The current total local sales tax rate in lewiston, me is 5.500%. The state’s average effective property tax rate is 1.30%, while the national average is currently around 1.07%.

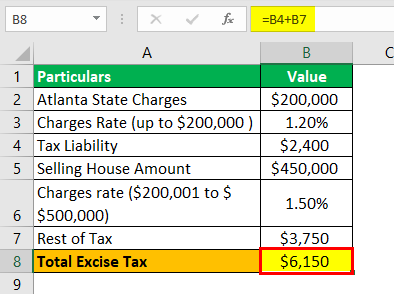

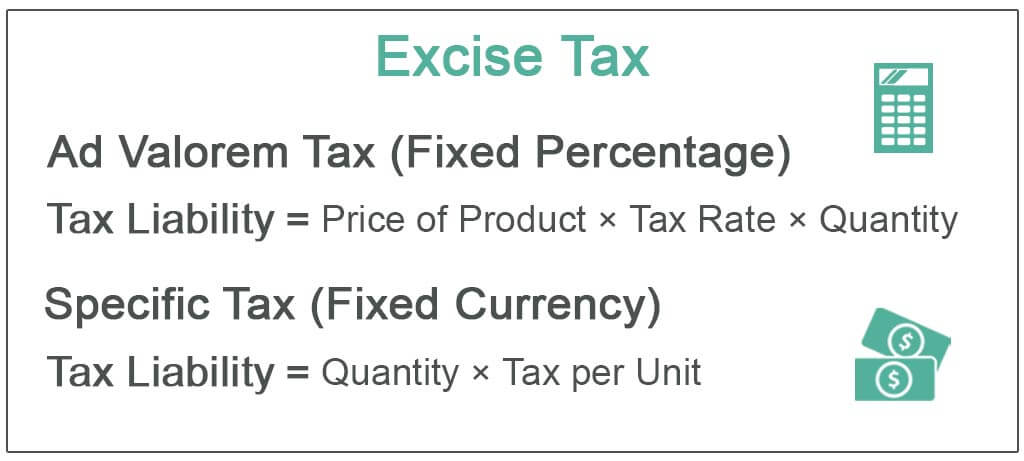

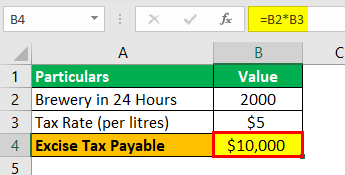

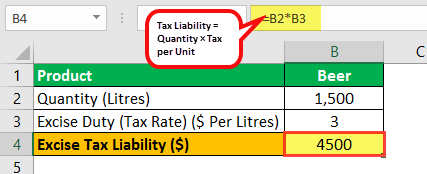

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Enjoy our quality of life.

Excise tax calculator lewiston maine. The county sales tax rate is %. Maine gas tax the state excise tax on gas in maine is 30 cents per gallon of regular gasoline. The state excise tax on gas in maine is 30 cents per gallon of regular gasoline.

Excise tax calculator this calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. The maine sales tax rate is currently %. The msrp is the manufacturer's suggested retail price of your vehicle.

The sales tax jurisdiction name is maine, which may refer to a local government division. For tax rates in other cities, see maine sales taxes by city and county. The 04240, lewiston, maine, general sales tax rate is 5.5%.

The excise tax due will be $610.80. If you have purchased a new or used vehicle from a maine licensed dealer, you may pay excise tax and complete the registration process in this office. City of lewiston is a locality in androscoggin county, maine.while many other municipalities assess property taxes on a county basis, city of lewiston has its own tax assessor's office.

Excise tax is an annual tax that must be paid prior to registering your vehicle. The tax rates range from 5.8% on the low end to 7.15% on the high end. If the owner establishes a permanent location for the camper, he is required to pay the state of maine a real estate property tax instead of the excise tax,.

Like all states, maine sets its own excise tax. Maine gas tax the state excise tax on gas in maine is 30 cents per gallon of regular gasoline. You may purchase new license plates or transfer license plates from your other.

This is the total of state, county and city sales tax rates. The typical maine resident will pay $2,597 a year in property taxes. This is only an estimate.

Maine residents that own a vehicle must pay an excise tax for every year of ownership. While many other states allow counties and other localities to collect a local option sales tax, maine does not permit local sales taxes to be collected. Waterville property owners now have the ability to pay current property taxes online with a card.

The december 2020 total local sales tax rate was 5.000%. Please note, jim is in the office every friday and every other wednesday. There is no applicable county tax, city tax or special tax.

As with in office card payments, there will be a 2.5% service charge added to the payment amount. If your property is located in a different androscoggin county city or town, see that page to find your local tax assessor. Pay in person lewiston city hall, 2nd floor 27 pine street, lewiston.

Now that we’re done with federal taxes, let’s look at maine’s state income taxes. The lewiston sales tax is collected by. Please contact the waterville finance office with any questions.

The state excise tax on gas in maine is 30 cents per gallon of regular gasoline. The amount of the tax is a calculation involving the manufacturer's suggested retail price and the year of the model. Property tax rates in maine are well above the u.s.

You can print a 5.5% sales tax table here. Online calculators are available, but those wanting to figure their excise tax in maine can do so easily using a manual calculator or paper and pen. The combined rate used in this calculator (5.5%) is the result of the maine state rate (5.5%).

Excise tax is an annual tax that must be paid prior to registering your vehicle. This service is offered through the state of maine’s online payment portal. The msrp is the 'sticker price' and not necessarily what you paid for the vehicle.

3 ballot, though municipal officials who oppose. To calculate your estimated registration renewal cost, you will need the following information: How 2021 sales taxes are calculated for zip code 04240.

The 5.5% sales tax rate in lewiston consists of 5.5% maine state sales tax. Other fees charged when purchasing a new vehicle you need to pay. After making this calculation, you know that you'll pay $58.18 in excise tax.

Excise tax is an annual tax that must be paid prior to registering your vehicle. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. Lewiston — maine voters get the chance to vote for lower motor vehicle excise taxes, thanks to a citizen’s initiative that placed it on the nov.

This is only an estimate. The minimum combined 2021 sales tax rate for lewiston, maine is. The excise tax due will be $610.80.

The lewiston, maine sales tax is 5.50%, the same as the maine state sales tax. Maine charges a progressive income tax, broken down into three tax brackets. The treasurer's office also serves as a state of maine renewal agent for registration of the following vehicles:

The lewiston sales tax rate is %. Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. A registration fee of $35.00 and an agent fee of $6.00 for new vehicles will also be charged for a total of $641.80 due to register your new vehicle.

The excise tax due will be $610.80.

I-team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Maine Income Tax Calculator – Smartasset

Analysis Current Vs Proposed Excise Tax On Cars – Feature Stories

Welcome To The City Of Bangor Maine – Excise Tax Calculator

What Is An Excise Tax Importing Into The United States

Lewiston Drops Property Tax Rate After Largest Valuation Increase In More Than A Decade – Lewiston Sun Journal

Do You Need To Worry About Excise Tax Nssf

Maine Income Tax Calculator – Smartasset

Welcome To Saco Maine

Welcome To The City Of Bangor Maine – Excise Tax Calculator

Excise Tax Information Cumberland Me

Maine Income Tax Calculator – Smartasset

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Maine Car Registration A Helpful Illustrative Guide

Excise Tax Definition Types How To Calculate Excise Tax Liability

Excise Tax Definition Types How To Calculate Excise Tax Liability

Federal Excise Tax Form 720 8849 2290

2

Welcome To Saco Maine