There is no applicable county tax, city tax or special tax. Property tax & records for fy22, the total value of taxable property in portland is $14.6 billion, which generates $190 million in property tax revenue to fund the operation of maine’s largest city.

How To Calculate Cannabis Taxes At Your Dispensary

You can print a 5.5% sales tax table here.

Excise tax calculator portland maine. 2,356 posts, read 5,367,704 times reputation: Year 1 0.024 year 2 0.0175 year 3 0.0135 year 4 0.010 year 5 0.0065 year 6 & Since books are taxable in the state of hawaii, mary charges her.

Every 2021 combined rates mentioned above are the results of maine state rate (5.5%). The sales tax jurisdiction name is maine, which may refer to a local government division. Excise tax amounts are based on the vehicle's msrp (manufacturer's suggested retail price) and year of manufacture.

Maine cities and/or municipalities don't have a city sales tax. The irs actually began to levy this tax in 2018, after it was included in the tax cuts and jobs act of 2017. The excise tax shall be paid as follows.

After 0.004 year one is the current model year (2020), year 2 is 2019, etc. . Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. You will need the complete information on the boat:

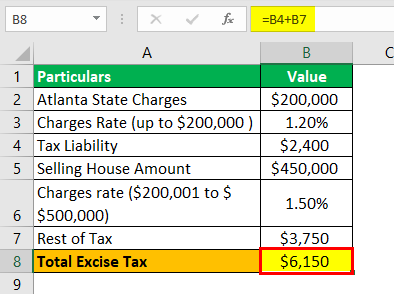

The msrp is multiplied by the mill rate according to the following chart. The motor vehicle excise tax is based on the manufacturer's suggested retail price when the vehicle was new, as taken from the window sticker. Even if your credit union hasn’t been affected by the.

Length, horsepower, serial number and me number if previously registered in maine. In maine, beer vendors are responsible for paying a state excise tax of $0.35 per gallon, plus federal excise taxes, for all beer sold. The 5.5% sales tax rate in portland consists of 5.5% maine state sales tax.

Please note the state of maine property tax division only provides quotes to the municipal excise tax collector and not to individuals. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. Overview of maine taxes maine has a progressive income tax system that features rates that range from 5.80% to 7.15%.

Trailers with a declared gross weight of 9,000 pounds or less are charged a flat rate vehicle excise tax of $8.00. The state excise tax on gas in maine is 30 cents per gallon of regular gasoline. Portland collects the maximum legal local sales tax.

The list of sales exempt from sales tax is found in title 36 section 1760, and that statute lists no less than 101 sales on which no tax is payable. The assessor’s department maintains tax records on over 24,000 real estate accounts, 3,200 business personal property accounts, and 481 tax maps. You can register a boat online with the state of.

The maine state statutes regarding excise tax can be found in title 36, section 1482. It is a calculator for figuring excise tax based on msrp and year of vehicle. Maine's general sales tax of 5.5% also applies to the purchase of beer.

How 2021 sales taxes are calculated in maine. You will pay excise tax, registration fees (plus an extra $10 fee for a milfoil sticker if the boat will be in used in fresh water), sales tax if a private sale or bought out of state. There is no county sale tax for maine.

This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. To calculate the excise on your vehicle the following scale is used: Maine residents that own a vehicle must pay an excise tax for every year of ownership.

Online calculators are available, but those wanting to figure their excise tax in maine can do so easily using a manual calculator or paper and pen. As though you don’t already know, maine charges 5.5% sales tax on all purchases except those exempted by statute. If the watercraft is owned by an individual resident of this state, the excise tax shall be paid to the municipality where the owner resides.

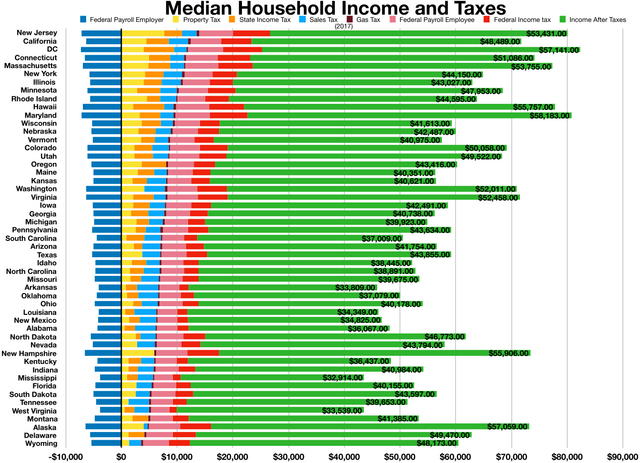

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. It includes groceries, as we all know, but also bibles, fuel used to. To renew registration any of the recreational vehicles listed above, you simply need to bring your registration for the previous year.

Like all states, maine sets its own excise tax. All applicable state of maine law requirements are followed in regards to excise tax credits. City of portland excise tax credits policy

The irs’s final regulations for the 21% excise tax levied against credit unions based on the income of certain highly compensated employees have been in place since january 2021. Directions hours media inquiries staff directory popular departments. City of portland 389 congress street portland, me 04101 phone:

The state general sales tax rate of maine is 5.5%. Any person who fails to pay a tax assessment for which no further administrative or judicial review is available pursuant to section 151 and the maine administrative procedure act is liable for a penalty in the amount of 25% of the amount of the tax due if the payment of the tax is not made within 10 days of the person's receipt of notice of demand for payment as provided by. Dog at large citation fine.

Excise tax is an annual tax that must be paid prior to registering your vehicle. The excise tax for watercraft owned by residents of indian reservations shall be paid to the tribal clerks.

Maine Auto Excise Tax Repeal Question 2 2009 – Ballotpedia

Sales Taxes In The United States – Wikipedia

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Welcome To The City Of Bangor Maine – Excise Tax Calculator

Welcome To Saco Maine

Excise Tax Information Cumberland Me

Welcome To Saco Maine

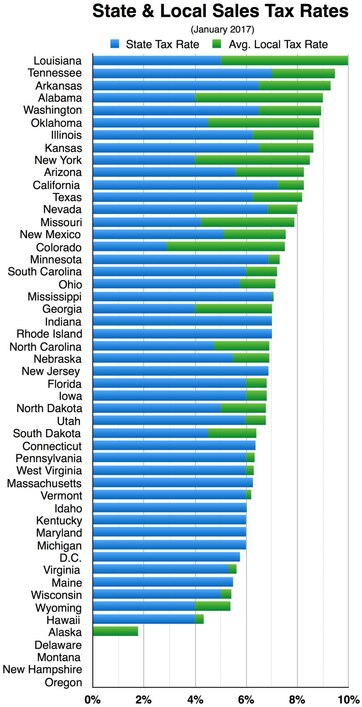

States With Highest And Lowest Sales Tax Rates

Sales Taxes In The United States – Wikipedia

I-team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

2

How High Are Spirits Taxes In Your State Tax Foundation

Maine Income Tax Calculator – Smartasset

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Want To Lower Maines Tax Burden Dont Forget To Consider Raising Incomes

Maine Income Tax Calculator – Smartasset

Welcome To The City Of Bangor Maine – Excise Tax Calculator

Maine Income Tax Calculator – Smartasset