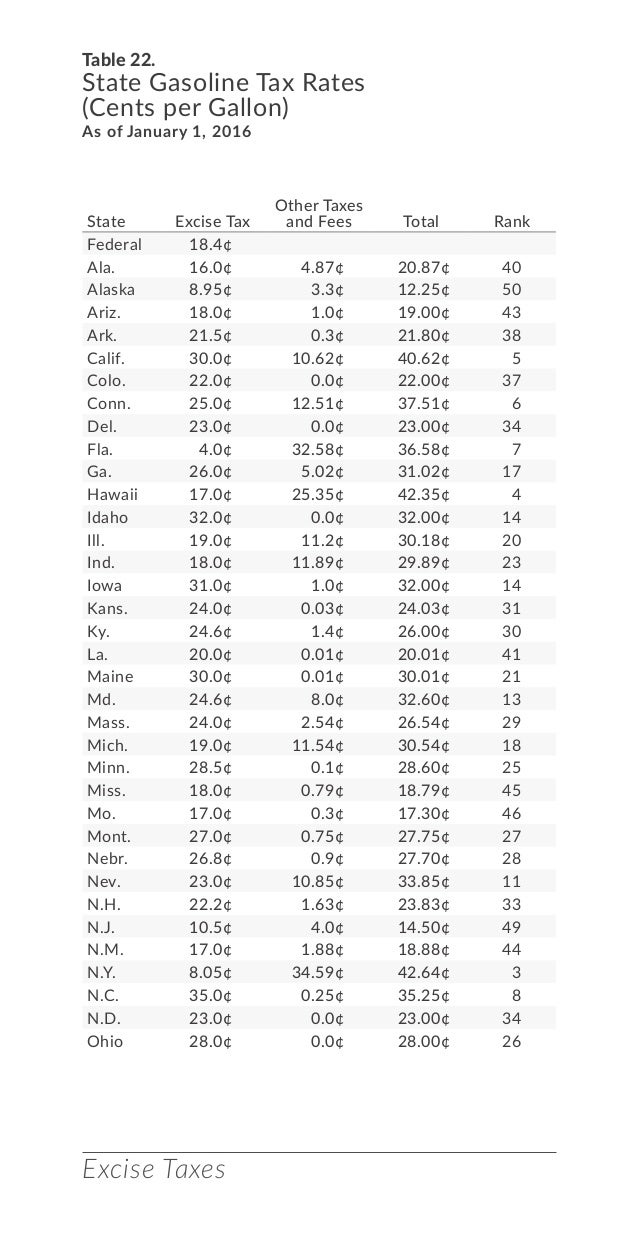

Nv invalid vehicle status memo updated: Motor fuels and alternative fuels tax rate from january 1, 2016 through june 30, 2016;

Facts Figures 2016 How Does Your State Compare

The lec acts as a liaison between the fuel tax administrators within the ifta membership and the fuel tax enforcement community by creating interest and promoting uniformity in fuel tax enforcement.

