Vermont does not permit portability of its estate tax exemption. Georgia has no inheritance tax, but some people refer to estate tax as inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The sale, use, storage, or consumption of energy which is necessary and integral to the manufacture of tangible personal property at a manufacturing plant in this state shall be exempt from all sales and use taxation except for the sales and use tax for educational purposes.

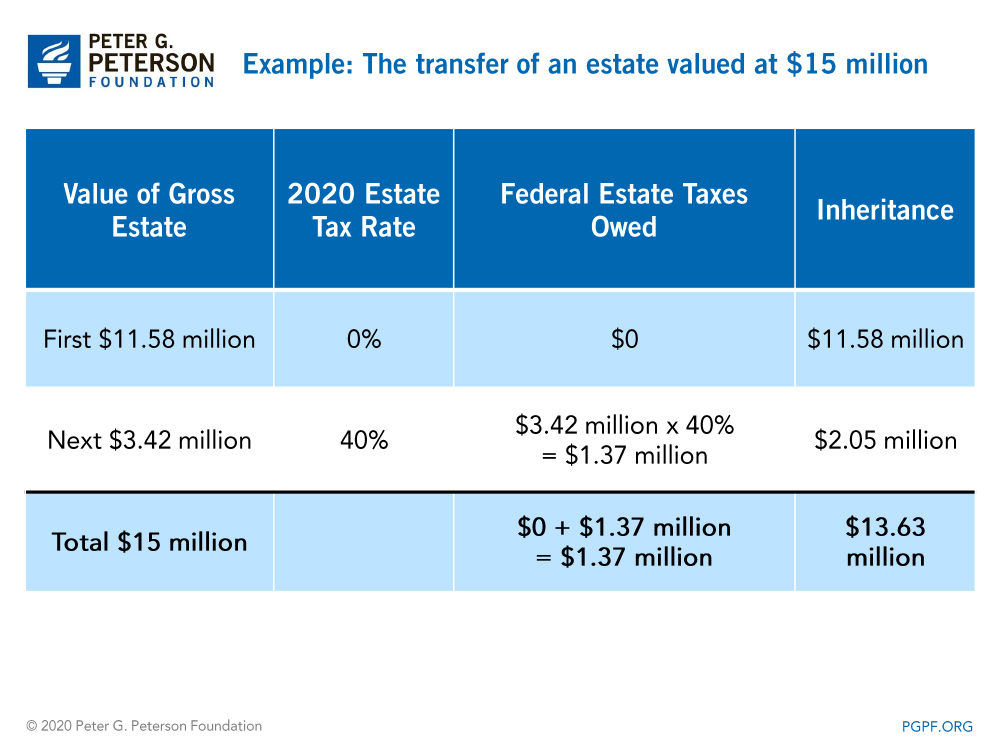

Georgia estate tax exemption 2020. Georgia's estate tax for estates of decedents with a date of death before january 1, 2005 is based on federal estate tax law. For 2020, the estate tax exemption is set at $11.58 million for individuals and $23.16. For 2020, the estate tax exemption is set at $11.58 million for individuals and $23.16.

The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023. No estate tax or inheritance tax. Georgia referendum a, property tax exemption for certain charities measure (2020) georgia referendum a, the property tax exemption for certain charities measure, was on the ballot in georgia as a legislatively referred state statute on november 3, 2020.

The higher exemption will expire dec. For more information on vehicle tax exemptions, contact your local county tax office. The $11.7 million exemption above means estates can subtract that amount from their total if they’re worth more than that.

No estate tax or inheritance tax. The maximum federal estate tax rate is 40 percent on the value of an estate above that amount. The state income tax rates in georgia.

Tax is tied to federal state death tax credit. So if an estate has a $12 million value, it will only pay estate taxes on. The top estate tax rate is 16 percent (exemption threshold:

No estate tax or inheritance tax. What this means is that anyone with an estate worth less than $5.45 million most likely owes no tax. Check the 2020 georgia state tax rate and the rules to calculate state income tax 5.

