Georgia property tax relief, inc. Calhoun this article explores the current state of georgia’s property tax exemption under o.c.g.a.

Taxes In Georgia Country Income Corporate Vat More

On the bright side, the georgia general assembly has been successful in offering property tax incentives which provide significant tax relief for agricultural lands, forest lands, environmentally sensitive areas and residential transitional properties which have saved landowners millions of dollars in tax relief.

Georgia property tax relief. The county board of tax assessors must send an annual notice of assessment which gives the taxpayer information on filing a property tax appeal on real property (such as land and buildings affixed to the land). Business inventory is exempt from state property taxes (as of january 1, 2016). The $2,000 is deducted from the 40% assessed value of the homestead.

On the bright side, the georgia general assembly has been successful in offering property tax incentives which provide significant tax relief for agricultural lands, forest lands, environmentally sensitive areas and residential transitional properties which have saved landowners millions of dollars in tax relief. Our staff has a proven record of substantially reducing property taxes for residential and commercial clients. The freeport exemption, offered by several of the state’s local governments, allows georgia manufacturers to exempt finished goods surplus inventory from ad valorem tax within.

Individuals 65 years or older may claim a $4,000 exemption from all state and county ad. Residents of georgia are required to file a return of their real property in the county where the real property is located. The law provides that property tax returns are due to be filed with the county tax receiver or the county tax commissioner between january 1 and april 1 (o.c.g.a.

Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary, legal residence and up to 10 acres of land surrounding the residence. Property in georgia is assessed at 40% of the fair market value unless otherwise specified by law. If the county board of tax assessors disagrees with the taxpayer’s return on personal property (such as airplanes, boats or business equipment and inventory), the board.

In a county where the millage rate is 25 mills the property tax on that (1) the property is committed to and held in good faith for an exempt use; Ad valorem tax, more commonly known as property tax, is a large source of revenue for governments in georgia.

Tax amount varies by county. The basis for ad valorem taxation is the fair market value of the property, which is established january 1st of each year. The basic formula to figure the tax on a home using the state's standard $2,000 homestead exemption is:

This does not apply to or affect county, municipal or school district taxes. We lower the property tax burden for parcels all across georgia and the atlanta area. We lower the property tax burden for parcels all across georgia and the atlanta area.

A level one freeport exemption may exempt the following types. To apply for this exemption you will need to bring your georgia driver’s license and a letter from the veterans administration stating that you are 100% disabled or paid at the 100% rate. Standard homestead exemption from georgia property tax.

Georgia property tax relief, incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of georgia property owners. Georgia manufacturers can receive temporary property tax relief for property tax year 2021, with the passage of hb 451, which expands the state’s level 1 freeport inventory exemption. The tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market.

The median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. The statewide exemption is $2,000, but it applies only to the statewide property tax, which is a relatively small slice of the overall property taxes in most areas. Almost all (93 percent) of georgia's counties and over 140 of the cities have adopted a level one freeport exemption, set at 20, 40, 60, 80 or 100 percent of the inventory value.

Georgia’s property tax exemption for charities after nuci phillips by clark r. Georgia property tax relief, inc. There are also a number of property tax exemptions in georgia that can reduce your home's assessed value and, therefore, your taxes.

Counties in georgia collect an average of 0.83% of a property's assesed fair market value as property tax per year. Fair market value means the amount a knowledgeable buyer would pay for the property and a willing seller would accept for the property at an arm's length, bona fide sale.

