income into subpart f income.

In addition, we will discuss the gilti guidance on a pwc webcast: The final gilti hightax exception from reg. Shareholder that owns a cfc.

As a result, taxpayers lobbied the u.s. To be eligible for the exclusion, the cfc’s earnings must be subject to an effective foreign corporate income tax rate that is greater than 90% of the current u.s. High tax exception gilti pwc.

Practical Considerations From The Hte Regulations Pwc

Us Cross-border Tax Reform And The Cautionary Tale Of Gilti

Lwcom

Gilti As Charged 3rd Booking The 2020 High-tax Exception Regs Pwc

Global Residence Citizenship Report 2017 Global Investor Handbook

Pwccom

Global Intangible Low-tax Income – Working Example Executive Summary – Mksh

Gilti As Charged Part 2 The Final Regs And High Tax Exception Pwc

Pwccom

The Tax Times Final Regs Provide That Gilti High-tax Exception Is Retroactive

Thesuitepwccom

Us Cross-border Tax Reform And The Cautionary Tale Of Gilti

Pwccom

Us Cross-border Tax Reform And The Cautionary Tale Of Gilti

Cross-border Tax Talks Podcast – Free On The Podcast App

Gilti As Charged 3rd Booking The 2020 High-tax Exception Regs Pwc

Lwcom

Us Cross-border Tax Reform And The Cautionary Tale Of Gilti

The High Tax Exception – Gilti And Subpart F Tax Readiness Podcast Podtail