No estate tax or inheritance tax Program early, either intentionally or unintentionally, the buyer will be responsible for any tax penalties and hold the seller harmless from and against tax liabilities and penalties resulting from the removal of the property from the program. In 2026, the exemption is predicted drop to about $6,600,000 per person.

The federal estate tax exemption is $11.18 million in 2018. Includes $20,000 off the assessed value on county, $20,000 off school, and $20,000 off recreation. The tax cuts and jobs act, signed into law in 2017, doubled the exemption for the federal estate tax and indexed that exemption to inflation.

Does georgia have an estate tax? Counties in georgia collect an average of 0.83% of a property's assesed fair market value as property. The $2,000 is deducted from the 40% assessed value of.

Georgia's estate tax is based on the amount allowable. 2 the top tax rate is 12%. Claimant and spouse income cannot exceed $10,000 after deductions (use line 15c of your georgia tax return).

Calculate your state income tax step by step 6. The buyer also assumes any responsibility for any breach of preferential tax and homestead exemption. More specifically, georgia levies the following taxes:

Must be 65 years old as of january 1 of the application year. It increases the exemption to $16,500 for school taxes and $14,000 for county levies. Relatively few people paid federal estate taxes last year.

The $11.7m per person gift and estate tax exemption will remain in place, and will be increased annually for inflation until it’s already scheduled to sunset at the end of 2025. The tax is paid by the estate before any assets are distributed to heirs. Married couples may give up to $28,000 per person per year.

This tax is portable for married couples, meaning that if the right legal steps are taken a married couple’s estate won’t have to pay a tax on up to $22.36 million when both spouses die. As of july 1st, 2014, o.c.g.a. The exemption will increase with inflation to approximately $12,060,000 per person in 2022.

Georgia has no inheritance tax, but some people refer to estate tax as inheritance tax. 541 which increased the vermont estate tax exemption to $4,250,000 in 2020 and $5,000,000 in 2021 and thereafter. On june 18, 2019, vermont enacted h.

The higher exemption will expire dec. In 2020, the estate tax exemption was $11.58 million. Taxes, and increases the exemption to $14,000 for all county levies.

No separate state qtip election permitted. It is not paid by the person inheriting the assets. The top tax rate is 16%.

Exemptions offered by the state and counties. Even though there is no state estate tax in georgia, you may still owe money to the federal government. For 2020, the estate tax exemption is set at $11.58 million for individuals and $23.16 million for married couples filing jointly.

The top estate tax rate is 16 percent (exemption threshold: In addition to the lifetime exemption, individuals may make unlimited gifts of $14,000 per person per year without incurring any tax consequences. Standard homestead exemption the home of each resident of georgia that is actually occupied and used as the primary residence by the owner may be granted a $2,000 exemption from county and school taxes except for school taxes levied by municipalities and except to pay interest on and to retire bonded indebtedness.

Georgia estate tax rate 2020.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do The Estate Gift And Generation-skipping Transfer Taxes Work Tax Policy Center

Does Your State Have An Estate Or Inheritance Tax State Estate And Inheritance Tax Rates And Exemptions In 2020 – Skloff Financial Group

What Are Estate And Gift Taxes And How Do They Work

What You Need To Know About Georgia Inheritance Tax

Key 2020 Wealth Transfer Tax Numbers Murtha Cullina – Jdsupra

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Wealthy Families Hoping To Save On Taxes Are In Limbo Heres Why