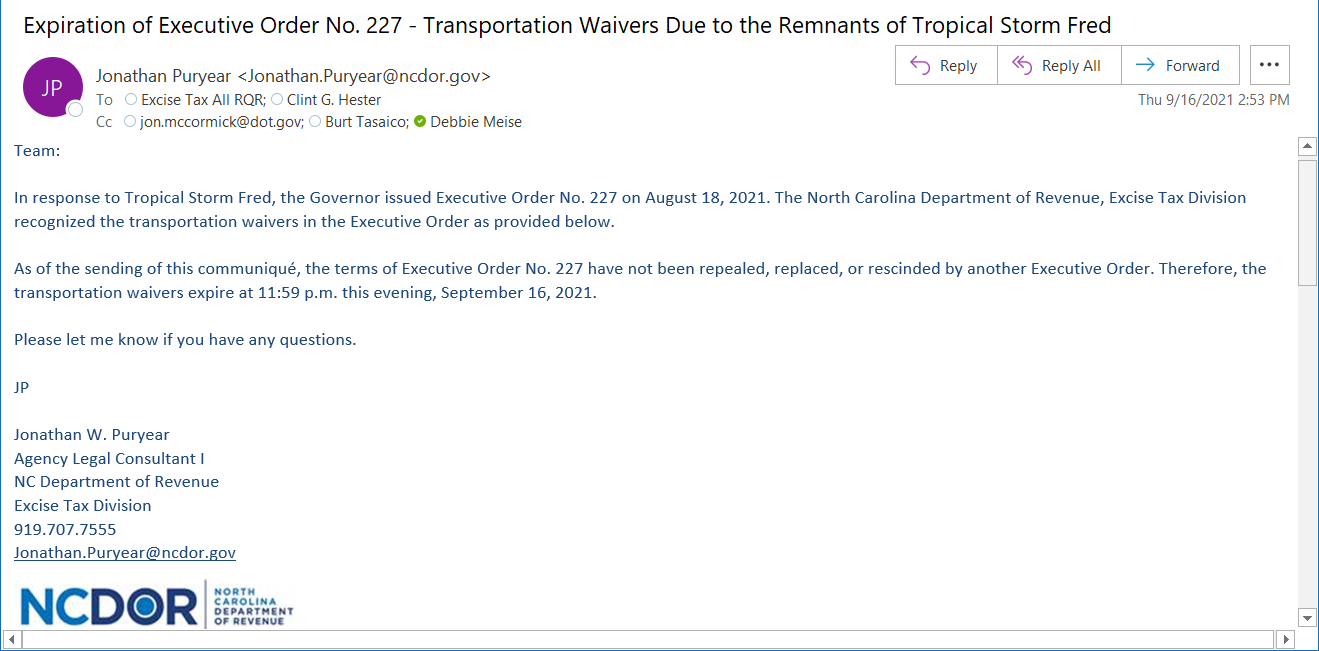

Excise tax division nc. Each new business should contact the north carolina department of commerce’s division of employment security at the address for information on unemployment taxes: Various reforms undertaken in et&nc department include legal reforms, administrative reforms, tax. Address the envelope to the attention of the taxing division for the tax to which the event or condition applies.

(9 days ago) sep 25, 2020 · when ownership in north carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property. Internal audit division director, daryl morrison See announcement covering april 1, 2015 through.

The move is scheduled for the week of may 10, 2021 and the office on rock quarry road will be closed from monday, may 10, through friday, may 14. Kerosene is generally taxed at $0.244 per gallon unless a reduced rate applies. North carolina charges an excise tax of $2.00 per thousand of the sales price.

Nc excise tax real estate. All retail operators must collect sales tax. Real estate excise tax, also known as revenue stamps, is imposed by north carolina law, and collected by the register of deeds at the time of recording.

Excise tax is customarily paid by the seller, but payment is dictated by the sales. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home. The nc department of revenue is a cabinet agency under the leadership of the secretary of revenue, the chief operating officer and three assistant secretaries.

Nc excise tax real estate real estate. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home. › verified 2 days ago

When ownership in north carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property. Mass scale reforms are underway in excise, taxation and narcotics control (et&nc) department khyber pakhtunkhwa under the reforms agenda of the incumbent provincial government to further improve their overall performance and ensure improved service delivery to the general masses. The state of north carolina charges an excise tax on home sales of $2.00 per $1,000.00 of the sales price.

North carolina department of revenue excise tax division 1429 rock quarry road suite 105, raleigh, nc 27610 telephone: The excise tax is deposited in the black lung disability trust fund. The new office on terminal drive will open on monday, may 17, 2021.

The following report to the secretary of revenue: Internal revenue code 4121 imposes an excise tax on coal from mines located in the united states sold by the producer. Learn more about the secretary.

Motor fuels and alternative fuels tax rate from april 1, 2015 through december 31, 2015; This tax is allowed to be paid by seller and is typically paid by seller, but the buyer must still negotiate with the seller so it is written accordingly in the contract. To fund public services benefiting the people of north carolina, the nc department of revenue administers the tax laws and collects the taxes due in an impartial, consistent, secure, and efficient manner.