Property Taxes Milton Ga

Exemptions To Property Taxes Pickens County Georgia Government

Georgia Revenue Service Responses To Covid-19 Pandemic Intra-european Organisation Of Tax Administrations

2

2

Are There Any States With No Property Tax In 2021 Free Investor Guide

2

2

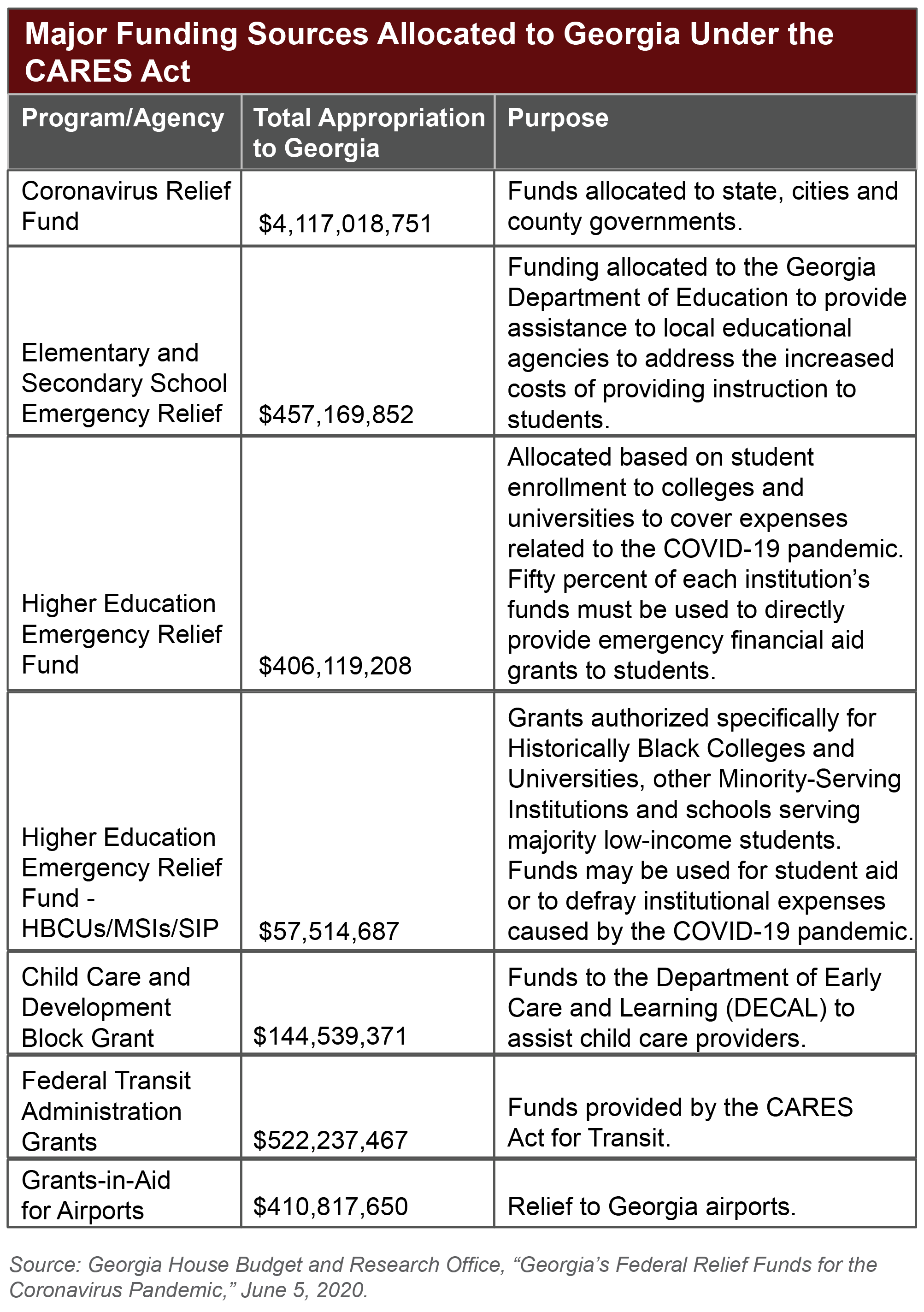

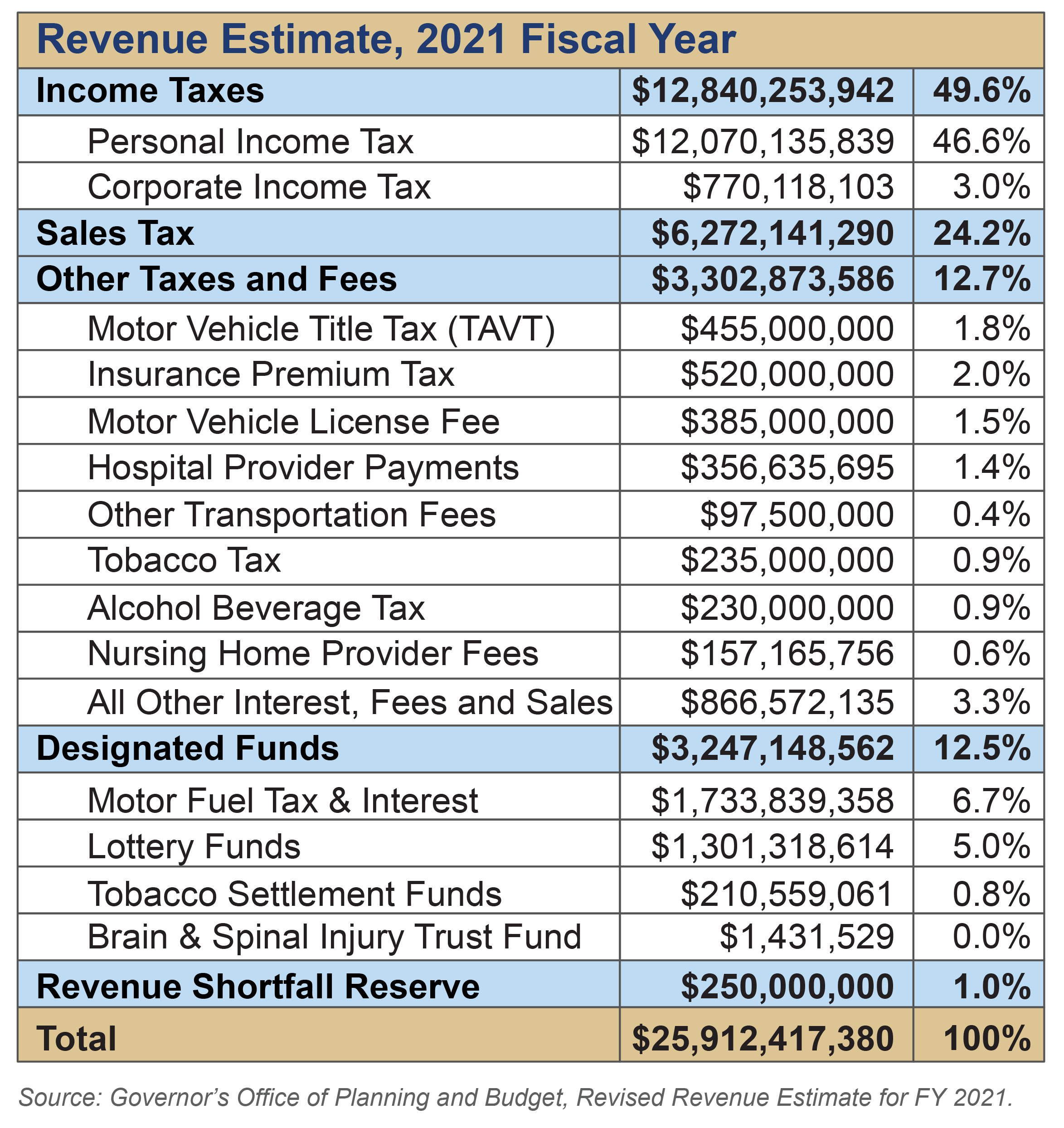

Georgia Revenue Primer For State Fiscal Year 2021 – Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 – Georgia Budget And Policy Institute

Are There Any States With No Property Tax In 2021 Free Investor Guide

Dekalb County 119 Million Property Tax Cut On The Way Dekalb County Ga

Heres What Homeowners Should Know About The Homestead Exemption

2

Disabled Veterans Property Tax Exemptions By State

Tips For Lowering Your Property Tax Bill In 2020 – Atlanta Tax

2

2

New Resident – Cobb Taxes Cobb County Tax Commissioner