State-by-state Estate And Inheritance Tax Rates Everplans

What You Need To Know About Georgia Inheritance Tax

2020 Year-end Tax Planning Georgia On My Mind Cpa Practice Advisor

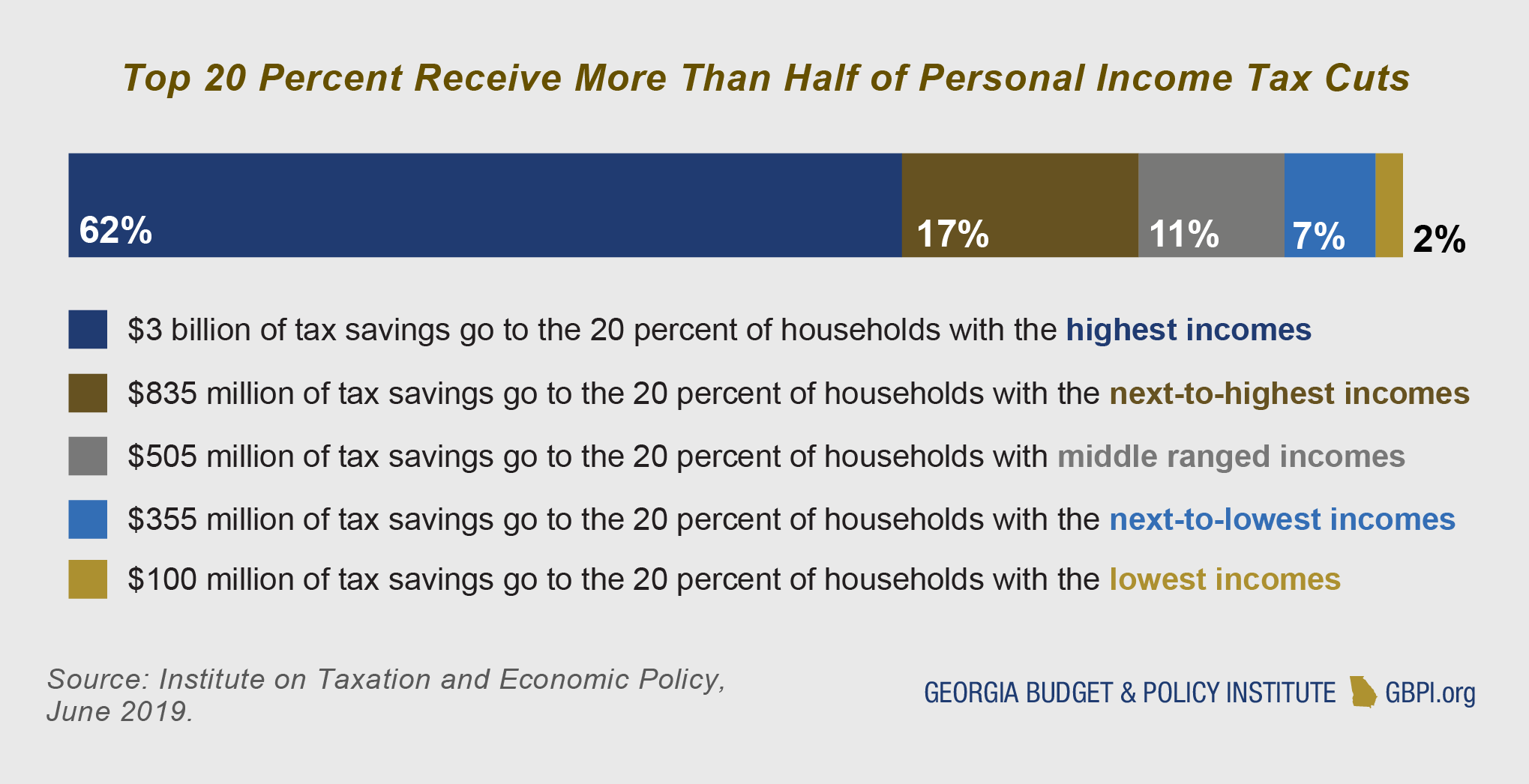

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits – Georgia Budget And Policy Institute

After The Georgia Runoff What Tax Planning Should You Do Now

Recent Changes To Estate Tax Law Whats New For 2019

Exploring The Estate Tax Part 1 – Journal Of Accountancy

Heres What Estate Taxes In Georgia Look Like

Estate Tax Exemptions 2020 – Fafinski Mark Johnson Pa

Estate Tax Rules To Know In Georgia Bomar Law Firm Llc

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits – Georgia Budget And Policy Institute