North carolina department of revenue waives diesel fuel penalty due to hurricane florence The division will continue to operate by appointment only. The tax is levied on conveyances of an interest in real estate by all persons and organizations except federal, state, county, and municipal governments and their instrumentalities.

Law enforcement committee authority and purpose the lec is established by the ifta articles of agreement pursuant to article r1810.200.050. Transfer taxes in north carolina. Secretary of revenue ronald g.

Nc excise tax division › verified 5 days ago

Tax Department New Hanover County North Carolina

Pdf Who Pays Cigarette Taxes The Impact Of Consumer Price Search

Mvr63 – Fill Online Printable Fillable Blank Pdffiller

2

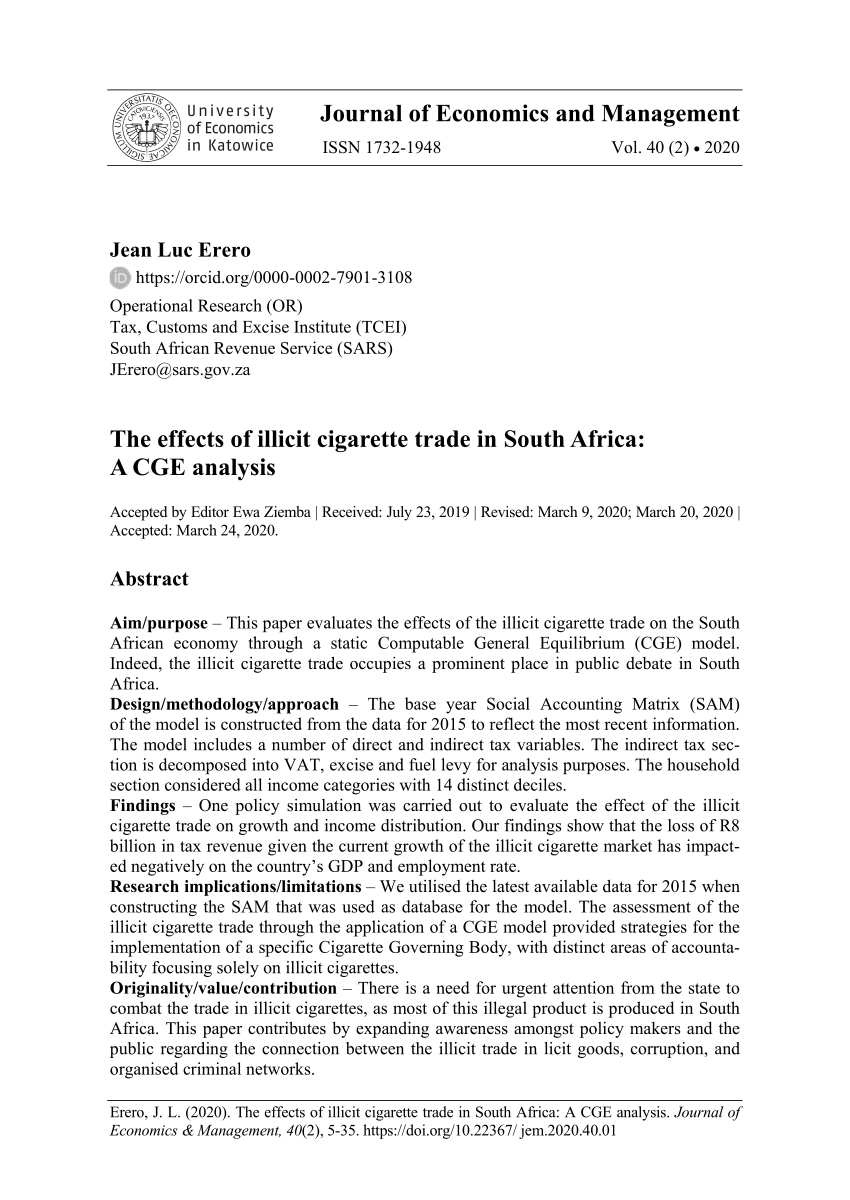

Pdf The Effects Of Illicit Cigarette Trade In South Africa A Cge Analysis

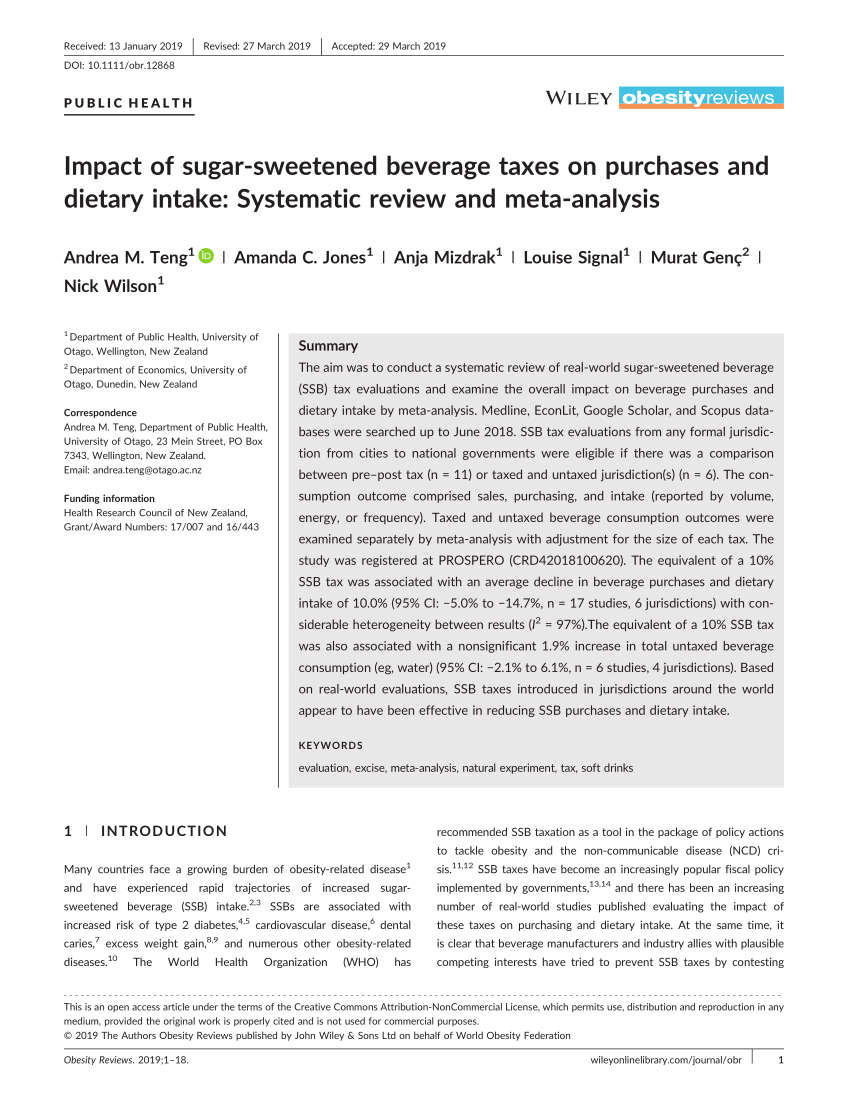

Pdf Impact Of Sugar-sweetened Beverage Taxes On Purchases And Dietary Intake Systematic Review And Meta-analysis

2

Cluster Solution-consumptive Orientation Download Table

Fet Compliance Ntda

Train Law Powerpoint Pdf Sugar Substitute Fructose

Pdf Who Pays Cigarette Taxes The Impact Of Consumer Price Search

Pdf The Role Of Creativity In Development Of Innovation In Tourism

Fet Compliance Ntda

Ifta Inc International Fuel Tax Association

2

File Pay Ncdor

File Pay Ncdor

31216 Corporate Income Tax Returns Internal Revenue Service

2